Confessions of a Day Trader: Smile at me, I’ve gone to RIO!

Pic: DKosig / iStock / Getty Images Plus via Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday August 9

Come in to see that gold has fallen 2.3% or so over the weekend. Toss up between NST and CHN as which one to have a punt on and end up buying 2000 CHN at $6.66 and manage a 4c turn on them just after midday.

They were $7.00 on Friday.

But before all or that, at 10.21am I buy 2500 FMG at $22.60. Was going to make it 5000 but chickened out as thought it a bit risky for my first trade of the week.

Sold them 2 mins later at $22.65, so should have made it a fiver. Didn’t need to worry too much as got another go a $22.60 at 11.48am. Had to hold them his time for 30 mins though and for exactly the same profit and size.

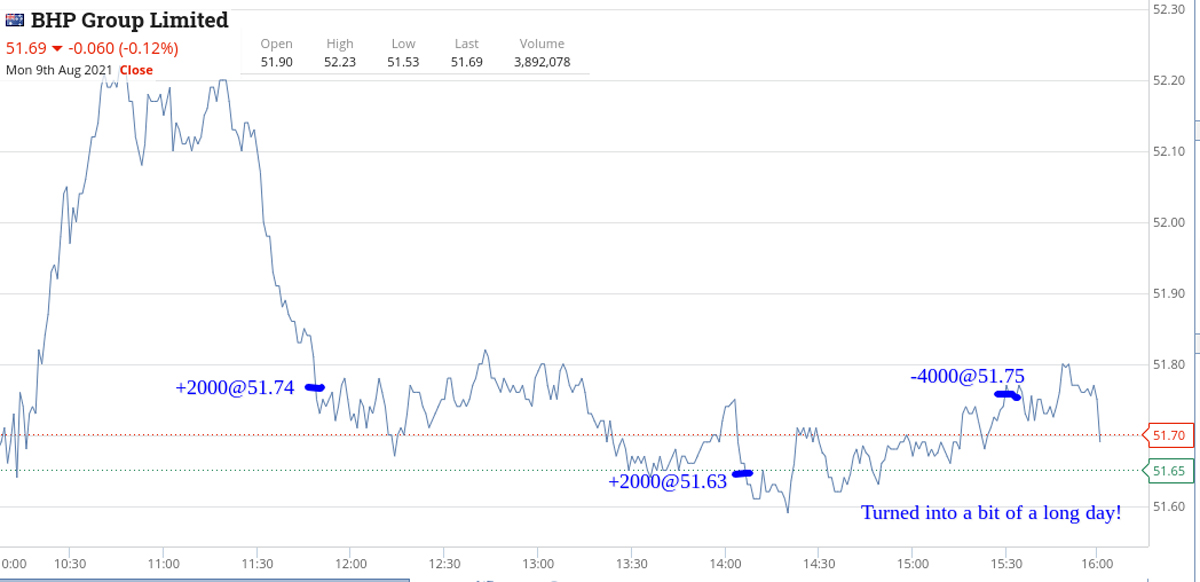

BHP were acting very strangely. Picked up 2000 at $51.74 in between my last FMG punt and had to buy another 2000 at $51.63 before they went out the door on a limit of $51.75. Was a long day in them but finally we got there.

Z1P gave me a 4c turn on 4000, getting set just before 11.00am, though their rally started 15 mins later than expected. Solid buying in them all day.

APT holding steady around the $128/$130 level.

Up $750 today, even with gold falling and the iron ore plays acting strangely. Let’s see if gold recovers a bit.

Tuesday August 10

AFR calling the market to open up a bit at 6.00am but with gold, oil and silver down in NY, so we shall see.

Bitcoin up 6% and silver at an eight-month low, so interesting times.

Very first trade was to buy 2000 Z1P at $8.02. Now watching the three iron ore stocks, BHP, FMG and RIO and waiting for them to crack downwards. Buy 2000 BHP at $51.87 and 2500 FMG at $22.58. Then buy 4000 Z1P at $7.94.

Sell the 2500 FMG at $22.655 (+187.50) and the Z1P at $7.99 (+$140). Then buy 1000 RIO at $128.15 and quickly sell them at $128.37 (+$220).

Back into the RIO 5 mins later at $127.97, for 1000.

BHP rally to $51.95, so sell the 2000 and book a $160 gross profit. Now BHP are rallying and RIO still falling.

So, buy another 1000 RIO at $127.51. Now long of 2000 at an average of $127.74 and down $460 on paper. Add in the commission and I would be down $560.

Time is 1.15pm.

They touched a low of $127.08 at 3.35pm, which puts me at down $1,320 on paper.

Then the rally comes. Down $560 with 7 mins of trading left. Two mins later down $60 and then up $220 1 min later and finally I’m out at plus $325, with 2 mins to spare and a very exciting ‘in lockdown’ relief rally for me and my nerves.

Whilst waiting for the RIO carnival rally, I buy and sell 2000 BHP (+$80), 2500 FMG (+$75) and 2000 NST (-$40) to book a gross profit for the day of $1,407.50 from 18 trades.

