Confessions of a Day Trader: Meltdown. Time for a massage and no heroics

Picture: Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday May 2

Big falls in America and interest rate jitters and politicians promising ‘free beer’ for everyone is the background to my Monday morning.

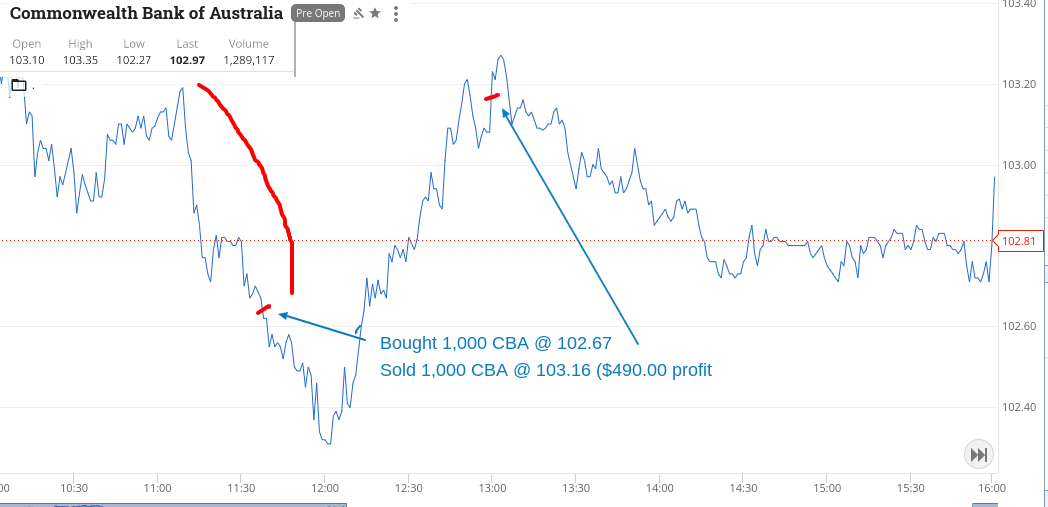

Have an early look and then just after 11.30am a couple of movements catch my eye and I have captured those movements on my phone.

So, remember that I can see no different from anyone else, so it’s not rocket science, just a bit of mental adjustment in your thinking.

As I have said before, it’s not the size of the win that counts, it’s the actual winning that counts.

Up $930, from only two trades this week. Nice!

Recap

Bought 1,000 CBA @ 102.67

Bought 2,000 ABB @ 4.15

Sold 2,000 ABB @ 4.37 ($440 profit)

Sold 1,000 CBA @ 103.16 ($490 profit)

Tuesday May 3

RBA’s move on interest rates coming in at 2.30pm today, so sort of make up my mind to do nothing today. However I do eventually get sucked in.

Watching and sitting on my hands was a bit hard as stocks fell after the 2.30pm announcement and it seemed a bit knee-jerky.

Watch stocks recover and eventually got to dip in my toes, but a bit aggressive. Kind of went bang, bang, bang into BHP, NAB and CBA.

BHP because marked down but not sure why an interest rate would do that, plus RIOs started to bounce and BHP was slower.

