Confessions of a Day Trader: Ride the CPI trade, but don’t get carried away

cpi trade

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday January 23

A very slow start to the week, with lower volumes flowing through.

Just dipped my toe in the water with 500 RIOs and 500 CBA.

When things are quiet, I find that taking a smaller amount of shares gives me something to concentrate on. I could put in trigger alerts for my phone, but it’s not the same.

Having done this and being ready to double average down, RIOs prove that I don’t have to, whereas CBA prove to be the opposite and I had to wait a fair bit of time for them to crack downwards.

When they did, I was ready to go, so pulled the trigger and waited. Up $270 on them and $155 on RIO so $425 for a slow day. CPI figs out on Wednesday and Australia Day on Thursday slowing things down.

Recap

Bought 500 RIO @ 125.67

Bought 500 CBA @ 108.95

Bought 1,000 CBA @ 108.50

Sold 500 RIO @ 125.98 ($155 profit)

Sold 1,500 CBA @ 108.83 ($270 profit)

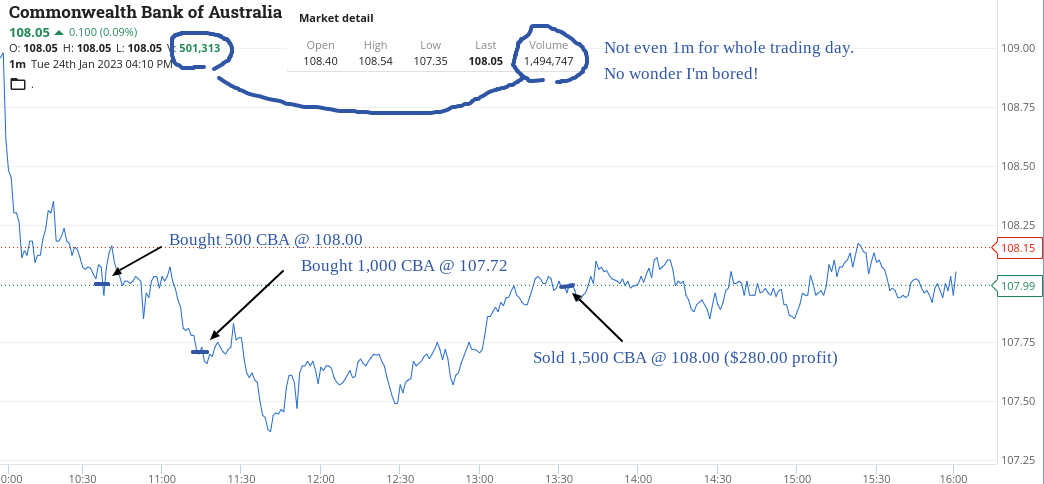

Tuesday January 24

Used the same tactic as yesterday, though RIOs never really came back.

CBA had a day range of $108.54 to $107.35, with $108 being their pivotal point. Caused me some pain before the gain but eventually, they got back up to $108.

I was already for a stop trigger pop, once they got to $108, but it never happened, just very slowly reacted, so I had to adjust my $108.07 selling limit down twice before eventually getting out of my boredom.

God, it’s slow. Up $280 and bored! At least tomorrow we should have some CPI action and I feel that everything has been built in, so we shall see.

Recap

Bought 500 CBA @ 108.00

Bought 1,000 CBA @ 107.72

Sold 1,500 CBA @ 108.00 ($280 profit)

