Confessions of a Day Trader: Some shrinkage evident

Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday October 23

Well, today CBA traded in the 97s which normally would call for a celebration for me, as at long last they are doing what I thought they should be doing weeks ago.

It’s been like death by a thousand knives watching and waiting for them. Problem was today were the low volumes in the morning before they picked up on heavier selling.

Not just in CBA but everything I was watching. Had a quick go in PLS and their volume was 49m and they closed at their day’s low.

RIOs, who were $119 last week, traded in the 111s and they did me proud today but unfortunately, I was let down by WDS, whose range today was $36.38 to $35.03 on half of their usual volume.

Luckily for me they had a late 15c spurt in the 4.10pm session, otherwise I would have had a red day.

Plus $340 and this week is going to stay a hard one. CPI figs out on Wednesday which will result in a bit more volatility if better than expected, as the general trend is still downwards.

Recap

Bought 1,000 WDS @ 35.63

Bought 1,000 WDS @ 35.56

Bought 5,000 PLS @ 3.67

Sold 5,000 PLS @ 3.70 ($150 profit)

Bought 1,000 WDS @ 35.43

Bought 2,000 RIO @ 111.34

Sold 2,000 RIO @ 111.78 ($880 profit)

Bought 3,000 WDS @ 35.07

Sold 6,000 WDS @ 35.19 ($690 loss)

Tuesday October 24

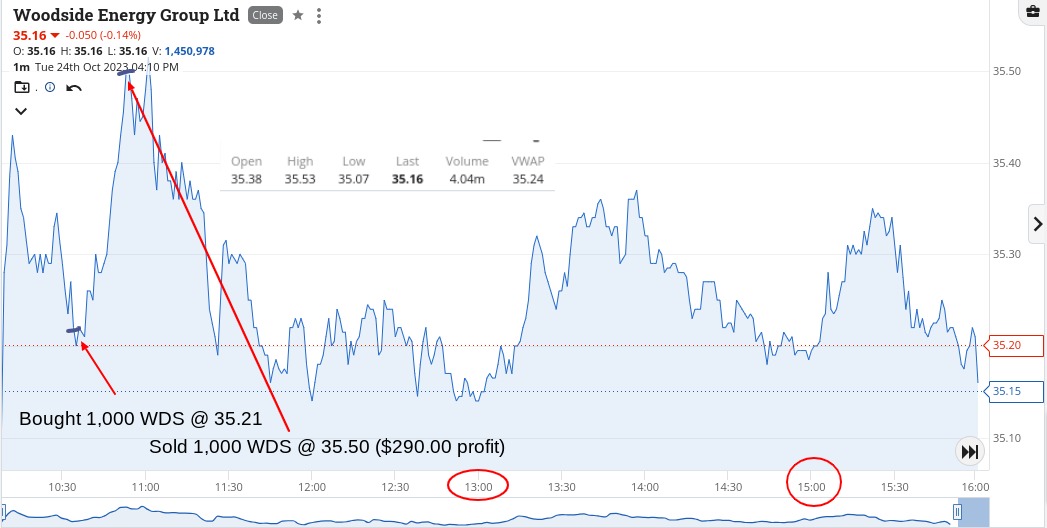

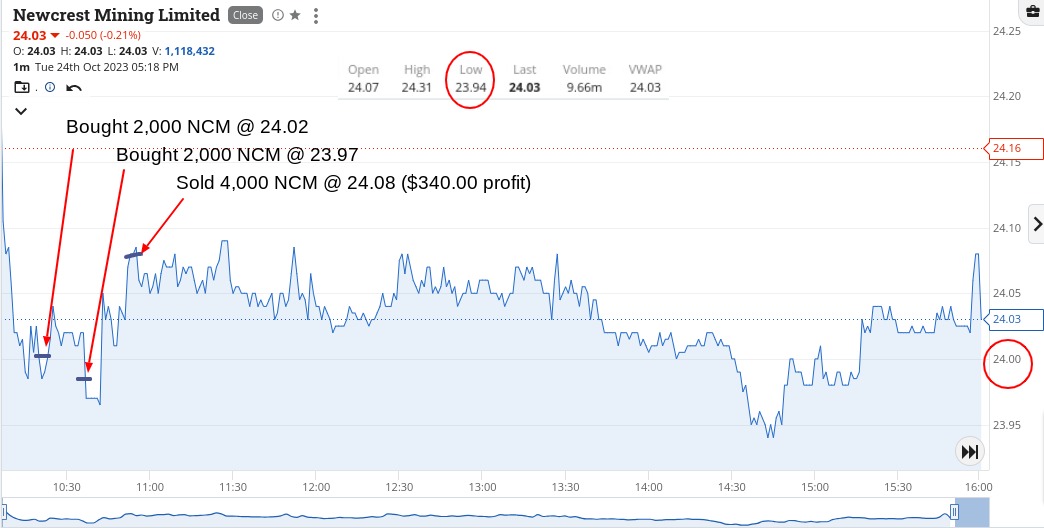

I wish all days were like this. NCM and WDS looked like easy ones to pick for me though the only problem was with WDS, who I went into softly after yesterday’s fingers burnt experience.

