Confessions of a Day Trader: Playing CBA can leave you feeling like a right banker

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday October 4

Bank holiday here but market is open, so going to be a slow day. Kick it off buying 2000 BHP at $36.86 and 2000 FMG at $14.53.

FMG promptly fall more and out of proportion to BHP and RIO, so buy 4000 at $14.35. Same time buy 1000 APT at $120.67.

Out go the APT at $120.92 (+$250), then the FMG at $14.46 (+$300) and finally the BHP at $$36.93 (+$140).

The BHP took ages to get there because of the bank holiday and I was at the beach at the time.

NVX was a big ASX 200 faller today, down 13% or so. Buy 2000 at $5.69 and then notice APT are also way down from previous trade. Buy 1000 at $119.41.

Sell the APT at $119.60 (+$190) and make a massive $20 on the NVX by selling them at $5.70 as bored with them.

So I got in some beach time, which was needed as a slower than usual screen-watching day because of the holiday.

Plus $900 exactly today, which was better than I thought and from only 11 trades.

Tuesday October 5

AFR calling the market down 1% or so and NASDAQ is down over 2% on interest rate worries. APT should be interesting today.

CBA closed up 5% yesterday at $105.16 having been as low as $99.62 in Friday’s session. Calling them $103.00 today.

Well, I get the call on CBA completely wrong as they actually touch $106.27 and have a day’s low of $104.21, so only out by $1.21!

However, have a bit better luck elsewhere and started off with a limit buy of 2000 Z1P at $6.50. They were above $7.00 last week. Sell them on a 5c turn at $6.55 and make $100.

Then buy 1500 FMG at $14.01, which is the lowest they have been for some time. Their day’s low is actually $13.97.

Move these on for a 4c turn as happy to book a small $60 profit. My selling prompts them to rally 27c so left a bit more on the table for you lot.

NVX are down again and they have fallen almost 20% in two days now. Buy 2000 at $5.16, as they look like they want to rally, from a low of $5.04. Sell them at $5.22 for $120.

So far up $280 for the day.

MIN are not reacting movement wise like BHP and RIO, so sneak in 1500 at $41.67 and sell them at $41.80 (+$195) very quickly.

They come back to $41.70, so buy 1500 again and put them on a $41.79 limit, which gets taken out for a $135 profit 30 mins later.

Lastly, CHN offer a cracker of a deal. Buy 2000 at $5.70, as way oversold and make a nice $320 on a $10 round trip, by selling them at $5.86 on a limit.

So, no luck in some of the heavy priced stocks today but doing OK in some of the others.

Plus $930 today, which also included a trip to have an eye check-up, so on the mobile most of today.

Wednesday October 6

Market looks like it will be up small today, so everything should rally first thing and then hopefully peter out around 11.30am/12.30pm before rallying a bit into the afternoon. Well that’s the plan anyway.

NXV are moving around early on. Buy 2000 at 5.09 and 2000 at 5.01 before watching them rally to $5.14 and I manage to sell 4000 at $5.13 (+$320). They were $6.60 on Monday.

Have a go at CBA for 11.00am rally. Buy 1000 at 103.12 and 500 at 103.13 and sit back and wait.

Still waiting and nothing but they have a ‘flash crash’ on me at 12.50pm and fall to $102.39 and bounce then fall again. Pick up another 1500 at $102.55. Be careful what you wish for as this is a day late for me.

Finally they do rally back to $103 and out they go at 103.01 (+$520).