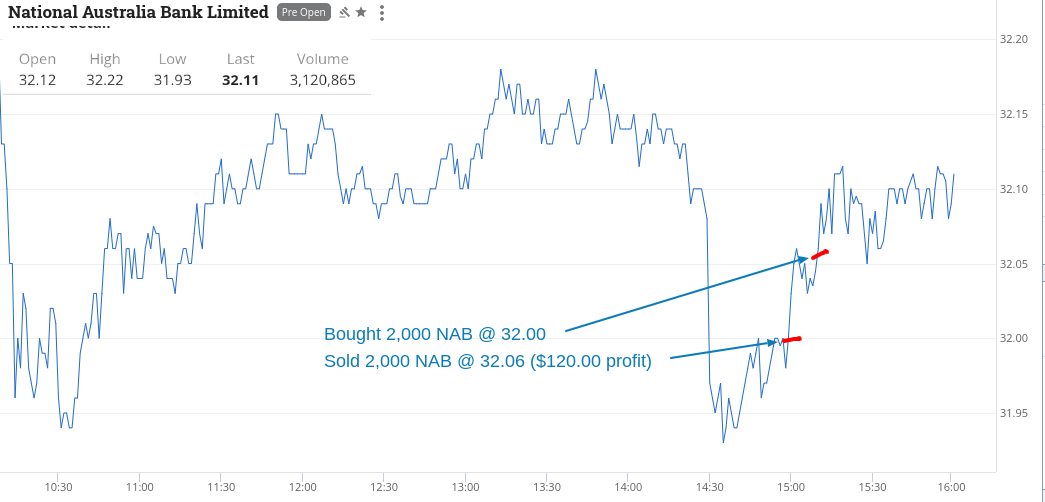

NAB still have a buy back on and $32 seemed like a good level.

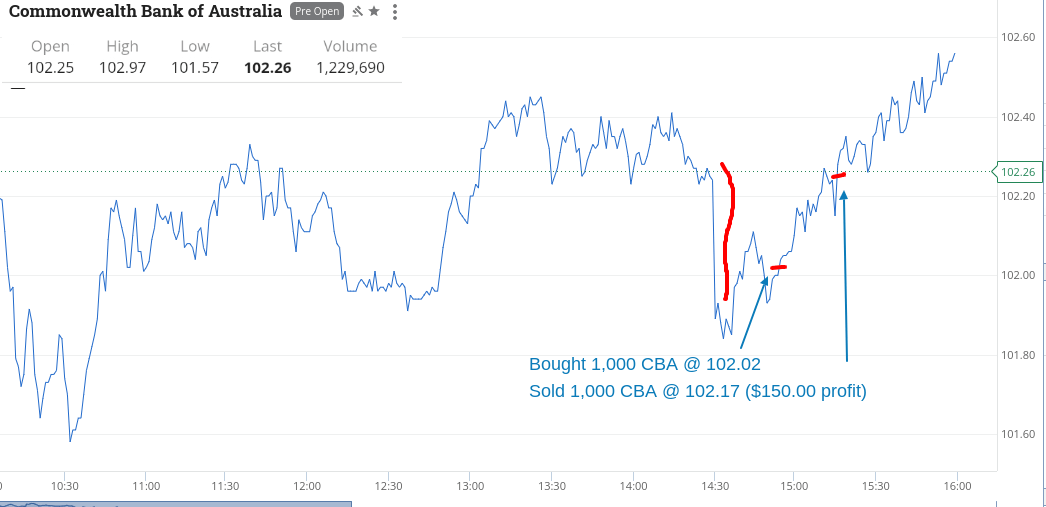

Watch CBA fall in a straight line at 2.30pm and down to $101.80 level then try and attack the $102 level. Got to $102.10 and fell back and picked them up at $102.02.

Put limits on all of them to sell and adjusted them down a bit to meet the market. Left a tidy sum on the table but happy to have scraped through with a profit. Up $430 and maybe tomorrow is the day to do nothing?

Recap

Bought 2,000 BHP @ 47.41

Bought 2,000 NAB @ 32.00

Bought 1,000 CBA @ 102.02

Sold 1,000 CBA @ 102.17 ($150.00 profit)

Sold 2,000 BHP @ 47.49 ($160.00 profit)

Sold 2,000 NAB @ 32.06 ($120.00 profit)