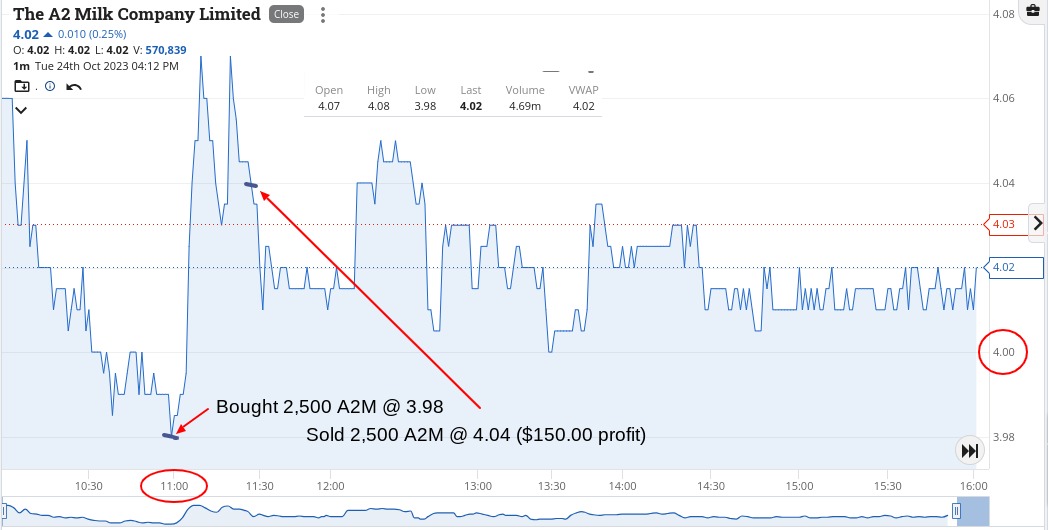

Quick profits and then a limit trigger in A2M produced a lazy $150 and then WBT came onto my radar after they broke down below $3.99.

Also put them on a limit, which they went through by 10c or more.

Up $960 and made it to the beach after lunch, as I didn’t need to look too much at my phone. My day was done. Went for the first swim of the year and boy was it cold.

Recap

Bought 2,000 NCM @ 24.02

Bought 1,000 WDS @ 35.21

Bought 2,000 NCM @ 23.97

Sold 4,000 NCM @ 24.08 ($340 profit)

Sold 1,000 WDS @ 35.50 ($290 profit)

Bought 2,500 A2M @ 3.98

Sold 2,500 A2M @ 4.04 ($150 profit)

Bought 2,000 WBT @ 3.91

Sold 2,000 WBT @ 4.05 ($280 profit)

Wednesday October 25

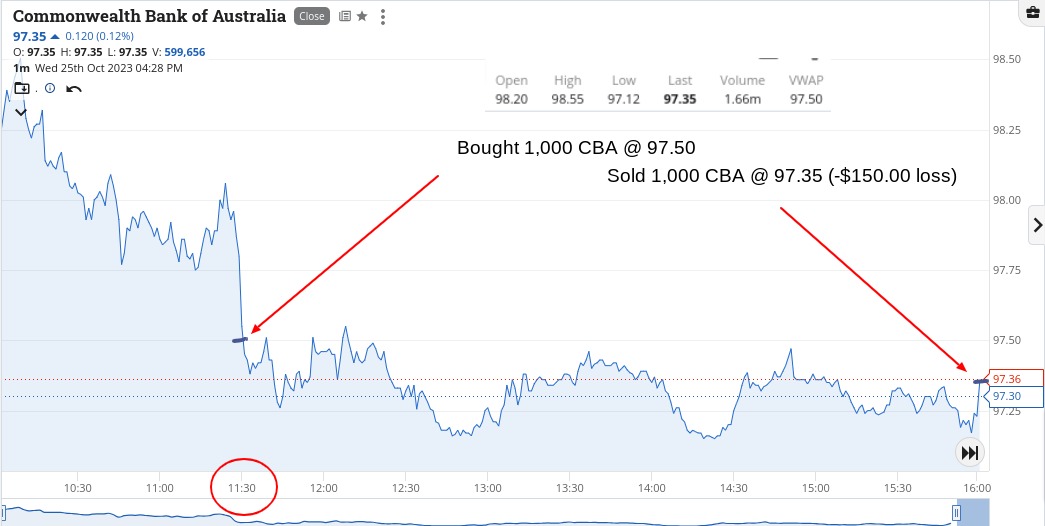

Well CPI figs came out today at 11.30am. I just hung back in the shadows until they came out.

