Confessions of a Day Trader: Red light, green light? Which one to run on?

Pic: DKosig / iStock / Getty Images Plus via Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday September 27

Fresh new week and feeling that some things should settle down a bit. CBA take off and smash through the $104 barrier. Amazing. APT do the opposite and fall $1.00 early on.

Don’t understand why APT are down and cautiously buy 500 at $130.51 as first trade of the week. Sell them at $131.09 (+$290). NXT are knocked down on news CEO had sold $20m worth of stock and mange to pick up 1000 at $12.77 and sell them soon after at $13.04 (+$270).

Nice to start off the week with a couple of profitable trades. Sets you off mentally in the right place.

Later on both APT and RIO are down a bit. Buy back into APT at $130.14 but now in 1000 and buy RIOs at $100.59, in 500 only though.

Sell the APT first at $130.41 (+$270) and then the RIOs at $100.78 (+$95) and then watch them both get smacked in the 4.10pm shuffle.

Nice plus $825 for the start of my trading week and not a too stressful start.

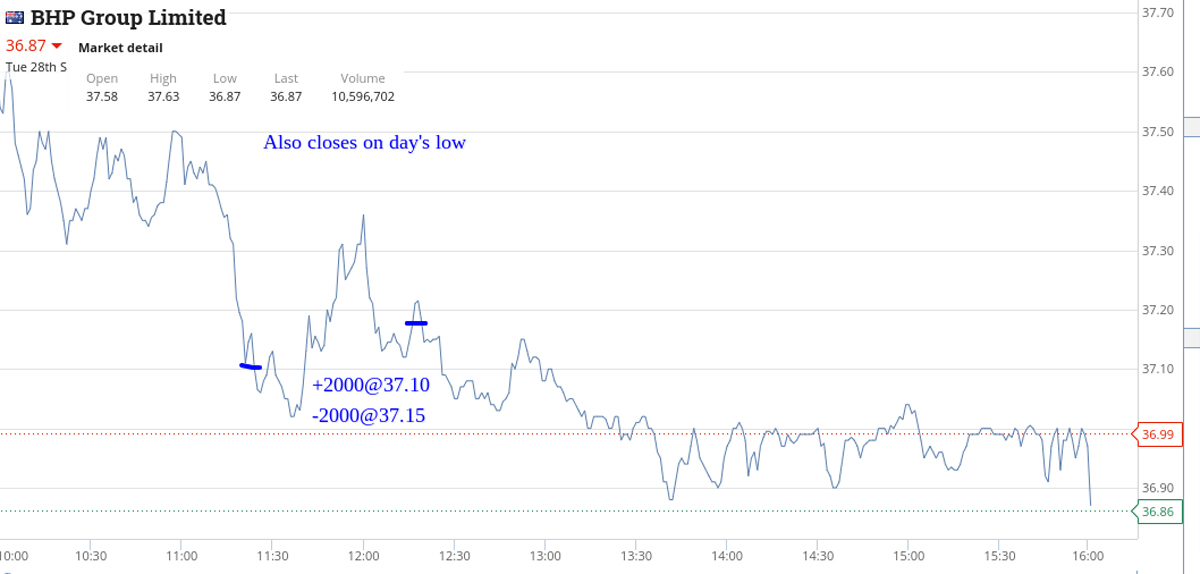

Tuesday September 28

Have to hang around till 11.20am before hitting the buy button on some of the iron ore plays and also APT to give a bit of balance, though APT almost ended up being a disaster.

So looking a bit over-sold, buy 1000 FMG@$14.96, 1000 MIN@$46.15, 500 RIO@$98.08, 500 APT@$128.00 and then 2000 BHP@$37.10.

Nice little bounces in FMG, MIN and RIO, but not in APT. Out go the 1000 FMG@$15.06, the 1000 MIN@$46.35 and the 500 [email protected]. Combined profit of $460. Now buy another 500 APT at $127.66.

Sell the 2000 BHP at $37.15 (+$100) and back into RIO for 500 at $97.97. APT still looking sick and average down in another 1000@$127.26 and then sell the 500 RIOs at $98.19 (+$98.19).

I miss the get out of jail bounce in APT as got distracted which really peeved me off. Meant had to really average down on another 2000@$127.16 and wait to see if 3.30pm kicks in today.

