Confessions of a Day Trader: Redemption comes in the form of Rio

Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

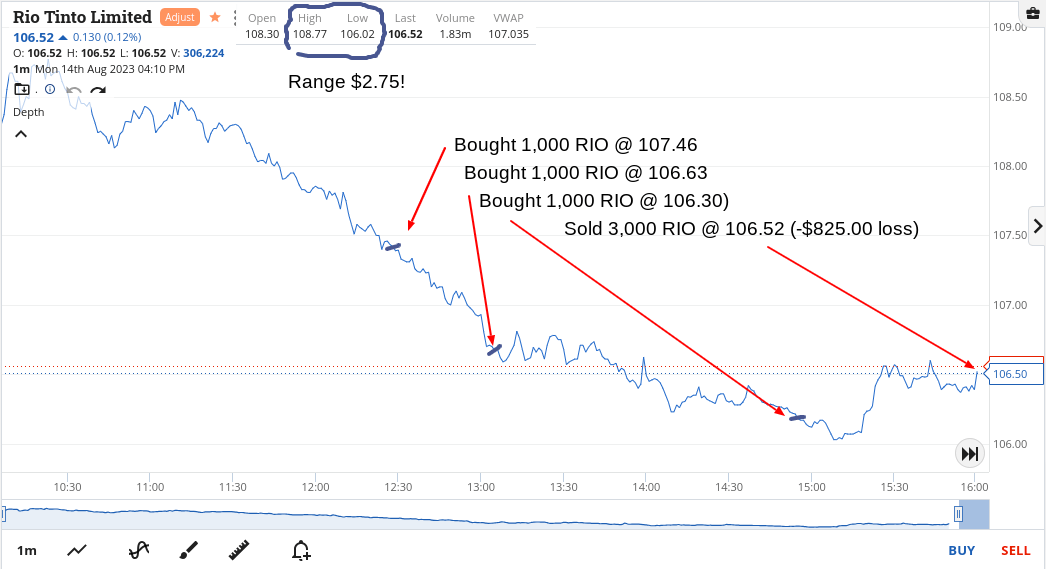

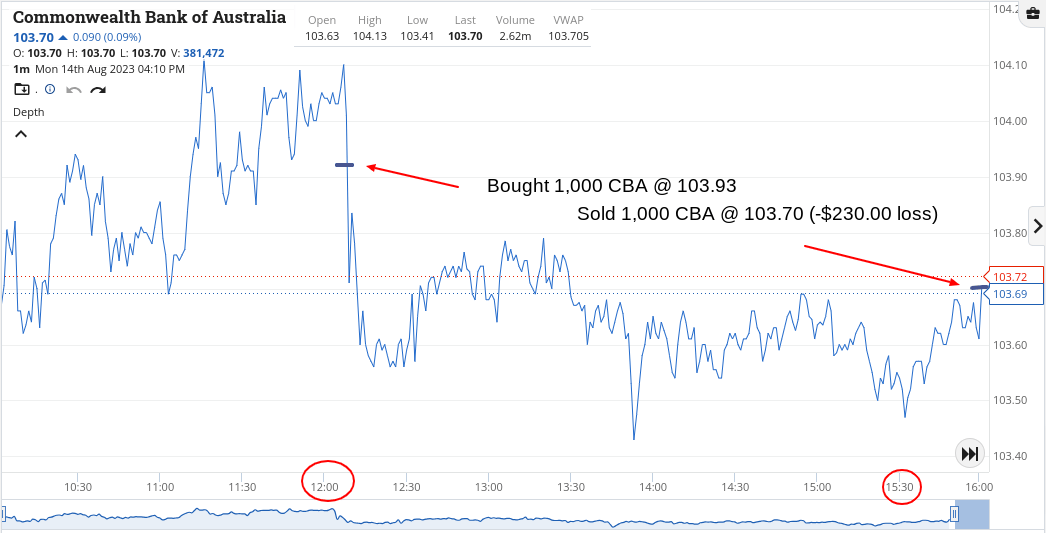

Monday August 14

Going to have my work cut out this week, as what worked last week didn’t work this week (and it’s only Monday, gulp!).

