Confessions of a Day Trader: Rules – and record profits – are made to be broken!

Pic: metamorworks / iStock / Getty Images Plus via Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday July 19

No real lead from Wall Street over the weekend but COVID and lockdown still leading the headlines, so kind of expecting everything lower or drifting.

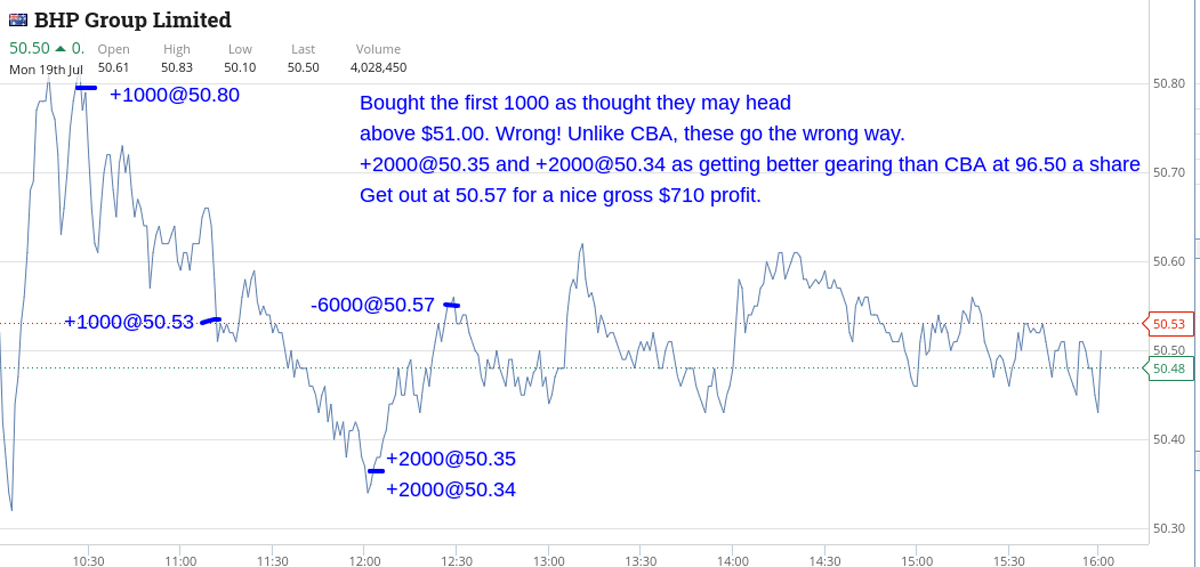

Have a bit of a brain snap and decide to buy 1000 BHP at $50.80 instead of waiting. Time is 10.27am. I was thinking that they would bounce back above the $51.00 level, where they were on Friday.

Buy 1000 CBA at $96.47. Time 10.38am. Buy 2000 Z1P at $7.11 a minute later.

Sell the 1000 CBA at $96.65 into an 11.00am rally at 11.06am. Then sell the 2000 Z1P at $7.15 but this time it’s two minutes later.

Paying for my brain snap and buy another 1000 BHP at $50.53. Time is 11.13am. Should have waited!

Then it gets a bit worse. Buy 2000 BHP at $50.35 and then another 2000 at $50.34 as I realised that I needed to really get my average in price down. They finally rally and at 12.30pm, I sell the 6000 at $50.57, to make $710 gross.

CHN were down almost 10% when I buy 5000 at $6.78, which is down from $7.50 on Friday. Sell them at $6.87 on a bit of short covering. That’s plus $375 gross.

Overall up $1,345 though still wondering why I went so early on BHP. Time for a lie down.

Tuesday July 20

Well it finally happened. Wall Street falls 2% in one day, which I’ve been waiting for. All set and ready to go. Let’s see what opportunities come along today. Will APT trade with a 99 in the front? Bring it on.

