Confessions of a Day Trader: Pump up the volume, this one’s in the bank

Picture: Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday January 10

Mmmmm is all I can say about today. Mmmmmm!

Volumes very low. Hard to find anything, though CBA made a classic 11am move and everything else was just bland.

Both APT and FMG allowed me out with just a couple of minutes to go. The results of no profit and $12.00 profit sum up the day.

So, that’s $172 for the day and put in a bit of time and energy to produce that. Mmmmm. Off for a swim and a beer.

Recap:

Bought 500 CBA @ 102.66

Bought 600 APT @ 72.27

Sold 500 CBA @ 102.98 ($160.00 profit)

Bought 2,500 FMG @ 20.63

Sold 600 APT @ 72.29 ($12.00 profit)

Sold 2,500 FMG @ 20.63 ($0.00 profit)

Got a text off a mate and this was my reply in blue:

Bitcoin (which I don’t trade but watch) hit $39,500 that night (inflation hedge vs gold, had gold up Bitcoin down) and Friday APT traded down to $69.03.

Tuesday January 11

After yesterday’s effort, decide to be a bit more aggressive on size today. CBA broke down below $101.00 a few times today and gave me two opportunities.

Both times left sell limits at $100.98 because if they were going to push back above $101, they would need to take me out first, so for the sake of 2c it is a good strategy to have.

Just put sell limits below key breakout figures as sometimes they can reach that figure and fall back.

Then as I’m laying down with a nice sea breeze blowing through I noticed FMG getting sold down with not long to go. Made a 3c turn on 5000 and could have gone either way, so was a ‘heads or tails’ trade and heads came in!

Up $645 and spent a bit on brokerage but this allowed for smaller turns required to get a profit.

Recap:

Bought 1,500 CBA @ 100.98

Sold 1,500 CBA @ 101.15 ($255.00 profit)

Bought 1,500 CBA @ 100.82

Sold 1,500 CBA @ 100.98 ($240.00 profit)

Bought 5,000 FMG @ 21.04

Sold 5,000 FMG @ 21.07 ($150.00 profit)

Wednesday January 12

Back to finding my ‘zone’ a bit today.

Working out that volumes are not as big as they could be but there’s still some volatility going on.

For example, CBA’s day range was $102.48 to $100.82 and FMG’s was not as dramatic at $21.20 to $20.68, but both have support(ish) levels. CBA $101.00 and FMG $21.00.

Doesn’t really mean anything in the real world but in the stock market world, they get sold down and bought back up.

FMG trade went on longer than I thought and CBA again gave me two opportunities. Go to bed thinking ‘should I up the size even more or will that bring me undone?’

Sipping a nice single malt as I type and contemplate my movements for tomorrow and asking my trading ‘God’ for guidance. Up $775 for the day.

Recap:

Bought 5,000 FMG @ 20.90

Bought 1,500 CBA @ 101.57

Sold 1,500 CBA @ 101.73 ($240.00 profit)

Bought 1,500 CBA @ 100.99

Sold 1,500 CBA @ 101.18 ($285.00 profit)

Sold 5,000 FMG @ 20.95 ($250.00 profit)

