Confessions of a Day Trader: No, this is how to go out with a bang

Picture: Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday September 19

Mondays are always hard, as you want to start with a profit that sets you up for the rest of the week.

Most of my watchlist opens higher and by 10.30am they are rallying a bit more.

RIOs were lagging behind a bit, so bt 1000 at below $93.00 and they kept moving above that level and then falling back very quickly. They were moving +/- 5-8c a pop.

Everything else was going ahead even more, so bt another 1000. They finally rallied through $93.00 and went almost in a straight line. Out they went for a $500-plus profit.

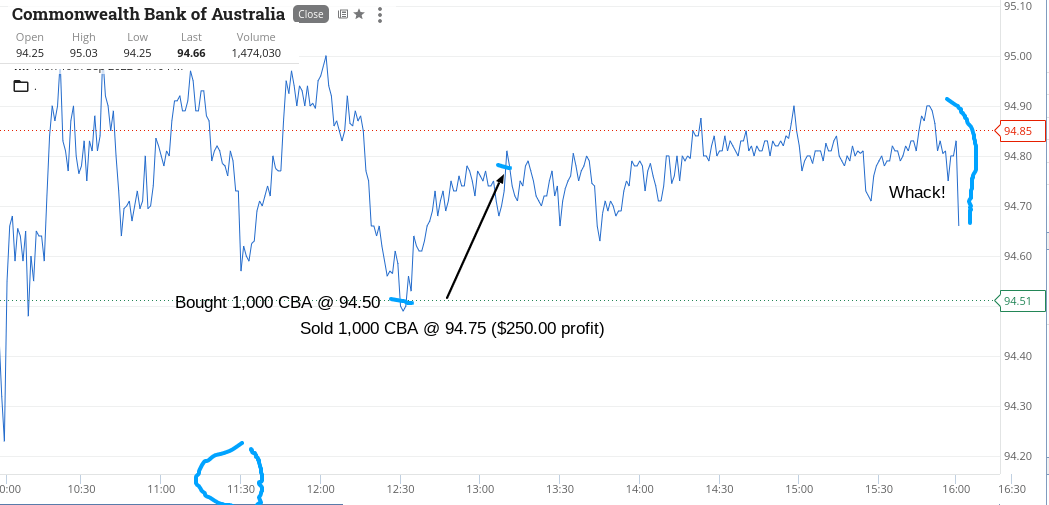

A good start to the week, so I walk away. Couldn’t help myself and noticed CBA coming down. Left a bid in at $94.50, which was about 10c below where they were trading.

Got hit and left them on a higher limit with an aim to make $200 after brokerage. This worked.

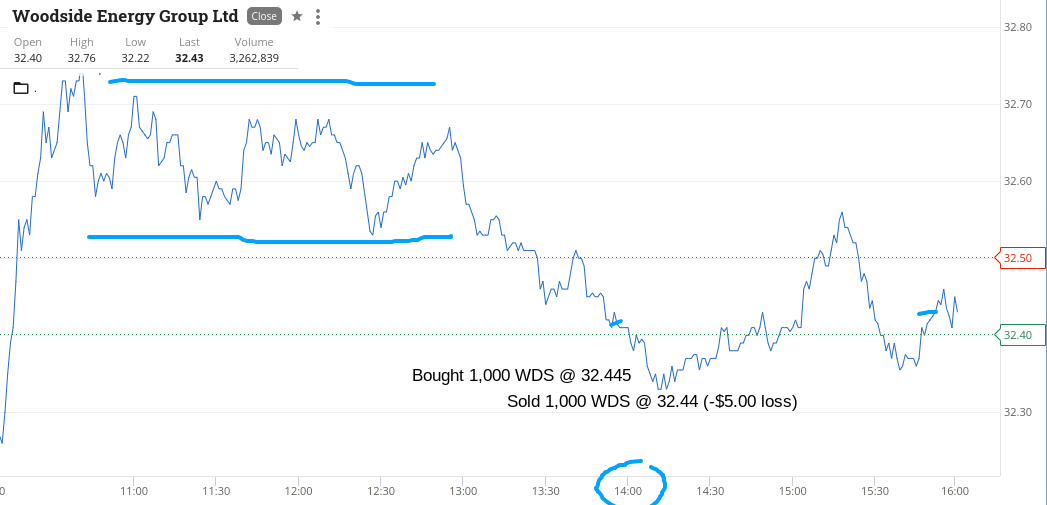

In the last 40 mins I had a go at WDS but cut them for a small loss, as they were just hardly moving. Up $50 profit or down $50, so I managed a small loss and this time I did walk away.

