Confessions of a Day Trader: Of course they went higher, but I didn’t care. Up $1,100 on a CPI day is Milky Bars on me

Chocolate. Via Getty

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

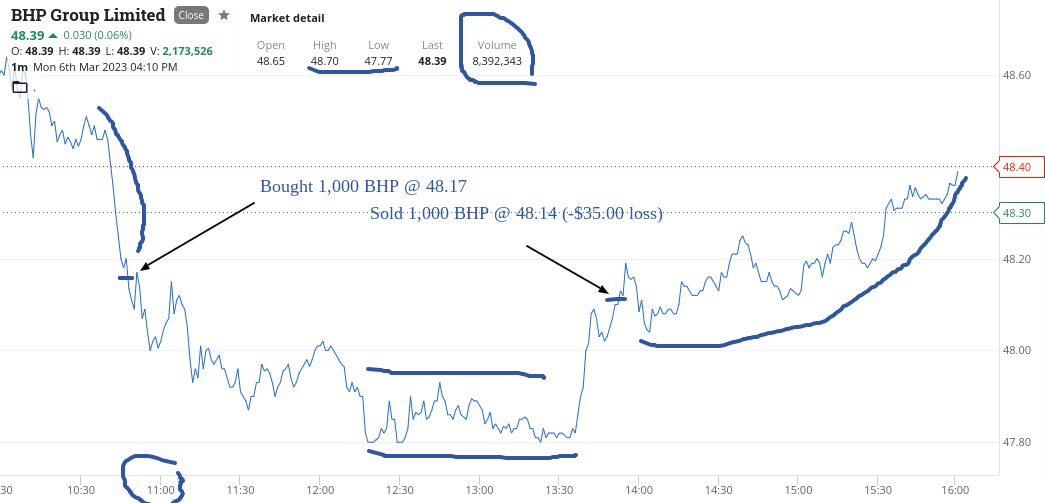

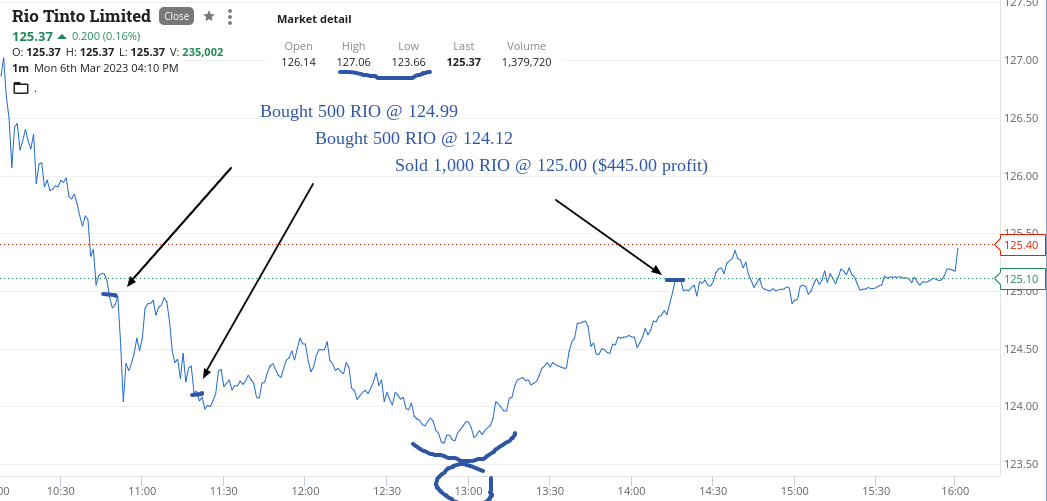

Monday 6th March

Banks up today and Iron Ore producers fell away. Rio’s had a big range on small volume.

RIO’s range today was $127.06 to $123.66 on 1.3m of which 235k went through at 4.10pm at a price of $125.37.

When they were trading at $125.50, I put in a limit buy at $124.99 for 500. When they went through me, they fell to the the $123.86 lows, as I had to double down and wait. Was down over $500 on them alone at one point.

BHP fell in sympathy and at $48.17, i thought I would be safe. Wrong- see chart. They also gave me grief but I hung in there, made $445 on RIO’s when they finally spiked and cut the BHP for a small loss.

I didn’t want to hang around, as a very hot day and the beach was calling me. Up $410 on a Monday, after staring at a $600 plus loss at one stage on both positions, so my timing was a bit out. Bit rusty, like the Iron Ore!

