Confessions of a Day Trader: Take the win. Any win.

Pic: metamorworks / iStock / Getty Images Plus via Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

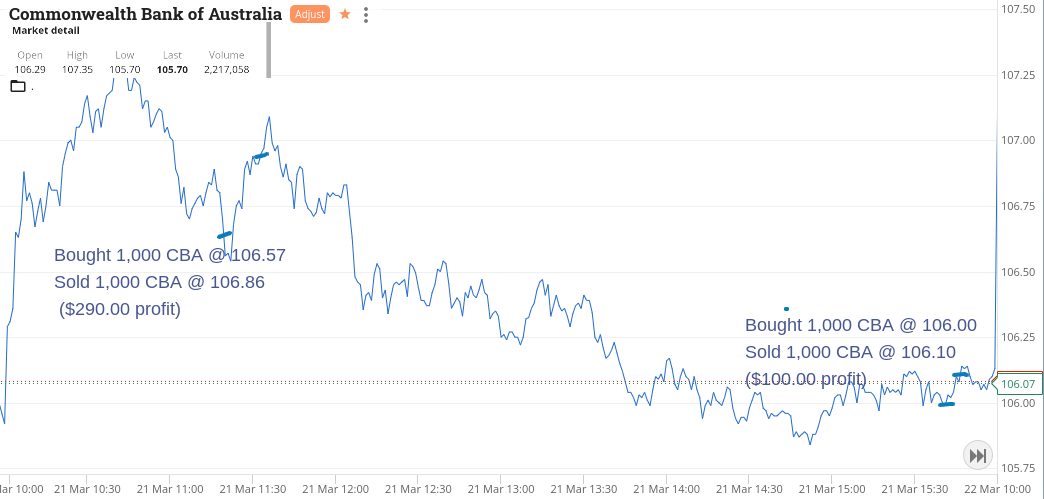

Monday March 21

Had to wait till almost 11.30am for the clouds to disappear and reveal some hopeful opportunities. Got set in CAB and then NAB, one after each other.

Both looked a bit oversold, with CBA having been up above $107 just after the open. As they got pushed back up there, locked in a profit, as I care about seeing if they get to $107 or not, as long as I can jump on the feeling that they might, I’m happy.

Same goes for NAB and happy for a very quick in and out, which is why I went to 2000 shares. Bit more boring than CBA’s volatility but they had been as high as $31.46.

Had a late minute go at CBA, more out of boredom and thought $106! Having been above $107. They gyrated around so I stuck on a limit, which got taken.

Plus $530 and it’s a Monday. Happy with that.

Recap

Bought 1,000 CBA @ 106.57

Bought 2,000 NAB @ 31.06

Sold 1,000 CBA @ 106.86 ($290.00 profit)

Sold 2,000 NAB @ 31.13 ($140.00 profit)

Bought 1,000 CBA @ 106.00

Sold 1,000 CBA @ 106.10 ($100.00 profit)