Plus $755.

Recap

Bought 1,000 RIO @ 92.96

Bought 1,000 RIO @ 92.97

Sold 2,000 RIO @ 93.22 ($510 profit)

Bought 1,000 CBA @ 94.50

Sold 1,000 CBA @ 94.75 ($250 profit)

Bought 1,000 WDS @ 32.445

Sold 1,000 WDS @ 32.44 ($5 loss)

Tuesday September 20

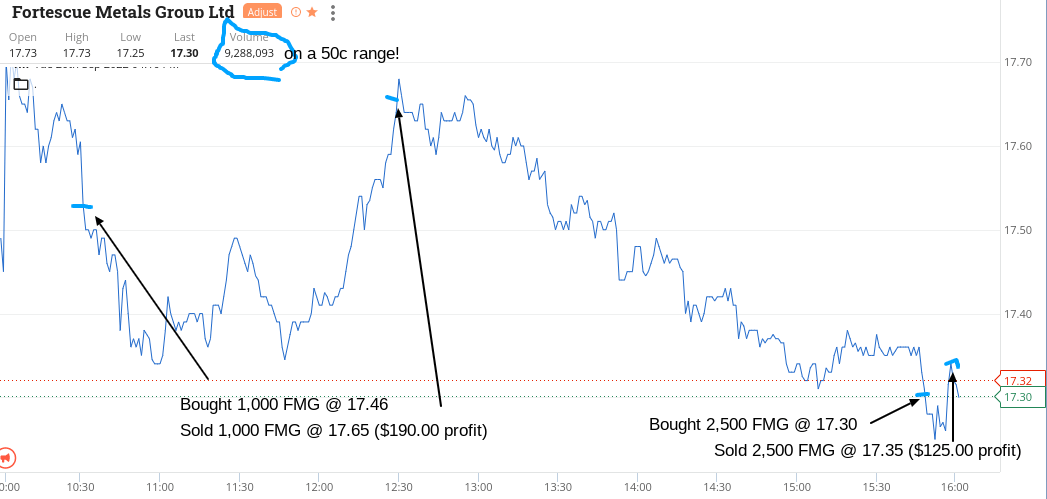

Come in with everything on my watchlist opening up firm, with the exception of FMG who open up at $17.73 and fall and by 10.40am I dip in my toes for 1000 at $17.46.

They keep falling till just before 11.00am, where they start to bottom out around the $17.30/32 level.

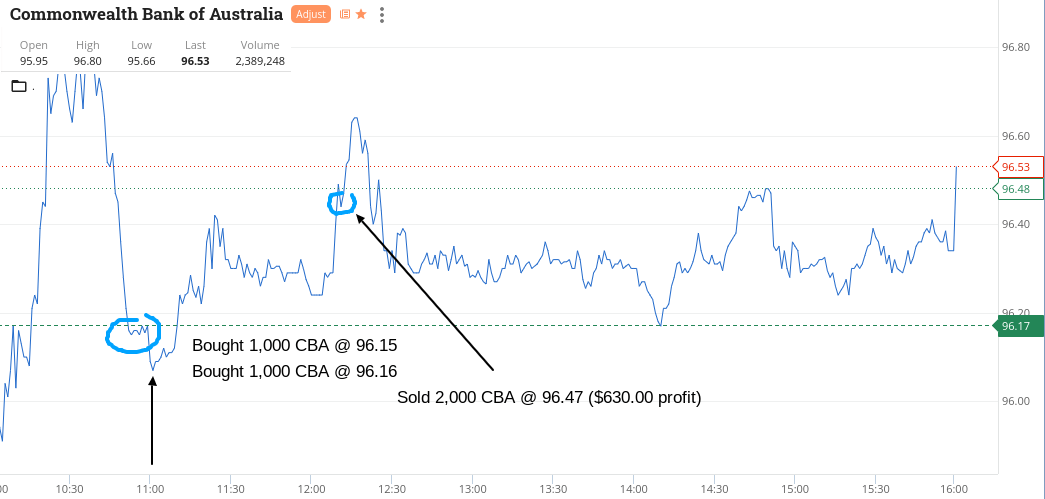

Ignoring them at the moment and looking at CBA for an 11.00am bounce.

Buy 1000 at $96.15 and they just hover, so just like yesterday in RIOs, I go again for another 1000 at $96.16. Now these babies actually opened up at $95.95 and had reached $96.80 before coming down to my in levels.

