Confessions of a Day Trader: The one where the Big 4 stock looks more like a commodity

Picture: Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday August 22

A slower start to the week, as kind of expected. One thing I have noticed, though not sure if it means anything, is that the gap between the share price of CBA and RIO has narrowed to around less than $1.00.

CBA going XD and falling has brought it down to being priced towards a commodity stock, rather than a bank.

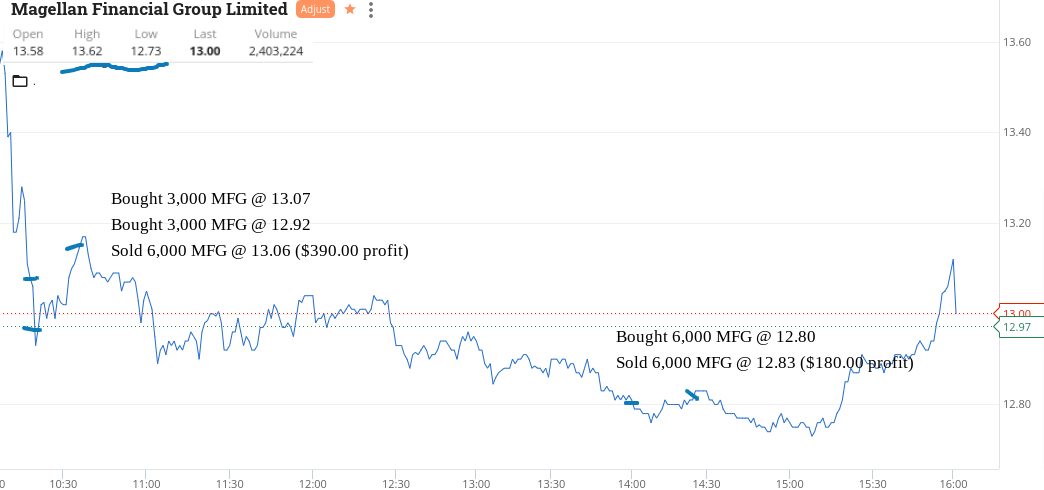

Anyway, Magellan go XD and it is not really a big volume stock, they seem oversold. Hovering around the $13.00 level, so have a nibble, just in case they bounce.

Which of course they don’t do, so I have to double down and get my average in cost down. Stick them on a limit, which they touch, go through and then collapse again.

So, am able to go again later in the day. No messing around, so all in for 6,000 for a 3c turn which should cover off all of my brokerage for the day.

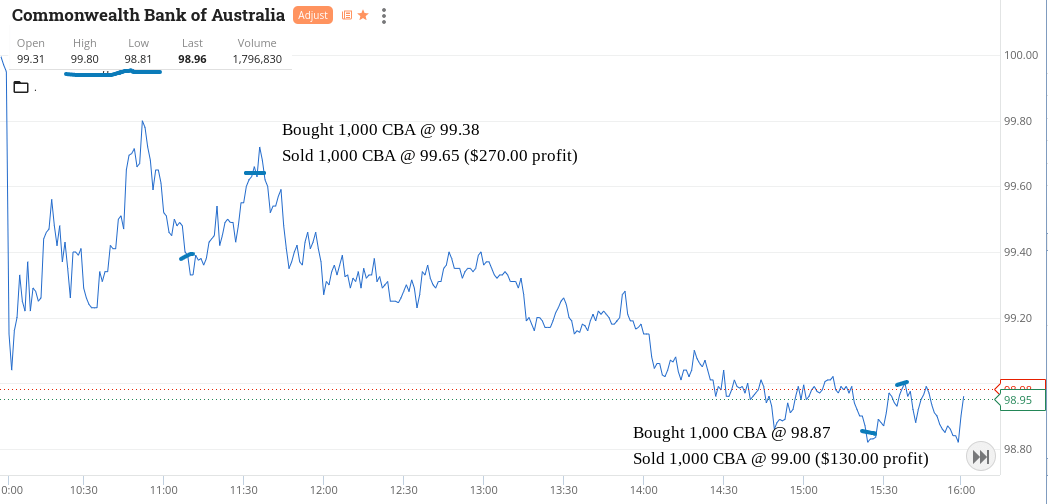

In between all of this, CBA also come in twice. Once below $99.50 and then again at below $99.00. Second time around was towards the end of the day, so happy for a grab and run.