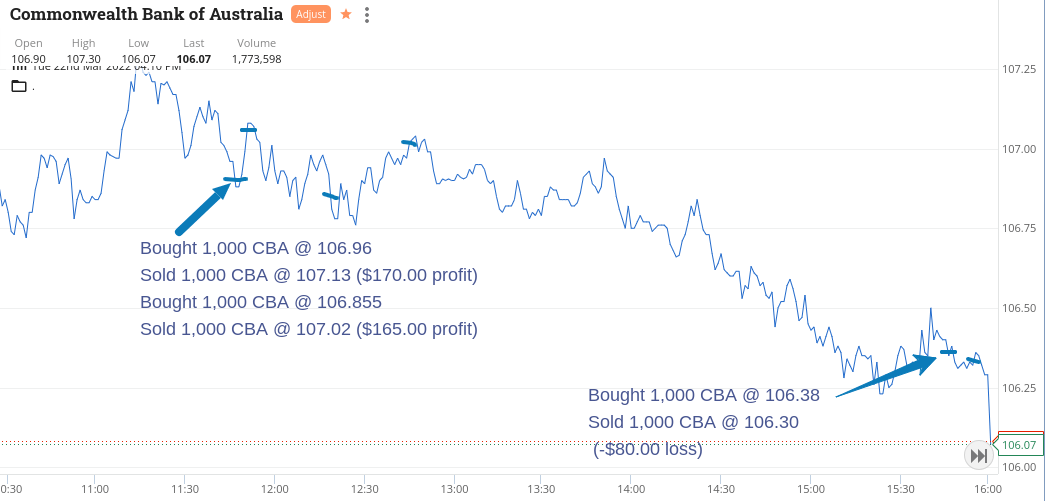

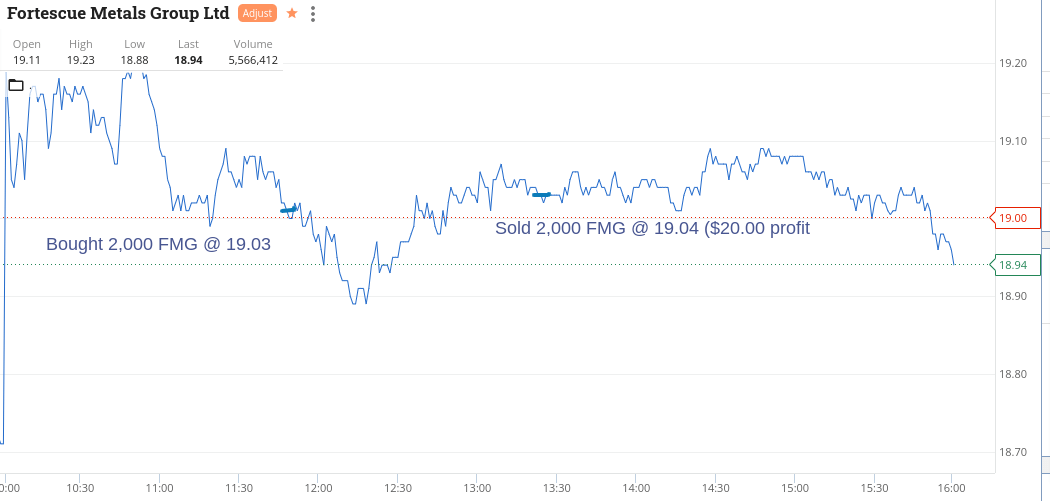

Tuesday March 22

CBA giveth and taketh away today, as my attempt to duplicate yesterday’s late heroic effort blew up $80 of todays profits plus a bit of commission.

Glad I did cut it and not wait for the 4.10pm ruck. Yesterday at 4.10pm they shot up and today they shot down.

Tried to get a little action in FMG and sold them after taking two profits in CBA. Was down $180 on them at one point so glad to get out of jail and collect a tenth of $200 dollars!

This $107 level in CBA seems to be their level at the moment but for how long?

Plus $275.

Recap

Bought 2,000 FMG @ 19.03

Bought 1,000 CBA @ 106.96

Sold 1,000 CBA @ 107.13 ($170.00 profit)

Bought 1,000 CBA @ 106.855

Sold 1,000 CBA @ 107.02 ($165.00 profit)

Sold 2,000 FMG @ 19.04 ($20.00 profit)

Bought 1,000 CBA @ 106.38

Sold 1,000 CBA @ 106.30 (-$80.00 loss)

Wednesday March 23

NASDAQ up overnight and the A$ cracking above 74.50 seems to bode well for the opening. RIOs open strong and then come back before rallying again and BHP was lagging their movement a bit.

Just before 11.00am, pick up 1000 BHP at $47.98, so hopefully the timing and the price below $48 working in my favour.

They indeed do have a spurt above $48 and out they went on a 15c turn. Then back to RIOs.

For some reason they head towards $113 after being as high as $114 and they bounce and bobble around.

Around 11.45am pick up 1000 at $113.14 and put them on a limit to sell at $113.48. Seems a tad ambitious but as it approached nearer to it I kept adjusting it down and finally waved goodbye to them on a 24c turn.

Up $390 and had a few looks at CBA and watched them close 1c below their high at $107.45, after a low of $106.43, so their daily range is starting to narrow. Don’t know what that means. Maybe about to spurt above $108 tomorrow?