So sat and waited and by 12.28pm, I am gone just as I’m sitting down for lunch.

During lunch FMG finally have a surge and they go out on a limit.

After an afternoon nap, a few screen checks and not much happening for me and then just before the close FMG have a fall, whilst BHP have a run up.

With 8 mins to go, pick up 2500 at $17.30, watch them hover around and then fall even more and with 30 secs to go, they take me out on a limit of $17.35. Phew.

Up $845.

Recap

Bought 1,000 FMG @ 17.46

Bought 1,000 CBA @ 96.15

Bought 1,000 CBA @ 96.16

Sold 2,000 CBA @ 96.47 ($630 profit)

Sold 1,000 FMG @ 17.65 ($190 profit)

Bought 2,500 FMG @ 17.30

Sold 2,500 FMG @ 17.35 ($125 profit)

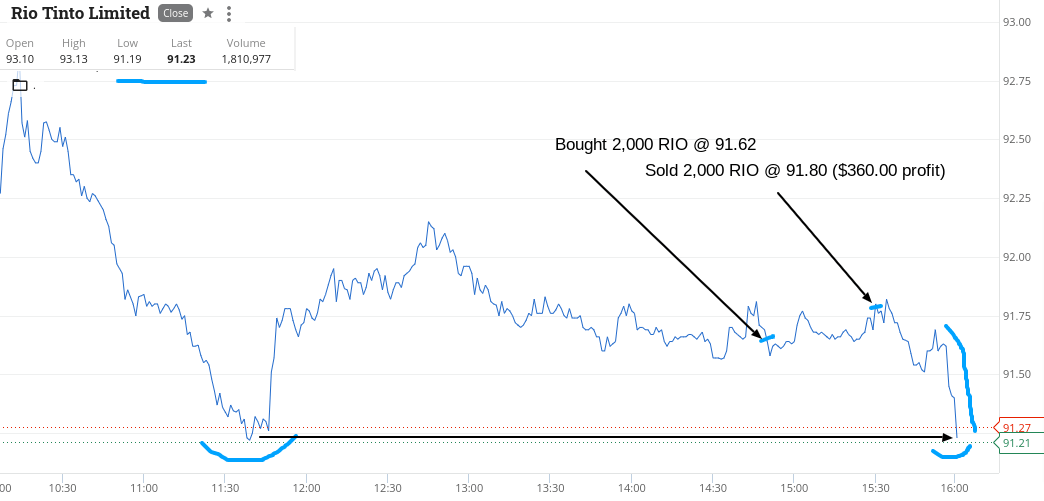

