Confessions of a Day Trader: Sorry, is there any room in the doghouse? No? Okay…

Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday Feb March 13

Well, I’ve had the whole weekend to digest all the news on America’s 16th largest bank meltdown and from what I can glean, it won’t be a GFC type of event.

I actually think we could have a bit of flight to quality and Australian banks shouldn’t be marked down too much.

Especially after Friday’s efforts.

So, before the market, enjoying one of my own coffees, I imagined how the market may react over the whole day and still imagine that 11am may be a key chance for a bounce.

CBA actually came out of the traps at $96 exactly, had a fall down to $95.62 and then rallied to their day’s high of $96.65 and all before 10.30am.

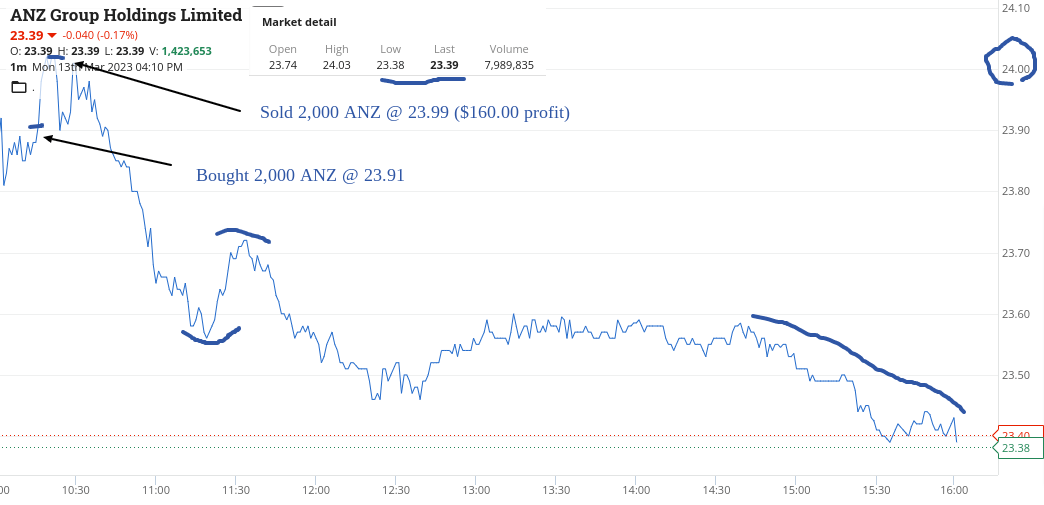

For some reason ANZ were slower to react, so picked up 2000 at $23.91 and put them on a $23.99 limit. I must admit I was a bit nervous going long of a bank and was delighted and amazed when they went through $23.99 and up to $24.03.

It was a very quick 9 min trade and just like CBA, they then started falling away and my whole watch list started turning red. Finally CBA fell back below $96 before 11.00am, so picked up a weak-wristed 500 only and watched them keep falling.