Let’s see what joy RIO brings tomorrow. Have my maracas at the ready!

Wednesday August 11

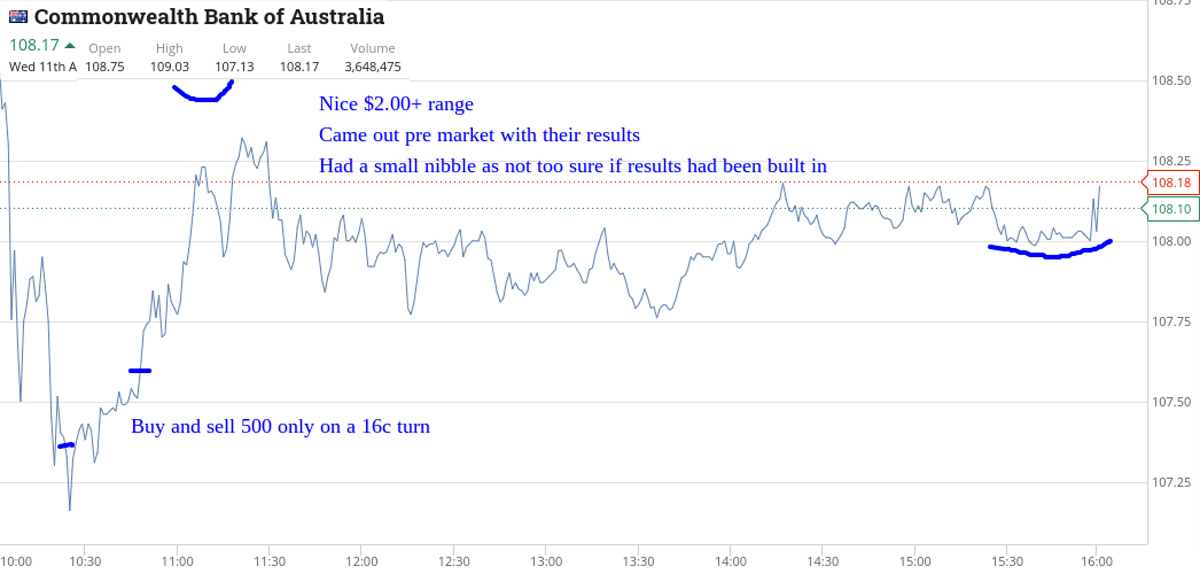

CBA results come out pre market. They jump to $109 on the open and then fall below $108. Nibble at 500. In at $107.39 and out at $107.55 as not too sure if results already built in. They seem to find support around the $8.00 level.

Make back yesterday’s loss in NST. In for a 1000 at 9.27 and out $9.325. As you all know, I hate losing money, so this makes me happy.

Z1P never get above $8.00 today. High of $7.94 and a low of $7.80. They find support at $7.84 for most of the day. Buy 1000 at $7.87 early on and sell them at $7.93. Later on, back in for 2000 this time at $7.83 and out at $7.87.

BHP never go above $53.00 as their high is $52.99! Iron ore down and these babies are up. Buy 2000 at $52.62 and sell them at $52.72, whilst making myself a lockdown salad for lunch.

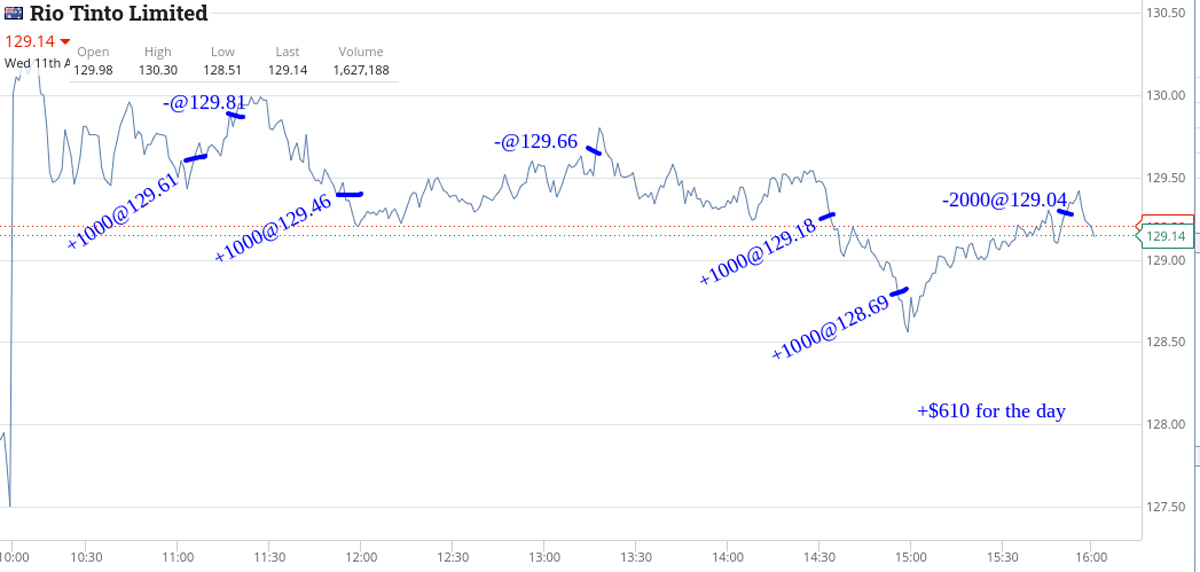

However, I now have an unhealthy (unlike my salad) COVID obsession with RIO. Trade them 7 times today and they have another 3.30ish rally, like yesterday. See graph for all the details.Commission may be high on them but I make $610 from them today alone.