Up $970 but feeling a bit cocky mentally, so expecting a bump back to earth with some losses tomorrow!

Recap

Bought 3,000 MFG @ 13.07

Bought 1,000 CBA @ 99.38

Bought 3,000 MFG @ 12.92

Sold 1,000 CBA @ 99.65 ($270 profit)

Sold 6,000 MFG @ 13.06 ($390 profit)

Bought 6,000 MFG @ 12.80

Sold 6,000 MFG @ 12.83 ($180 profit)

Bought 1,000 CBA @ 98.87

Sold 1,000 CBA @ 99.00 ($130 profit)

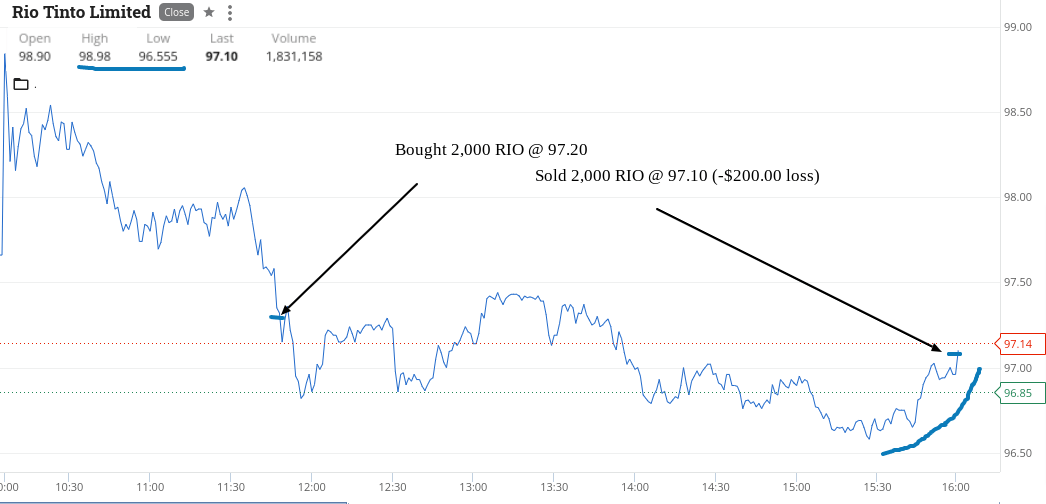

Tuesday August 23

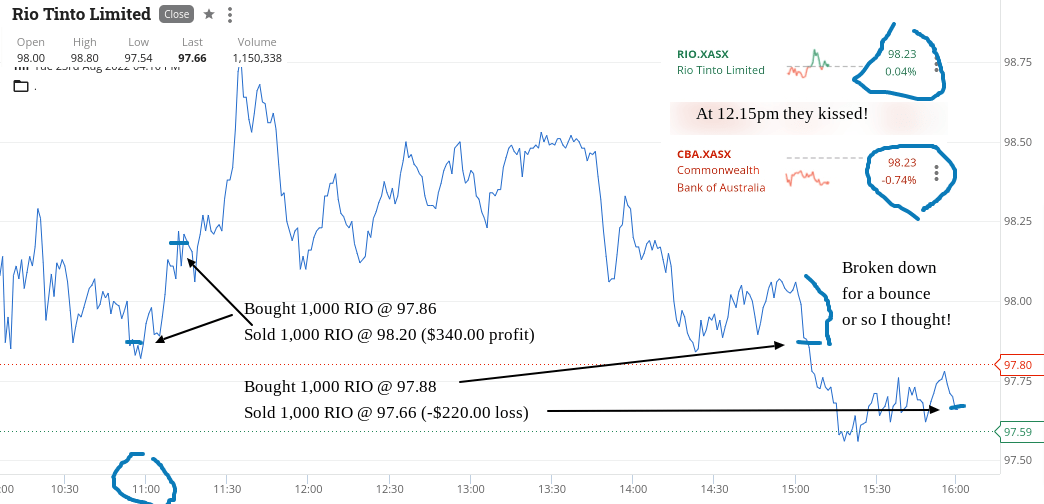

Today turns out to be a one step forward, one step back kind of day.