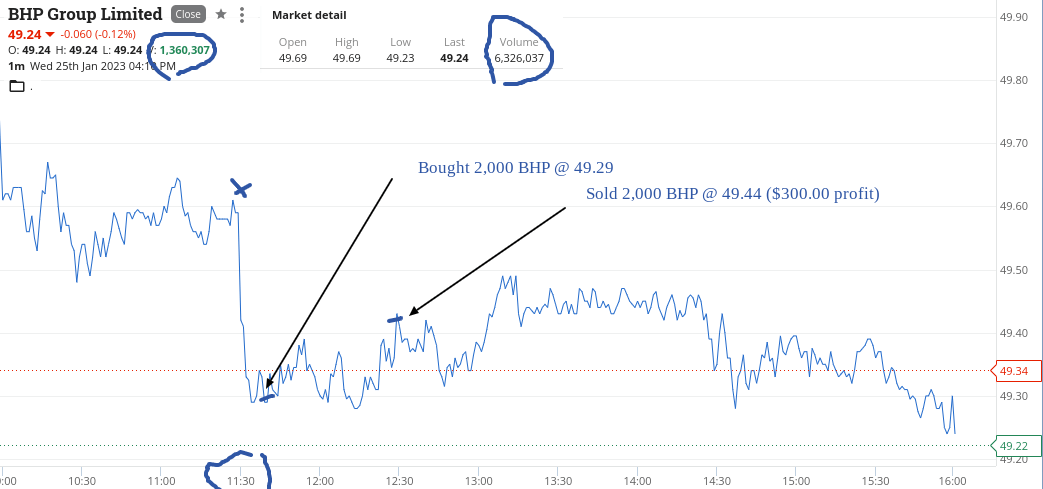

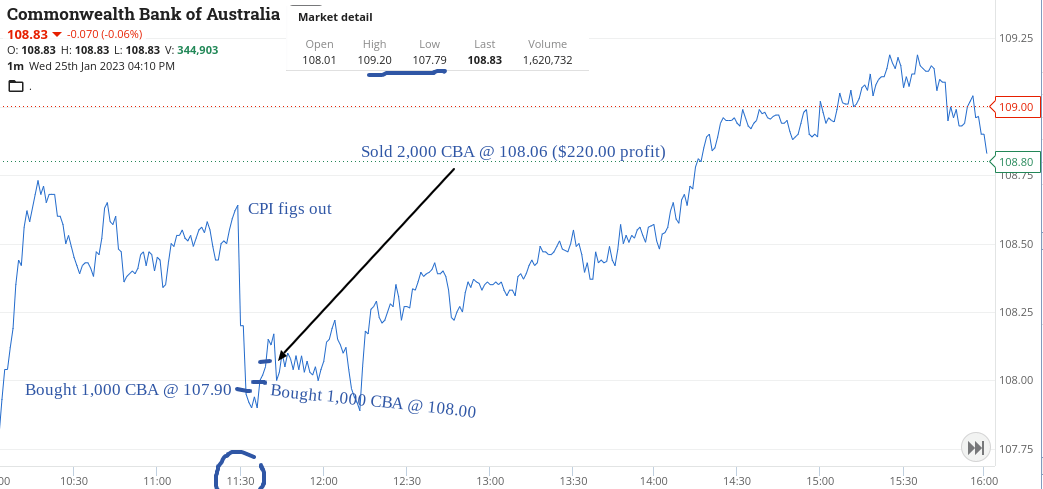

Wednesday January 25

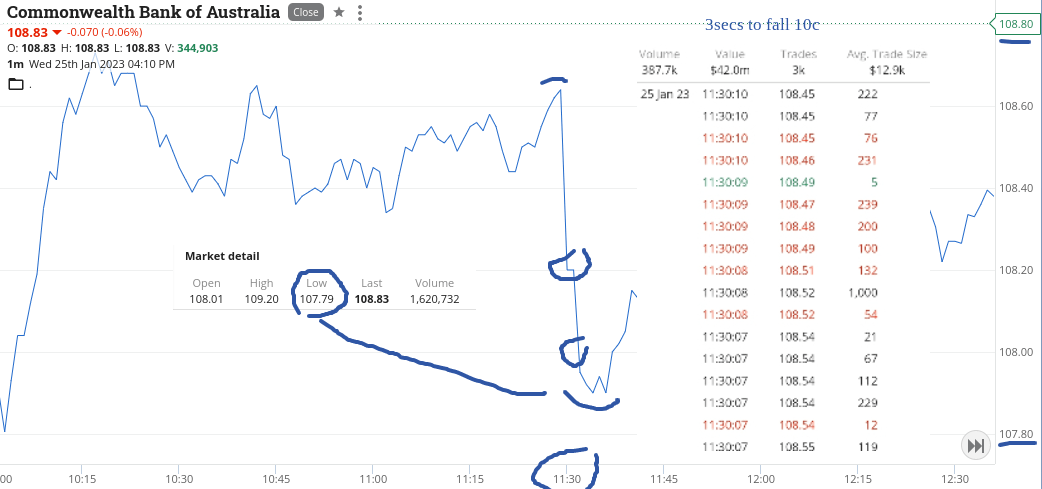

CPI day today.

So I wait and I wait. Then it got quite exciting, as watching CBA and counting down from 11.29am to 11.30am and then BANG.

They fall like a stone and I buy 1000 at $107.90 which is down 70c in like a minute. As they bounce I buy another 1000 at $108 for the pop. Only did this ‘cos I could. More an ego thing than a trading thing as the comm chews my arse away.

Anyway, out they go at $108.06 and then I move onto BHP and WDS. Why BHP are marked down on a CPI figure, I take it as just sentiment. In for 2000 at $49.29 and out for 2000 at $49.44 proves my thinking.