Recap

Bought 1,000 BHP @ 48.17

Bought 500 RIO @ 124.99

Bought 500 RIO @ 124.12

Sold 1,000 RIO @ 125.00 ($445.00 profit)

Sold 1,000 BHP @ 48.14 (-$35.00 loss)

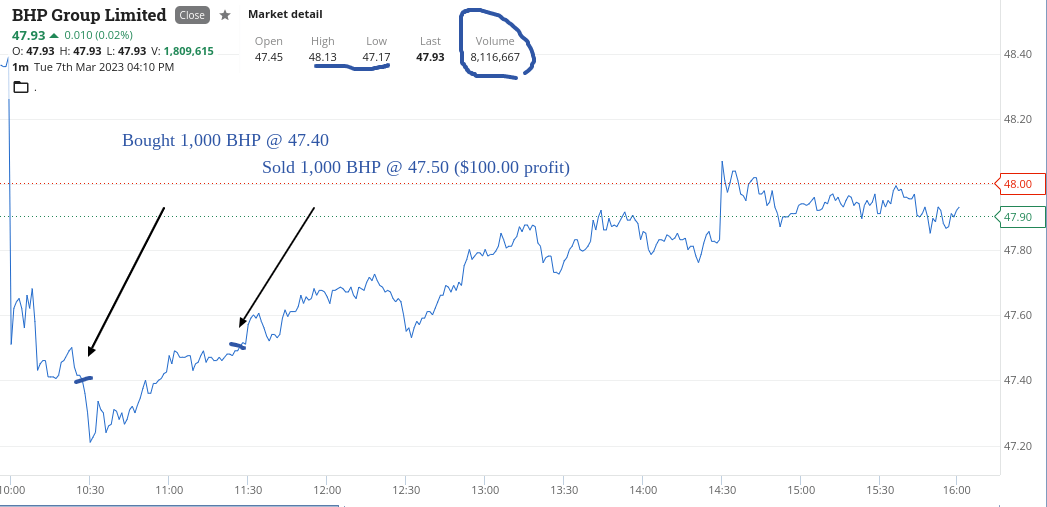

Tuesday 7th March

CPI day today, so nimble trading ahead of 2.30pm.

Started out trying to avoid the banks.So got stuck into some BHP as both BHP and RIO’s were down in NY trading. RIO’s started to recover and BHP were a bit slower, hence the purchase.

All the banks were up but CBA was not. Saw a couple of small trades, where once in limit sell orders were placed to take small turns ahead of 2.30pm.

Then just before the 2.30pm headline, CBA were back down and hovering around the $98.40 to $98.44 level and I thought about it.

Have $440 profit, so can absorb a 40c fall from here and everytime they have fallen, so do the opposite of what everyone is thinking.

Went long 1000 at 2.28pm and was out with a 66c profit at 2.33pm. They shot up so fast, that as I was putting in my sell order around $99.00 they put on another 9c and out they went.

Of course they went higher, but I didn’t care. Up $1,100 in a day. A CPI day. Phew. Could have gone the other way but it didn’t.

Recap

Bought 1,000 BHP @ 47.40

Bought 1,000 CBA @ 98.46

Sold 1,000 CBA @ 98.66 ($200.00 profit)

Sold 1,000 BHP @ 47.50 ($100.00 profit)

Bought 1,000 CBA @ 98.38

Sold 1,000 CBA @ 98.52 ($140.00 profit)

Bought 1,000 CBA @ 98.43

Sold 1,000 CBA @ 99.09 ($660.00 profit)

