Confessions of a Day Trader: There is only one way to eat an elephant

Picture: Getty Images

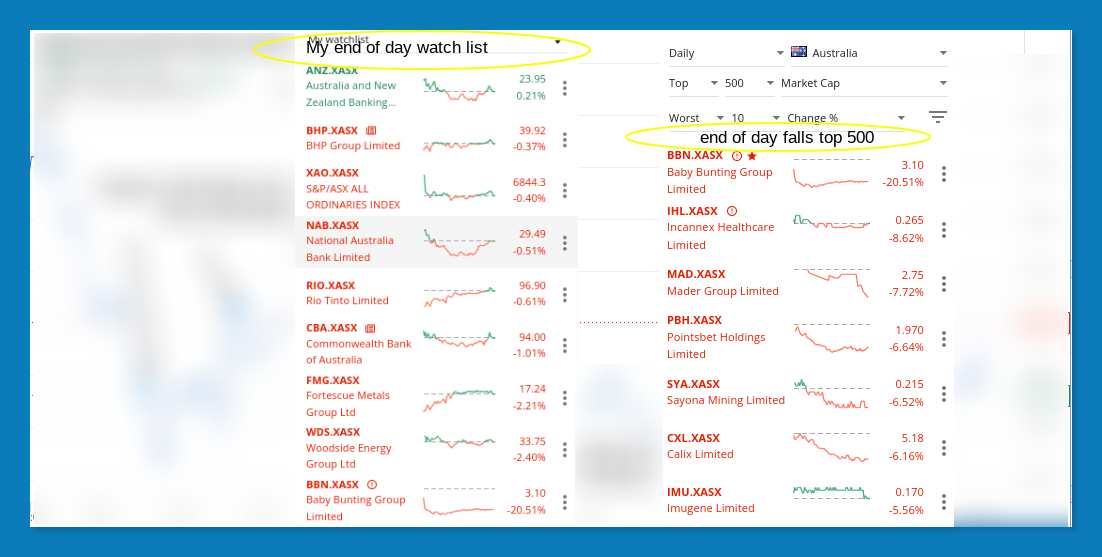

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday October 10

“I don’t like Mondays” – singing in my head today.

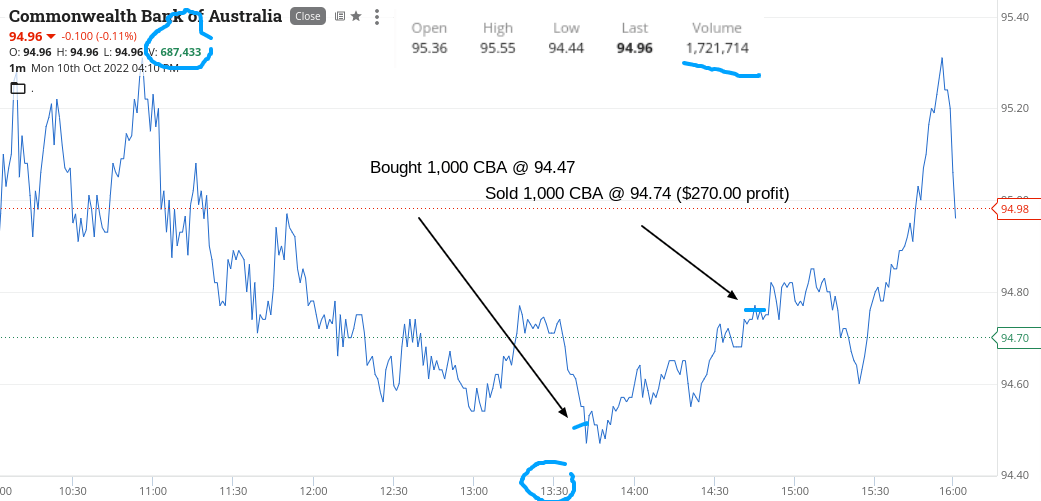

CBA had a day’s high of $95.55 very early on and kind of drifted from there. Had to wait for ages (well it felt like it) until I saw them fall below $94.55 and keep going.

Also just heading into just past 1.30pm, so picked up 1000.