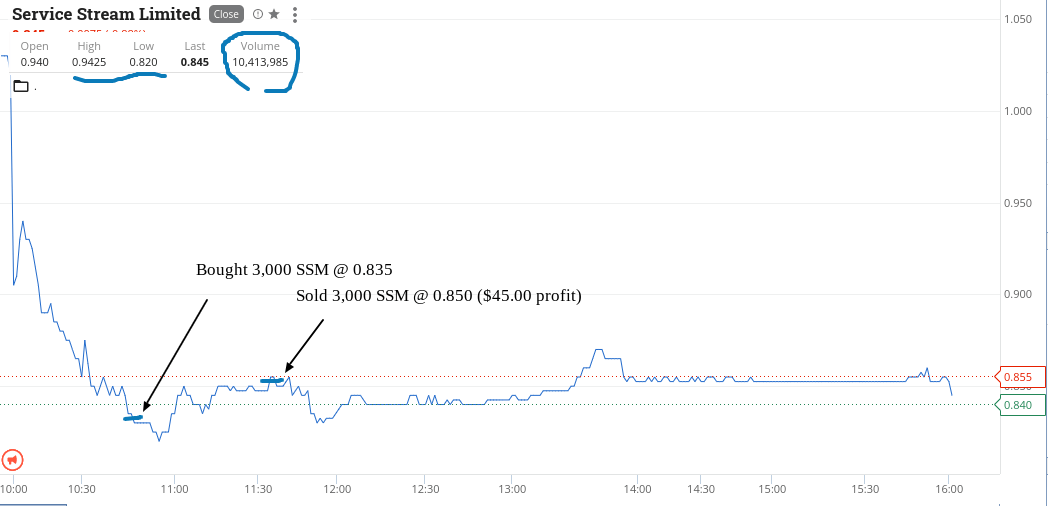

I do make a profit and a loss in RIOs today but also have a win elsewhere.

Finish up $165 after taking a late trading loss in RIOs in the 4.10pm ruckus.

Also today, RIO’s and CBA’s share price values kissed each other at 12.15pm and then crossed over.

CBA finished at $97.02 and RIO at $97.66, so that kinda tells you where sentiment is at.

Recap

Bought 1,000 RIO @ 97.86

Bought 3,000 SSM @ 0.835

Sold 1,000 RIO @ 98.20 ($340 profit)

Sold 3,000 SSM @ 0.850 ($45 profit)

Bought 1,000 RIO @ 97.88

Sold 1,000 RIO @ 97.66 ($220 loss)