A bit worse than everyone expected, so everything got marked down as you will see from the charts.

Even WDS got whacked and after I bought 1000 I thought about how stupid it was that this CPI figure should do so much damage to an oil producer, so I just doubled my position.

This turned out to be a wise move though my punt in CBA didn’t. This was more about following them to see how they reacted.

Lost $150 but was worth the lesson.

Their range was $98.55 to $97.12 on 1.66m shares which is a bit bigger than the last few days.

Came out the other side in profit today, so I was happy with that. Back to another hospital appointment tomorrow, so I will be watching with interest as I’m in the waiting room.

Up $340.

Recap

Bought 1,000 WDS @ 34.64

Bought 1,000 CBA @ 97.50

Bought 1,000 WDS @ 34.65

Sold 1,000 CBA @ 97.35 (-$150 loss)

Sold 2,000 WDS @ 34.89 ($490 profit)

Thursday October 26

Well, at long last CBA start trading in the 96s and amazingly they closed at bang on $97.00 with 2.29m shares going through. They also gave me an 11.00am special today.

They opened at $96.99 and closed at $97.00!

That’s one for the record books!

Over 2m shares trade and they finish 1c above their opening price.

A bit of hospital waiting room trading went on today and even though I hate hospitals (everyone looks so ill!) I may have to go back and sit there just to trade, going by today’s form.

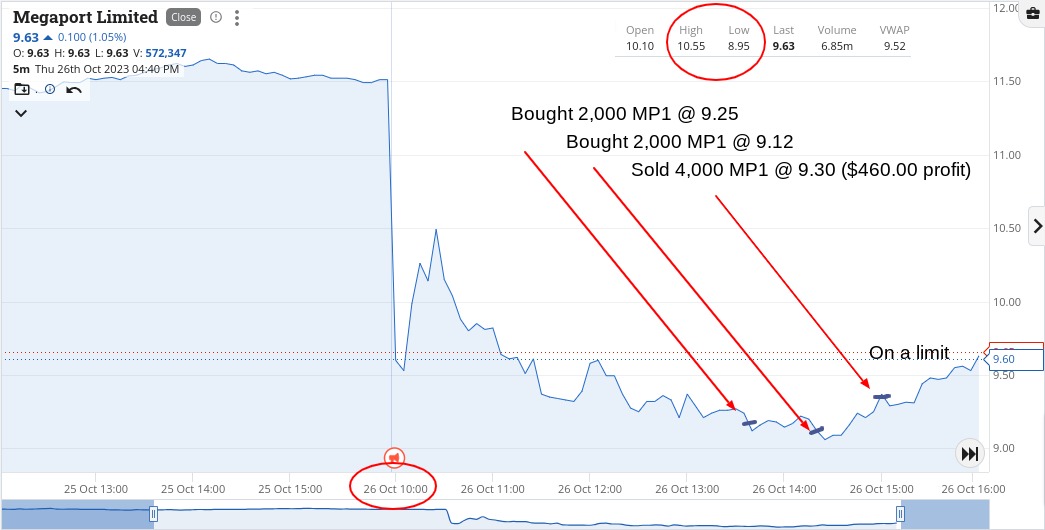

Up $940 for the day and a special thanks to MP1 for doing what you did. They made me feel so much better than any doctor I met.

I wonder if we will see $95 tomorrow?

Recap

Bought 1,000 CBA @ 96.71

Sold 1,000 CBA @ 96.96 ($250 profit)

Bought 1,000 CBA @ 96.76

Bought 2,000 WDS @ 34.83

Sold 2,000 WDS @ 34.90 ($140 profit)

Bought 2,000 MP1 @ 9.25

Bought 2,000 MP1 @ 9.12

Sold 1,000 CBA @ 96.85 ($90 profit)

Sold 4,000 MP1 @ 9.30 ($460 profit)

Friday October 27

Not much I can do today.

Managed to grab some WBT as they hurtled downwards towards 11.00am, so could only presume someone was being margined out.

Put them on a $200 profit limit and eventually they got there.

Being a Friday, the volumes were still not that great and the volatility was just not really there for me today.

CBA was up 55c on their open and that just happened to be their low for the day.

What a steal in the 96s they were. So much for $95 – maybe next week?

Up $200 today and $2,780 gross for the week or $2,367 net and this week included having those CPI figs come out.

Recap

Bought 2,000 WBT @ 3.77

Sold 2,000 WBT @ 3.87 ($200.00 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.