Wednesday May 4

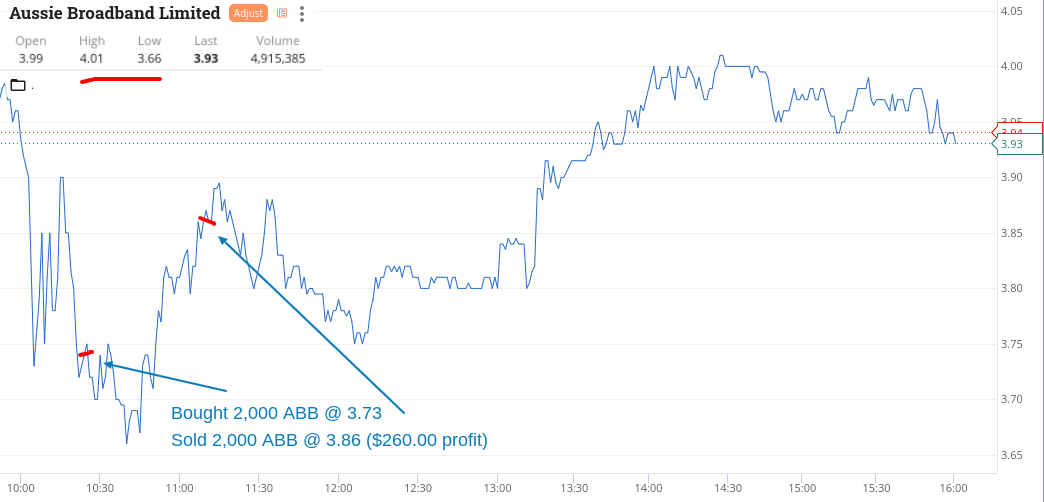

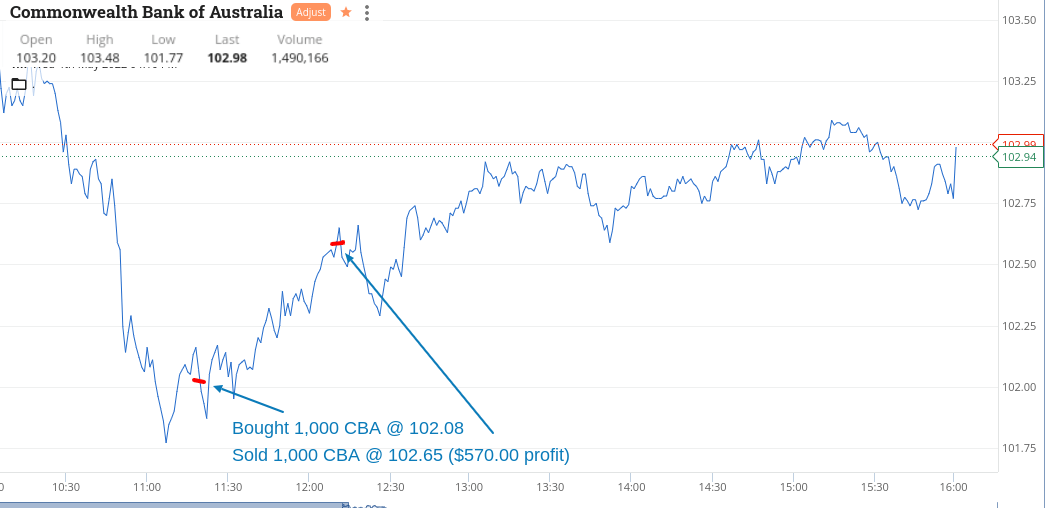

ABB and CBA came in with a couple of early morning specials and decided to book in an afternoon massage, having made some good coin.

