Confessions of a Day Trader: The greatest hits come off low bases

Lemmy. Picture: Lemmy Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday March 8

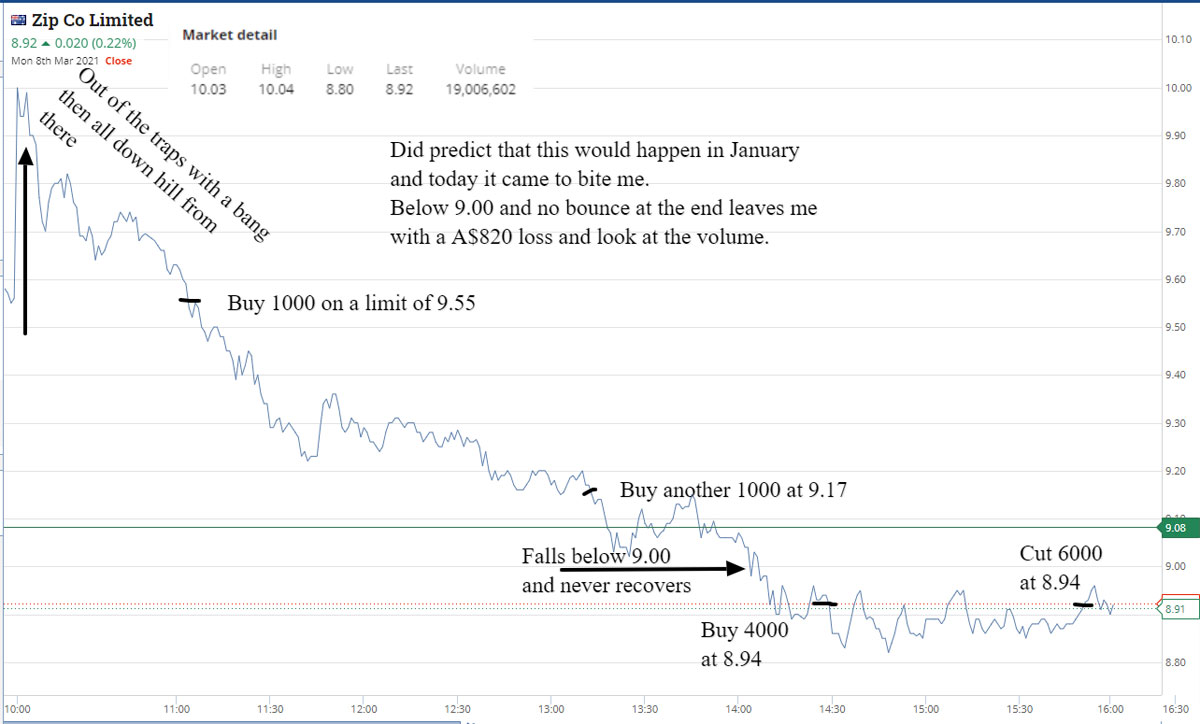

I did predict in January that there would be a rout in the BNPL stocks I follow and trade in. I didn’t get the share price levels correct but I did with the timing. And today is the day… and like many others, I get caught.

Following Z1P as the 10.00 psychological barrier got tested the other day. At 10.10am, I put in a limit order to buy 1000 at 9.55, which was Friday’s support level. Get hit at 11.07am and they keep falling. At 1.11pm they are trading at 9.17, so am down A$380 on 1000 shares!!!! Buy another 1000 at that level and then watch them fall below 9.00 and they never recover.

I try and trade my way out by buying another 4000 at 8.94 for the bounce above 9.00 to come but it never does. Forced to cut the whole 6000 at 8.94 just before the close.

A$820 loss for the day which is not the best of starts for the week. Now have four days to see if I can claw it back. Ouch!

+1000 Z1P at 9.55; +1000 Z1P at 9.17; +4000 Z1P at 8.94; -6000 Z1P at 8.94; Loss A$820 (No bounce! Where was the bounce????)

