Confessions of a Day Trader: Some markets just want to watch the world burn

Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday January 8

Well, we are back to a full trading week, which now gives me another day to either win or lose.

Volumes are still low and there is some good volatility coming through but the underlying current is downwards.

For example, CBA had a high of $113.22 and a low of $$111.87 and RIO’s high was $133.48 and their low was $130.82.

I got myself into such a pickle with RIOs that I realised that when I doubled down, I would have such a bad average, that I would have to go again just to get to something where I had a chance of getting out of the position, alive.

So my ‘in’ average worked out at $131.503333333 after the number three purchase price of $130.94.

That’s how far in a hole I was.

Decided to hang on till the grim death and I manage to scrape out with a small profit, though brokerage still killed me.

Up $110 gross but still scarred from today’s effort.

Recap

Bought 1,000 RIO @ 132.62

Bought 1,000 RIO @ 130.95

Bought 1,000 WTC @ 70.24

Bought 1,000 RIO @ 130.94

Sold 1,000 WTC @ 70.30 ($60 profit)

Sold 3,000 RIO @ 131.52 ($50 profit)

Tuesday January

After yesterday’s effort and how the market was, I decided to wait for a bit before dipping the old toes in and again, the results weren’t that crash hot.

The waiting, oh the waiting… was all my mind was thinking every time I checked my phone.

Managed plus $285 but gee it was boring. Low volumes and school holidays still on. Can’t see this week getting any better.

Recap

Bought 1,000 RIO @ 131.76

Bought 2,500 FMG @ 28.01

Bought 2,000 BHP @ 48.96

Sold 2,000 BHP @ 48.97 ($20 profit)

Sold 2,500 FMG @ 28.06 ($125 profit)

Sold 1,000 RIO @ 131.90 ($140 profit)

Wednesday January 10

CPI figs out at 11.30am so I’m happy to get an early mark in on some RIOs.

Market reaction is not too hot, after they come out.

By 2.30pm, everything has been mainly sold down and in I go on WBT, RIOs again and CBA.

CBA did the complete opposite to RIOs in the 4.10pm ruck. Of course I doubled down on CBA and not RIOs, so CBA shot me in the back today.

Down $110 after today’s heroic effort and feeling bruised, rather than scarred like Monday’s effort.

When does this week end?

Recap

Bought 1,000 RIO @ 128.97

Sold 1,000 RIO @ 129.20 ($230 profit)

Bought 2,000 WBT @ 3.68

Bought 1,000 RIO @ 128.73

Bought 1,000 CBA @ 112.41

Bought 1,000 CBA @ 112.12

Sold 1,000 RIO @ 128.90 ($170 profit)

Sold 2,000 CBA @ 112.04 ($450 loss)

Sold 2,000 WBT @ 3.65 ($60 loss)

Thursday January 11

Having a quiet day today, as I have to do an afternoon drive. Going away for the night, which works out okay for me, for a change

My lower limits in RIO and FMG don’t get touched, though I managed to ride some FMG on the upside, as they looked like they were about to go for a run.

And that was that for me today. CBA’s range today was $113.66 to $112.24 and they closed 6c below their high.

RIOs on the other hand, traded between $129.30 and $128.03 and their last trade was at $128.40.

Up $250 and cancelled all my lower limit buys, just in case.

Recap

Bought 2,500 FMG @ 27.20

Sold 2,500 FMG @ 27.30 ($250 profit)

Friday January 12

My manic child CSL came good today, though I missed them the first time on the sell at $289.60, but not the second time, as I put them on a limit after they fell away.

Their range today was $288.40 to $290.40, last at $290.40, so they didn’t let anyone down on the volatility level.

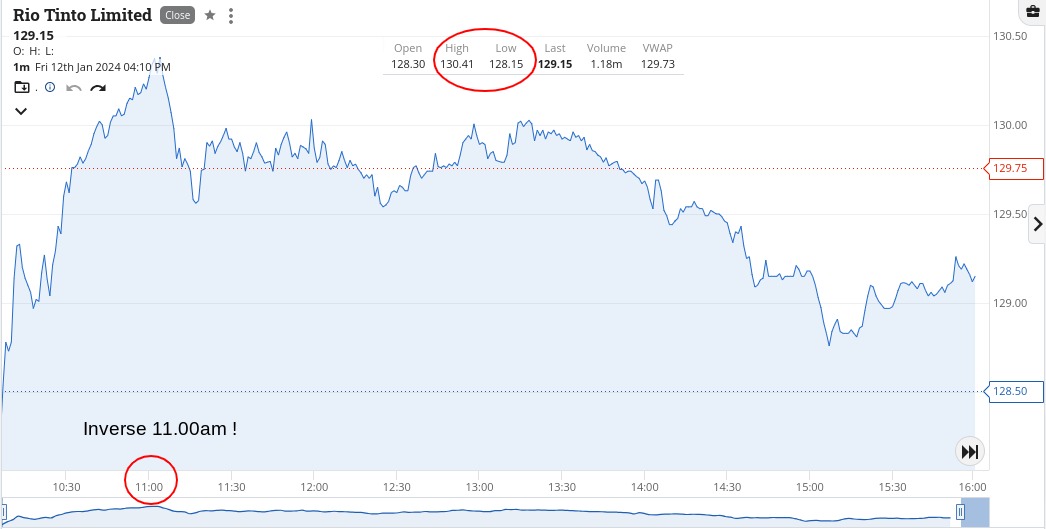

Everything else rallied a bit from their opening levels, though strangely enough, RIOs did a kind of inverse at 11.00am, as you will see on their chart.

Up $230 today and $765 for the week gross or $299 net, so I should have really just sat at the beach with everyone else and basically do nothing and let the sun burn me instead of the markets.

Monday will be interesting as Monday night Wall St is shut for Martin Luther King day, so there will be no overseas lead for 48hrs.

Recap

Bought 500 CSL @ 289.14

Sold 500 CSL @ 289.60 ($230 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.