Confessions of a Day Trader: Miners in front, banks bringing up the rear. What are the odds?

Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday October 30

Come in today and the AFR says the market will be down 1% as the futures are looking that way.

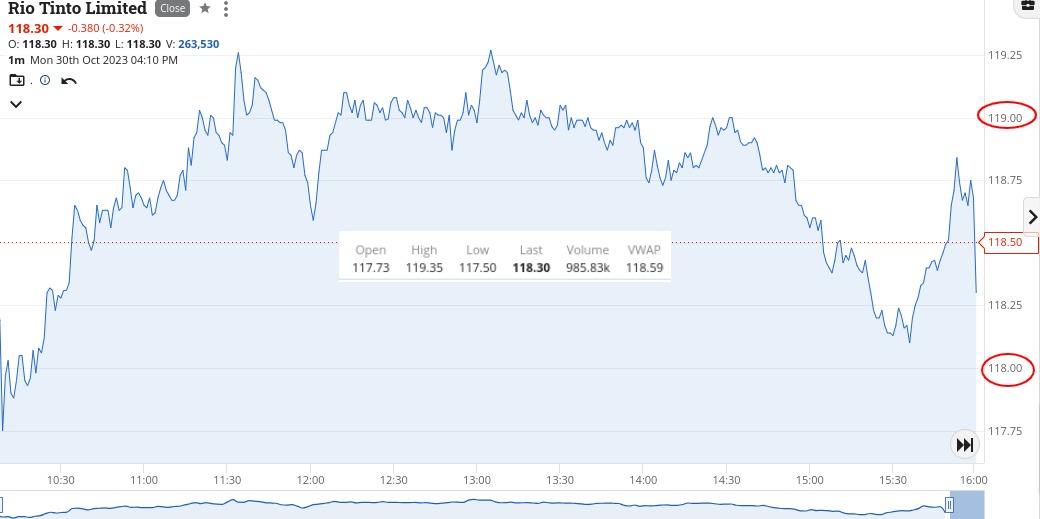

So, all the banks were down and the iron ore miners were up. RIOs touched a high of $119.35 and CBA reached a low of $96.15.

CBA close 7c higher than their low and stayed in a narrow range today, so there were slim pickings for me until IGO popped up as the day’s biggest major faller.

They had some disappointing figs out pre-market. They had a high of $10.50 and a low of $9.40 on volume of 9m shares.

Unfortunately for me, I got stuck in a bit too early, as I was thinking well, their bad news is out for everyone to see.

Had four goes at getting my average down and never reached breakeven, though missed that by 2c. Split the sell order up and got out just before their close.

Could have been worse on the red ink side but not too bad a loss, though I wished I had have just done nothing. At least I wasn’t too bored.

CBA were just 15c away from trading in the $95s and that’s down from $98 on Friday, so they are getting interesting to watch.

Let’s see what the rest of the week brings.

Lost $437.50.

Recap

Bought 2,500 IGO @ 9.93

Bought 2,500 IGO @ 9.77

Bought 2,500 IGO @ 9.66

Bought 2,500 IGO @ 9.63

Sold 5,000 IGO @ 9.70 ($218.75 loss)

Sold 5,000 IGO @ 9.70 ($218.75 loss)

Tuesday October 31

Well, today turned out to be a bit of a bread and butter day though there was a bit of pain before the gain.

RIOs actual traded range was $119.30 to $116.88 and I thought I was being pretty smart at $117.84 but had to double down at $117.00.

I did try and get them in the $116s but had to chase my tail and eventually $117.00 was the level.

CBA were very slow to go green for me and wafted in and out of profit. Their range was $97.21 to $96.25.

Needed some patience today and I think tomorrow will be worse, as waiting around for opportunities can be quite tedious.

Such is life!

Up $890, so back above water after yesterday’s result.

Recap

Bought 2,000 BHP @ 44.63

Bought 1,000 RIO @ 117.84

Bought 1,000 RIO @ 117.00

Bought 2,000 BHP @ 44.31

Bought 1,000 CBA @ 96.43

Sold 2,000 RIO @ 117.64 ($440 profit)

Sold 4,000 BHP @ 44.55 ($320 profit)

Sold 1,000 CBA @ 96.56 ($130 profit)

Wednesday November 1

Did nothing all day but watch RIOs fly off as they almost touched $121.00 at their peak.

Their range was in fact $118.33 to $120.92 and they were acting as if they were caught up in a short squeeze.

