Confessions of a Day Trader: Saved on the bell by a RIO rally!

Picture: Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

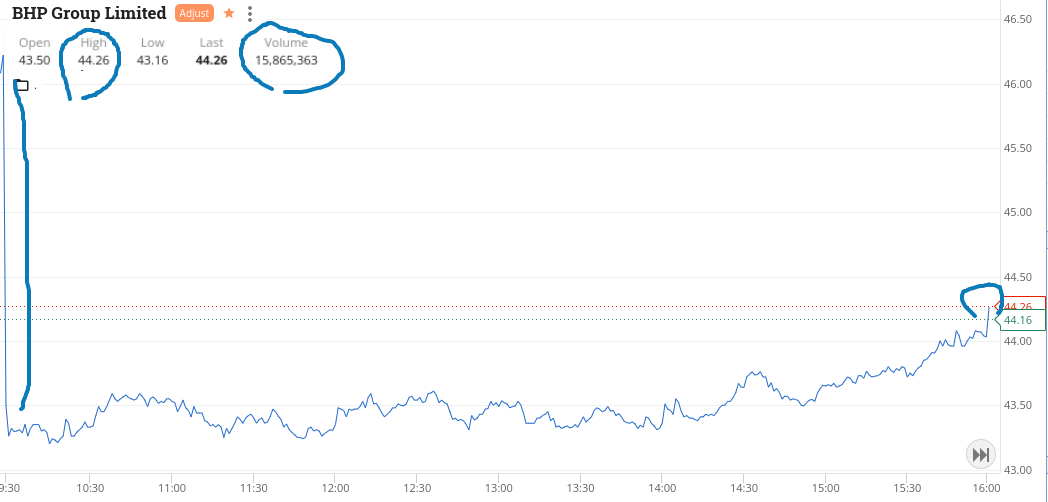

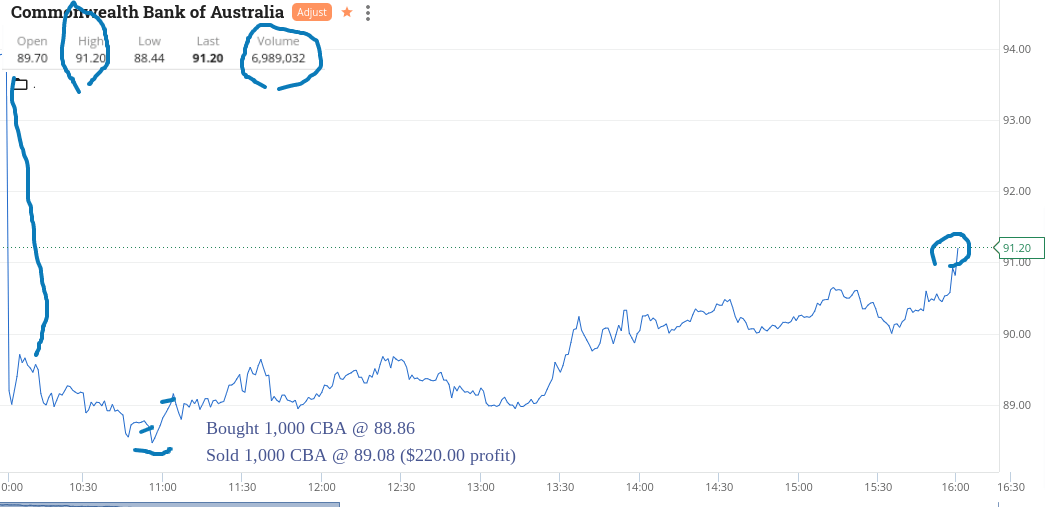

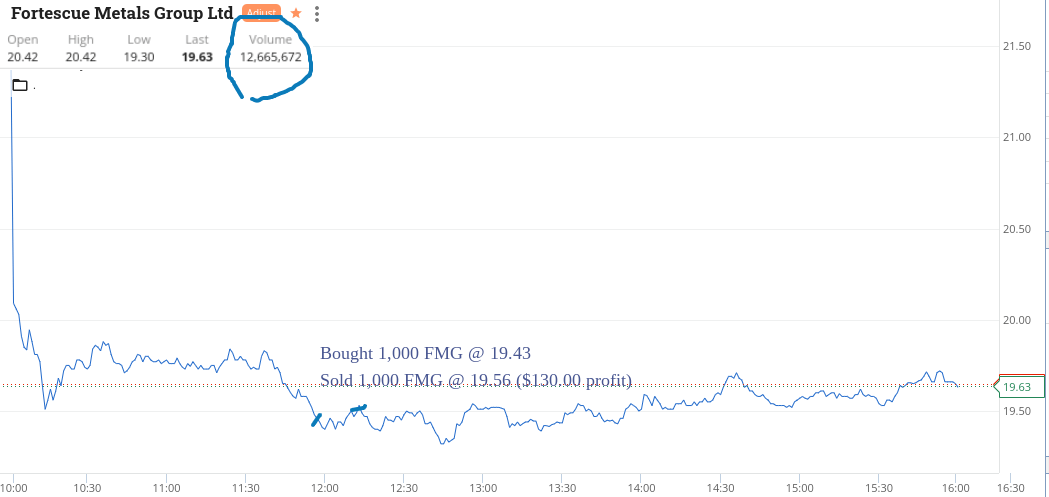

Tuesday June 14

Everything getting smashed today. Having said that a few opportunities did arrive.