So start out the week with some losses and now I’m going to be under pressure to make them back.

Plus the double whammy of not coveraging brokerage just rubs more salt into the wounds of a broken trader.

Oh well. I will just have to pick myself up, rub off the dust and try again tomorrow.

Down $795 and now RIO’s share price is only $3.00 higher than CBA’s.

How things change.

Not many months ago it was $18!

Recap

Bought 1,000 CBA @ 103.93

Bought 1,000 RIO @ 107.46

Bought 1,000 RIO @ 106.63

Bought 2,000 BHP @ 44.77

Bought 1,000 RIO @ 106.30

Sold 2,000 BHP @ 44.90 ($260 profit)

Sold 1,000 CBA @ 103.70 ($230 loss)

Sold 3,000 RIO @ 106.52 ($825 loss)

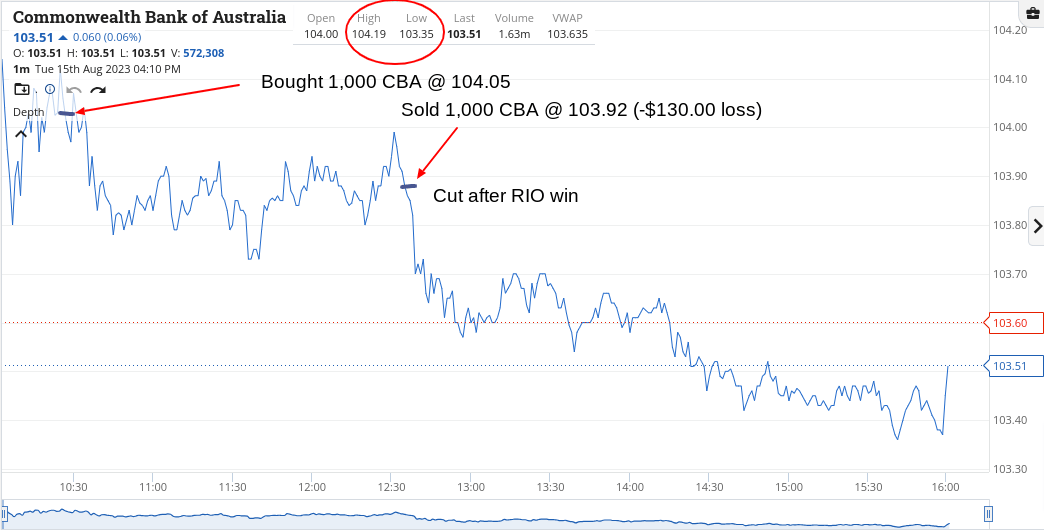

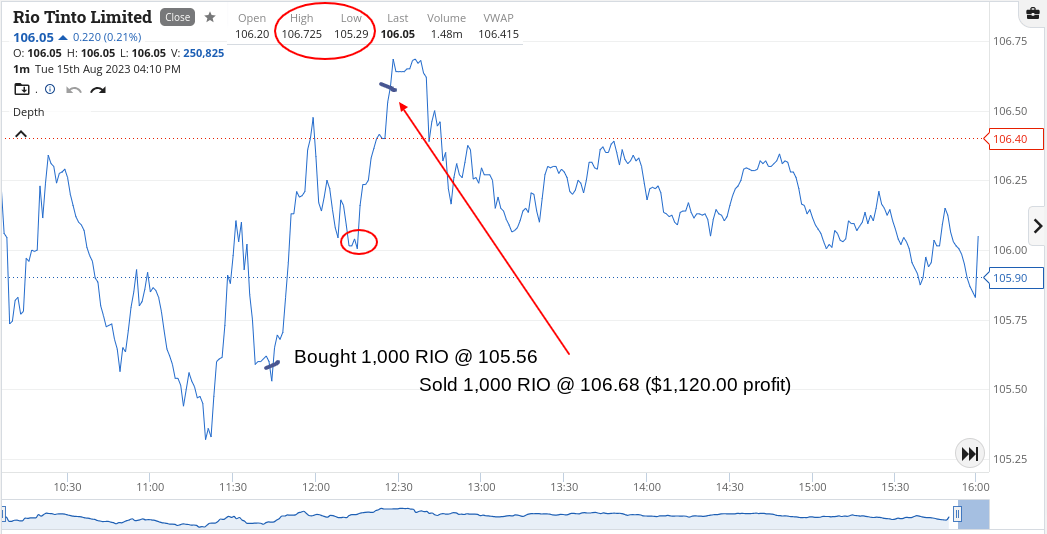

Tuesday August 15

