Confessions of a Day Trader: One golden turn deserves another. And another! One more? Oh go on then…

Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday January 29

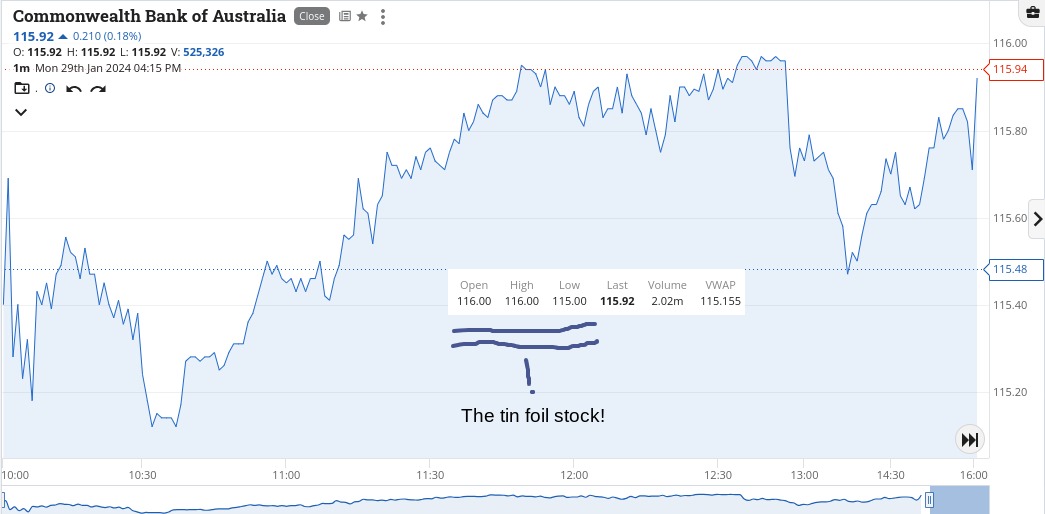

Now, I’m not a flat earther or a conspiracy theorist but this is how CBA went today.

Opened at $116.00, had a high of $116.00 and a low of $115.00 and 2.02m turned over with the last being $115.92. Their low was hit at 10.03am.

Far out!

So anyway, after I had taken the tin foil off of my head, a couple of things stood out.

BOE had opened at $5.35 they also touched their day’s high of $5.45 before later slumping down and reaching a low of $5.16, just before midday.

I got into them just before 11.00am at $5.21 and hoped for a bounce.

It did come at 2.00pm when eventually my limit got taken out, which was way longer than I thought it would take, though their rally saved me – see chart.

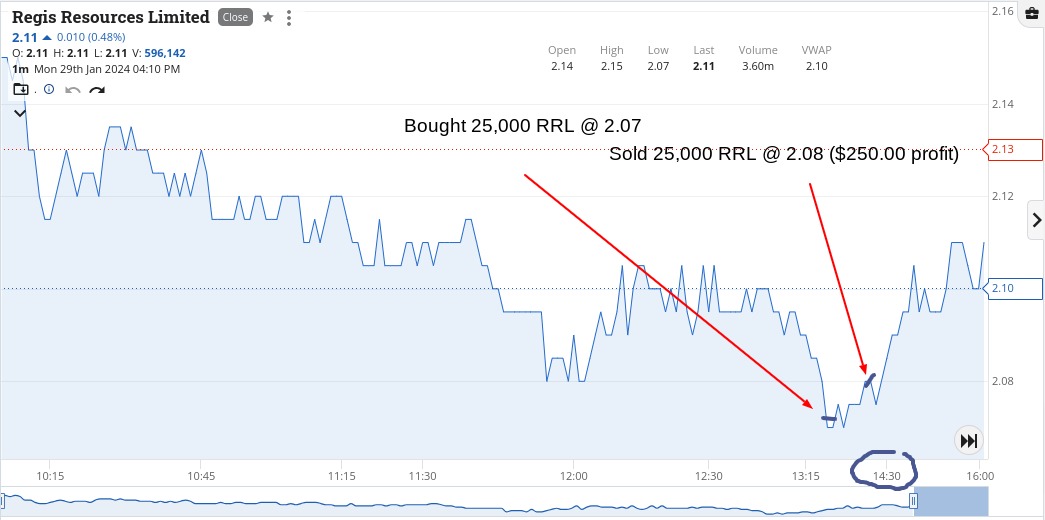

RRL was also a bit of a waiting game, after seeing them open at $2.14, $2.07 seemed like a bargain, which turned out to be true, as they closed at $2.11.