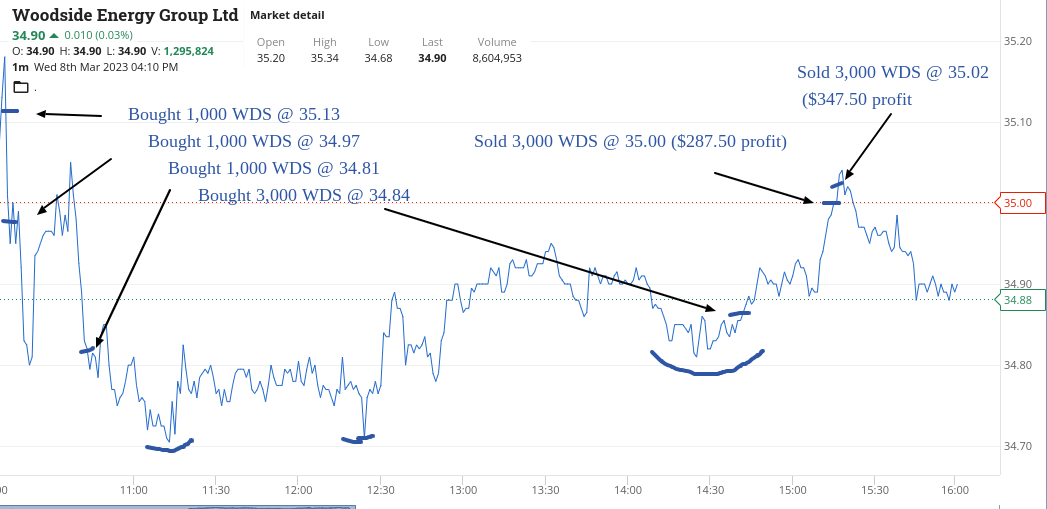

Wednesday 8th March

Today was a long day of waiting around and then having to find the right time to really double down.

WDS went ex div and at one point they were marked down 7% or so and my mistake was going a bit too early.

At just above $35.00 I thought I would be safe, seen as yesterday they closed at $37.62 but I should have waited for them to crack below $35.00

Just before 3.00pm and having boringly watched them all day, I decided to bite the bullet, as my gut feeling was that they were about to move higher.

Now long of 6,000, I split them into two sell orders. One at $35.00 and the other at $35.05, though the latter, I had to adjust down.

Came in with a $635 profit in the end. Everything on the watch list was glowing red and I was too far deep into WDS, that I couldn’t even look too much at anything else.

Recap

Bought 1,000 WDS @ 35.13

Bought 1,000 WDS @ 34.97

Bought 1,000 WDS @ 34.81

Bought 3,000 WDS @ 34.84

Sold 3,000 WDS @ 35.00 ($287.50 profit)

Sold 3,000 WDS @ 35.02 ($347.50 profit)