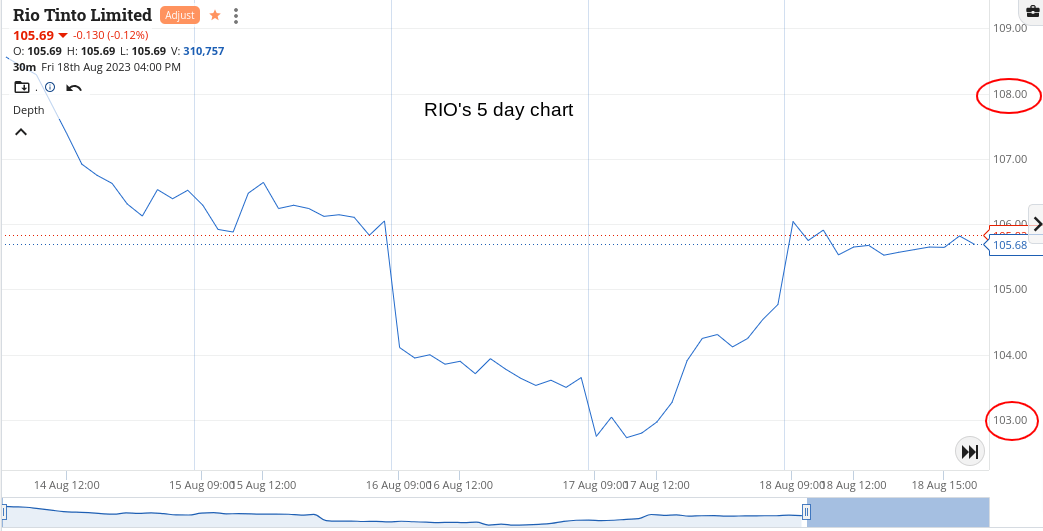

Back on the horse and get an early winner from BHP, before RIOs come roaring from behind and make a magnificent winner.

It would appear that yesterday, China came out with slower growth numbers, hence RIOs selling yesterday but today China cut their interest rates.

Before all the excitement in RIOs they had a bit of a fall, recovered, fell back again and then bingo!

Managed to cover yesterday’s losses, as up $1,270 today and this has now given me a grand running total of plus $475. Basically cut the CBA after the win in RIOs and left the room.

Recap

Bought 1,000 CBA @ 104.05

Bought 2,000 BHP @ 44.51

Sold 2,000 BHP @ 44.65 ($280 profit)

Bought 1,000 RIO @ 105.56

Sold 1,000 RIO @ 106.68 ($1,120 profit)

Sold 1,000 CBA @ 103.92 ($130 loss)