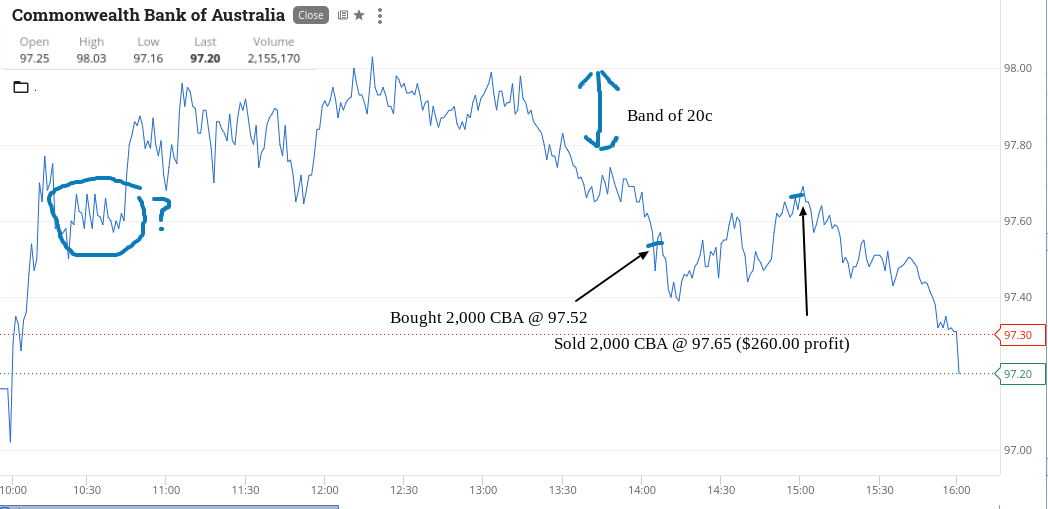

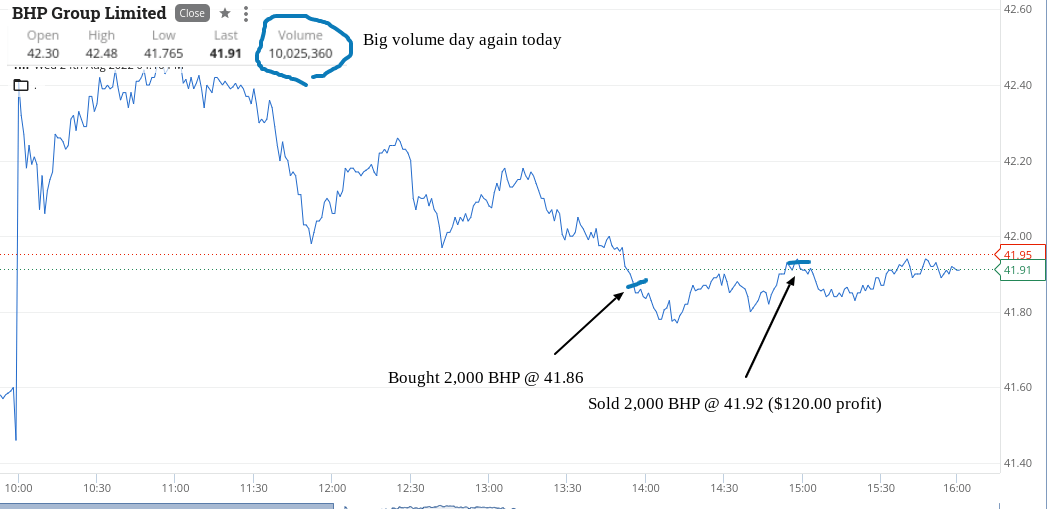

Wednesday August 24

RIO and BHP were marked up in the US overnight, so it kind of gave me a lead, though you wouldn’t know it from the performance of RIO.

Anyway, kicked off the day in BHP and ended the day getting out of RIO for a loss.

In fact, end the day up $180 and CBA finished at $97.20 and RIO finished at $97.10, having been as high as $98.98. They had a day range of $2.40 and managed to bounce off their day’s low in the last 30 mins, so will try and make back my loss tomorrow.

Recap

Bought 2,000 BHP @ 41.86

Sold 2,000 BHP @ 41.92 ($120 profit)

Bought 2,000 RIO @ 97.20

Bought 2,000 CBA @ 97.52

Sold 2,000 CBA @ 97.65 ($260 profit)

Sold 2,000 RIO @ 97.10 ($200 loss)