Tuesday March 9

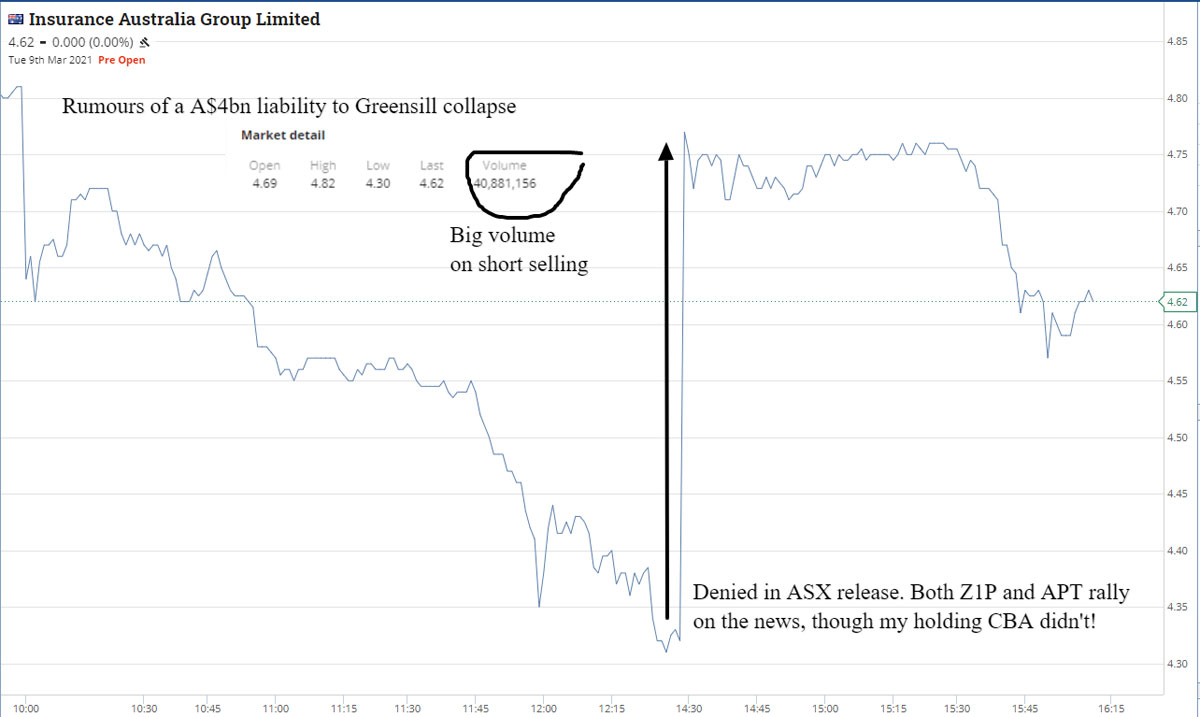

Rumours are swelling around on Twitter that IAG may have a A$4bn liability from the Greensill collapse, which is more than their market cap. So add them to the watch list.