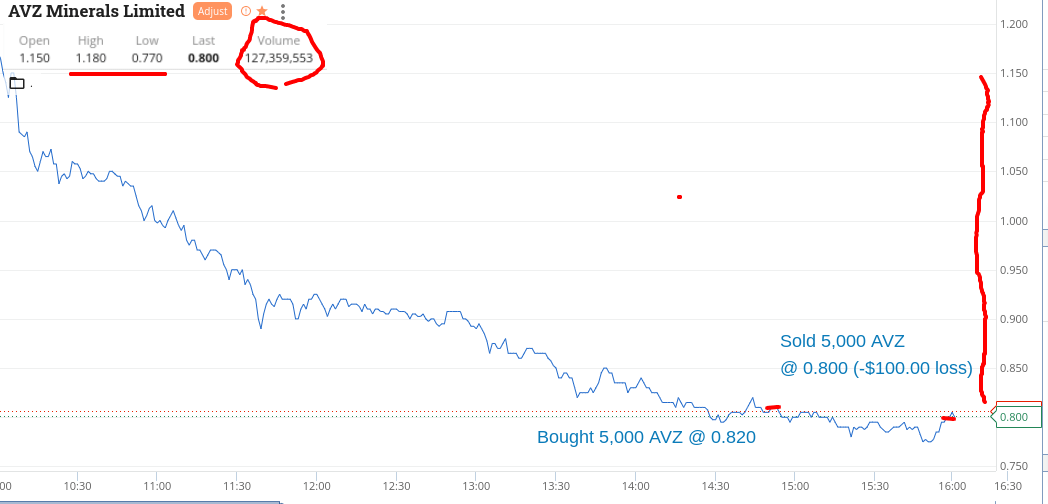

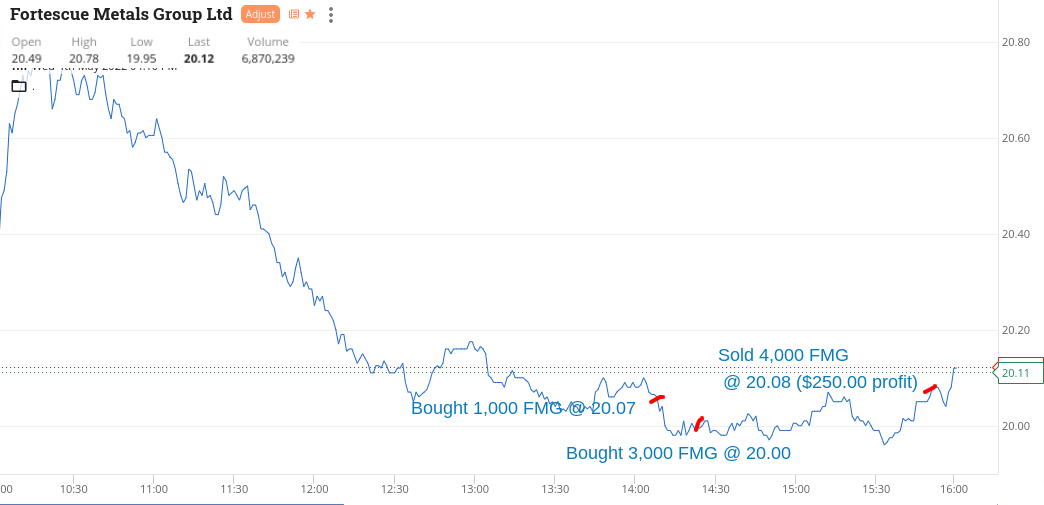

So closed up the coffee shop and headed across the road and whilst waiting, I had a look around. Had a go at some FMG and the day’s biggest faller on my list, AVZ. Turns out that AVZ was a loss-maker for me as had to cut just before the close.

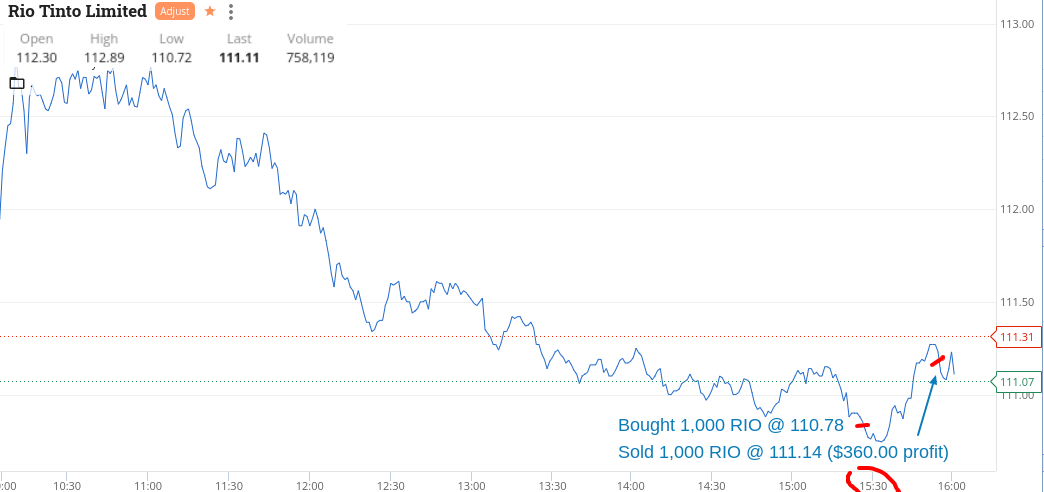

Came out of massage and doubled down on FMG by a figure of three and went for 1000 RIO for the 3.30pm bounce (not all the time but sometimes).