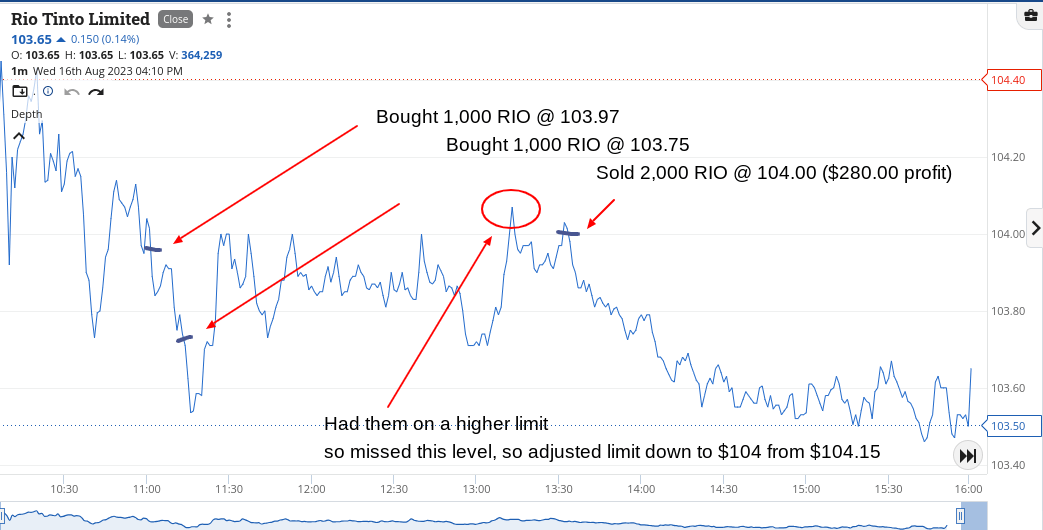

Wednesday August 16

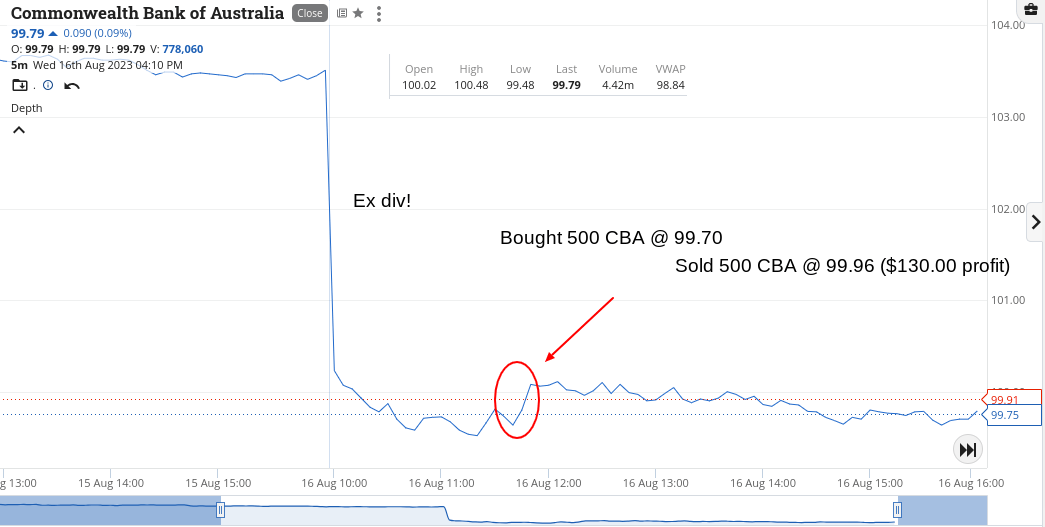

A big day for CBA as they went ex div. They finished the day down $3.72 at $99.79, which was a bigger move than expected.

I dipped in my toe at $99.70 in 500 shares as I haven’t a clue what they are going to do, as markets overnight were weaker.

Same for RIOs below $104. Had to go twice and was geared up and ready to go a third time, though I didn’t have to, as they eventually went my way.

In fact, I bt some BHP instead of averaging further down in RIOs, which also turned out OK.

Up $670 and only $130 of that was in an ex CBA, so interested how they will go tomorrow if everything holds steady overnight.