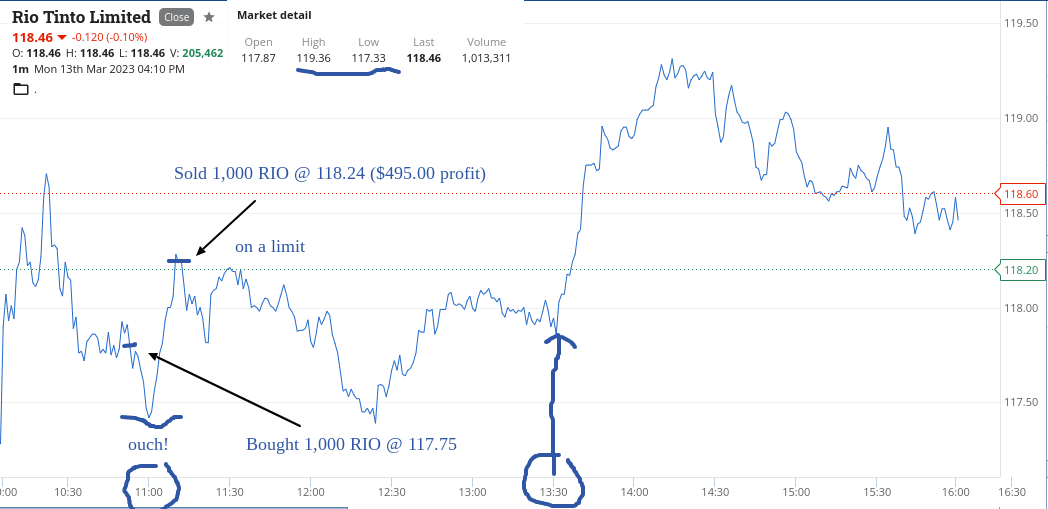

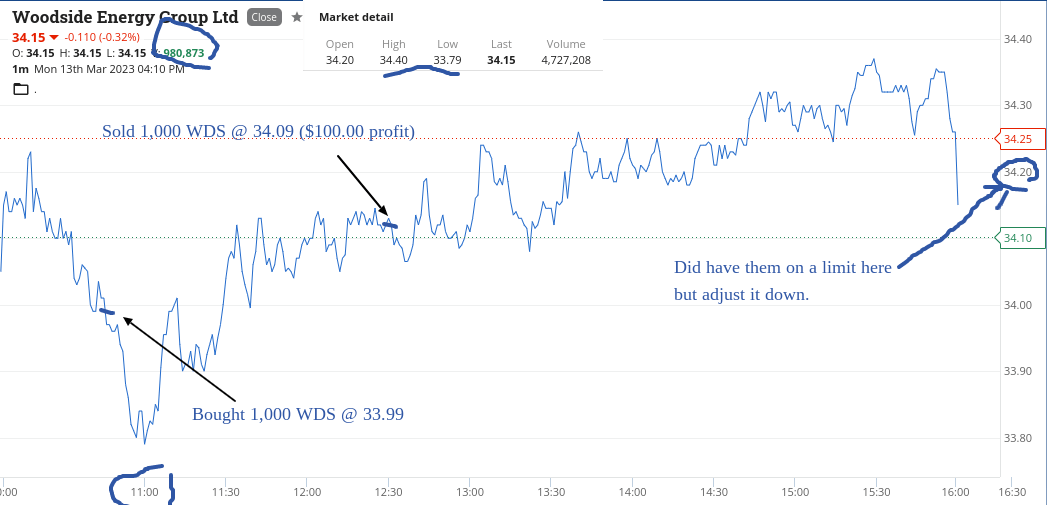

Doubled down at $95.32 and watched them fall below $95. Was nervous but I couldn’t work out why WDS and RIOs should be down. Stuck sell limits on all three of my longs. RIOs came good first, then CBA did me proud and WDS got a bit boring so adjusted my sell limit from $34.20 to $34.09 for a 10c turn and called it a day.

Plus $945 on a bit of a nervous day and clawed back more than Friday’s loss.

Recap

Bought 2,000 ANZ @ 23.91

Sold 2,000 ANZ @ 23.99 ($160 profit)

Bought 1,000 WDS @ 33.99

Bought 1,000 RIO @ 117.75

Bought 500 CBA @ 95.72

Bought 500 CBA @ 95.32

Sold 1,000 RIO @ 118.24 ($495 profit)

Sold 1,000 CBA @ 95.71 ($190 profit)

Sold 1,000 WDS @ 34.09 ($100 profit)

Tuesday March 14

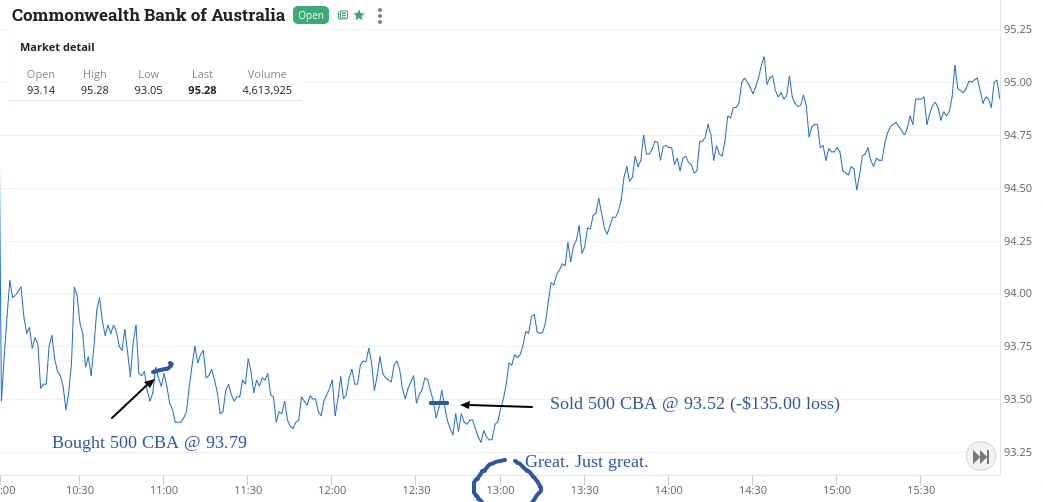

Today I do the walk of shame. I managed to lose money when buying 500 CBA at $93.79. They had a high of $95.28 and because I’m very nervous of being caught, I cut them at a small loss.

