Confessions of a Day Trader: Showing some mettle after a Twiggy spanking

Picture: Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday September 6

Mmmmm, the day doesn’t end as it started. I only have eyes for FMG and they go ex-div $2.11 100% fully franked at the 30% tax rate, so that’s $2.11bn going to Twiggy’s wallet and the stock closed on Friday night at $20.85.

In my efforts to get some of that into my wallet, didn’t quite go to plan. Bt 1500 just after the open at $18.74 and watch them go to above $19.00 and then go back down to $18.74 at 12.45pm, where I had placed a limit order.

So, go long of 5000 at $18.74 and now long of 6,500. Get hit in another limit order at 1.15pm for 5000 at $18.55.

Now long of 11,500 (average $18.65739) and wait for them to bounce back towards the $18.70 ish level, but it never happens.

I try to average down, with a purchase of 8500 at $18.55 and then 5000 at $18.54 and watch CBA bounce and even BHP bounce but not FMG. Cut 12,500 at $18.56 and they fall to $18.51 before they recover a bit and I cut the other 12,500 also at $18.56. My average in price overall was $18.5974.

I lost $935 on FMG today and learned a bit of a lesson from a high yielder like this one going ex, in that I should have waited for the franking component to kick in.

Not a great start but have another four days to make it back, commission and all. Open a beer and sulk!

Tuesday September 7

At 5.00am, the AFR is calling for a slightly higher opening, though iron ore is down by over 8% and Wall Street is closed for a holiday. Bitcoin above U$51,000 and the A$ is at 74.30. Going to be fun!

Have to wait a bit for the iron ore players to fall enough to look tempting. Start off by buying 1000 RIO at $108.90, 2000 FMG at $18.12 and 1500 BHP at $41.57 and just to mix it up a it, 1000 CBA at $101.75.

First out the door is the 1500 BHP at $41.68, then the 1000 RIO at $109.10 and then the 1000 CBA at $101.94.

FMG not behaving again today, as had to buy another 2000 at $17.92 before they had a late rally and I get out of jail by selling the whole 4000 at $18.05, just before the close. Their low today was $17.72.

So overall, I manage to claw back $675 against yesterday’s loss and will feel a lot happier once I have clawed back the whole lot.

Wednesday September 8

Overnight RIO are down 1.6% and BHP are down 1.7%. The A$ is below 74c and iron ore bounces 4% higher. Bitcoin is smashed down 9% and major tech stocks in NY close up 2% or more, so at 5.02am, the AFR is calling the market lower. Bond yields starting to tick up. Bring on 10.00am!

Have to wait until just 11.00am before hitting the buy button. Buy 2000 FMG below $18.00 at $17.88 and 1000 BHP at $41.58.

Manage to sell the 2000 FMG at $17.99 on a limit (at $17.99 you know you will get taken out, but not at $18.00 as it can bounce back down and you miss out).

Then sell the 1000 BHP at $41.71.

Next ARB pop up as a heavy ASX200 faller and I buy 1000 at $49.14, which is 6% lower than yesterday’s close. Have to buy another 1000 at $48.84 before selling the 2000 ARB at $49.05.

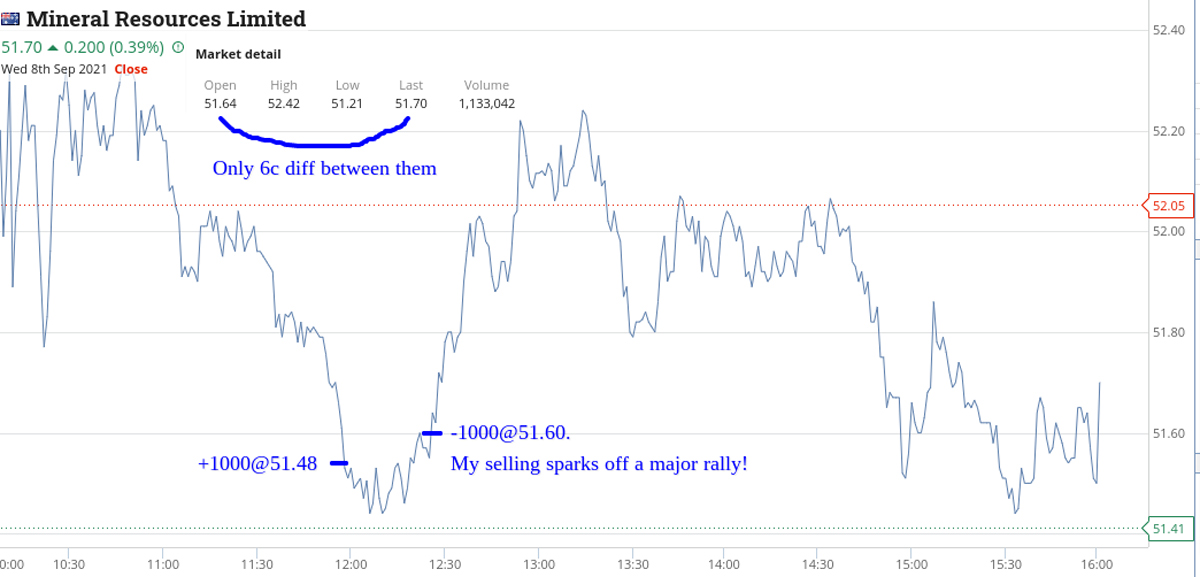

In between the two buys in ARB, I have to buy 1000 MIN as they also appear in my top list of ASX200 fallers. Buy the 1000 at $51.48 and sell them 12c later at $51.60.