Recap

Bought 500 CBA @ 99.70

Bought 1,000 RIO @ 103.97

Bought 1,000 RIO @ 103.75

Bought 2,000 BHP @ 43.43

Sold 2,000 BHP @ 43.56 ($260 profit)

Sold 500 CBA @ 99.96 ($130 profit)

Sold 2,000 RIO @ 104.00 ($280 profit)

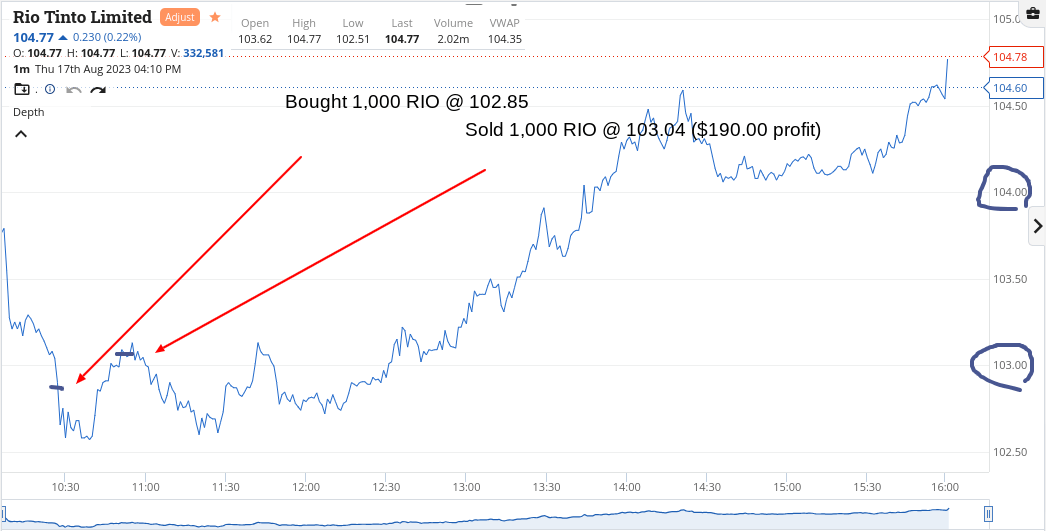

Thursday August

I had a look at when RIO went ex div last week and they went weaker the next day. So when CBA did the same thing I was not surprised.

Just had some lower limits in for CBA, BHP and RIOs. Got hit in all of them, gulp!

Once I got hit I put them all on sell limits at around their key price levels. This worked out OK, but have a go at RIOs. After I sold they took off.