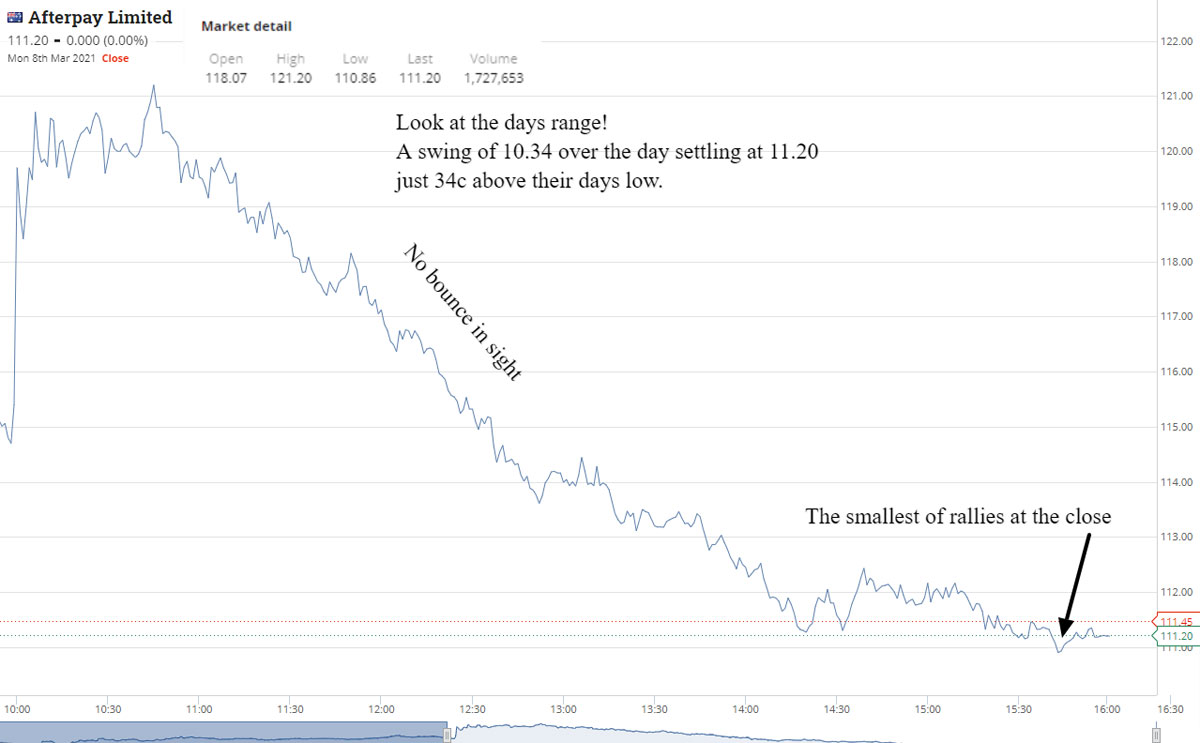

APT come on weak and move around very fast. Just waiting to see what happens after the 11.00am margin deadlines are out of the way, to see what happens.

Buy 100 APT at 102.00. Time 10.28am. Sell them at 104.12 six mins later. Back in at 100.00 even at 10.52am and out at 101.08, also by chance, six mins later.

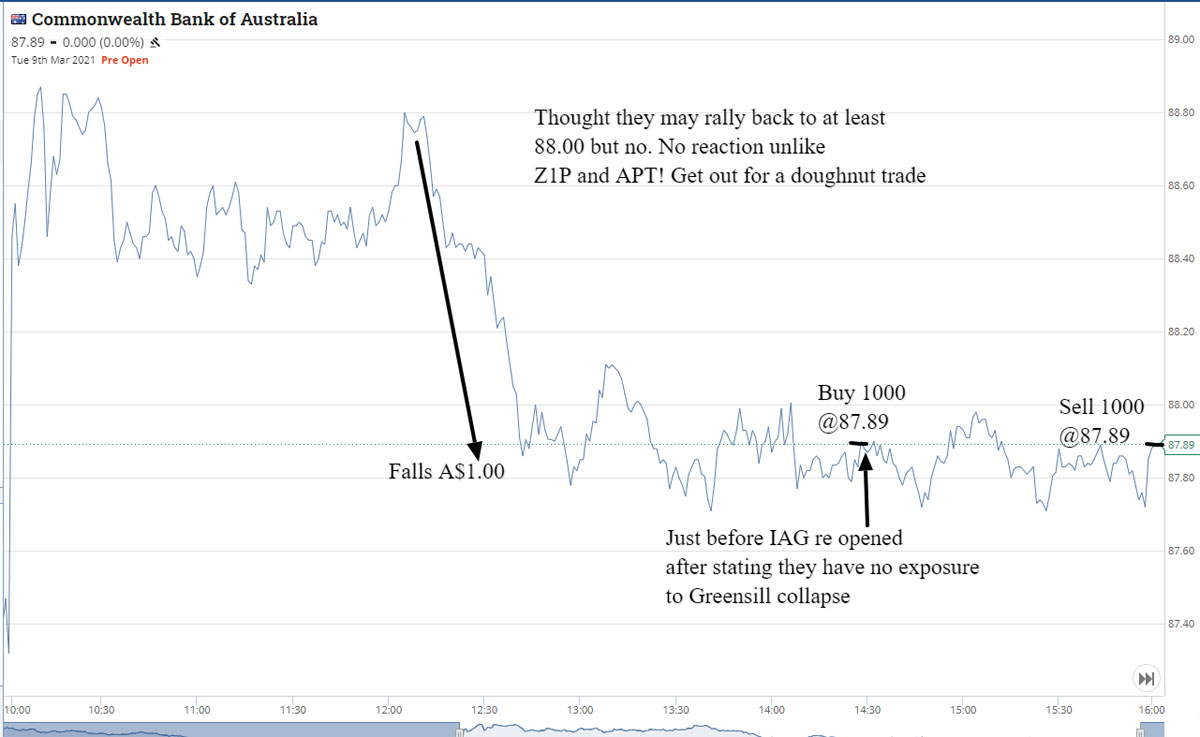

IAG go into a trading halt and release a ‘nothing to see here folks’ announcement and rally 30 cents when they come out of their trading halt. This announcement leads a rally in Z1P and APT.