Recap

Bought 1,000 BHP @ 47.98

Sold 1,000 BHP @ 48.13 ($150 profit)

Bought 1,000 RIO @ 113.14

Sold 1,000 RIO @ 113.38 ($240 profit)

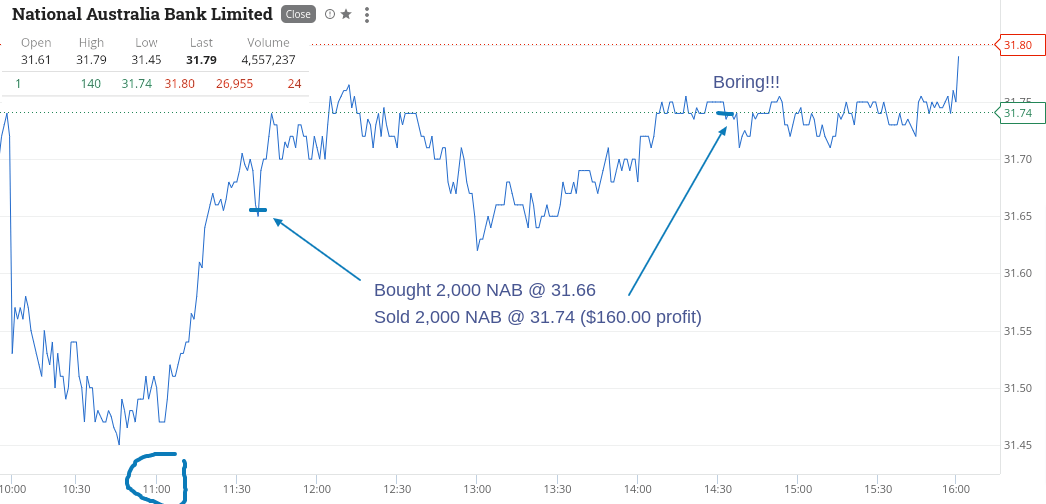

Thursday March 24

A quiet day for me today. I really didn’t have much time early on to check in and when I did nothing took my fancy.

I saw that NAB had increased their buy back, so when they looked a bit oversold, I picked up 2000 and basically sold them as I got bored watching them!

May not be much today but hey, in this kind of market I am happy to make a profit no matter how small and you should all be the same. Remember that cash is king!

Up $160.

Recap

Bought 2,000 NAB @ 31.66

Sold 2,000 NAB @ 31.74 ($160.00 profit)

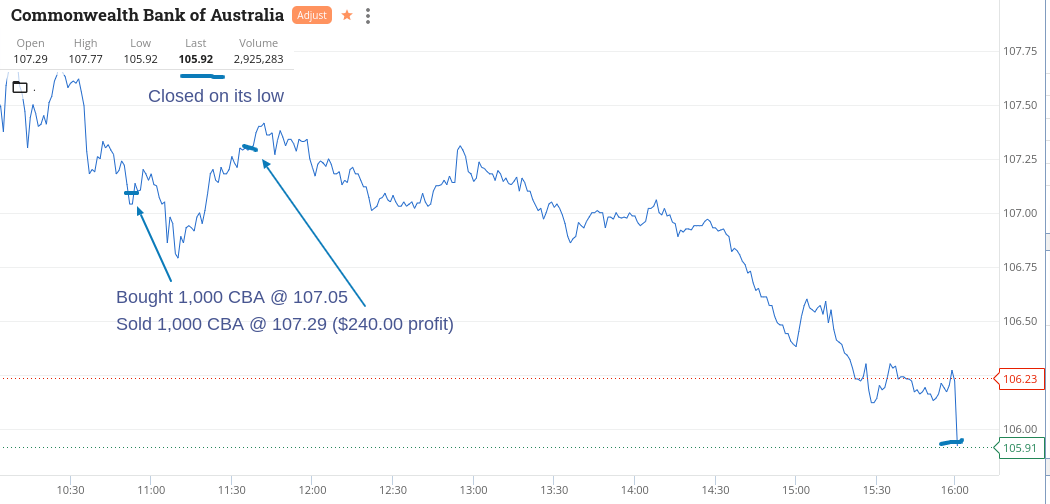

TGIF March 25

Hey hey it’s Friday and expecting some book squaring towards the close, so staying away from any afternoon temptations!

CBA came in with an 11am special today, but not as big a bounce as usual and volumes a bit sluggish.

Got in a bit early, little bit of pain and then a little bit of gain and then they ended the day with $105 on front of their quote. Mind you, who wants to be long ahead of Monday’s opening action?

Up $240 today, $1,595 gross and $1,320 net and a bit drained out. Time for a cold one!

Recap

Bought 1,000 CBA @ 107.05

Sold 1,000 CBA @ 107.29 ($240 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.