Up $750 and now just wondering about CBA and how it managed to trade with such exact numbers as its high and low.

Recap

Bought 5,000 BOE @ 5.21

Bought 25,000 RRL @ 2.07

Sold 25,000 RRL @ 2.08 ($250 profit)

Sold 5,000 BOE @ 5.31 ($500 profit)

Tuesday January 30

Managed a couple of in’s and out’s earlier on and then CBA had a bit of a collapse before 3.30pm, which can sometimes be a bouncing spot.

Anyway, I got two goes heading into the last 30 mins so I was happy to up the size a bit and keep my eyes wide open shut.

And it worked!

Up $985, which was a bit amazing and something I was not expecting at all.

Recap

Bought 5,000 NAN @ 2.93

Bought 25,000 RRL @ 2.11

Sold 25,000 RRL @ 2.12 ($250 profit)

Sold 5,000 NAN @ 2.96 ($175 profit)

Bought 1,000 CBA @ 115.91

Bought 1,000 CBA @ 115.85

Sold 2,000 CBA @ 116.02 ($280 profit)

Bought 2,000 CBA @ 115.87

Sold 2,000 CBA @ 116.01 ($280 profit)

Wednesday January 31

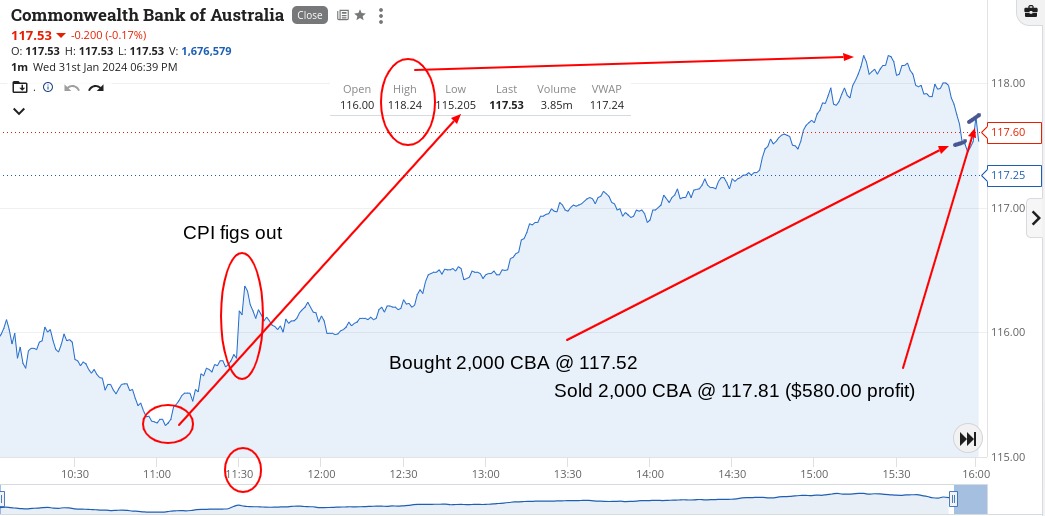

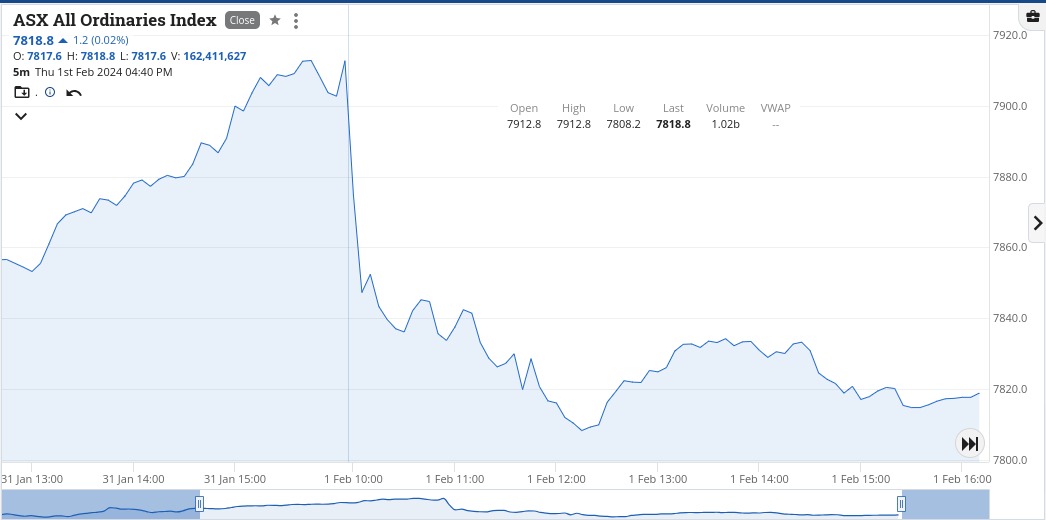

CPI figs came out at 11.30am and a tad better than expected, so bonds and equities rallied.