RIOs did me proud and even FMG managed to do the right thing. Closed all three out with 2 mins to go.

Nice and relaxed and up $1,340 and before you ask, yes, that was my happy ending and nothing else!

Recap

Bought 2,000 ABB @ 3.73

Sold 2,000 ABB @ 3.86 ($260 profit)

Bought 1,000 CBA @ 102.08

Sold 1,000 CBA @ 102.65 ($570 profit)

Bought 1,000 FMG @ 20.07

Bought 5,000 AVZ @ 0.820

Bought 3,000 FMG @ 20.00

Bought 1,000 RIO @ 110.78

Sold 4,000 FMG @ 20.08 ($250 profit)

Sold 1,000 RIO @ 111.14 ($360 profit)

Sold 5,000 AVZ @ 0.800 (-$100 loss)

Thursday May 7

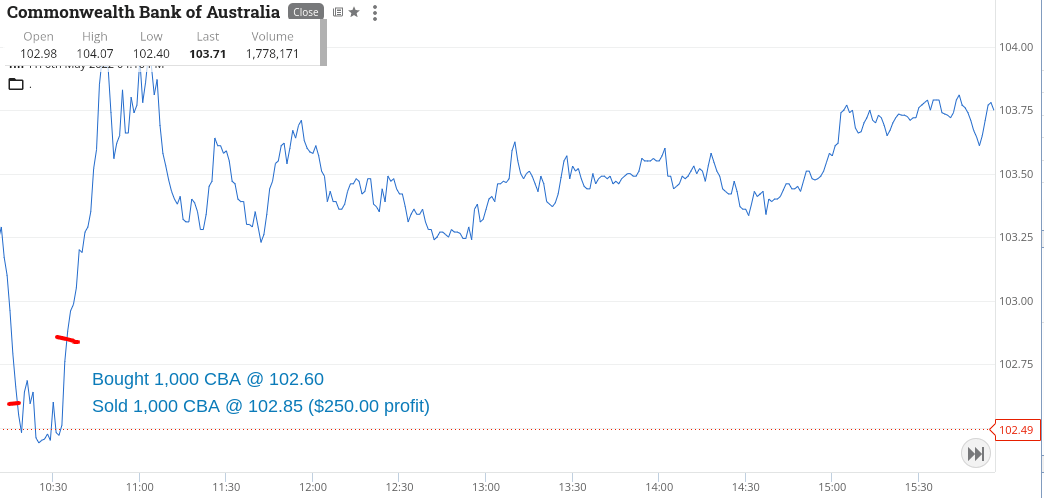

CBA had an early meltdown, which I captured on my phone and also had a go!