Don’t get me wrong, I made money today but I can feel the guys laughing at me on the floor and ribbing me as for weeks I’ve been talking about them trading in the 95s.

Today they traded in the 93s and I cut them, when deep down I know I should have just held on and waited. My head said don’t blow your profits and my guts said hang on.

Anyway I’m not going to say much more.

Recap

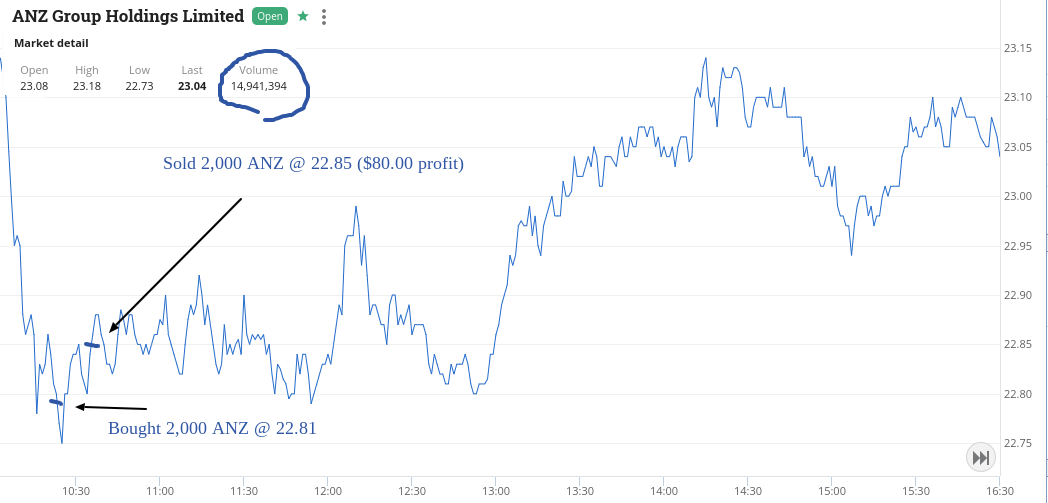

Bought 2,000 ANZ @ 22.81

Bought 1,000 WDS @ 33.00

Bought 500 CBA @ 93.79

Bought 1,000 RIO @ 117.16

Sold 1,000 RIO @ 117.60 ($440 profit)

Sold 2,000 ANZ @ 22.85 ($80 profit)

Sold 1,000 WDS @ 33.10 ($100 profit)

Sold 500 CBA @ 93.52 ($135 loss)

Bought 1,000 BHP @ 44.91

Sold 1,000 BHP @ 45.05 ($145 profit)

Up $630 but I can feel the finger pointing. All of my mates just said ‘how could you’ and laughed at me and when I got home even the dog was giving me the cold shoulder.

$93.79 FFS. Minus D.

Wednesday March 15

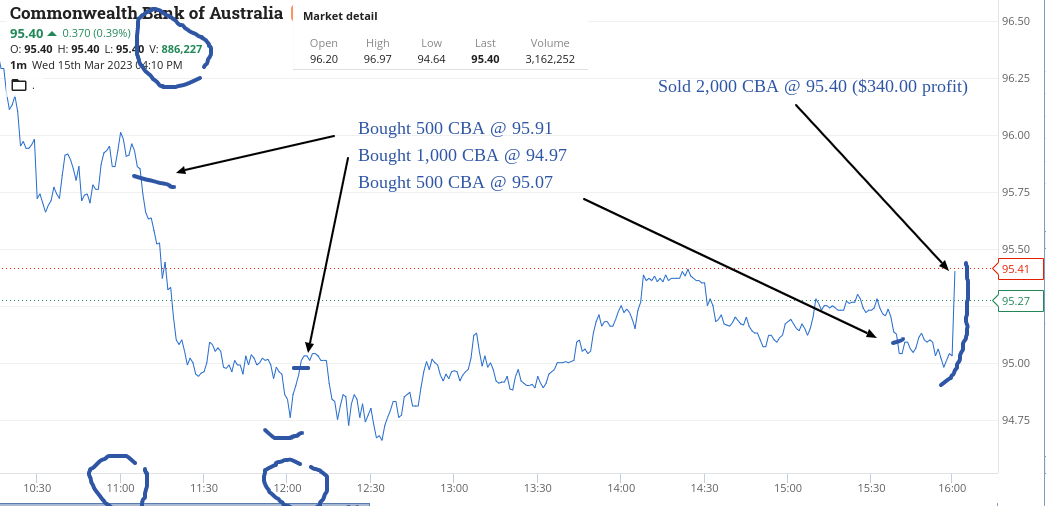

OK. Today we find out why CBA has been not acting as I expected. The other three majors have not been as erratic and down as much as CBA.