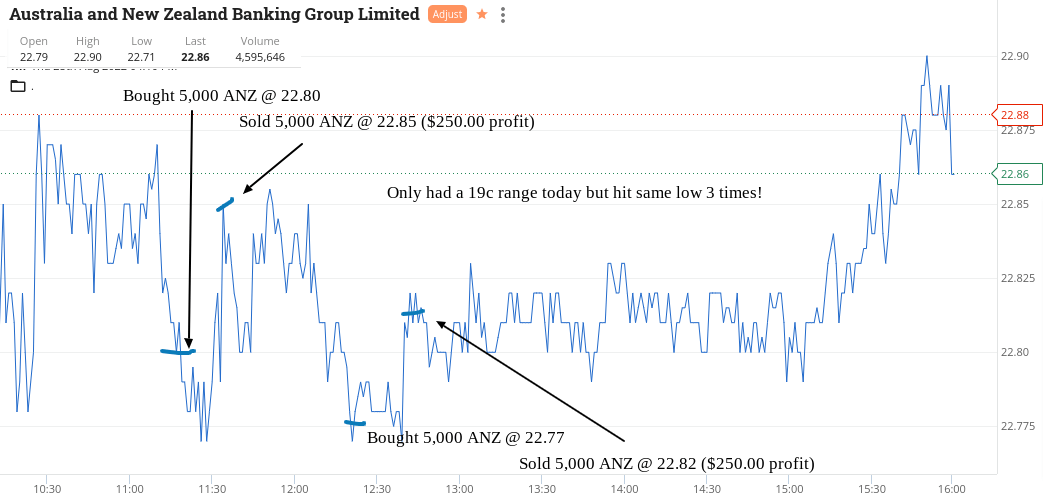

Thursday August 25

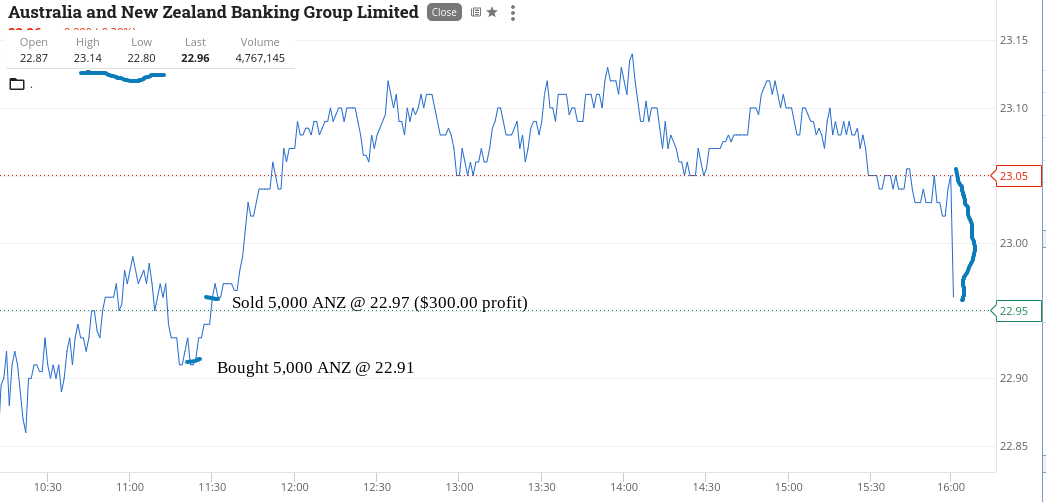

Everything was up today on the old watch list today, though I managed two trades in ANZ.

They had a small trading range of under 20c but hit the same low three times and bounced and then became very boring for the rest of the day.

Up $500 and never got a look in at my RIOs. Had a lower limit buy in them below $97.00 but they never came close enough. I think I missed them by 5c or so. Will try again tomorrow as thinking Friday will have a weaker finish.

Recap

Bought 5,000 ANZ @ 22.80

Sold 5,000 ANZ @ 22.85 ($250 profit)

Bought 5,000 ANZ @ 22.77

Sold 5,000 ANZ @ 22.82 ($250 profit)