The very second I hit the sell button, they take off and add 60c and more in a rally. Unbelievable!

Anyway, finish the day up $590 and have now more than made up for Monday’s loss. Phew.

Thursday September 9

BHP and RIO are marked down in NY trading and the iron ore price is down 4%. Will be interesting to see what FMG do today. I wonder if they could hit $17.60 to A$17.50 range.

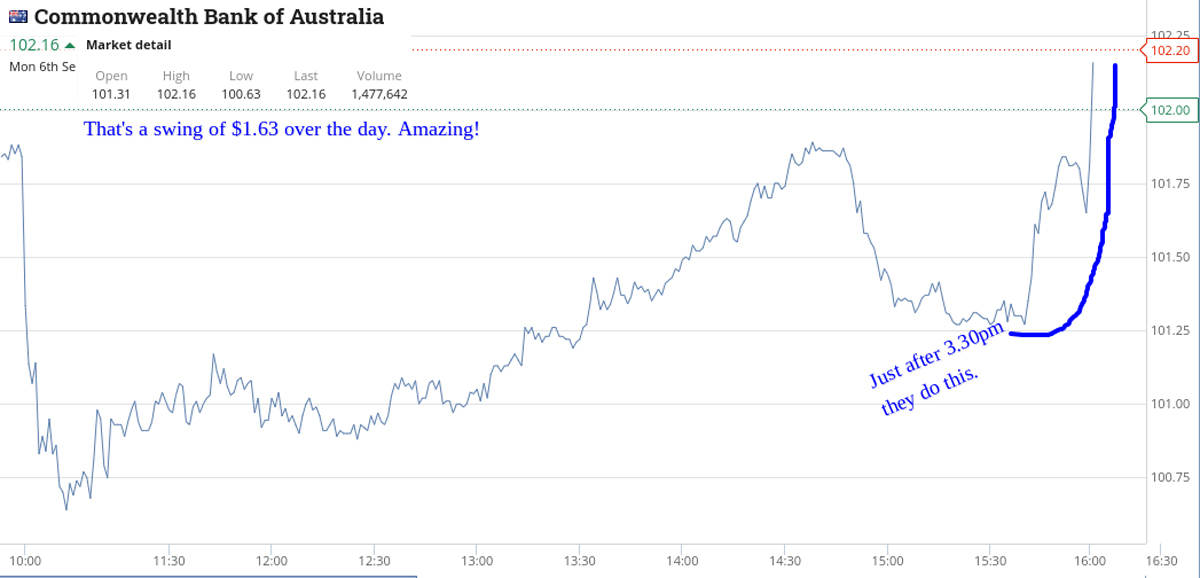

Interestingly, FMG hold steady whilst BHP and especially RIO have a rough time, but the standout today was CBA.

I started out in APT by buying 500 at $127.65 and then another 500 at $127.09.

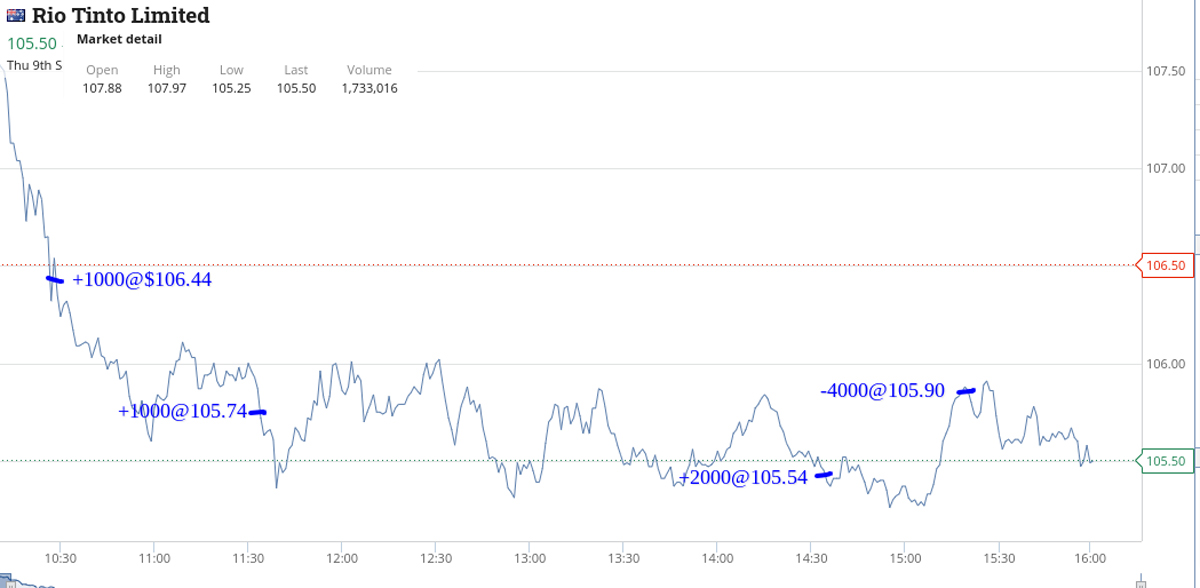

Then buy 1000 RIO at $106.44 before selling the APT at 127.53 (+$160).