Well, they’ve issued a A$1.75bn bond which has an equity trigger component in them, so there has been a bit of rebalancing by the major funds.

Of course, they still give me trouble today, right up till 4.10pm. Today should be the end of their erratic behaviour and they should re-align with the other banks and even outmanoeuvre them.

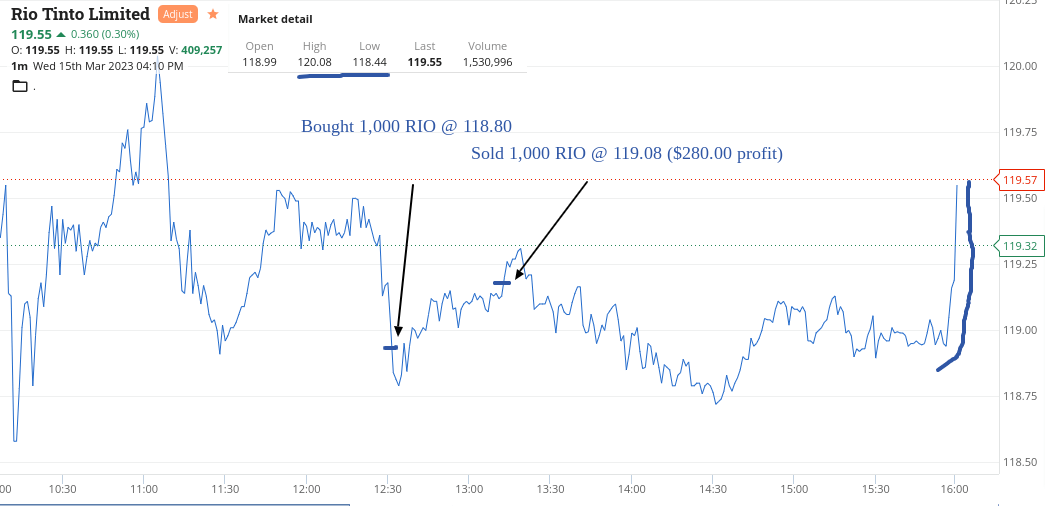

RIOs touched $120 so at $118.80 I thought I would be safe and I was. Makes a change! Same for WDS, below $33.

Up $800 and more than made up for my shameful trade in CBA yesterday. Let’s see what tomorrow offers. Friday will be a quick grab and run day as not sure all the USA bank dramas have finished yet.

Recap

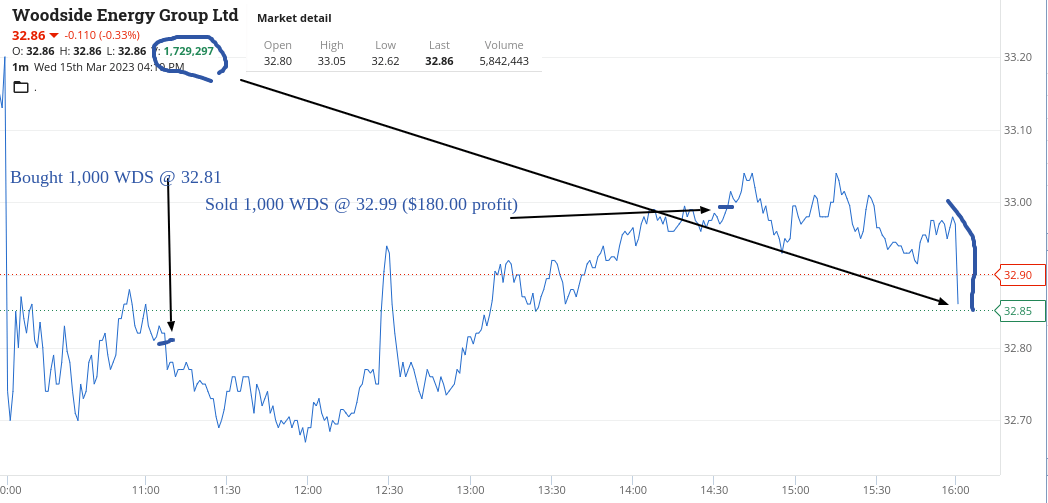

Bought 1,000 WDS @ 32.81

Bought 500 CBA @ 95.91

Bought 1,000 CBA @ 94.97

Bought 1,000 RIO @ 118.80

Sold 1,000 WDS @ 32.99 ($180 profit)

Sold 1,000 RIO @ 119.08 ($280 profit)

Bought 500 CBA @ 95.07

Sold 2,000 CBA @ 95.40 ($340 profit)

Thursday March 16

Bank meltdown overnight, leads into a nervous opening.

