Confessions of a Day Trader: Profits and temperatures rising – time to sweat the small stuff

Picture: Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

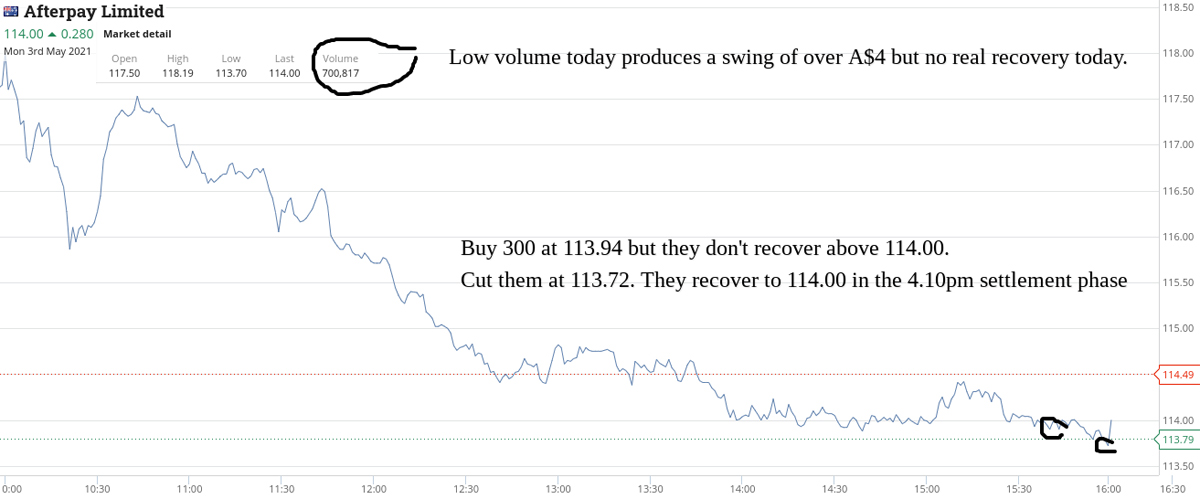

Monday May 3

Turns out that today was a long watching day. Maybe there was some window dressing on Friday for the funds monthly valuations.

Who knows, but had a couple of goes with 15 minutes left to go, but both didn’t go my way. Ended day with a loss of A$106.

+300 APT at 113.94; -300 APT at 113.72; Loss A$66 (Had to cut)

+1000 BHP at 47.00; -1000 BHP at 46.96;

Loss A$40 (Waited all day to buy!)

Tuesday May 4

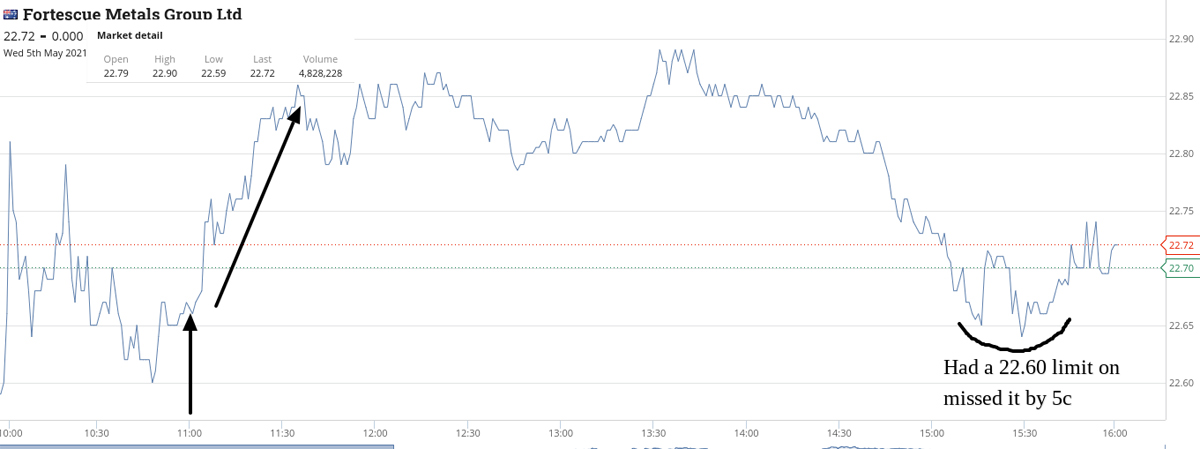

Have a couple of pre 11.00 o’clock trades; one in FMG and one in CBA.

Watching CBA’s first 15 mins is like watching a manic person’s brainwaves. They open at 89.94 and have a high of 89.99 in their first 4 mins of trading.

At 10.56am, I put my foot on 1000 CBA at 89.65 and 1000 FMG at 22.44. APT are trading at 112.95 and still looking sick.