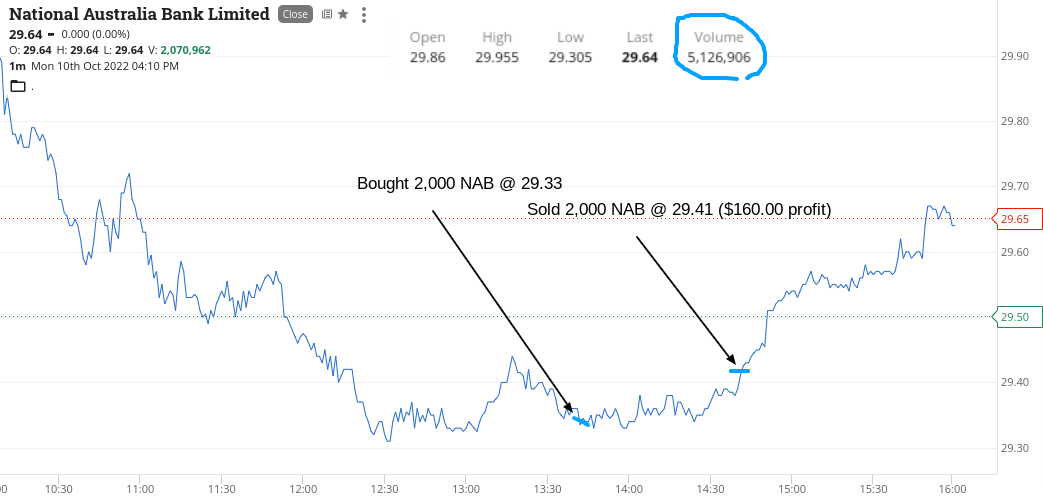

Then NAB still has a buyback on, so I thought they may get a kick up at some point. They had a high of $29.955, so at $29.33, they felt comfortable.

They went out first and then the CBA on a limit of $94.80, which I adjusted down a couple of times before they bounced through it for the second time.

Plus $430.

Recap

Bought 1,000 CBA @ 94.47

Bought 2,000 NAB @ 29.33

Sold 2,000 NAB @ 29.41 ($160 profit)

Sold 1,000 CBA @ 94.74 ($270 profit)

Tuesday October 11

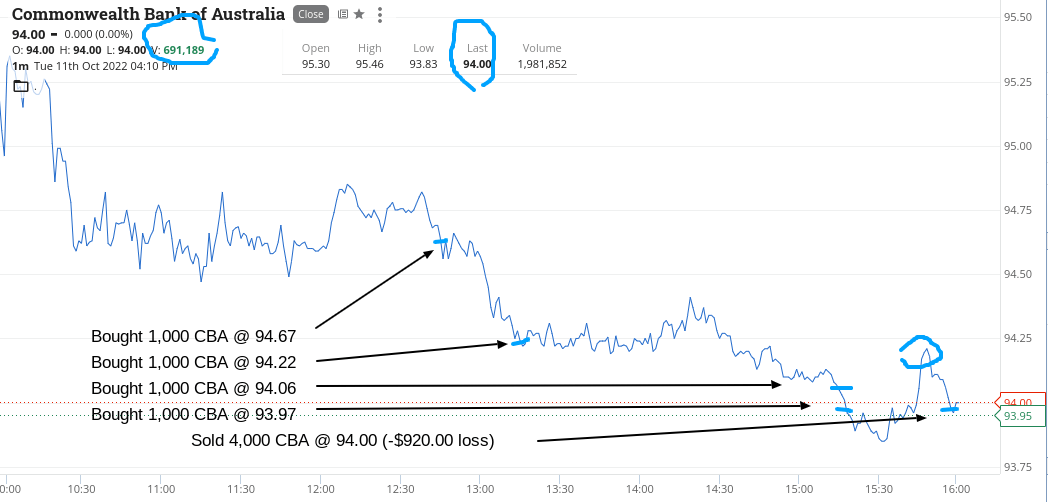

Everything starts out OK but end with me now singing “I don’t like Tuesdays”, as CBA give me a right royal roasting,

In a move that turns out to be wrong, I held them till the death, instead of booking a small loss on them. They just really got sold down, with the occasional dead cat bounce.