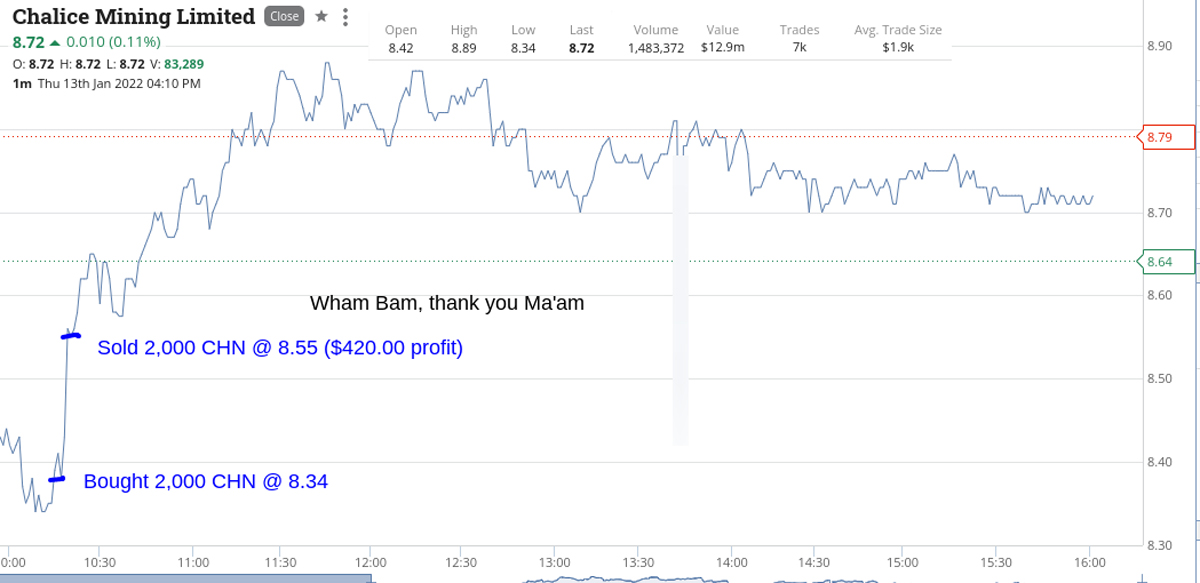

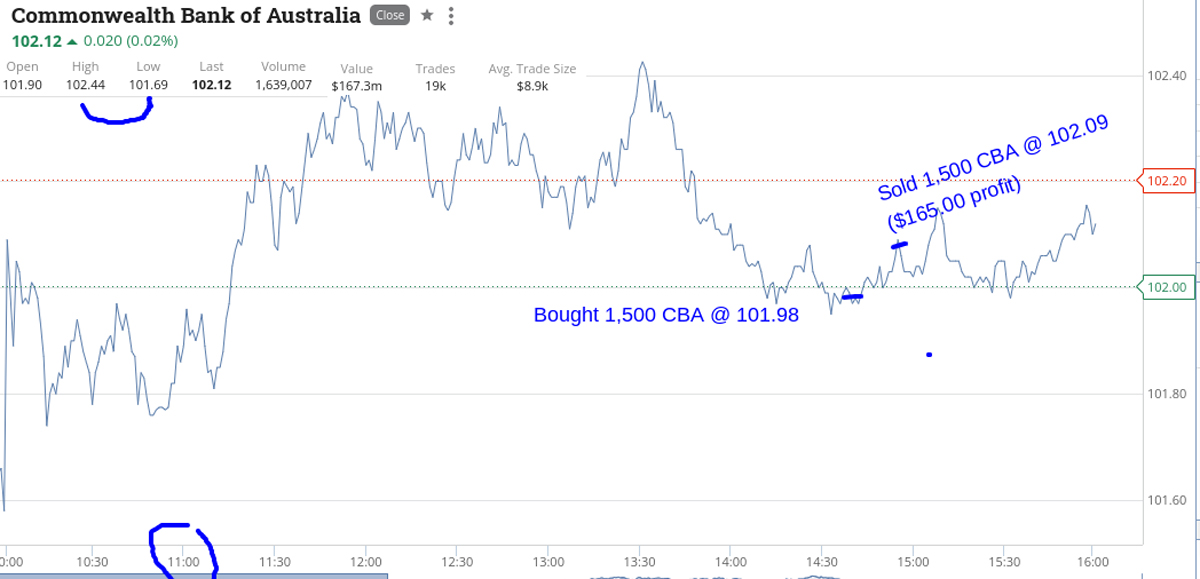

Thursday January 13

Pre-market, the news that USA inflation was at a 40-year high got me thinking about gold.

Then out of the blue, CHN opened down and I lined up 4000 to buy and then chickened out and made my order 2000. I thought there maybe something fundamentally wrong as a reason for marking it down.

As it turned out my timing was good but my size was not. Then later on, CBA gave me another opportunity when it fell below $102.00.

Good result for not too much effort today. Plus $585.

Recap:

Bought 2,000 CHN @ 8.34

Sold 2,000 CHN @ 8.55 ($420.00 profit)

Bought 1,500 CBA @ 101.98

Sold 1,500 CBA @ 102.09 ($165.00 profit)

Friday January 14

Well today was the day that APT traded with a 6 in the front. Can you believe it? Amazing to think that once they were par with CBA.

Just shows that a quality dividend payer will always win in the end. Not touching APT now until they become Block on the 20th.

Got a fix on CBA and also MFG. The range on CBA was $102.65 to $100.50. WTF is all I can say and today was all about patience.

Low volume and inflation scares and a Friday and an Australian holiday mode all adding to the volatility.

Up $2635 gross and $2089 net after brokerage (CBA the main culprit). Bring on Monday!

Recap:

Bought 1,500 CBA @ 100.59

Bought 2,000 MFG @ 19.58

Sold 1,500 CBA @ 100.81 ($330.00 profit)

Sold 2,000 MFG @ 19.65 ($140.00 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.