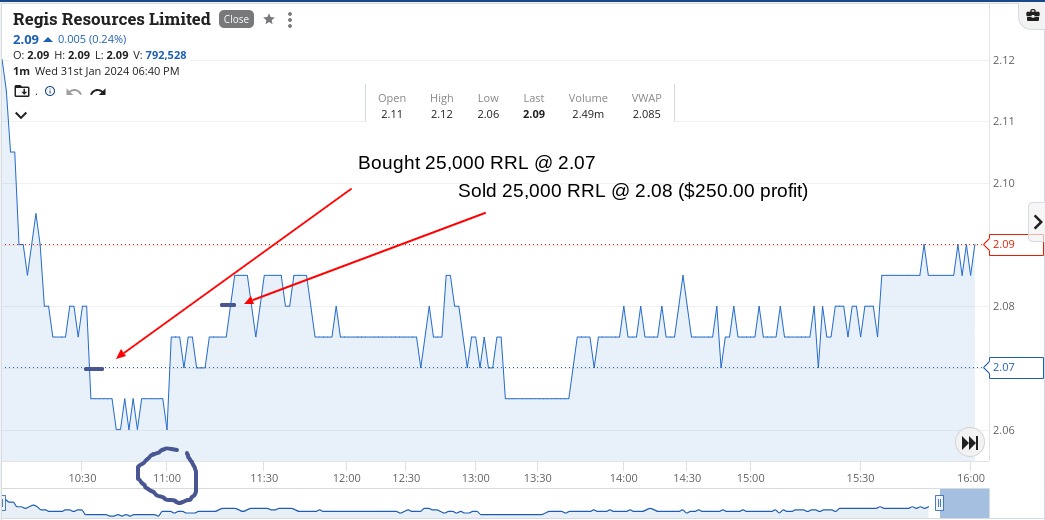

I played safe with some RRL, pre CPI figs and low and behold, even they got a leg up on the way through.

In the afternoon, drum roll please, CBA touched a high of $118.24 before having a bit of a setback, towards the close.

They fell from that high down to $117.45 on some heaving selling, which I put down to option expiry shenanigans.

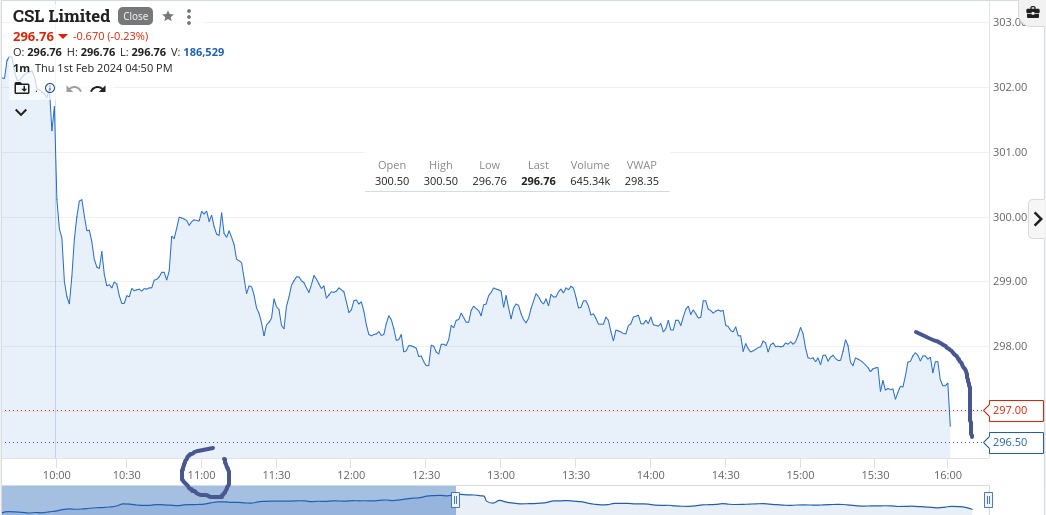

And then we have the manic child CSL.