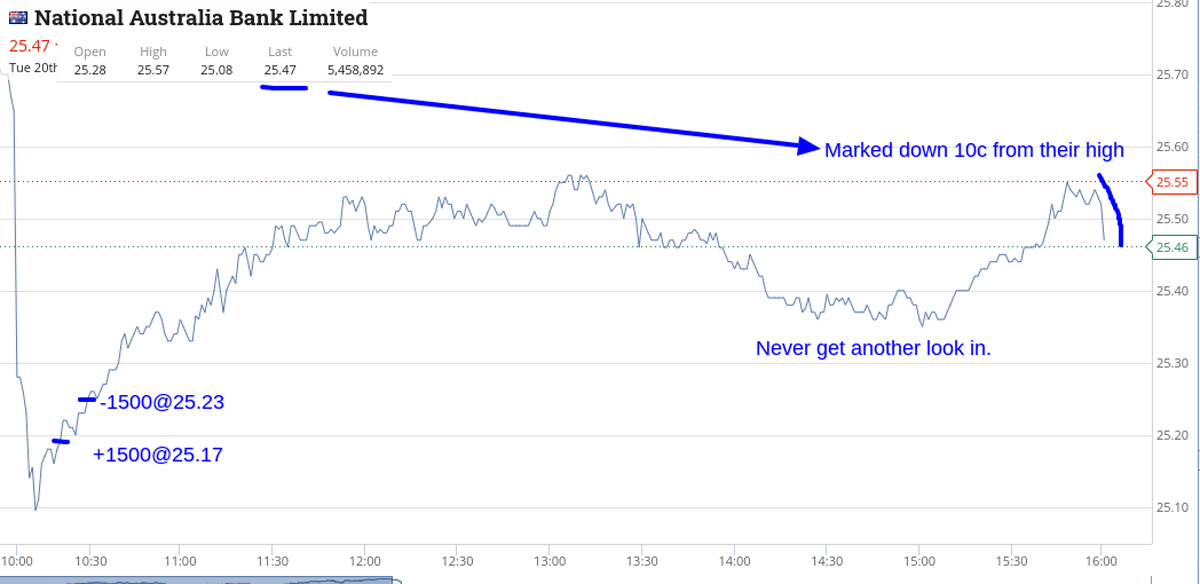

I add more bank stocks to my watch list, so now have all the four majors. I buy 1000 WBC at $24.20, which is down 59c, 30secs after they open. At 10.17am, I buy 1500 NAB at $25.17 and then 1000 ANZ at $26.99, a min later.

Chased the ANZ up from $26.90, as they started to climb. Sell all three positions at 10.28pm for a $220 profit.

Switch into 1000 BHP at $49.33. Time 10.30am. Sell them at $49.45, 25mins later. Back in at 1.43pm for 1000 BHP at $49.31 and 2 mins later sell them for $49.38.

Also made $70 on 2000 Santos, to bring it to up $480 for the day, which is a bit disappointing as CBA took off and APT did the complete opposite of what I thought and touched $109.00 intraday. The banks were the story of the day and I left profits on the table for others.

All my lower limit buys in CBA never got a look in. It was like watching a balloon floating up into the sky!

Wednesday July 21

Wall Street recovers overnight and eager to see what the bank shares will do today. APT is anyone’s guess.

Everything is ticking higher. BHP coming off a bit so buy 1000 for $50.15 at 10.49am. No 11.00am bounce so have to buy another 1000 at $50.08.

Time 11.24am. KGN are a big faller, so buy 1500 at $11.79. Buy another 1000 BHP at $49.90.

Time 12.09pm. Finally and annoyingly I buy 3000 BHP at $49.79. Time is 12.33pm and now wait for a bounce. By now my palms are getting a bit sweaty.

At 1.15pm I sell all 6000 BHP at $50.00 on the nose and now relax a bit. Plus $500.

Buy 3000 KGN at $11.54 but they never go above my breakeven, so I break a golden rule and keep them for tomorrow. That’s what rules are for, I tell myself. Maybe but I don’t really know. Mmmm.

Need some fresh air, so head to the beach.

Thursday July 22

Markets are up overnight and the first thing I do is close out the KGN at $11.67 just after they open and my golden rule break gives me a $210 profit. Then things get a bit bizarre in both KGN and Z1P.

Buy 5000 KGN at $11.40 and 5000 Z1P at $7.20. Buy another 5000 KGN at $11.26, which is down from $11.67! Sell the 5000 Z1P for $7.25 and make $250. Then buy them back at $7.15 and then sell the 10,000 KGN at $11.36, making $300.

Sell the 5000 Z1P at $7.18 for a $150 profit. Then back in for 5000 at $7.13 and out at $7.16. Then buy them back at $7.10 and sell them at $7.16 and finally can’t help myself and buy 5000 at $7.05. They promptly fall below $7.00 and then bounce back to $7.05 in the blink of an eye. Sell the last 5000 parcel for $7.07.