Thursday 9th March

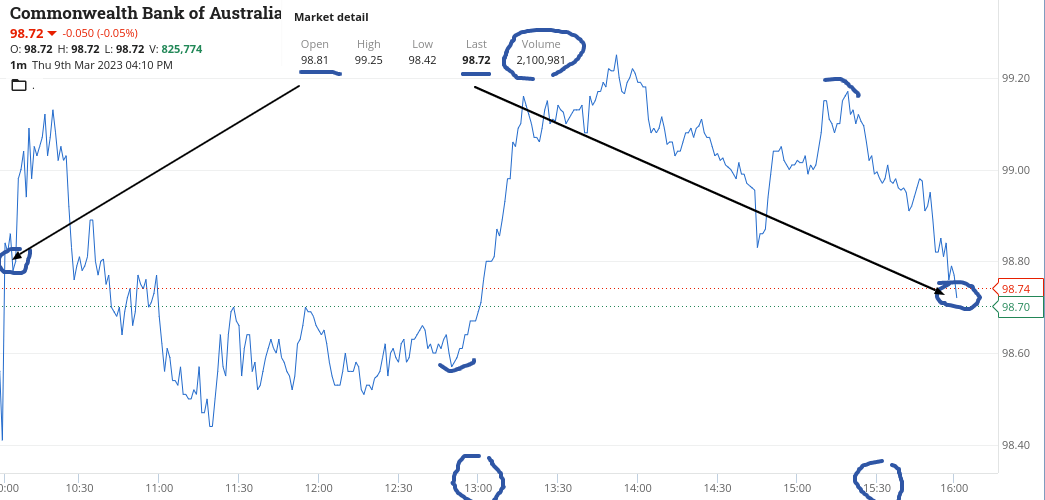

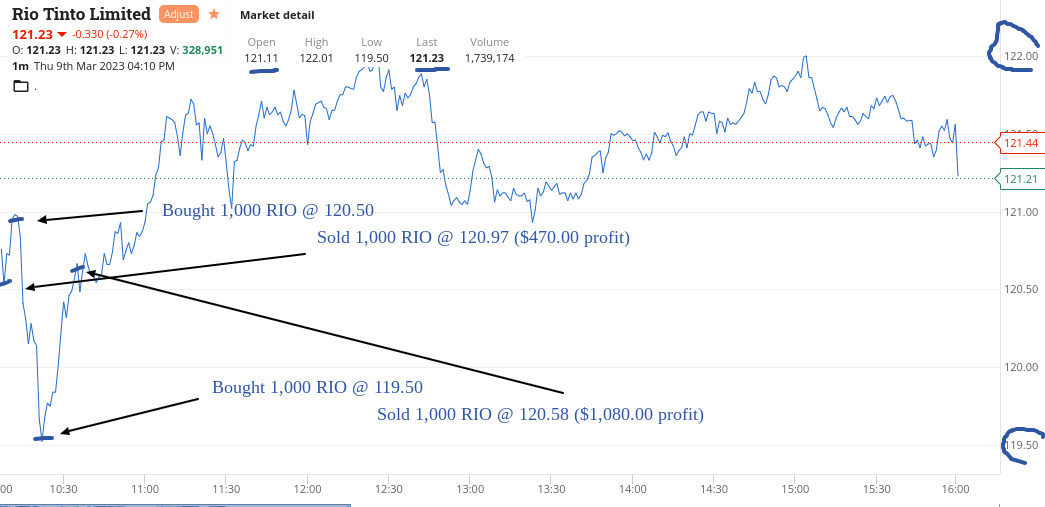

Cracker of a day, thanks to RIO’s. Up $1,485.

For some reason, RIO’s opened down more than expected or indicated by the AFR’s 5.00am morning report.

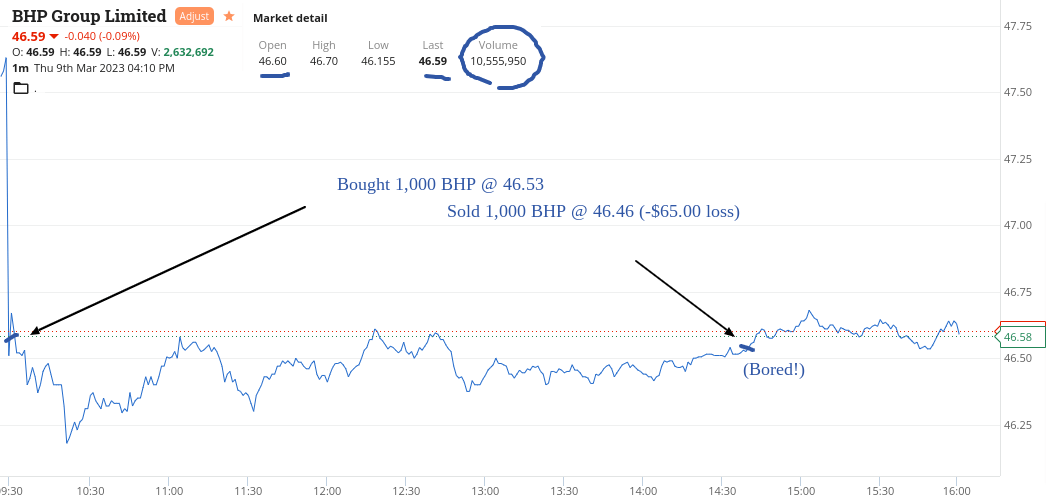

Got into both RIO and BHP early. BHP was cut later after I decided that I didn’t want to keep watching them after RIO’s performance.

Market madness I call it. CBA managed to open at $98.91 and close at $98.72. In between that, 2.1m shares turned over and the day range was 83c! BHP had 10m shares turnover and closed with a 1c diff between open and close.

By the way, today, the milky bars are on me!

Recap

Bought 1,000 BHP @ 46.53

Bought 1,000 RIO @ 120.50

Sold 1,000 RIO @ 120.97 ($470.00 profit)

Bought 1,000 RIO @ 119.50

Sold 1,000 RIO @ 120.58 ($1,080.00 profit)

Sold 1,000 BHP @ 46.46 (-$65.00 loss)

Friday 10th March

Be careful what you wish for!

With CBA trading with a $95 in the front was something I have been waiting for and with bad bank news coming out of the USA overnight.

I knew things would get bad and having waited most of the day, they cracked the $96 level.

I thought at $95.80, I would be safe.

But no.

Even waiting till the 4.10pm death couldn’t save me and as for RIO’s. OMG.

They had a range of $119.95 to $116.68 and luckily for me they had a 4.10pm rally, which trimmed some of my losses and the same with WDS.

So, today I lost $810. The trading God giveth and then he taketh, is now going through my head. Up $2,820 gross for the week or $2,353.net.

Recap

Bought 1,000 CBA @ 95.80

Bought 1,000 WDS @ 34.23

Bought 1,000 RIO @ 117.62

Sold 1,000 CBA @ 95.51 (-$290.00 loss)

Sold 1,000 WDS @ 34.05 (-$180.00 loss)

Sold 1,000 RIO @ 117.28 (-$340.00 loss)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.