Head back into APT at $127.01, just before 11.00am

Buy another 1000 RIO at 105.74.

Then buy 1000 MIN at $50.53 and sell them for $50.73 (+$190). I noticed yesterday that they seem to stir when the Perth boys hit 10.00am their time, so waited a bit before getting stuck in. Back in for 2000 this time at $50.55 and out at $50.68 (+$200).

Finally sell the APT at $127.53 (+$160).

RIO still causing me heartburn. Manage to buy 1000 BHP at $40.88 before selling them at $41.04 (+$160) 20 mins later.

CBA then hit the radar and buy 1000 at $101.28 and 1000 at $101.19 before selling the 2000 at $101.32 (+$165) and now focus is back to RIO.

Buy another 2000 RIO at $105.54 (they were $108.70 on Tuesday). Sell them all 4000 at $105.90 (+$340) and then watch CBA collapse $1.40 very quickly.

I buy 1000 as fast as I can at $100.21, watch them drop and then recover. Sell them at $100.45 (+$214) and watch them then go to $100.65 (also very quickly).They have an intra day range of $2.21.

Amazing! Up $1,555 today, with most of the action after 12 o’clock.

TGIF September 10

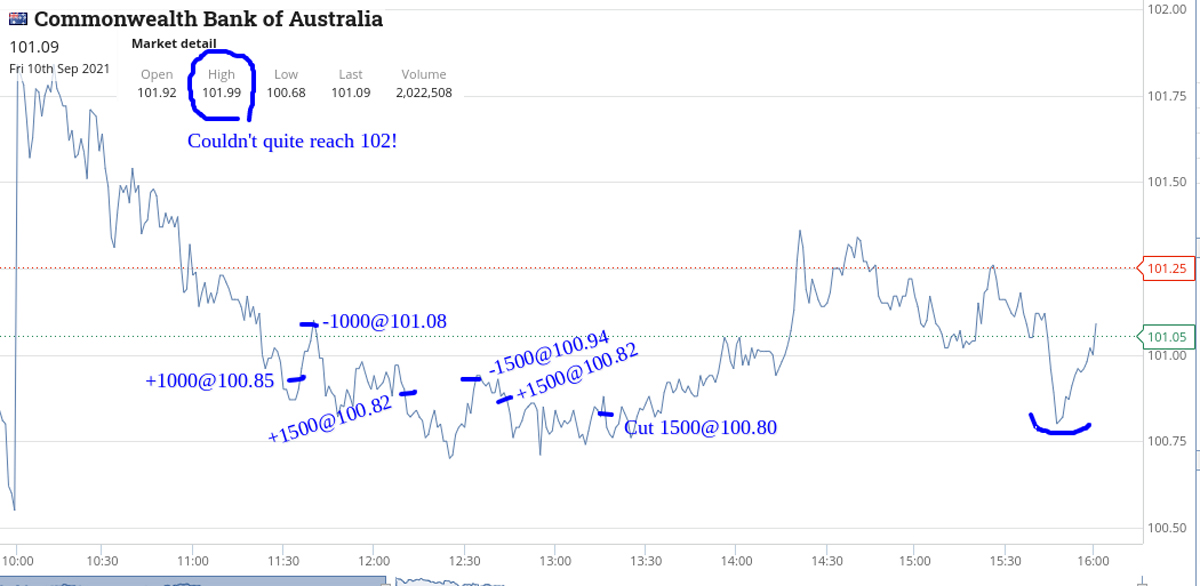

Nothing happening till after 11.30, when CBA fall below $101.00, so pick up 1000 at 100.85 and sell them at 101.08 (+$230). Then back in for 1500 at $100.82, out at $100.94 (+$180) and then back in for 1500 at $100.82.

APT now falling towards $126.00 (they were $135 not too long ago). Buy 1000 at $126.03 and cut the 1500 CBA at $100.80 for a $30 loss, so I can concentrate on APT.

Buy another 1000 at $125.78 before selling the 2000 at $126.07 (+$330).

Then back in 60 mins later for 2000 at $125.80 and out at $125.99 (+$380) and then with 5 mins left to go they fall towards $125.50.

Pick up 2000 at $125.60 (as I think they are way oversold here) and now on a bounce and sell them at $125.72 ($240). Not my usual style but couldn’t help myself.

Finish off the day up $1,330 and overall up $3,215 gross for the week and $1,936 net and that’s even after my disaster in FMG on Monday, which was my own fault as my trading ego really thought I could make $10,000 out of them and instead, got shot down by the market.

Oh well, lockdown easing in a few places and sun has been kind so far this week. Bring on Monday.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.