CBA gave an 11.00am special:

Then FMG looked like a goer, so had a small shot.

In a day which had a bloodbath running through it, managed a gain of $350, so happy with that.

Strangely enough both CBA and BHP ended their day on their highs. Amazing.

Recap

Bought 1,000 CBA @ 88.86

Sold 1,000 CBA @ 89.08 ($220.00 profit)

Bought 1,000 FMG @ 19.43

Sold 1,000 FMG @ 19.56 ($130.00 profit)

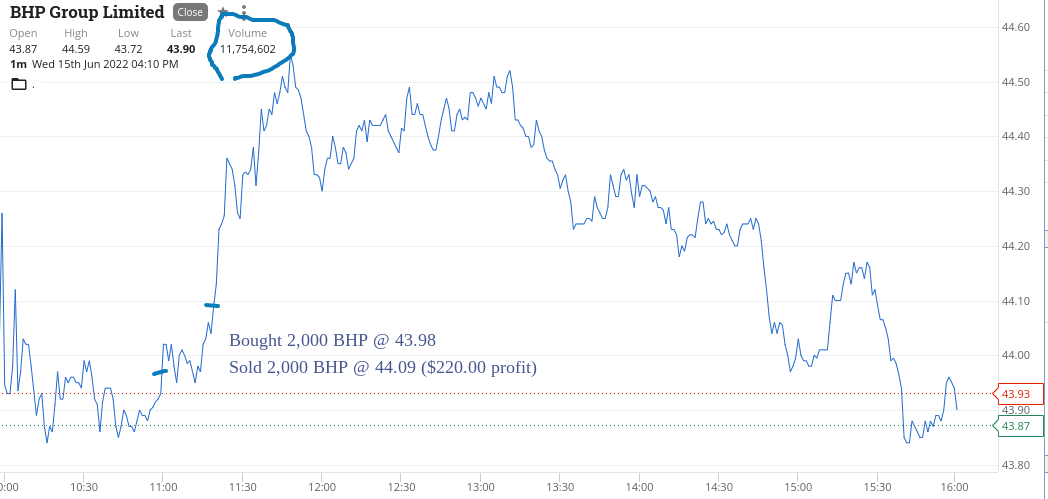

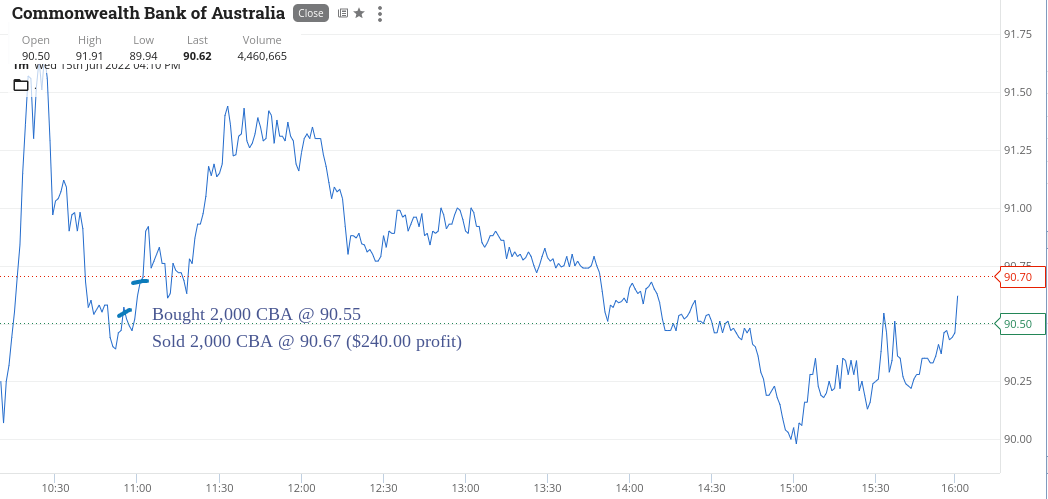

Wednesday June 15

A couple of quick 11.00am specials in BHP and CBA. Doubled up in size, so happy to be in and out very quickly.

As using a bigger size, was happy to take smaller tuns and walk away. You could have gone long or short in both and still made money.

It was that kind of market.

Up $460 but comm a bit higher today, which BHP basically covered off. Was going to double up in BHP as RIO and FMG were going higher and they were still hovering around the $44.00 level, but remained cautious.