I made the judgement that CBA may also rally, which it didn’t as I anticipated and have to wait till the 4.00pm wash-up to break even on the trade. See charts!

+100 APT at 102.00; +100 APT at 100.00; -100 at 104.12; -100 at 101.08; Profit A$320 (slowly clawing back Monday’s loss)

+1000 CBA at 87.89; -1000 CBA at 87.89; Profit A$ ZERO (didn’t rally like Z1P and APT)

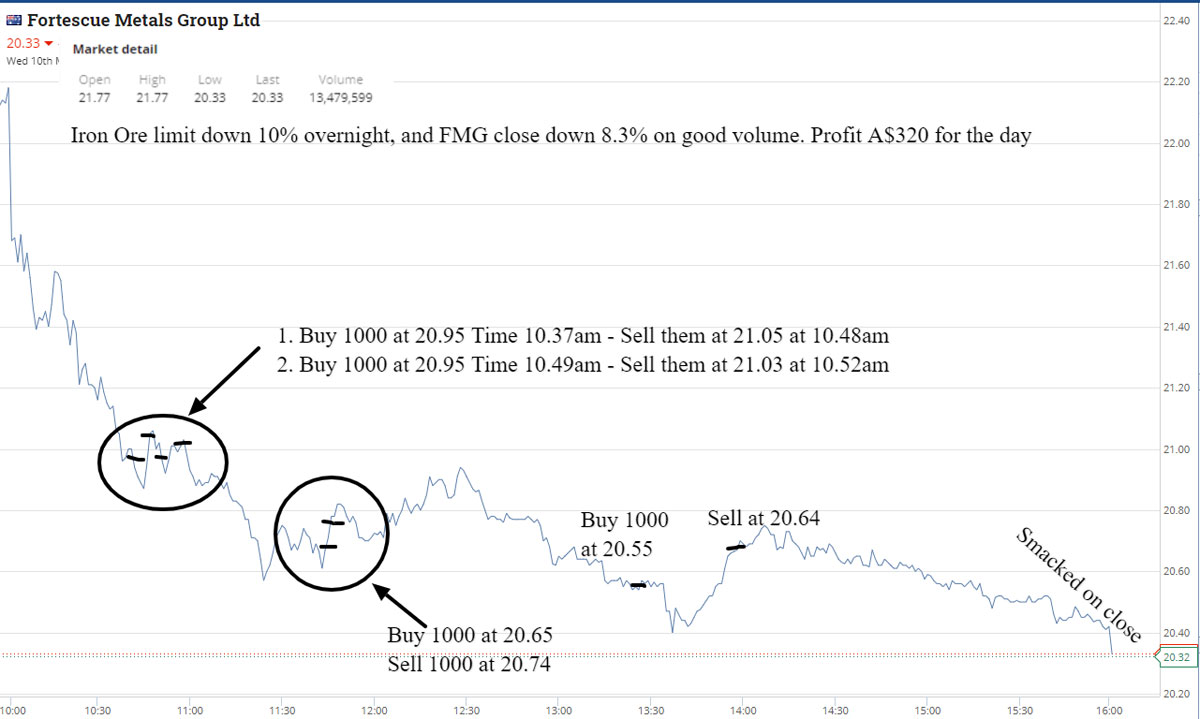

Wednesday March 10

NASDAQ up and iron ore down 10%, so it’s going to be an interesting day. FMG open down at 21.77 and dip in the toes when they fall below 21.00. Buy 1000 at 20.95. Time 10.37am. Sell them 11 mins later at 21.05.

Back in at 20.95. Time 10.49am. Three mins later out at 21.03 after adjusting my limit down from 21.05.

Out shopping and have a limit of 20.65 for 1000. Get hit and get out next to the milk cabinets in Woolworths at 20.74. Buy another 1000 at 20.55 on a limit at 1.22pm. Manage to sell them at 20.64. Time 1.57pm.

Before this, had a go at Z1P below 9.00 but lost A$150 doing so. Buy 1000 at 8.54. Cut them at 8.39 as not prepared to double down.

All up finish plus A$210 for the day.