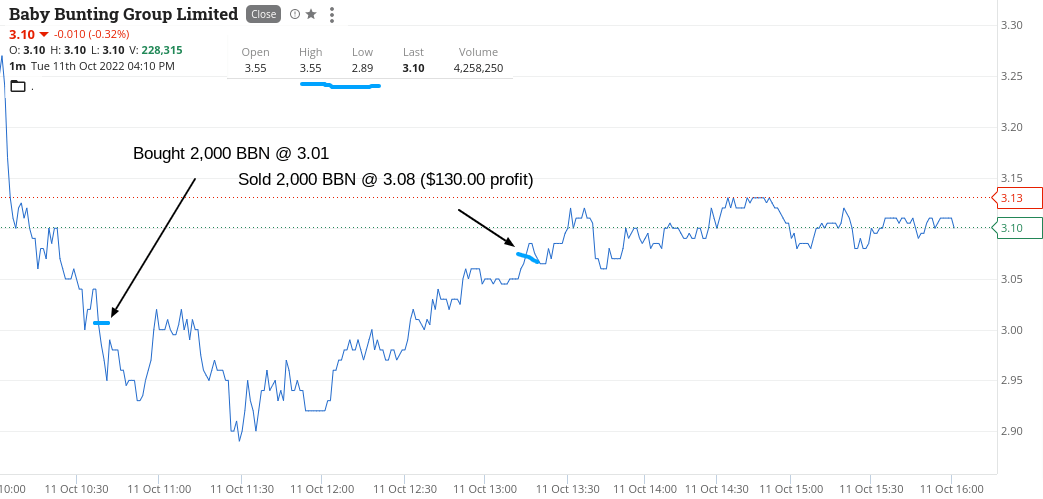

BBN came out with some bad pre-market news and were the biggest top loser. Down $3.55, picked up a small value parcel, which was going to be 5,000 but I cowarded out and made it 2,000.

NAB with their buyback seem to be a bit of a play and got into them twice today, but all of my energy got swallowed into the big black hole of CBA.

Down $480 and $50 for the week so far and I now definitely don’t like Tuesdays! (A$ and bonds getting a bit of bashing, just like me).

Recap

Bought 1,000 CBA @ 94.67

Bought 2,000 NAB @ 29.44

Bought 2,000 BBN @ 3.01

Sold 2,000 NAB @ 29.52 ($160 profit)

Sold 2,000 BBN @ 3.08 ($130 profit)

Bought 1,000 CBA @ 94.22

Bought 2,000 NAB @ 29.42

Bought 1,000 CBA @ 94.06

Bought 1,000 CBA @ 93.97

Sold 2,000 NAB @ 29.49 ($150 profit)

Sold 4,000 CBA @ 94.00 (-$920 loss)

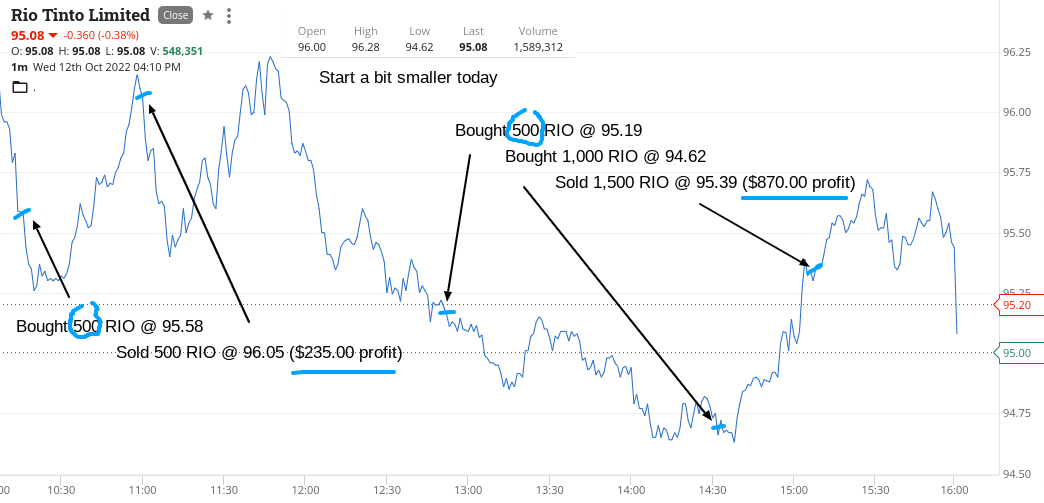

Wednesday October 12

Decided to change tactics today, otherwise I might start hating every day of the week. Going in for smaller opening gambits.