It does and they bounce to $127.50 and then just hang, so manage to sell the 4000@$127.50 for a gain of $590. This leaves me at plus $1,260 for the day.

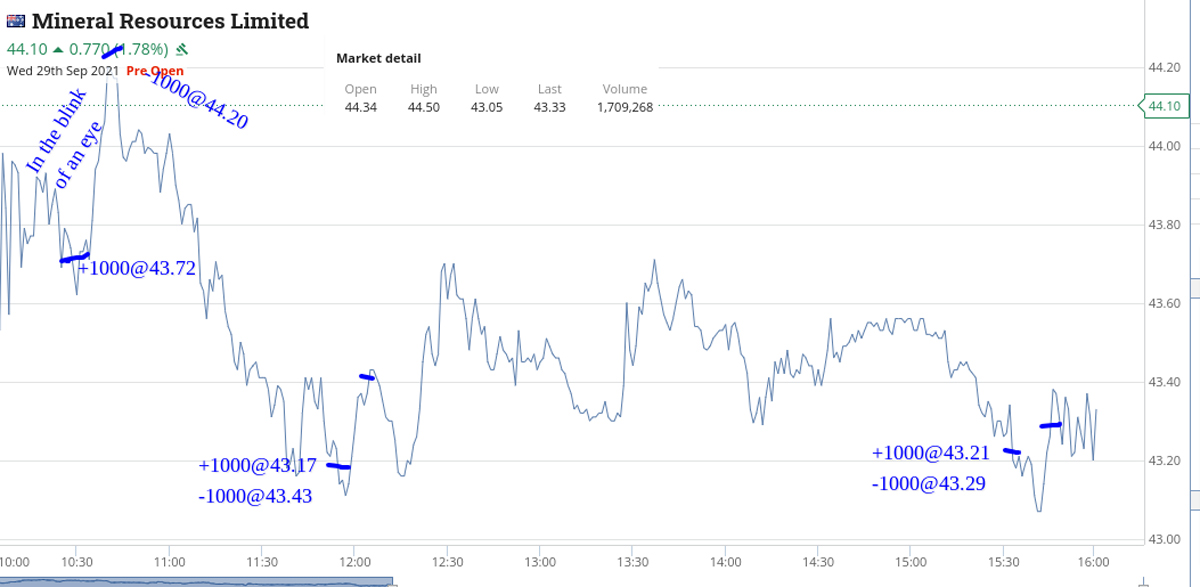

Wednesday September 29

Everything appears red overnight according to the 5am edition of the Fin Review, as bond yields are jumping back up and oil price higher, so inflationary commentary is hitting the headlines again.

CBA went above $105 yesterday and closed at bang on $104, so it will be interesting to see how they go. All the iron ores will get smashed today. May have to wait till 12.30pm before they bottom out.

As it turns out around 12.00pm or just before was when a few bottoms were reached. These are the days when my trading theories can really shine.

Started off just taking small turns where I could and then moving to bigger positions around the middle and end of the day.

The amount of volatility is market madness and all I can think is this is what it would have been like hanging out with Robin Williams and Robbie Williams, if they somehow managed to be at the same party in the 80s.

All up, I managed a wonderful 26 trades and came out plus $2,665 gross for the day, with the biggest winner out of APT in the 4.10pm wash up.

CBA, for example, had a high of $103.88, a low of $101.85 and a last trade of $102.62. Volume was a big 4.79m for them and down from $104.00 on Tuesday.

I’ve marked up some of the charts as best I can, as writing it all down would be too long-winded.

So far, up $4,750 for the week.