All up, plus $1,165 gross for the day. Now waiting for USA inflation figs to come in overnight, to see how Thursday will shape up.

Thursday August 12

Inflation comes in high but seems to be coming less hot, so Wall Street hangs in OK.

I realise that this lockdown is making me do too many trades, as stuck at home with computer, however my new obsession with RIO comes into play.

They open up down 6%, as they have gone ex-dividend. I watch them as even though marked down, they are the same underlying company. Ie, they should recover back over the next few days.

Jump into the shower and thinking about it, decide to go in boots and all. I spend hours trading and then marking up the charts, so want to break my lockdown trading. Just getting too much.

Come back to the screen and buy 5000 at $120.32. They were $129.14 yesterday and today they are still producing cash returns. I can’t believe them at this level, when compared to the last week.

Sell the 5,000 at $120.80 and watch them go to $120.95, close the computer and go out for a walk and a takeaway lockdown coffee. Decide going to do nothing else today.

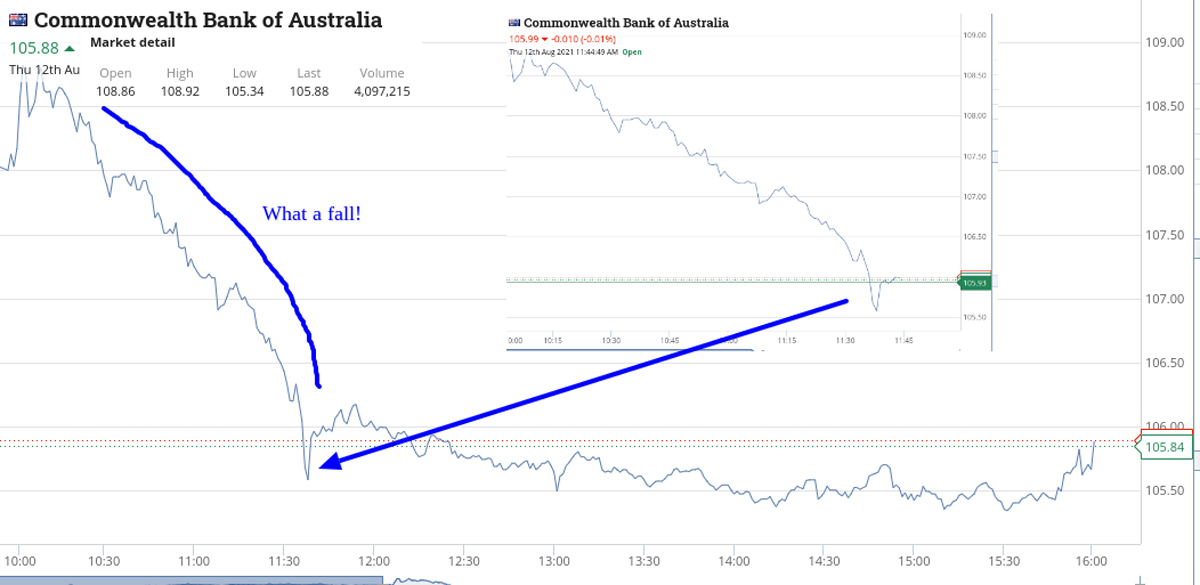

Come back home and take a quick peek and bloody hell. CBA are down to $106.00, from $108 plus. I thought this would happen yesterday, but must be a delayed reaction. Can’t help myself.

Buy 5000 at $105.93 and close my eyes. Of course they fall and I think surely they must rally. They keep flirting around the $106.00 level and then spike and I’m out at $106.16.

Up $3,550 and only a couple of charts need marking up. Now that’s lockdown smart but not sure what’s going to happen tomorrow. ACT gone into lockdown.

Friday 13th. Gulp.

My obsession with RIO continues and I have added an extra chart, with my reasoning. It’s only a few times a year where a stock goes ex-dividend. If you are short you have to pay the dividend, including the franking credit.

Today, they hit a low of $118.54 and closed at $120.36. They were way oversold today, which happened just before 11.00am.

Friday 13th, way oversold, 11.00am – bring it on. Love it.

Made $1,550 out of them today. Sure brokerage was high but that’s all part of the deal.

All up +$8,422.50 gross for the week. Brokerage came in at $1,572, so all up plus $6,850.50.

Ended the week trading in lockdown, which meant I had too much time at the screen, so had to adjust my mindset and thankfully RIO was there to help me do this.

Next week should be back to more normal stuff and dreaming of going to RIO after COVID keeps my mental state in check.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.