Very quickly, I sell the CBA for 89.76 and FMG for 22.49 and bank A$160 and watch BHP rise a whole A$1.00 above yesterday’s close.

CBA close the day at 90.45 and APT close at 110.79. Bt 300 at 110.92 and again had to cut this but this time I did it in the 4.10pm shuffle.

Up A$121 for the day.

+1000 CBA at 89.65; -1000 CBA at 89.76; Profit A$110 (they close at 90.45!)

+1000 FMG at 22.44; -1000 FMG at 22.49; Profit A$50

+300 APT at 110.92; -300 APT at 110.79; Loss A$39 (Will keep trying till I win)

Wednesday May 5

Lots of red in USA tech stocks this morning, so expecting Z1P and APT to get smashed. 11am tomorrow will be interesting.

Also, having seen CBA smash through the 89.99 level to 90.45 will be interesting to watch them today. They open up above 92, so done my dash in them now for the day. End up only having a go at APT, for a small gain of A$66.

+300 APT at 107.01; +300 at 106.69; -600 APT at 106.96; +A$66

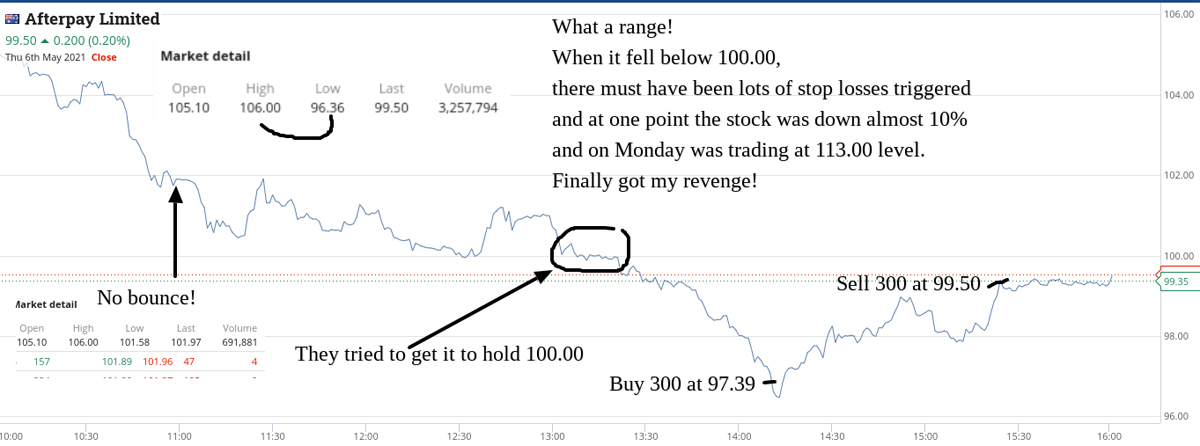

Thursday May 6

Feel a cold coming on, so have a hot shower, rug up and sweat it out in bed, with some Lemsip. With my laptop on top of the bed, I discover that I can really concentrate and focus. End up dealing away like a demon and end up doing over 20 trades for the day.

Had a couple of sleeps in between and came out very well at the close of the day up A$1,598 and in a haze of Lemsip, sweat and tissues. See APT and BHP graphs for amazing swings.

+1000 CBA at 92.21; -1000 at 92.31; +A$100

+1000 BHP at 49.80; -1000 at 49.92; +1000 at 49.74; +1000 at 48.95; -2000 at 49.56; +A$555 (See chart for an amazing fall and recovery)

+2000 Z1P at 7.38; -2000 at 7.40; +2000 at 7.36; -2000 at 7.38; +2000 at 7.32; -2000 at 7.34; +2000 at 7.32; -2000 at 7.34; +A$120 (Just upped the size and lowered the profit level to 2c – maybe was the Lemsip shot?)

+3000 FMG at 22.78; -3000 at 22.81; +A$90 (Switched into after BHP sale)

+1000 FLT at 14.37; -1000 FLT at 14.41; +1000 FLT at 14.32; -1000 FLT at 14.35; +A$100 (been watching them fall for 3 days, before having a go)

+300 APT at 97.39; -300 at 99.50; +A$633 (Finally!)

Friday May 7

Don’t feel up to anything today, so stay away from the computer, but here are some charts to take a look at.

APT has been a rollercoaster of a ride this week, whilst CBA and BHP have made some solid gains.

Should be ready to go again on Monday after my confidence was knocked a bit by APT at the beginning of the week but now fully restored, 633 times!

Gross profit: A$1,679

Less brokerage: A$312

Net Profit: A$1,367

Most satisfying: APT

Least satisfying: APT

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.