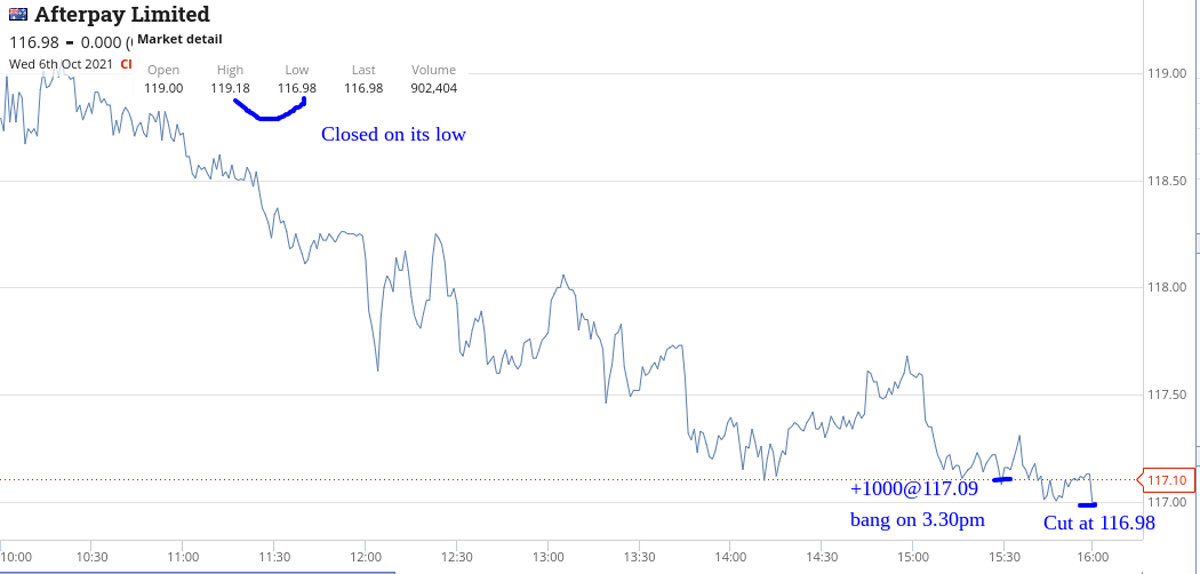

After the shock of seeing CBA fall dramatically, I don’t really want to do anything. Buy 1000 APT at bang on 3.30pm but even that doesn’t go my way and cut them at 4.10pm for a $110 loss (-1000 at 116.98).

Finish plus $730, but most of my watch list close on their lows, which is not a good sign for tomorrow.

Thursday October 7

A slow day today. It’s like everyone is dancing around the chair, waiting for the music to stop. Only managed to trade in three stocks today, with two wins and one loss.

Bt 1500 FMG at $14.00 even and thought they could go one way or other but ended up cutting them for a $45.00 loss at $13.97.

Had better luck buying 2000 CHN at 5.73, as seem a bit oversold and had to wait a few hours before they rallied and out they went. Sold the 2000 for $5.81 and pocketed $160.

CBA were very strange today. They touch $104 and fell back. I bt 1000 at $103.10 as a starting price. They fall below and buy 1000at 102.80 and then another 1000 at 102.82, as thinking about yesterday’s trading.

They slowly recover and are very frustrating to watch. They reach $3.10 with 40 mins of trading left and then fall back and touch $102.92.

Then just after 3.30pm, they get the horn and start to rise.

Have seen them hit $103.07 twice and fall back so put them on a limit and out they go for a $490 profit. Becomes a bit bittersweet now, as even though a nice profit, they continue to rally 30c plus. I had just ran out of patience.

Plus $605 for today, half of which was spent between Bunnings and the beach.

Friday October 8

Markets up overnight and it’s Friday so can’t see much happening today, are my early thoughts with three hours to go before the market opens.

And we’re off and nothing appeals, though pre 11.00am, CBA are trading below $103. After two attempts this week at the 11.00am ding dong and getting smacked around the head trying, I cautiously buy 1000 at $102.97.

At 11.15am, they take off and I sell the 1000 at $103.63 (+$660), which happens to be third time lucky. Of course it happens when only long of 1000.

It’s a pre-COVID opening day for me, which entails two trips to Bunnings, so happy to finish here, but having an afternoon laydown, APT pop up pre 3.30pm. Buy 1000 at 122.78 and wait. The rally starts and then falls away, unlike CBA. Right idea, wrong stock.

Anyway, out of the APT at 122.99 in the 4.10pm ruck. Make $870 out of four trades out of a pretty ordinary day, so happy chappy. Up $4035 gross for the week or $3,465 net and looking forward to Monday, October 11’s ‘Freedom Day’.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.