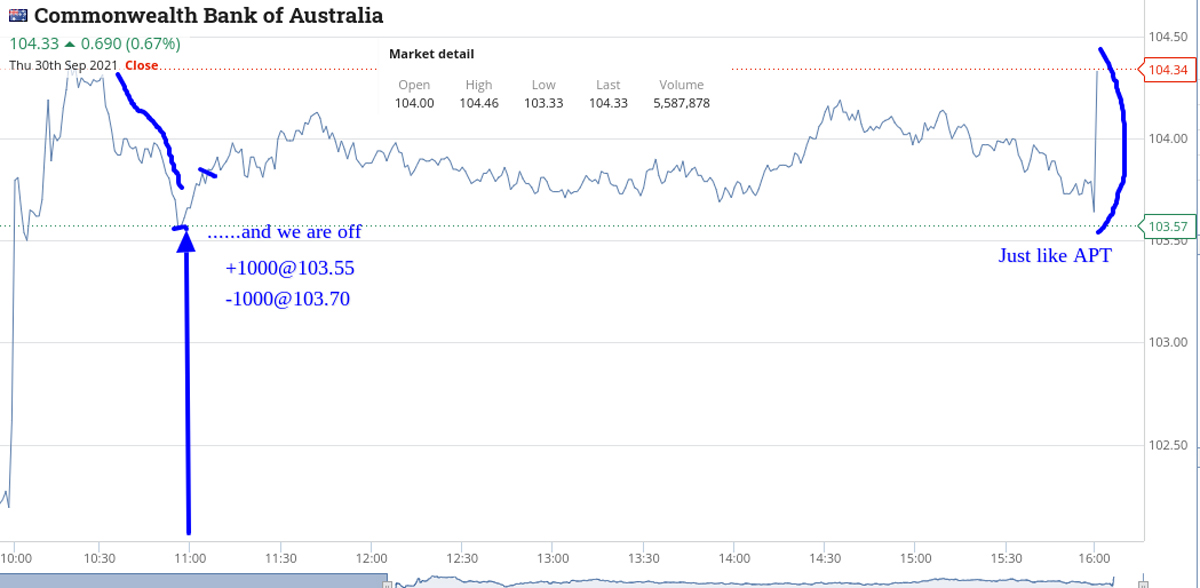

Thursday September 30

Going to be a slower day today, which is good for the head but not so for the wallet. Let’s see.

After yesterday’s movements, there must have been a few margin calls I think, so buy 1000 CBA at $103.55 and 1000 MIN at $43.17 with 3 mins to go before 11.00am.

Sell the CBA at $103.70 and the MIN at $43.32, making $150 out of each.

It’s not so much the money but the fact that we saw yet another 11.00am rally.

I buy and sell 1000 Z1P on a 4c turn and 1000 CHN on a 7c turn and then APT come into play.

Coming up just after lunch time, they are getting sold down and as a slow day, I buy 1500 at $120.84 having watched them try and break down below $121.00 and bouncing.

Put them on a limit and out they go at $121.01.

Then back in for another 1500 at $120.86 and just before the potential 3.30pm rally. It happens but fizzes out very quickly.

Now staring at a loss, I roll up my sleeves and buy another 1500 at $120.70 and then blow me down, I have to buy another 1500 at $120.59 and watch them fall to their day’s low of $120.47.

They were above $122.00 in the morning session and I put them into the 4.10pm closing session… you have to see the chart to see what happens.

Book a profit of $3,380 gross for the day and was not expecting this today. Month-end tickle ups seems to be the order of the day. That’s twice now for an APT 4.10pm rally but don’t think it will be third time lucky for me.

Friday October 1

Pinch and punch for first of the month! At 5.00am, the AFR is calling the market to fall with a weaker Wall Street and bond yields ticking up again.

Wait until 10.50am before getting set in 1000 CBA at $100.07. They may bounce soon, so better to get set before take off. Not going to plan, so buy another 1000 at $99.78 and just watch them fall before buying another 1000 at $99.67, which turns out to be 5c off their low.

They do rally but not until 20 mins later that I wanted, so bit of a painful wait. Out at $100.08 (+$720) and then in and out of 1000 APT for a 19c turn. In at 119.12 and out at $119.31 (+$190).

Then it all goes a bit pear-shaped for me as I let my ego take over and plan my 3.30am action. MIN are well down on the day so buy 2000 of them at $42.20 and back into 1000 APT at $119.12 again.

No rally, all pain and no gain and cut both in the 4.10pm wash up. Close the APT at $118.82 (-$300) and the MIN at $47.41 (-$920). Knew I had to give something back at some point and today was the day.

Down $310 for the day but up overall $7,820 gross for the week and because of the larger amounts of brokerage, settles at $6,365 net. And still in lockdown after a crazy market week.

Time for a cider with ice. Cheers.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.