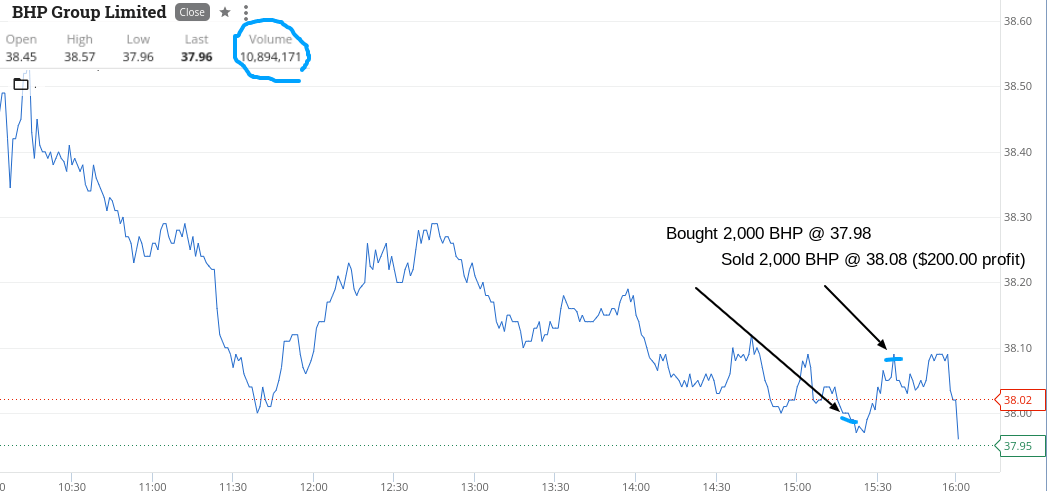

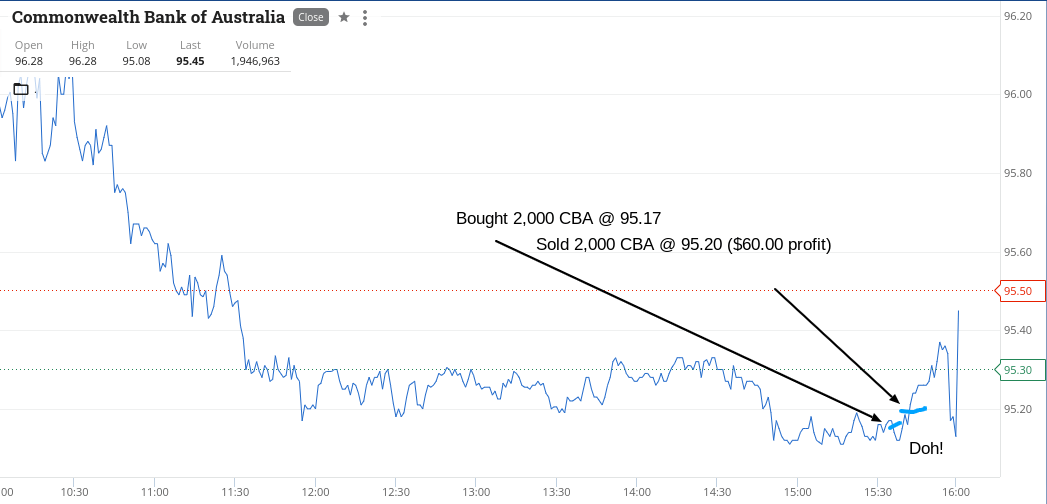

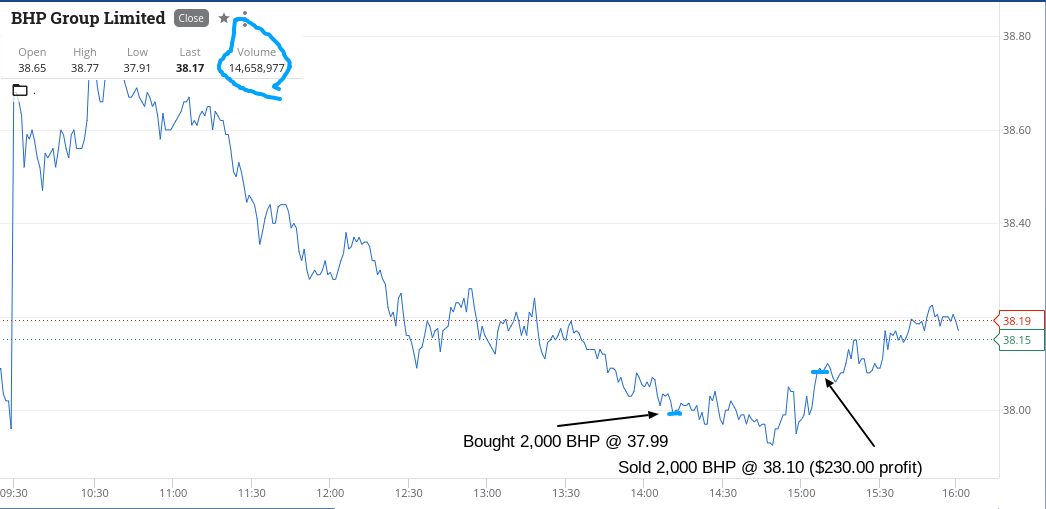

Wednesday September 21

Today was one of those waiting around days. Nothing really tickled my fancy until a bit later in the day.

Look at RIOs, down to $91.62 and CBA at $95.17. That is a big widening of the gap between them.

Basically did all right in RIO and BHP and just about broke even on CBA.

Up $620 ahead of the American interest rate rise tonight.

Recap

Bought 2,000 RIO @ 91.62

Bought 2,000 CBA @ 95.17

Bought 2,000 BHP @ 37.98

Sold 2,000 RIO @ 91.80 ($360 profit)

Sold 2,000 CBA @ 95.20 ($60 profit)

Sold 2,000 BHP @ 38.08 ($200 profit)

Thursday September 22

A national day of mourning.