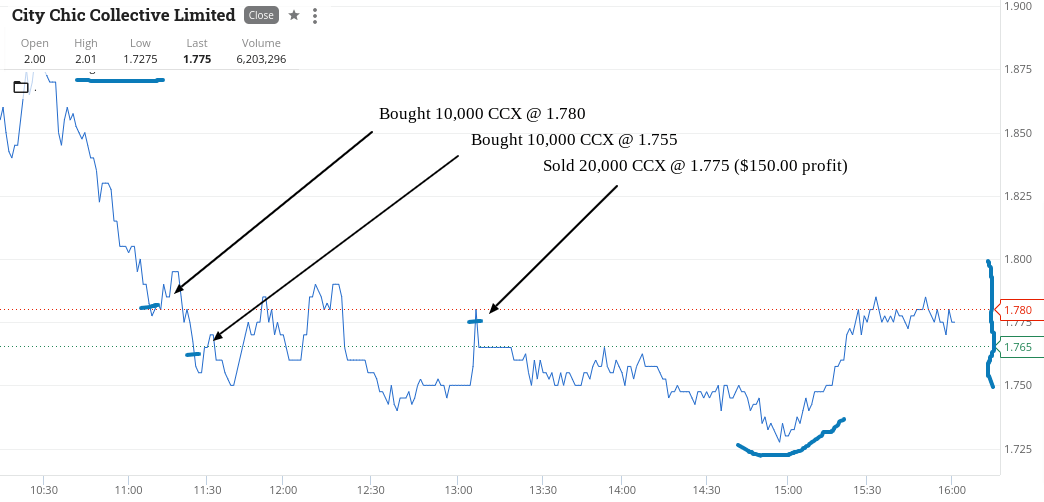

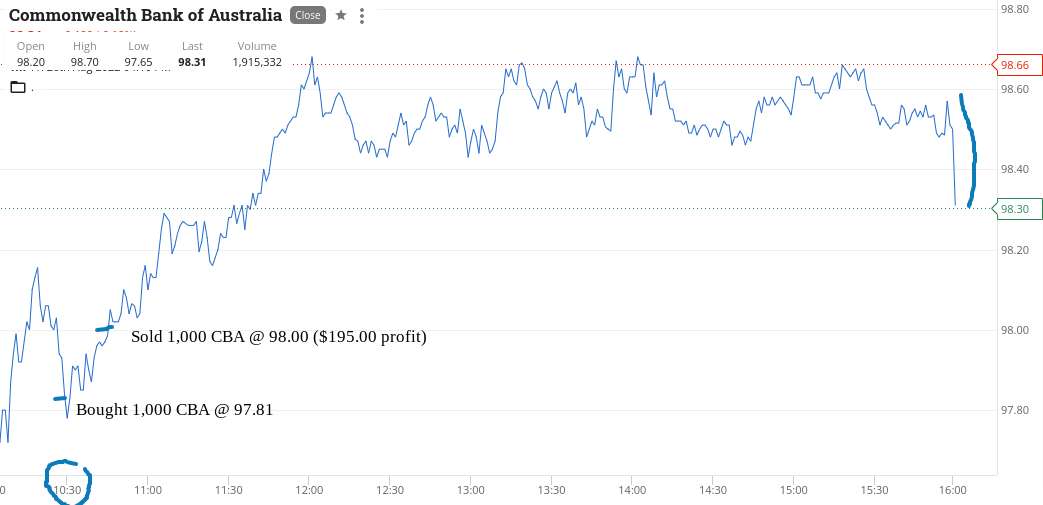

TGIF August 26

Can’t do anything in RIOs again today, though managed a couple of quick in and outs in CBA and ANZ.

Also went and had a go at CCX, who have fallen about 25% over the last two days. Didn’t make a big profit but enough to more than cover off today’s brokerage.

ANZ really was a quick one and CBA was a classic, wanting to break above $98.00. I was out as they hit that level and watched them keep going but as yesterday I was expecting today to be a down down, was happy with $195 profit.

Today up $645, $2460 gross for the week and $1906 net. Feels like Monday may actually be a down day looking at how this week went. We shall see!

Recap

Bought 1,000 CBA @ 97.81

Sold 1,000 CBA @ 98.005 ($195 profit)

Bought 10,000 CCX @ 1.780

Bought 5,000 ANZ @ 22.91

Sold 5,000 ANZ @ 22.97 ($300 profit)

Bought 10,000 CCX @ 1.755

Sold 20,000 CCX @ 1.775 ($150 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.