Total profit for the day is $1,250, which will more than wipe out my personal Z1P spending account. Take with one and give with another, I think to myself.

Friday July 23

So far, up $3,665 and humming ‘should I stay or should I go now’ in my head, as I sit down and open my computer lid.

I only managed to find one trade today and that is in Northern Star, who popped up as one of the biggest fallers on my screen. They closed the day down 6.2% at $10.06, down from $10.80. Lucky for me they never fell below $10.00.

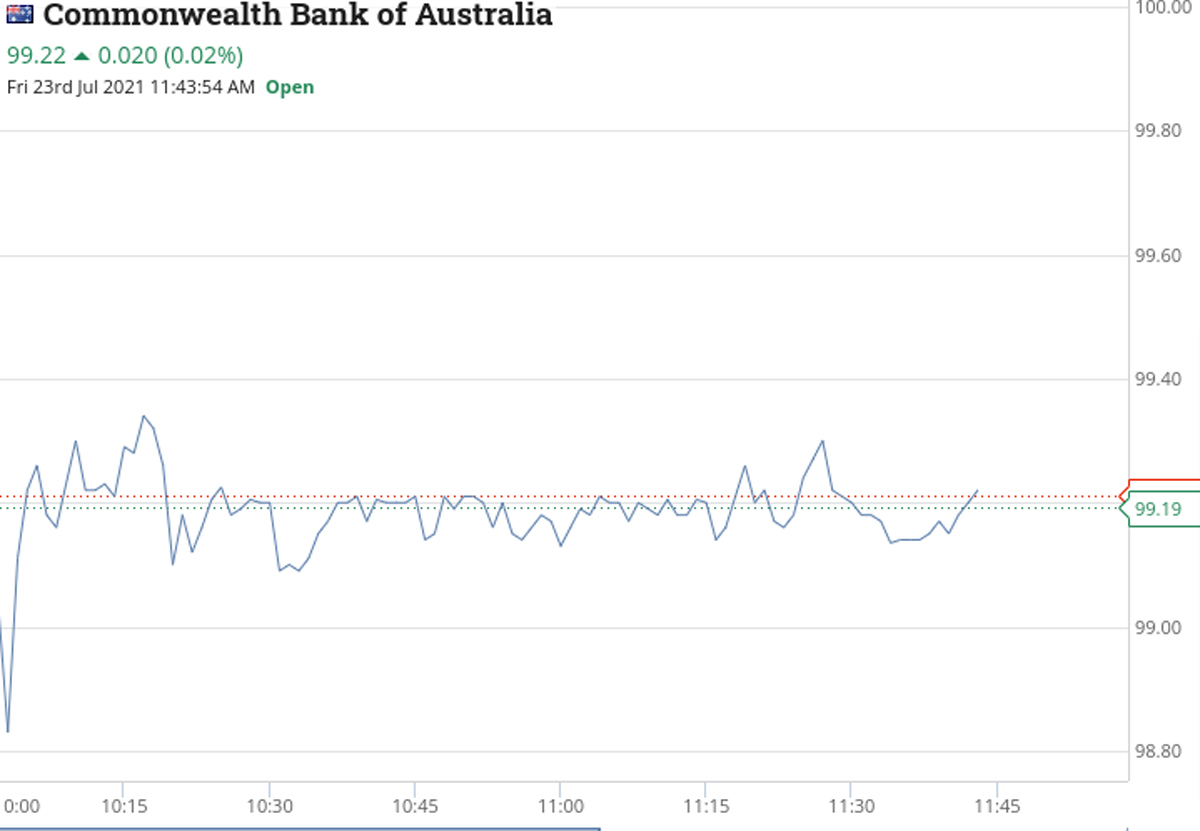

Bt 5000 at $10.06 and left them out on a limit at $10.14, which sort of looked like a support level, earlier on. To show what sort of day it was, I’ve included a snapshot of CBA at 11.43am.

What with it being a Friday and COVID news dominating the headlines, everything sort of drifts off into the sunset. Had a cracker of a week, with Z1P on Thurs being my best trades and my worst was in breaking a golden rule in KGN on Wed.

All up +$4,065 gross and +$3,476 net. Mask up and head to the pub.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.