Mainly to limit my potential losses but I have found out in the past that it focuses your mind a bit more and gives you the opportunity to pick the lows twice.

RIOs were a great example today. They had a range of $96.28 to $94.62 and a last of $95.08. They opened at $96.00 and I got set early in 500 (only) at $95.58 early.

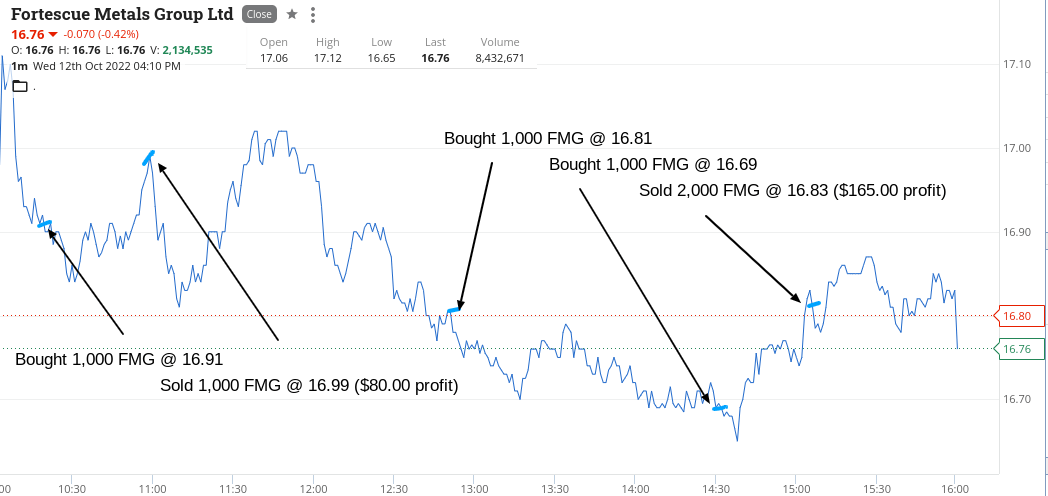

I’m thinking it could be plus or minus $500. Same for FMG, just pick up 1000 at below $17.00, as their moves are more in cents than dollars.

Out go the RIOs at $96.05 and then the FMG on a limit of $16.99. So that’s a profit of $315, so far.

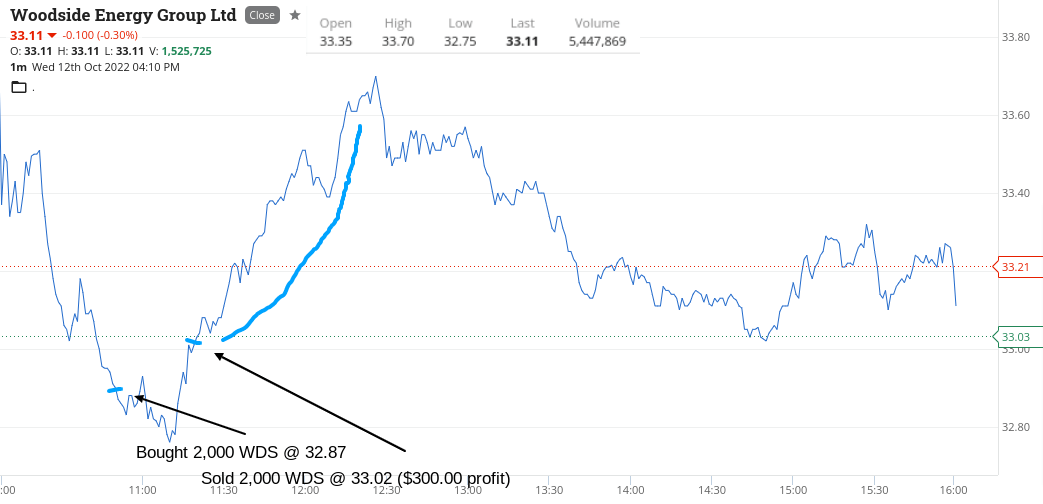

Then WDS offered a trade below $33.00 and that threw out a $300 profit and happy to walk away for the day.

