Confessions of a Day Trader: Thank God It’s… Monday?

Pic: Getty

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday January 17

On the opening, BRN come up as a big faller. Figure all their news is out and buy and sell 2000 for a $70 profit.

This sets me up mood wise and around 10.45am FMG are below $21.00. Buy 2500 and hold a bit of powder back and sure enough they touch $20.85, so buy some more. Out they went on a limit $20.98.

Then CBA go below $101 for the second time and buy 1000 at $100.99. Then back into FMG at way below $21.00.

Have a limit in to sell the CBA and when you see the chart, you will also swear. An unbelievable move upwards goes straight through my limit and 20c higher in the next 20 mins or so.

Now just left staring at FMG and it takes forever to book a profit but eventually they get there.

Finish up $690, which is good but still shocked by CBA’s moves, though on a small volume like 450,000 at the time I got taken out.

Them’s are the markets, I suppose!

Recap

Bought 2,000 BRN @ 1.390

Sold 2,000 BRN @ 1.425 ($70.00 profit

Bought 2,500 FMG @ 20.97

Bought 2,500 FMG @ 20.85

Sold 5,000 FMG @ 20.98 ($350.00 profit)

Bought 1,000 CBA @ 100.99

Bought 2,500 FMG @ 20.69

Sold 1,000 CBA @ 101.11 ($120.00 profit)

Sold 2,500 FMG @ 20.75 ($150.00 profit)

Tuesday Jan 18

Finding volumes again low today and not too many knee-jerk movements downwards. For example, CBA’s volume is only 1.2m of which a third went through at 4.10pm.

Having said that, CBA gave me two good opportunities and by pure chance, both exits were at the same price, which was not a conscious decision by any means. CBA has this $101 level at the moment and crazy moves below.

See chart. Up $905 and on both trades left them longer than usual, before cushing out.

Recap:

Bought 1,000 CBA @ 100.75

Sold 1,000 CBA @ 101.07 ($320.00 profit)

Bought 1,500 CBA @ 100.68

Sold 1,500 CBA @ 101.07 ($585.00 profit)

Wednesday Jan 19

Busy busy today, Got into CBA twice early on and then cut them for a loss as didn’t feel right. Took a $255 hit and then waited.

Also day’s biggest faller was MP1, who were down about 16% and again their news was out so had a real quickie in them. Upped the size in them and never traded them before but an 11c turn on 5000.

Broke my rule on not touching APT which I cut after some profits elsewhere.

Todays ‘level in CBA was $99.00 and NAB’s was $29.00.

Volumes up a touch on yesterday’s, with CBA double yesterdays, so was busy today spending a bit on brokerage but that’s the cost of getting a bit of gearing going, my way.

Turned out OK and APT’s last day before becoming Block (Square) tomorrow. Plus $1622.50 gross.

Recap:

Bought 1,500 CBA @ 99.95

Bought 1,500 CBA @ 99.80

Sold 3,000 CBA @ 99.79 (-$255.00 loss)

Bought 1,500 CBA @ 99.38

Bought 5,000 MP1 @ 15.33

Sold 5,000 MP1 @ 15.44 ($550.00 profit)

Bought 1,000 APT @ 67.02

Bought 1,500 CBA @ 98.90

Bought 5,000 NAB @ 28.99

Sold 5,000 NAB @ 29.07 ($400.00 profit)

Sold 3,000 CBA @ 99.27 ($397.50 profit)

Sold 1,000 APT @ 67.00 (-$20.00 loss)

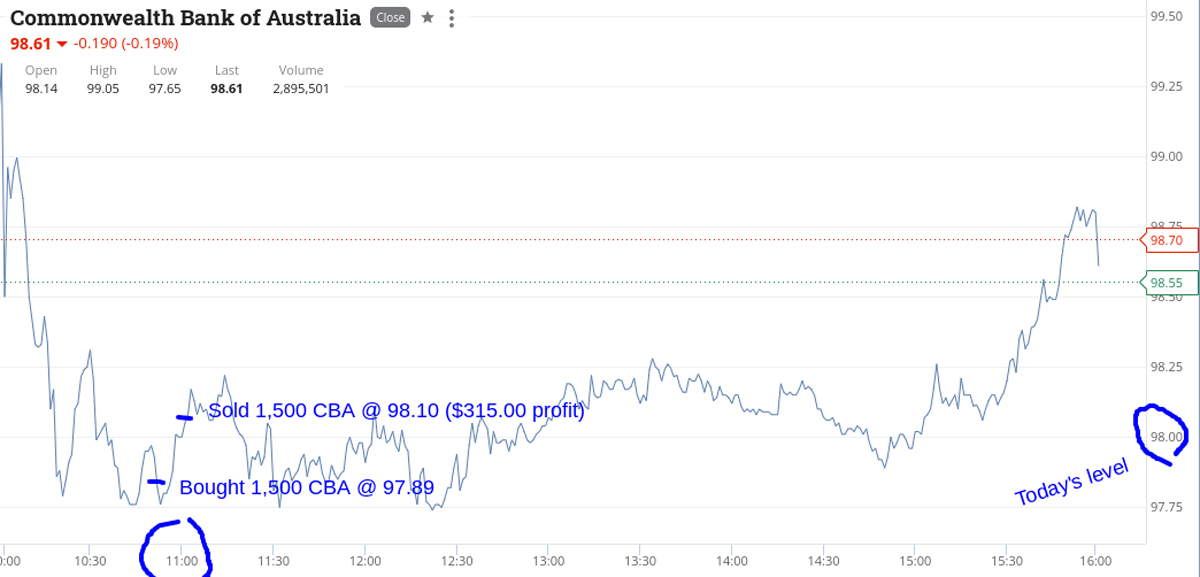

Thursday Jan 20

Mixed day today.

CBA behaved itself just before and after 11.00am.

Had a go at BRN as they were the biggest major faller at one point. Went a bit early and had to cut them with a $110 loss, with a few mins to go.

Also had a go at NAB, which took all day to finally get out of jail with a small $50 profit.

Plus $365 with some volumes starting to pick up but APT no longer listed, so will have to find another one for the watchlist!

Recap:

Bought 1,500 CBA @ 97.89

Sold 1,500 CBA @ 98.10 ($315.00 profit)

Bought 2,500 NAB @ 28.66

Bought 2,000 BRN @ 2.06

Sold 2,500 NAB @ 28.68 ($50.00 profit)

Sold 2,000 BRN @ 2.01 (-$110.00 loss)

Friday Jan 21

Go into the trading ring feeling that I am Muhammad Ali, only to come out realising that I am not.

Only a bit of blue was a profit on CHN and everything else was blood red.

Bloodied nose, cuts over both eyes, blurred vision and a couple of teeth missing.

It was brutal and especially with my style of trading.

There was no bottom. There was no bounce. There was no profit. There was no gain.

Threw in the towel at the close and went and laid down. Anyone holding Bitcoin will understand.

Finished the day down $1540 and the week up $2042 gross or $899.50 net.

APT off the watch list and also Block Inc and added a few more of the banks.

Next week will be interesting for some of these tech stocks.

Recap

Bought 1,500 CBA @ 97.92

Bought 10,000 Z1P @ 3.40

Bought 1,500 CBA @ 97.63

Bought 5,000 CHN @ 8.12

Sold 5,000 CHN @ 8.20 ($375.00 profit)

Sold 3,000 CBA @ 97.37 (-$1,215.00 loss)

Sold 10,000 Z1P @ 3.33 (-$700.00 loss)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.