They punched through the $300 barrier, even though there was 47,000 on offer at that level and keeping a lid on things.

Their range was $295.12 to $302.50 on 1.12m shares. WOW!

Anyway, in for a penny, in for a pound and same tactics as yesterday, but this time a dollar or two higher.

Up $830, thanks mainly to CBA.

Recap

Bought 25,000 RRL @ 2.07

Sold 25,000 RRL @ 2.08 ($250 profit)

Bought 2,000 CBA @ 117.52

Sold 2,000 CBA @ 117.81 ($580 profit)

Thursday February 1

Come into a morning where one of America’s bank’s share price collapsed by 26% overnight, so that was a big red flag for me today.

CBA actually closed on its low for the day at $114.10. They reached above $118 only yesterday.

I was surprised at how the market only fell 1%, though on my main watch list I only had two companies not in the red.

RRL gave me a bit of a heart murmur, when they came out with a trading halt. It said they may come back on Monday and I was thinking thank Christ I wasn’t long of them and then that happened.

Anyway all’s well that ends well and when they did come back, I thought their markdown was a bit overdone and managed to get a 2c turn out of them.

Up $500 and popcorn watching the bond yields falling, which probably helped the market from not falling as much as it could have done. Got a feeling that tomorrow I will lose money!

Recap

Bought 25,000 RRL @ 1.92

Sold 25,000 RRL @ 1.94 ($500 profit)

Friday February 2

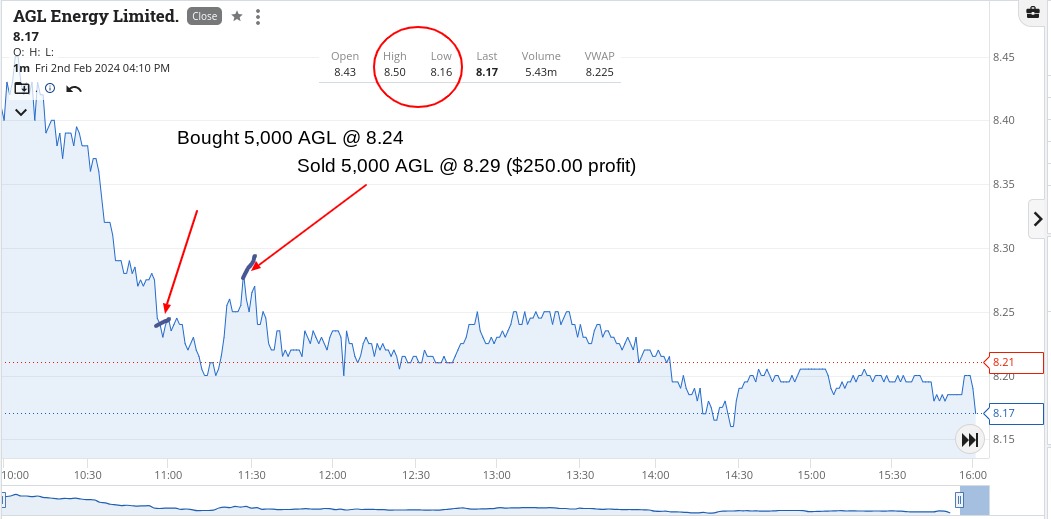

Noticed a couple of fallers in the As today, namely ANZ and AGL.

Luckily for me my thoughts on losing money today were a prediction which didn’t eventuate and I managed a couple of 4c turns.

Why both of them were down was a mystery to me, especially ANZ. Left a bit on the table with them. Both were on sell limits.

I think everyone is a bit shocked at how much the market cap of Facebook’s owner, META, went up by overnight. Something like US$200bn which is more than our little old CBA is worth in total.

The biggest mover on my current watch list was Boss Energy, who were up 7.95%, though a blast from the past Bougainville Copper shot up 128%, having gone from 36c to 80c on 700,000 shares.

Anyway, up $500 today bringing in the week at $3,565 ($3,176 net), which is a bit of a shock for me as I was expecting to be down this week. Have to shake off my negativity with a dive in the sea and just breathe a bit ahead of a nice cold beer.

Recap

Bought 5,000 AGL @ 8.24

Bought 5,000 ANZ @ 26.93

Sold 5,000 ANZ @ 26.98 ($250 profit)

Sold 5,000 AGL @ 8.29 ($250 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.