Then as I’m making a cheese sandwich for lunch (that’s the payback for last day’s trading effort), I have a sneak peak.

In between mouthfuls I go again in RIOs @$95.15 and FMG @$16.81 and in smaller size again.

Add a bit of pickle as things are looking up. So much so that I add BHP to the mix.

Of course the mix of pickles and what I thought were good buys, now starts to give me a bit of indigestion, though the losses aren’t large, thanks to my new tactics.

Like I said it helps you get more of a feel than just watching. Now I double down on all three again, especially with RIOs down at $94.62 and FMG at $16.69.

Then BINGO! RIO’s go on an amazing run just after 2.30pm, which also drags up FMG. So out they both go as fast as I can hit the buttons. BHP still lag behind, so I just cut them and run.

Up $1,575. I now like Wednesdays.

Recap

Bought 500 RIO @ 95.58

Bought 1,000 FMG @ 16.91

Sold 500 RIO @ 96.05 ($235 profit)

Sold 1,000 FMG @ 16.99 ($80 profit)

Bought 2,000 WDS @ 32.87

Sold 2,000 WDS @ 33.02 ($300 profit)

Bought 500 RIO @ 95.19

Bought 1,000 FMG @ 16.81

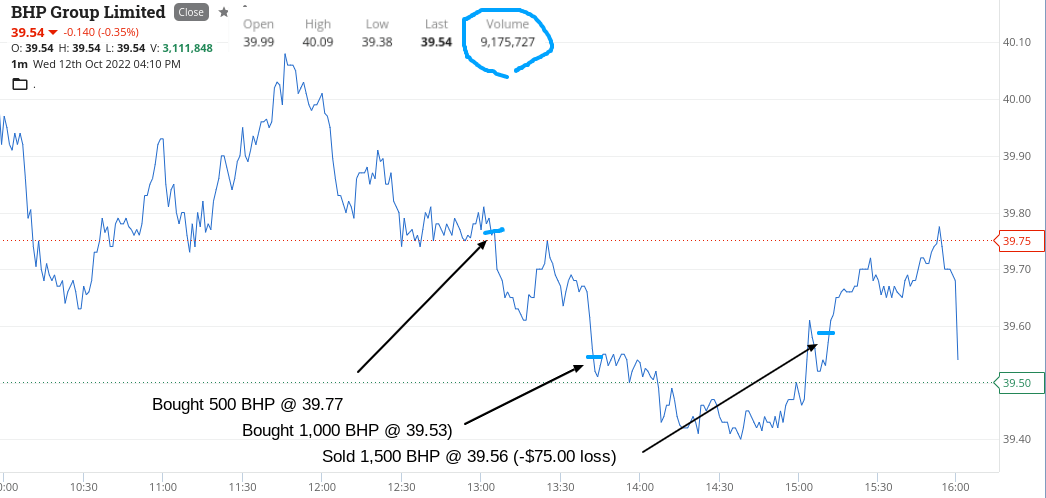

Bought 500 BHP @ 39.77

Bought 1,000 BHP @ 39.53

Bought 1,000 RIO @ 94.62

Bought 1,000 FMG @ 16.69

Sold 1,500 RIO @ 95.39 ($870 profit)

Sold 2,000 FMG @ 16.83 ($165 profit)

Sold 1,500 BHP @ 39.56 (-$75 loss)

Thursday October 13

Stayed on the same laneway today as yesterday and came through with a $790 result and I doubled up, not down in some FMG, which is a turn up for the books.

Happy to go early and leave early as tonight in USA they have their CPI figs coming out.

RIO put on the strongest rally followed by FMG but just not too sure about BHP. They feel like they are going to have some kind of share issue or go for another takeover.