I decided not to look until 45 mins in and my watch list was a sea of red. Watching CBA coming into 11.00am and they start taking off. I chase them up towards the $95 level along with everyone else!

Finally get set in 500 only as worried that this is not a normal trading day. Happy to do a few quick grab and runs, even with smaller than usual profits, which cover off my costs plus a bit more.

Up $475 on a day like today and happier to have a go in ANZ (twice) and WBC rather than CBA, as they need to settle down a bit. Their range was $2.80 today on 6m shares.

As for WDS, their range was 98c on 11m shares and even though oil was weaker overnight, I found a quick trade though.

Did not enjoy today and now wait for Friday’s opening. I was very close to doing nothing today and ready to do nothing tomorrow, unless we can see clear trends, which I doubt.

Recap

Bought 500 CBA @ 93.99

Sold 500 CBA @ 94.39 ($200 profit)

Bought 2,000 ANZ @ 22.91

Bought 1,500 WBC @ 21.27

Bought 1,000 WDS @ 31.51

Sold 1,500 WBC @ 21.34 ($105 profit)

Sold 1,000 WDS @ 31.60 ($90 profit)

Sold 2,000 ANZ @ 22.95 ($80 profit)

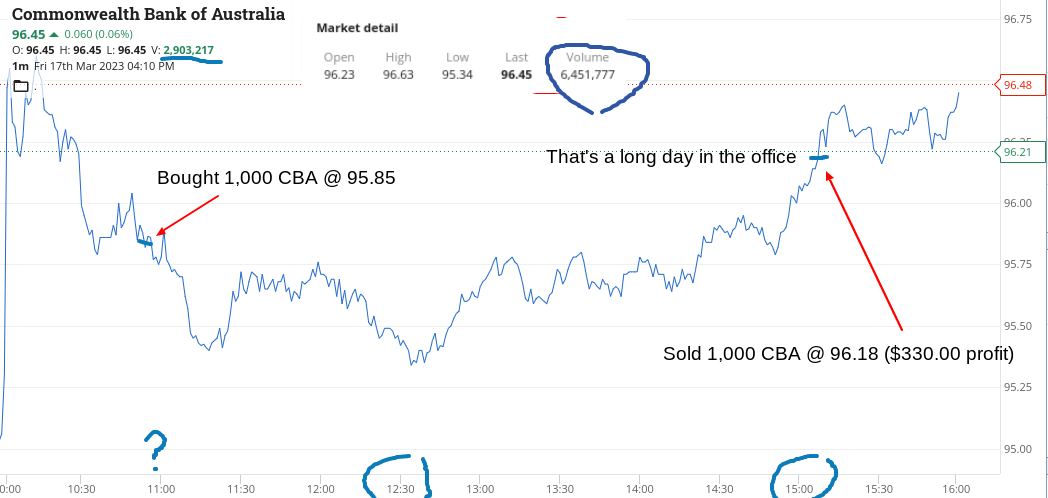

Friday March 17

A bit of a rally overnight, but I really don’t trust it. Being a Friday and with what’s been going on in the banking world, I don’t see many traders wanting to be long going into the weekend.

Having thought this, I just look at CBA and below $96, I think there is a turn in it, as at some point it should head back above that level.

It does, but it took a hell of a long time and they fell more than I thought they would, before coming good. I went in 1000 instead of 500 because with a smaller parcel, you need the stock to move 75c in your favour to get the same result as a 30c move.

The last few days was about being cautious and today I could be a little bit looser. A weekend in these kind of markets can seem very long, as so many articles and opinions appear, that I need to shut out the white noise, until early Monday morning.

Up $330 today on just the one trade and being in CBA, it tasted a bit sweeter this week than last week. Total for the week was up $3,180 gross or $2,710.

A big week where I enjoyed some days and others I didn’t.

Recap

Bought 1,000 CBA @ 95.85

Sold 1,000 CBA @ 96.18 ($330 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.