Confessions of a Day Trader: Not such a silly banker?

Pic: d3sign / Moment via Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday November 23

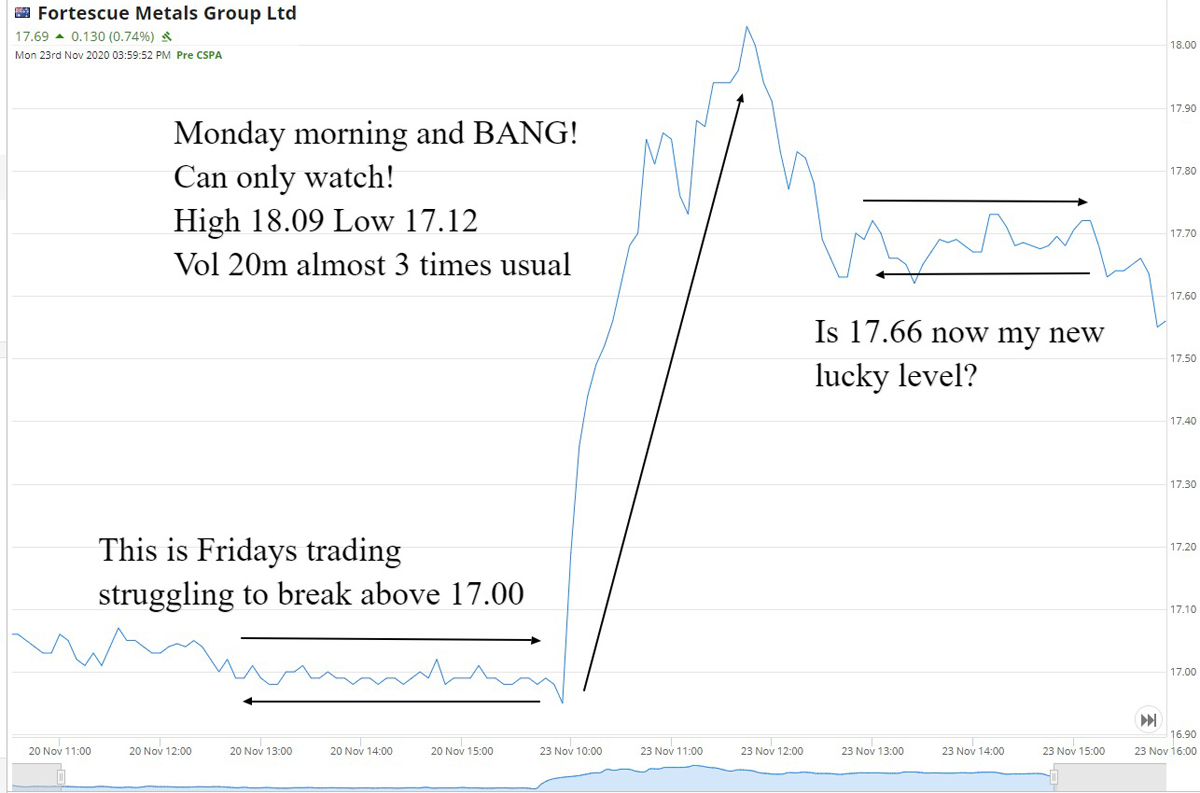

Don’t what to expect today, but FMG come out of the gates and take off like a rocket and literally put on $1.00 in the first 90 mins of trading. Having seen them on Friday bouncing around 17.00 and hit 18.02 today before midday is leaving me open-mouthed.

Notice that IAG are down 5% or so having raised $605m at 5.05 a share. So tickle 1000 into the account at 5.155.

It’s 11.42am. Buy 1000 NST at 13.91 as they keep testing the 14.00 level and falling back. Stick them on at 13.96 to sell and at 12.27pm, I’m taken out. $50 profit.

Z1P came out with a trading update and hit 6.52 around the open and then start sliding all the way down to 6.14/6.15 levels. Buy 1000 at 6.15.

It’s 12.41pm. Just watching FMG around the 17.75 level. Could go to 18.00 again or drop to 17.50. All too hard! Sell the Z1P when they hit 6.20 at 1.13pm for $50 profit. Cut the IAG for a loss of A$25 at 5.13.

It’s 3.20pm. FMG are 17.62 and I am wondering if my new ‘lucky level’ is now 17.66. Not touching them till maybe tomorrow. Overall up $75 for the day.

+1000 AIG at 5.155; -1000 AIG at 5.13; Loss $25

+1000 NST at 13.91; -1000 NST at 13.96; Profit $50

+1000 Z1P at 6.15; -1000 Z1P at 6.20; Profit $50

Tuesday November 24

Not much happening overnight, though gold gets a bit of a whack downwards as another COVID vaccine hits the headlines. Will be interesting to see how much NST fall today, having fought to stay around the 14.00 level yesterday.