Will try to avoid them tomorrow.

Who knows, tomorrow could be the day to go a bit harder size wise. My gut feeling is that USA will be a bit of a fizzer. Let’s see.

Recap

Bought 500 FMG @ 16.67

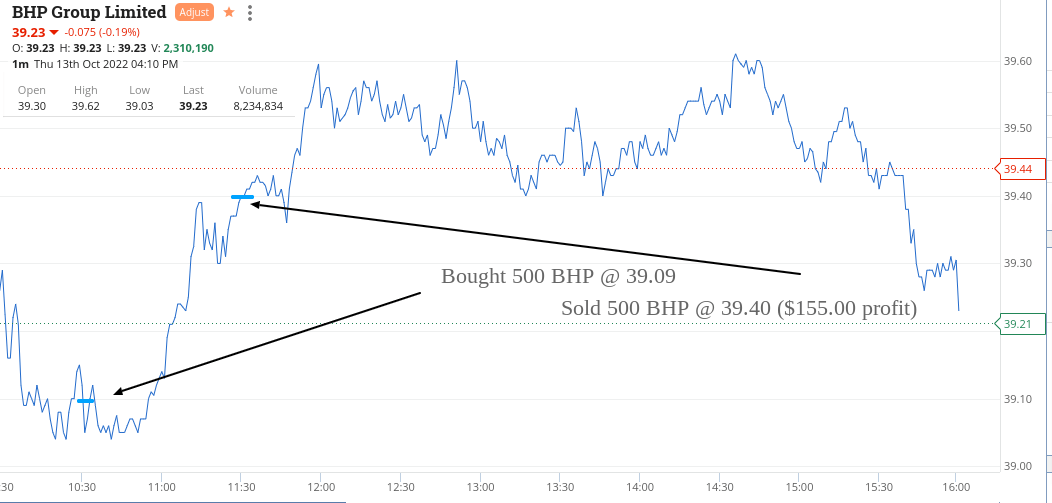

Bought 500 BHP @ 39.09

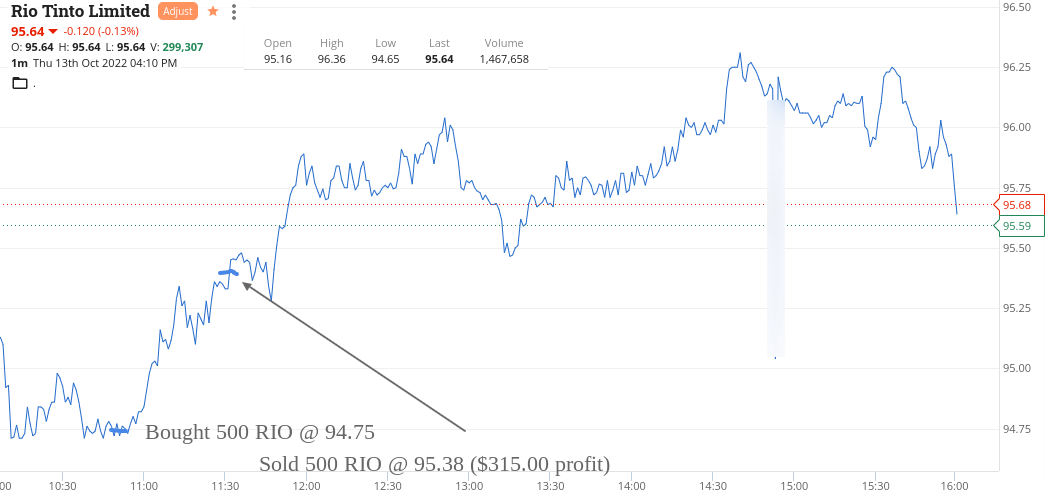

Bought 500 RIO @ 94.75

Bought 500 FMG @ 16.79

Sold 500 BHP @ 39.40 ($155 profit)

Sold 500 RIO @ 95.38 ($315 profit)

Sold 1,000 FMG @ 17.05 ($320 profit)