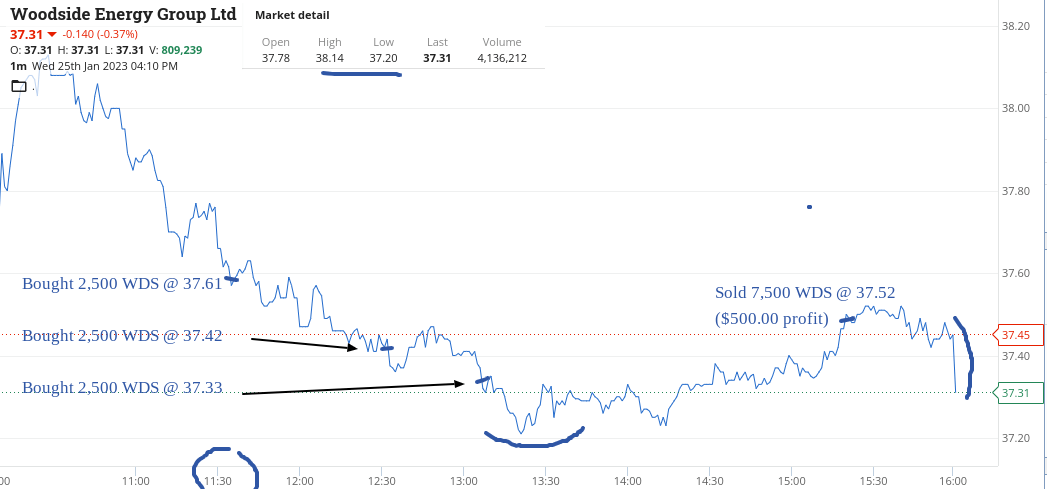

However, WDS are a different kettle of fish, as you can see from their chart.

OMG!

Had to go three times before they made a recovery, heading into 3.30pm. They had some figs out pre market, which is why their trading pattern was different from the rest, as I work out when doing the end of day charts.

Up $1020 and now closed tomorrow.

All the excitement today and then tomorrow nothing!!!!

Be interesting to see the volumes going through on Friday, as some traders may just be extending the weekend out.

Recap

Bought 1,000 CBA @ 107.90

Bought 1,000 CBA @ 108.00

Sold 2,000 CBA @ 108.06 ($220 profit)

Bought 2,500 WDS @ 37.61

Bought 2,000 BHP @ 49.29

Bought 2,500 WDS @ 37.42

Sold 2,000 BHP @ 49.44 ($300 profit)

Bought 2,500 WDS @ 37.33

Sold 7,500 WDS @ 37.52 ($500 profit)

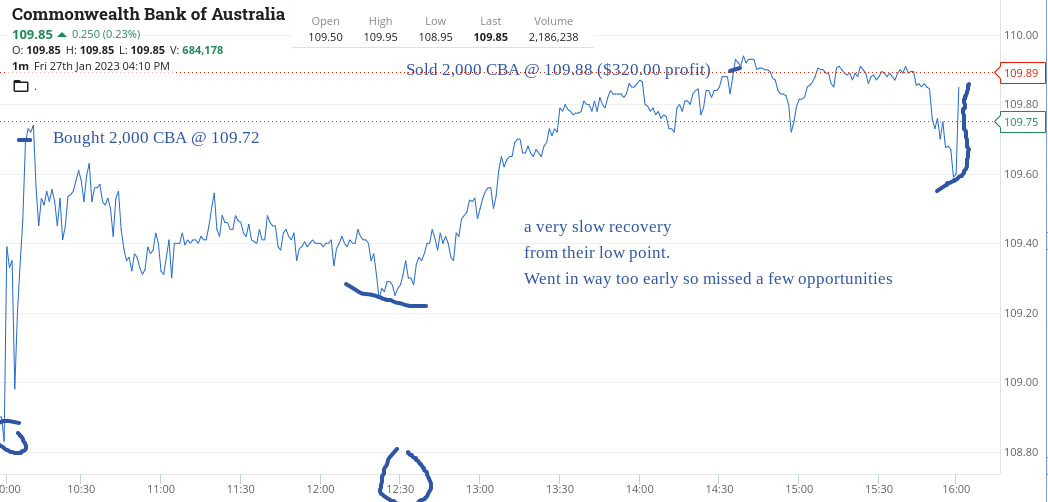

Friday January 27

I don’t know why but I managed to break one of my golden rules today. Worked out OK in the end but left me with some pain and guilt, till almost the end of the day.

Maybe it was the fact that we had a one-day break on a Thursday or sitting in the sun too long but I decided in my wisdom that CBA would hit the magical $110.00 today and it would be early on.

So, they popped out the gate and I thought here we go, double the size and in 5 mins walk away up $400 easy.

It wasn’t until 2.35pm that they finally hit my sell limit of $109.88 and in between that, they had a low of $109.24 at 12.22pm.

So a tough day in the office mentally, which was my own fault through a moment of weakness and now have a few days to recant my trading rules back to myself.

Up $2045 gross for a four-day week and $1623 net as a few of the heavyweights soak up more and more commission.

See you back on Monday morning.

Recap

Bought 2,000 CBA @ 109.72

Sold 2,000 CBA @ 109.88 ($320 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.