+1000 FMG at 20.95; +1000 FMG at 20.95; +1000 FMG at 20.65; +1000 FMG at 20.55; -1000 FMG at 21.05; -1000 FMG at 21.03; -1000 FMG at 20.74; -1000 FMG at 20.64; Profit A$320

+1000 Z1P at 8.54; -1000 Z1P at 8.39; Loss A$150 (not prepared to chase down)

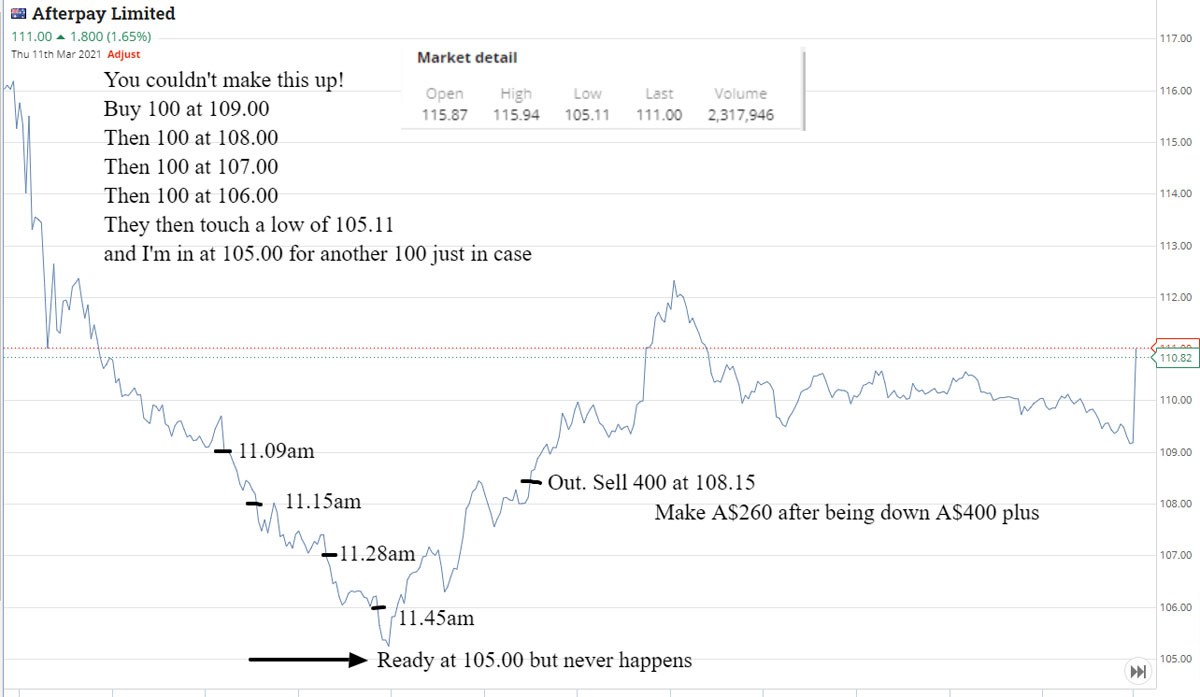

Thursday March 11

OMG. What a really bizarre day. I am looking like I am about to make another large loss.

APT opened down at just below 116.00. I buy my first 100 at 109.00 at 11.09am. Then I buy 100 at 108.00, then at 107.00 and then at 106.00 and just miss out at 105.00. Down A$400 and not looking good.

Then – bang – they rally back up past 108.00 and I’m out at 108.18. Man oh man, a lot of pain for not much gain!

Nervously bought 1000 Z1P at below 7.99. Can you believe it? Go long at 7.89 and out at 7.95 and happy to book a A$60 profit.

CBA have an also mad trading range swing of over A$2.00. Buy 500 at 85.85, having seen them at 87.88!. Sell them at 86.20 and they moved very fast to get there.

Then we had FMG. They broke below 19.99 and I had a limit in at 19.95, which got hit but not before they touched 19.96 twice. When hit they keep falling but eventually move above 20.00 and I’m out at 20.05.

Time 11.40. An amazing morning and leave everything alone after 12.15. Up A$600 on the day.

