Confessions of a Day Trader: Once more unto the breach, dear friends, once more…

Pic: Getty

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Valentine’s Day

Today was like going out fishing. Casting me eyes over my watchlist and the biggest major fallers and waiting.

BLD came out with pre-market results and after their recent capital return, they are still down $2.65 from a month or so ago. So they offered an opportunity and then so did CBA.

CBA’s range was $98.20 to $100.51 so they had those $100.00 and $99.85 levels to watch and wait on. Got them both twice and the second chance was a bit of a mouth open moment, as I didn’t think it would be possible.

In between all of this NVX was the day’s biggest major faller and finished the day down over 10%. Went a bit early and had to double down.

Finished up $865 and tomorrow is CBA’s last day before going ex $1.75 fully franked. Should be fun!

Recap:

Bought 2,500 BLD @ 3.71

Sold 2,500 BLD @ 3.77 ($150.00 profit)

Bought 1,500 CBA @ 100.04

Bought 4,000 NVX @ 5.91

Sold 1,500 CBA @ 100.21 ($255.00 profit)

Bought 2,000 CBA @ 99.81

Bought 4,000 NVX @ 5.80

Sold 8,000 NVX @ 5.87 ($120.00 profit)

Sold 2,000 CBA @ 99.98 ($340.00 profit)

Tuesday February 15

Bit of Ukraine tension overnight and European markets down, though Wall Street not so much. MFG were a big early rapper and I remember reading that staff and directors are margined up.

They fell to $17.39 and bounced to $17.48 and as a few mins before 11.00am, I just stuck in a limit order at that price. Got hit and watched them rally and knocked them out for a 16c turn.

Very nervous on everything else. The miners were weak, bar BHP, who put some good results out.

CBA had a $1.42 trading range today and go ex div tomorrow. Plus $320 today.

Recap:

Bought 2,000 MFG @ 17.39

Sold 2,000 MFG @ 17.55 ($320.00 profit)

Wednesday February 16

Biggest major faller of the day was NWL and it was a classic, as came out with figures pre-market. Got marked down, then got oversold and then recovered off its lows.

Seeing as all the bad news was out, picked up 3000 when they were down about 15% and then they recovered.

Kinda left more than a bit on the table as it turns out but more than happy with the profit of $765.

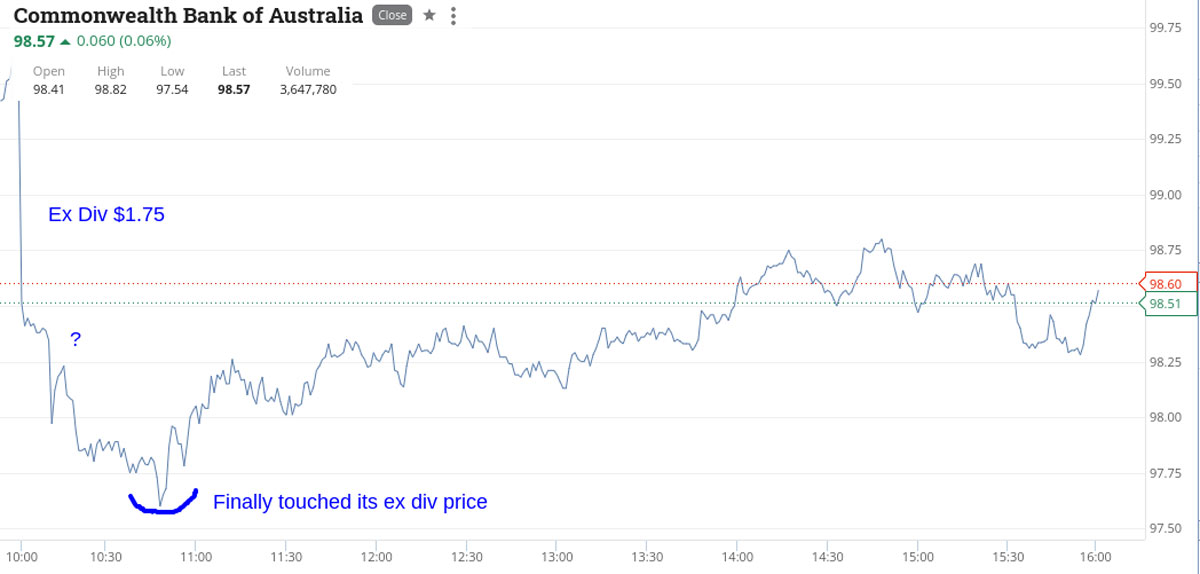

CBA went ex div $1.75 fully franked and didn’t hit their full div amount until just before 11.00am.

This threw me a bit, as was expecting it to happen first thing.

Had some limit buy orders in and then cancelled them around 10.30am so missed out when it finally did happen. So missed them in the end. – See chart.

Recap:

Bought 3,000 NWL @ 12.26

Sold 3,000 NWL @ 12.52 ($765.00 profit)

Thursday February 17

Had a punt on FMG at $21.00 and moved them on, as they went the right way for a change. A 15c turn, thank you very much.

ORG were the biggest major faller for the day, so took a small profit on them and also ANZ, as I had to drive for an hour or so and didn’t want any distractions.

Also, still nervous about the market – plus $355.

Recap:

Bought 1,500 FMG @ 21.00

Sold 1,500 FMG @ 21.15 ($225.00 profit)

Bought 1,000 ORG @ 5.77

Bought 2,000 ANZ @ 28.02

Sold 1,000 ORG @ 5.82 ($50.00 profit)

Sold 2,000 ANZ @ 28.06 ($80.00 profit)

Friday February 18

Not going to be a hero today. What with it being a Friday and anything could happen from 10.00am today and follow into the weekend, so there will be some book squaring today and expecting more weakness.

QBE had some news out and were the day’s biggest faller.

Did a real quick grab and run on them for an 8c turn and happy to leave it there, walk away and not have to worry about all the things making me nervous – bonds, Ukraine and inflation – so off to a big lunch with lots of amber nectar, as I feel next week could get nasty.

Up $160 today and for the week plus $2465 gross or $2216 net.

Recap:

Bought 2,000 QBE @ 11.27

Sold 2,000 QBE @ 11.35 ($160.00 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.