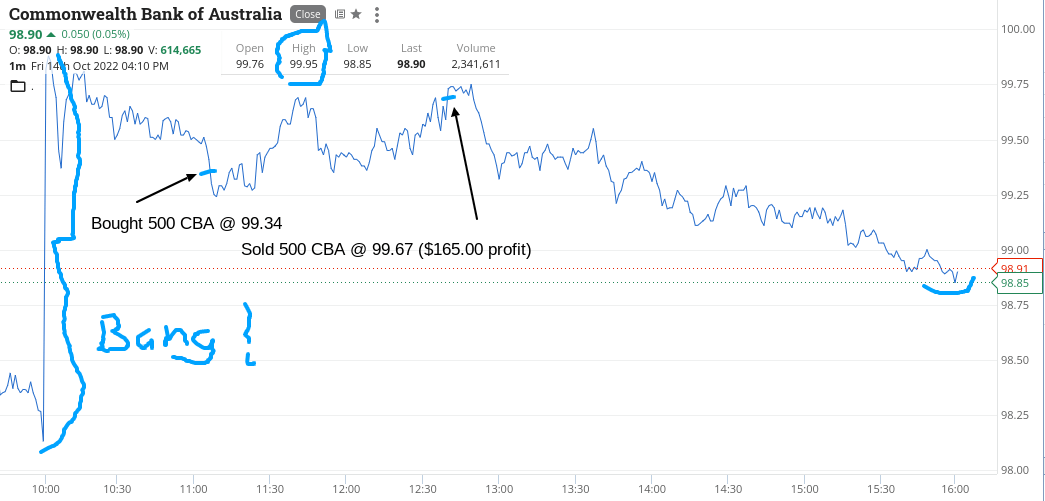

Friday October 14

Well, last night in the USA they had a bit of a rollercoaster ride. As I said yesterday, I thought the CPI would be built into the market.

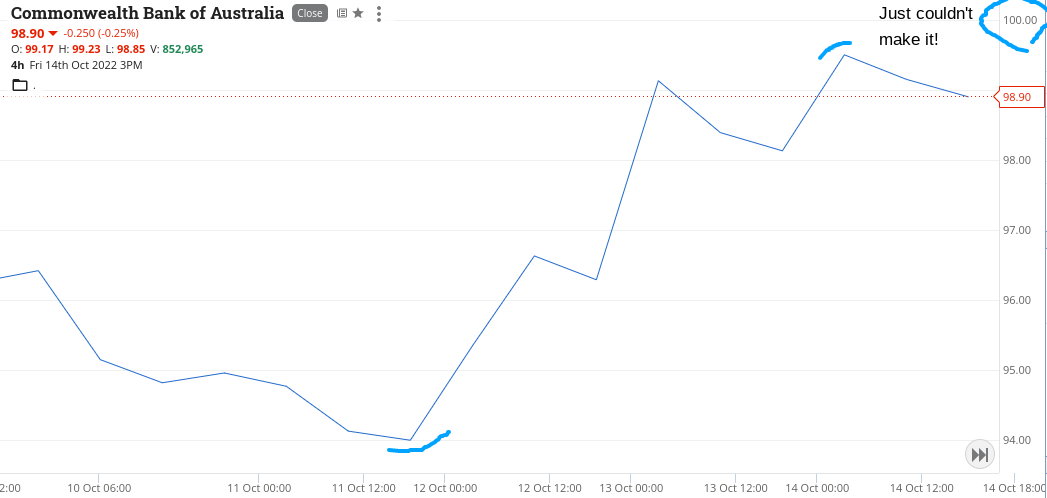

So, the ASX charges out of the traps and CBA touches $99.95, but just can’t hit the $100 level. I have a little punt on a pullback, which works out OK. Otherwise my trading hands were tied up today.

CBA did not hit a low of $91 as I talked about them doing this week. In fact their range for the week was $94.03 to $99.95, so I was right on one side of my call.

A rollercoaster with my P/L this week, especially after Tuesday’s disaster but changing tactics seems to have saved me this week.

Smaller sized trades concentrate the mind and gives you more of a feel for a stock’s movement.

Plus $2480 gross for the week, which includes losing $900 in one trade and $1991 net.

See you on the other side.

Recap

Bought 500 CBA @ 99.34

Sold 500 CBA @ 99.67 ($165 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.