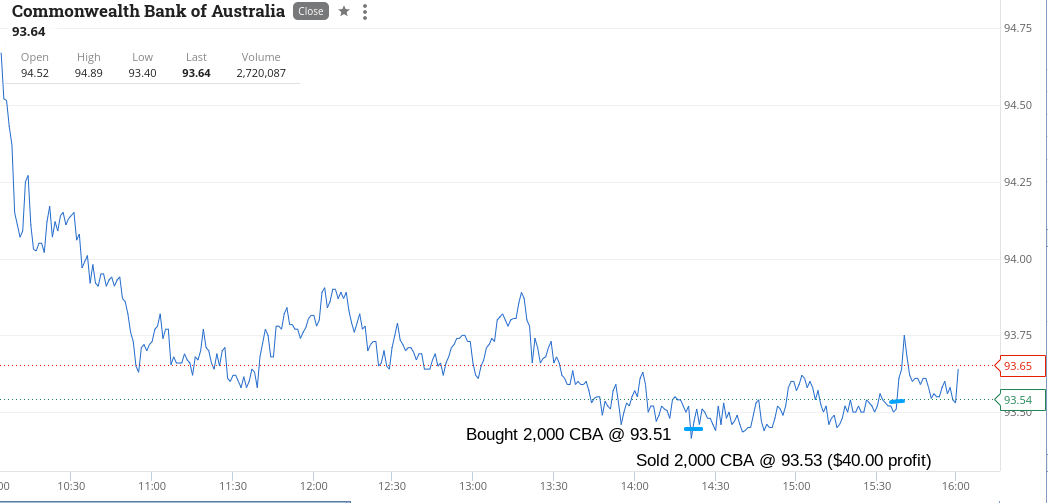

Friday September 23

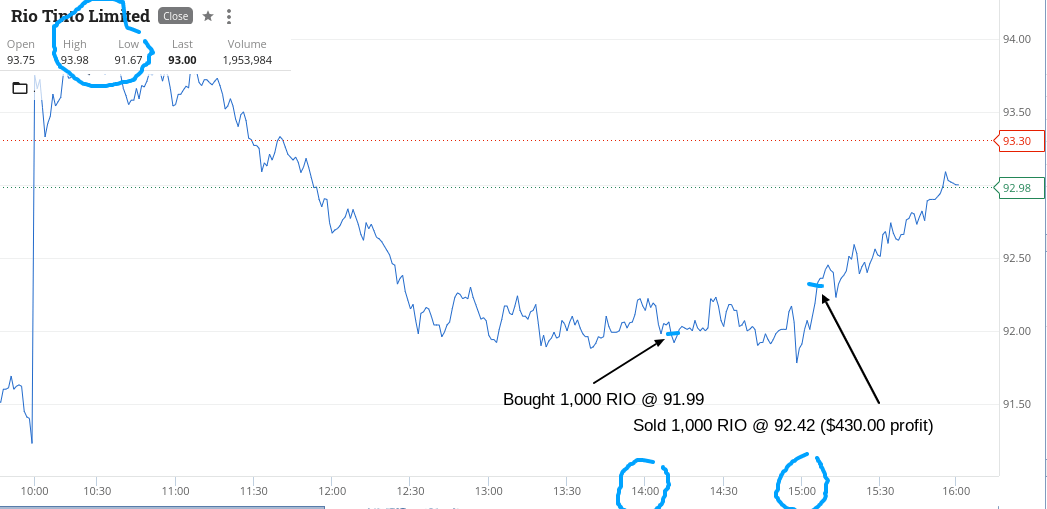

Waited around for a long time, just watching the hour time rather than any particular trading patterns. At 2.00pm it looks like the market is turning and maybe, just maybe Friday night trading in USA may also turn around.

15 mins later that rally has petered out, so I close my eyes and go bang, bang, bang, bang and shoot from the hip on four buys.

Starting with 2000 WDS, then 1,000 RIOs, then 2000 CBA and finally 2000 BHP. Went a bit heavier on the last two, as only have what, another hour 45 min left to go?

I thought there might be a 2.30pm rally but no. However, at 3.00pm there was the start with RIOs leading the charge, so sell them and then the BHP and then just cut WDS and CBA to close out all my positions.

The day ended with mixed results; RIOs putting on another 50c or so and WDS finally rising on short covering ahead of the weekend.

Up $690 gross today and $2,326 net for the week, which included being shut down for one day. Let’s see what Monday brings!

Recap

Bought 2,000 WDS @ 31.45

Bought 1,000 RIO @ 91.99

Bought 2,000 CBA @ 93.51

Bought 2,000 BHP @ 37.99

Sold 1,000 RIO @ 92.42 ($430 profit)

Sold 2,000 BHP @ 38.10 ($230 profit)

Sold 2,000 WDS @ 31.445 (-$10 loss)

Sold 2,000 CBA @ 93.53 ($40 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.