Amazing stuff.

CBA were extremely boring and were in a tight range and I ended the day resolved to the fact that I was not going to be able to do anything in any stock today.

However, coming into the last 15 mins of trading NAB were being marked down and with RIOs up, surely CBA will have a rally to catch up.

So, against all rules, in I went and waited.

Up and down 2c every second in both CBA and NAB till they hit 4.00pm and then they both had a tickle up, though CBA had a real rib-cager of a tickle.

Up $930 and all in the last 10 min match-up, which makes a change.

Made today a long one, though I did sneak in a nana nap under a shady tree by the beach an hour before the close.

Recap

Bought 2,000 CBA @ 96.58

Bought 5,000 NAB @ 28.09

Sold 2,000 CBA @ 96.87 ($580 profit)

Sold 5,000 NAB @ 28.16 ($350 profit)

Thursday November 2

Stronger markets overnight leads to me having a pre-market plan, as I think the banks will rocket out the traps, so with ANZ starting to shoot out first in the opening rotation before CBA, then NAB and finally WBC.

Basically I’m in ANZ on the opening and out of them just after WBC open up. It may only be a small profit but it was more about nicking a profit in a horny market.

Later as I’m giving my watchlist an 11.00am check, WDS are the only one in red,so I give them a quick nudge in and out.

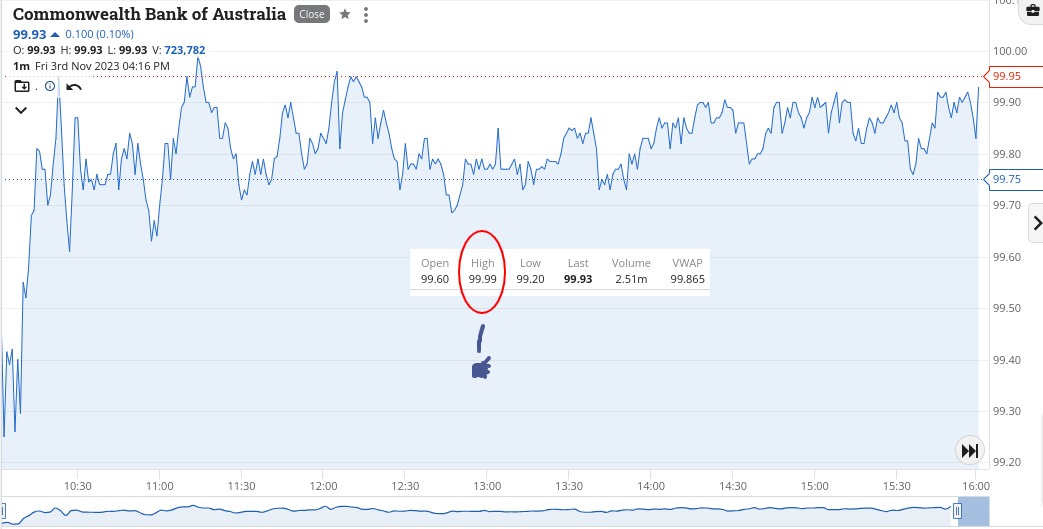

The CBAs and RIOs were the shining stars today, so have added their charts as well. RIOs in the $121s and CBA nudging $99, who would have thought?

Not me.

Up $240.

Recap

Bought 2,000 ANZ @ 25.25

Sold 2,000 ANZ @ 25.30 ($100 profit)

Bought 2,000 WDS @ 34.38

Sold 2,000 WDS @ 34.45 ($140 profit)

Friday November 3

Strong opening all round.

Over the day, CBA hit $99.99 and couldn’t just make a full ton.

In fact you could say that today they did a Bradman, whilst over in RIO, they were basking in the sun after going through the $123 level. It was only last week that we were trading in them at the $111 level.

I did alright out of TWE today, after they came back on following a fund raising exercise.

Their range today was $11.44 to $10.75 and at their close of 11.04, they were down 7.8%.

Took a bit of pain but eventually I could lock in a profit, which took me a few goes as my phone was playing up and I had to reboot it a couple of times before it came good.

Up $880 today, which makes it $2,502 gross for the week or $2,028 net.

Of course next week we have the Melbourne Cup/Rate rise? Combo and either way, everyone will end up being messy by the end of the day!

Recap

Bought 4,000 TWE @ 11.14

Bought 4,000 TWE @ 10.88

Sold 8,000 TWE @ 11.12 ($880 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.