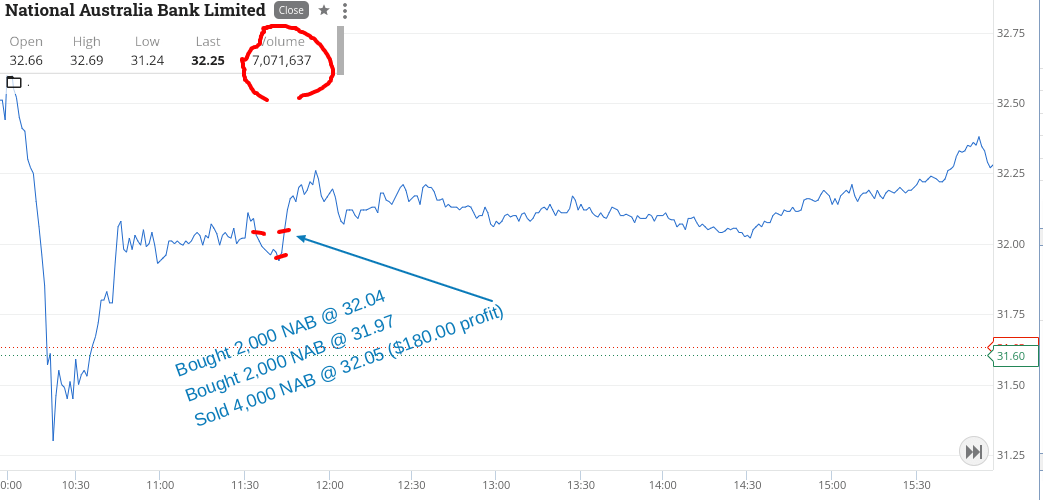

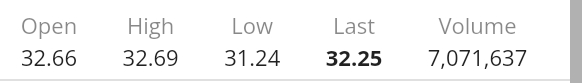

NAB still have the buyback on so around that $32 level had a double size go, which punished me a bit as I had gone double. Had to double down and really only made money on the last 2000.

Don’t trust this rally though. Up $430, so happy with that.

Recap

Bought 1,000 CBA @ 102.60

Sold 1,000 CBA @ 102.85 ($250 profit)

Bought 2,000 NAB @ 32.04

Bought 2,000 NAB @ 31.97

Sold 4,000 NAB @ 32.05 ($180 profit)

Friday May 8

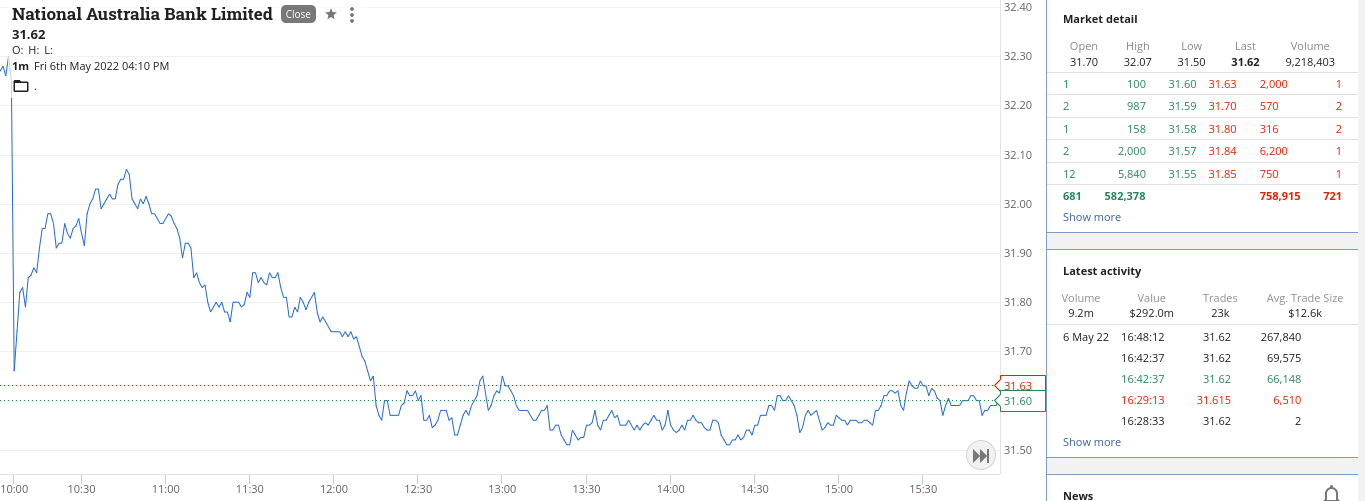

OMG overnight falls all round. Everything is so volatile, so today I do nothing.

In times like this I find it best just to step back and try not to be a hero.

If you get your timing wrong and you are staring at two hours trading left heading into a weekend – where Wall St can do anything – the risk-rewards don’t appeal.

Added some charts for the record.

Plus $3,130 gross and $2,720 net for the week.

Hoping that things will settle down a bit next week. Hope you all stayed safe and didn’t get yourselves into too much of a trading pickle.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.