NST open down 50c or so and FMG at 17.80 and I watch them flirting with the 18.00 level. They keep hitting it and coming back, so on their third pullback, I buy 1000 at 17.92 and sell them two mins later at 17.97 for a quick $50 profit.

Time is 10.39am. NST just keeping on falling, a cent at a time and start settling around the 13.00 level and just below. I buy 1000 at 12.96. Time is 12.32am. Having watched them for almost 40 mins touching 12.99 and falling back, decide enough is enough and take $30 profit.

Time is 1.18pm. Make a sandwich and take an afternoon nap. Wake up and NST are 12.80 and FMG at 18.08. APT and Z1P not doing much movement wise today. NST close down a ‘lucky for some’ 8.88%. Profit of $80 today.

+1000 FMG at 17.92; -1000 FMG at 17.97 Profit $50 (18.05 becomes the new 17.00)

+1000 NST at 12.96; -1000 NST at 12.99; Profit $30 (struggling to break 13.00 so sold out)

Wednesday November 25

Mkts up about 1.5% overnight, though gold taking another battering, down 1.7%, so will be interesting to see if NST fall and hit the 12.00 level. Added NAB to the watch list this morning. Let’s see if we can make more out of them than the interest they pay on a fixed deposit.

At 10.24am FMG come out with a good announcement, sneak in and buy 1000 at 18.27 and sneak out at 18.34 2 mins later. Nice $70 profit. In a moment of madness and euphoria from that quick trade, jump in and buy 1000 NAB at 23.87. Having just added them to the watch list this morning, should have waited to see where they settle. See graph as it takes till 14.17pm before I sell them at 23.95 having watched them bounce off that level three times and not looking like they will crack 24.00.

Looks the right move until bang, they gap up 15c in 1 min and hit 24.13. Didn’t realise that a $79bn company share could do that! Anyway, managed to make $80, which must be like having $80,000 on deposit.

APT got talked down in the papers and close down 5.8% and I had a 6.00 dabble in Z1P and cut them for a $30 loss after lunch. Both stocks have shares coming out of escrow, so both under extra pressure. NST down another 1.8% so almost down 10% in two days.

Up $120 for the day including trading a bank share!

+1000 NAB at 23.87; -1000 NAB at 23.95; Profit $80 (back in fashion and bigger % mover than CBA)

+1000 FMG at 18.27 -1000 FMG at 18.34; Profit $70 (now paying above 18.00 for them!)

+1000 Z1P at 6.00; -1000 Z1P at 5.97; Loss $30 (they did go to 6.03 and had a limit on at 6.04!)

Thursday November 26

Mmm. Not much to go off this morning. Added CBA to the watch list, as after yesterday’s effort with NAB, I was curious to watch them. They opened at just under 82.00 and at 10.54am I buy 100 at 81.56 as they look like they may go higher.

Z1P do the usual and fall below 6.00. Pick up 1000 at 5.95. Time is 11.00. Put them on a limit to sell at 5.99 and at 11.24am, they are sold.

FMG are really starting to slow down on the volatility. Buy 1000 at 18.50, just before 1.00pm. Sell them at 18.55.

Time is 3.32pm. Still looking at the CBA and wondering why I did what I did. Sell them on the death at 8.25. Loss of $31.00. Overall up $59 for the day.

+1000 FMG at 18.50; -1000 FMG at 18.55; Profit $50 (volatility slowing down)

+100 CBA at 81.56; -100 CBA at 18.25; Loss $31 (moment of weakness)

+1000 Z1P at 5.95; -1000 Z1P at 5.99; Profit $40 (took off after I sold)

Friday November 27

No real lead indicators on the market before the open, though AFR is suggesting that it will open lower. Having a tooth out at 11.30 today, is the only thing I am certain about. Do nothing till back from the dentist and maybe the needles make me a bit more aggressive than usual and notice that Z1P are hovering 6.00, so put in a limit buy for 2000 at 5.99. Get filled two mins later.

Time 12.11pm. Exactly two hours later, to the dot they, break out above 6.00 so I sell them at 6.03. That’s a handy $80 profit.

FMG are now stuck in a 30c range and down from those $1.00 swing days. Z1P just appears so consistent at the moment around that 6.00 level. APT have settled around the 95 level.

The weirdest chart of the day is NAB, where they spiked 15c in a minute and then came back down. See below.

+2000 Z1P at 5.99; -2000 Z1P at 6.03; Profit $80 (two hours to break out!)

Best trade: NAB +$80

Worst trade: CBA -$31

Gross Profit for the week: $384

Brokerage: $110

Net rolling tally: $1,513.60 after four weeks

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.