Recap

Bought 2,000 CBA @ 90.55

Bought 2,000 BHP @ 43.98

Sold 2,000 CBA @ 90.67 ($240.00 profit)

Sold 2,000 BHP @ 44.09 ($220.00 profit)

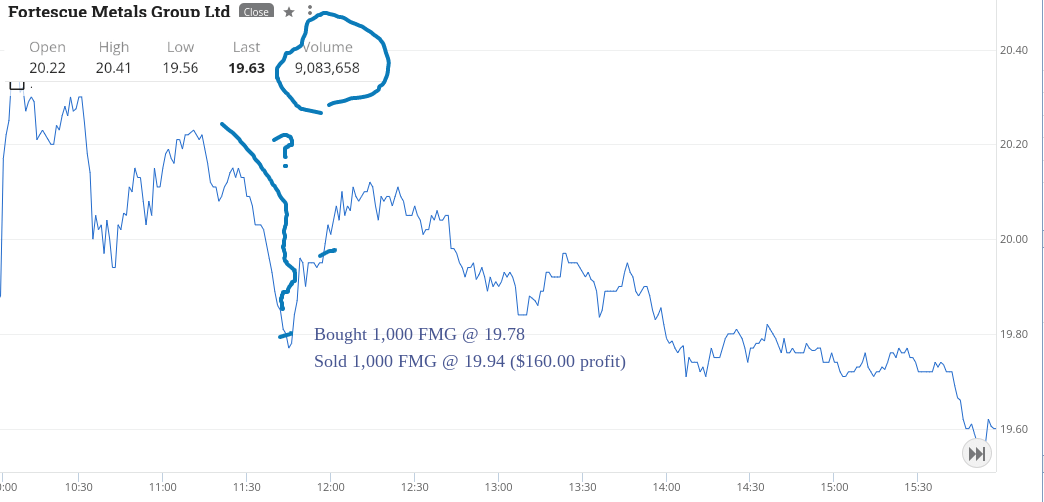

Thursday June 16

Had to be a bit more patient today, as things were bouncing higher though it still feels fragile underneath everything.

Like walking on eggshells.

So even though we see a jump at the opening, things like CBA and FMG still get sold down, a bit overdone and bounce.

The rise in bond yields tell me things aren’t that rosy still.

Plus $450.

Recap

Bought 1,000 CBA @ 90.24

Bought 1,000 FMG @ 19.78

Sold 1,000 CBA @ 90.53 ($290.00 profit)

Sold 1,000 FMG @ 19.94 ($160.00 profit)

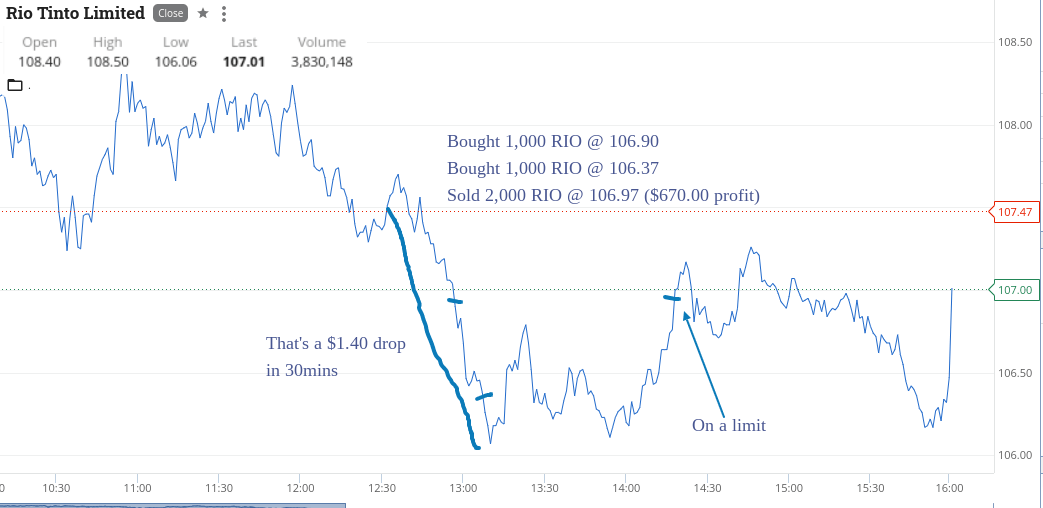

Friday June 17

Everything down again, so the see-sawing continues. Cash is king and crypto is shite!

Iron ore was lower overnight, so the usual suspects were down and having seen RIOs $5 or $6 higher in the week, at below $107, I thought they looked good.

Of course I got a bit of pain and reluctantly doubled down as was about $600 in the red. I thought that this good go either way.

In a change of a bit of luck from last week’s CBA loss, they did rally and really quickly and this turned a $600 loss into a $690 gain plus a few grey hairs added as well.

Don’t really enjoy weeks like this, as emotionally I can feel everyone’s pain and not just in Australia but thanks to Bitcoin, around the world.

End the week up $1930 gross and $1701 net, so I can live to fight another day.

Monday feels like it could be a black day!

Recap

Bought 1,000 RIO @ 106.90

Bought 1,000 RIO @ 106.37

Sold 2,000 RIO @ 106.97 ($670.00 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.