+500 CBA at 85.85; -500 CBA at 86.20; Profit A$180

+1000 FMG at 19.95; -1000 FMG at 20.05; Profit A$100

+1000 Z1P at 7.89; -1000 Z1P at 7.95; Profit A$60

+100 APT at 109.00; +100 at 108.00; +100 at 107.00; +100 at 106.00; -400 at 108.15; Profit A$260 (65c x 400 shares)

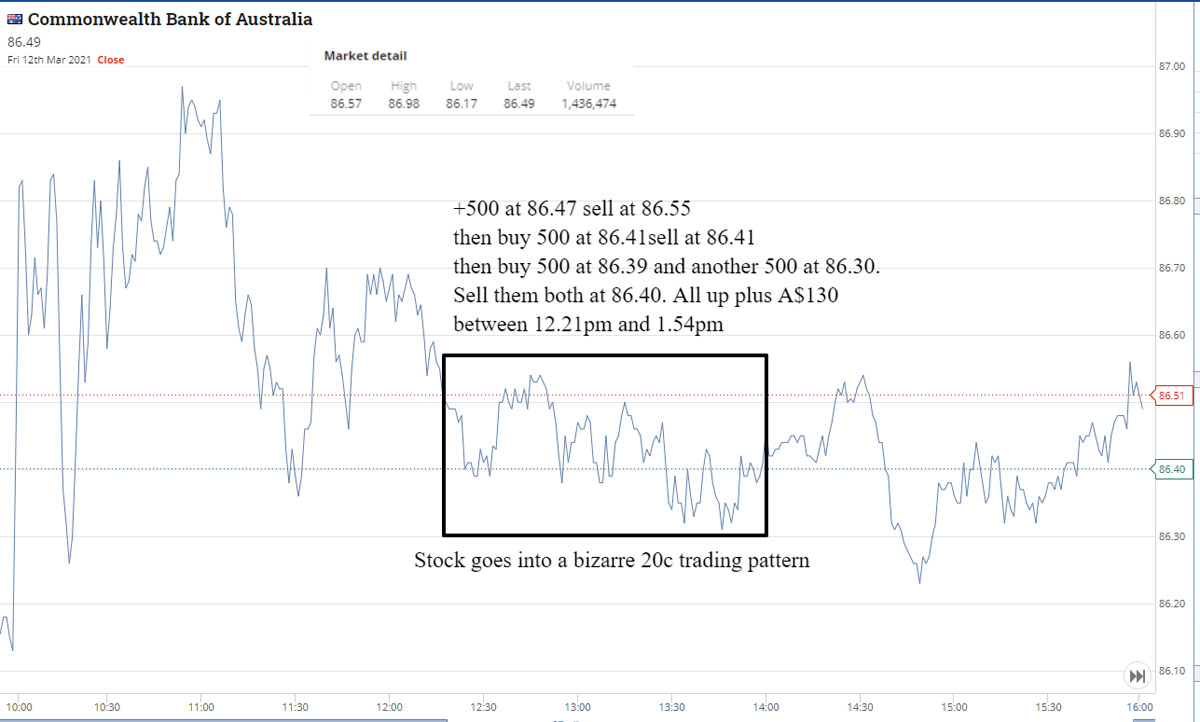

Friday March 12

The volatility in APT and Z1P slows down today, with APT only having a A$3.00 swing. Notice that Z1P was a bit decoupled from APT and wait to see what happens after the 11.00am margin calls have been made and they bounce and I grab 1000 at 8.49 and sell them 4 mins later at 8.53.

Time is 12.09pm. Then sitting at screen having a ham and tomato sandwich and notice that CBA are trading in a 20c trading range and I buy 500 at 86.47 and sell them at 86.55 and make A$40. Still munching away and they are back down again. So buy 500 at 86.41 and sell them at 86.48. Fifteen mins later buy 500 at 86.39 and 500 at 86.30.

Time is 1.50pm. Sell the whole 1000 at 86.40.

Time 1.54pm. So I made A$130 gross whilst having lunch. I like that. Finish +A$170 for the day.

+1000 Z1P at 8.49; -1000 Z1P at 8.53; Profit A$40

+500 CBA at 86.47; -500 CBA at 86.55; +500 at 86.41; -500 at 86.48; +500 at 86.39; +500 at 86.30; -1000 at 86.40; Profit A$130 (Ham sandwich earnt me that.)

Gross Profit: A$440

Brokerage: A$182

Net Profit: A$258

Least satisfying: Z1P (Mon)

Most satisfying: CBA (Fri)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.