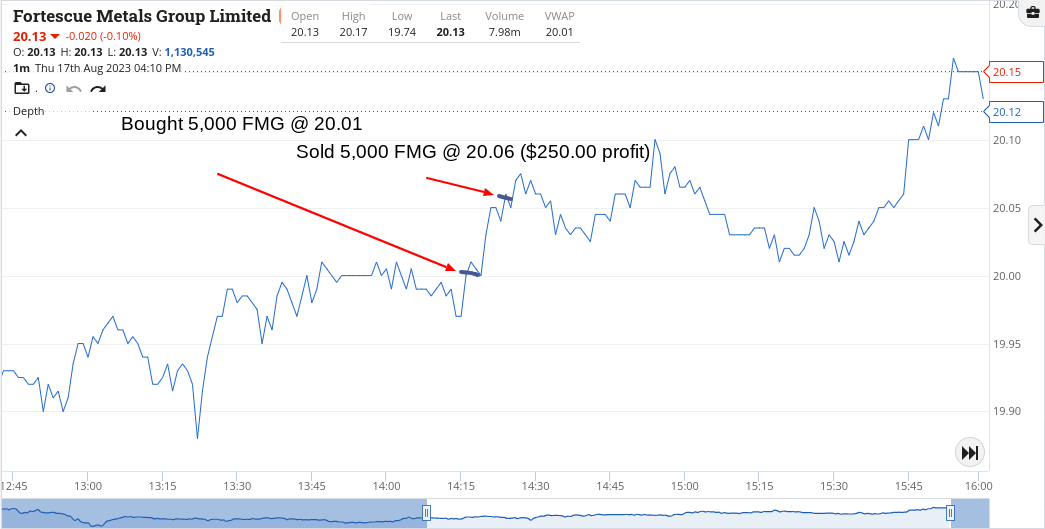

However, when they had cracked $104.00, I could see FMG lagging behind, so picked up 5,000.

Not blowing my own trumpet but that was the easiest $250 I’ve ever made.

Up $835. Had a look at CXO after their big placement at 40c got put to bed. Too hard, even though 68m went through.

Recap

Bought 500 CBA @ 98.75

Bought 2,000 BHP @ 42.84

Sold 2,000 BHP @ 42.98 ($280 profit)

Sold 500 CBA @ 98.98 ($115 profit)

Bought 1,000 RIO @ 102.85

Sold 1,000 RIO @ 103.04 ($190 profit)

Bought 5,000 FMG @ 20.01

Sold 5,000 FMG @ 20.06 ($250 profit)

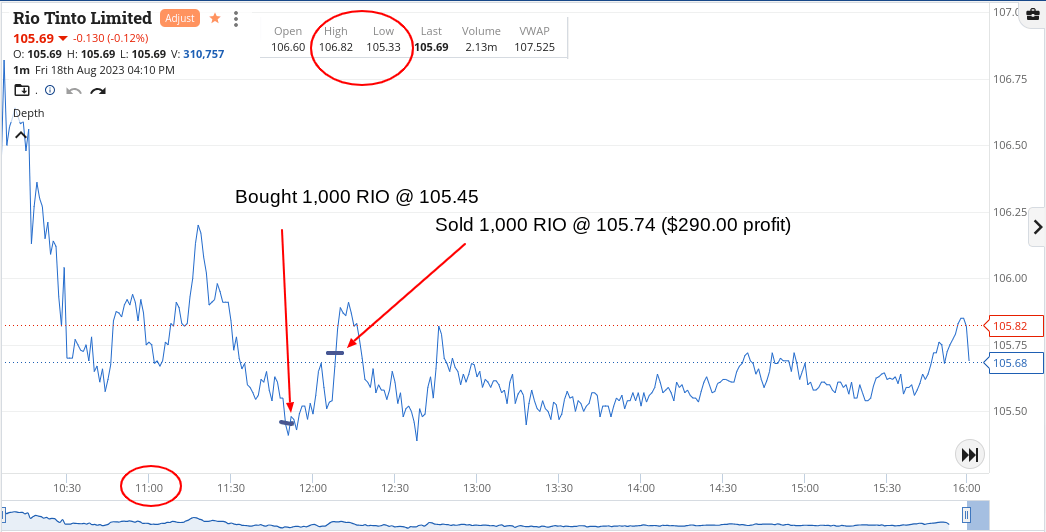

Friday August 18

Finally confident to up my size in CBA, which pays off and as soon as that position was closed out, it straight back into RIOs.

A cruisy end to the week, after Monday’s disaster and Tuesday’s claw back. CBA going ex wasn’t as exciting as RIO but I did predict CBA should be trading with a 99 in the front of their price.

Just needed an ex div to do it!

Finish the week with a bit dignity as up $530 today, making it $2,510 gross or $1,944 net. The Aussie dollar is looking a bit shaky and 10yr bond yields have jumped up again, so expecting Monday to be a down day.

Let’s just hope it’s just the market and not my P/L.

Recap

Bought 1,000 CBA @ 98.91

Sold 1,000 CBA @ 99.15 ($240 profit)

Bought 1,000 RIO @ 105.45

Sold 1,000 RIO @ 105.74 ($290 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.