Confessions of a Day Trader: Market down – the day we both got it wrong!

Picture: Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday September 5

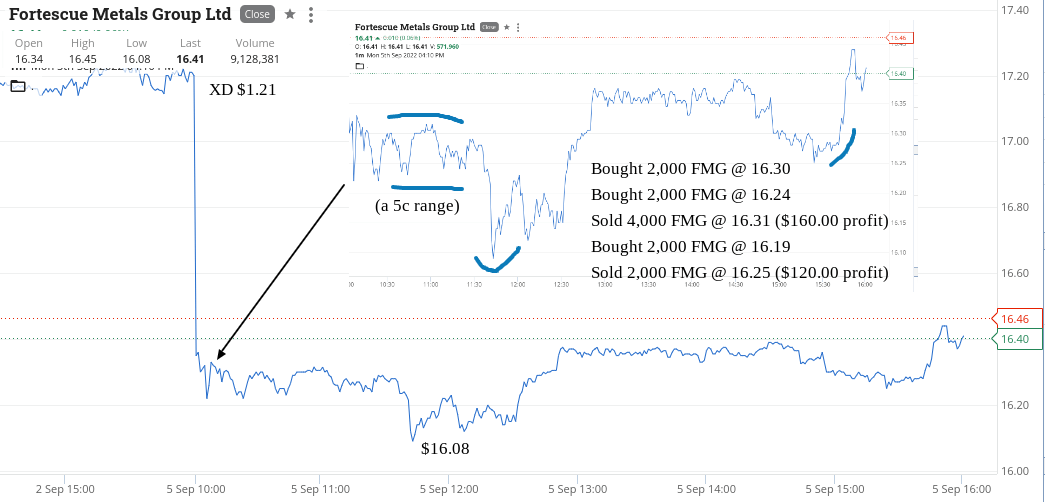

Another ex day for me and this time it is FMG’s turn. Their dividend is $1.21 and it’s 100% fully franked at 30%. So times $1.21 by 1.30 and grossed up it comes in at $1.573.

They closed on Friday at $17.20 and opened at $16.34, which is a difference of 86c but you have to remember that even at $1.21, their yield is 7% on $17.20 and that’s without taking into account their franking credits, which of course can’t be claimed by non-Australian holders.

Manage to squeeze $280 out of them today, which is like the dividend on 231 shares with no holding costs, just brokerage. Had two goes in them and could have gone once more but that was with 30 mins to go and I was still long of 2000 CBA.

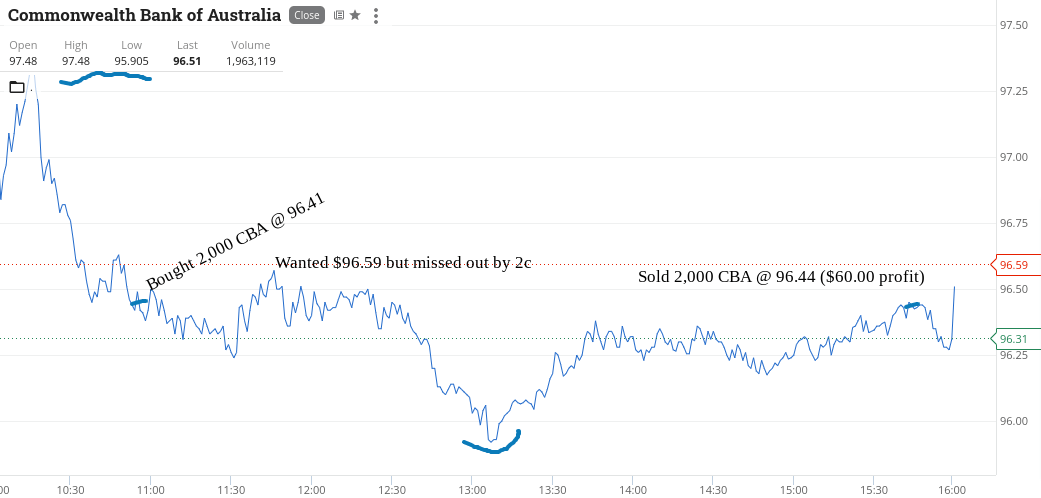

CBA gave me a bit of heartburn having gone a bit too long at the wrong price of $96.41, which was already down from its opening price of $97.48, so that’s over $1.00 lower.

I missed out selling them at $96.57 by 2c on a limit. My bad!

And then to my horror, they actually fall another 50c or so before recovering.

I did have an alert set for $95.85, but they never reached it.

They closed at $96.51, but I managed a small profit at $96.44 and with that and a small profit in ZIP, I basically broke even after brokerage on the two.

GMA had a big fall and they have a buy back on so managed a 4c turn on 5000 shares and ZIP was well, just being ZIP.

A $590 profit for the day, which could have been more if I had started in CBA at 1/2 the size order. Serves me right for being too greedy.

PS. Have added a chart on BHP’s XD behaviour over the last few days, for your reference.

Recap

Bought 2,000 FMG @ 16.30

Bought 2,000 FMG @ 16.24

Sold 4,000 FMG @ 16.31 ($160 profit)

Bought 2,000 CBA @ 96.41

Bought 2,000 FMG @ 16.19

Sold 2,000 FMG @ 16.25 ($120 profit)

Bought 5,000 GMA @ 2.61

Sold 5,000 GMA @ 2.65 ($200 profit)

Bought 10,000 ZIP @ 0.835

Sold 10,000 ZIP @ 0.840 ($50 profit)

Sold 2,000 CBA @ 96.44 ($60 profit)

Tuesday September 6

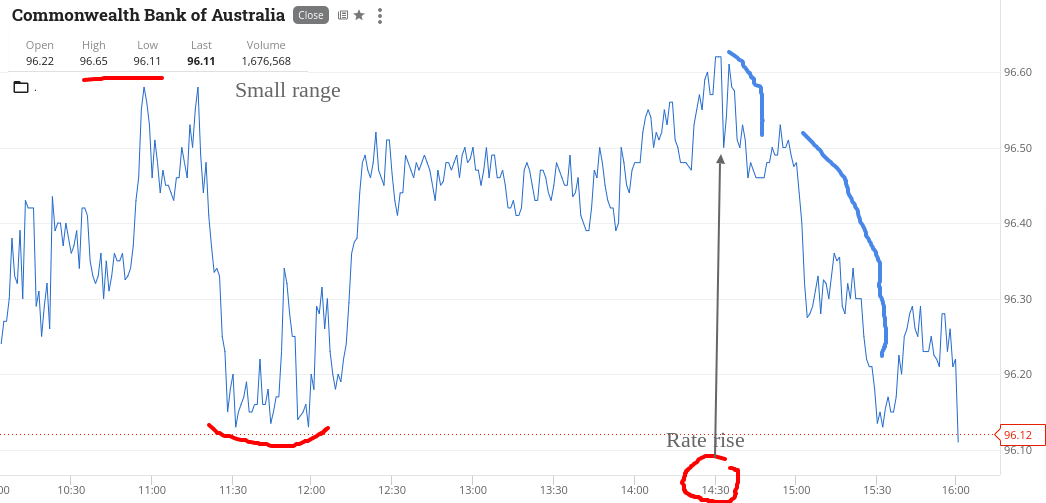

Today is RBA interest day and at 2.30pm we will get what is expected, which is a 0.5% increase in the base rate.

So not going to do anything before then, or so I thought.

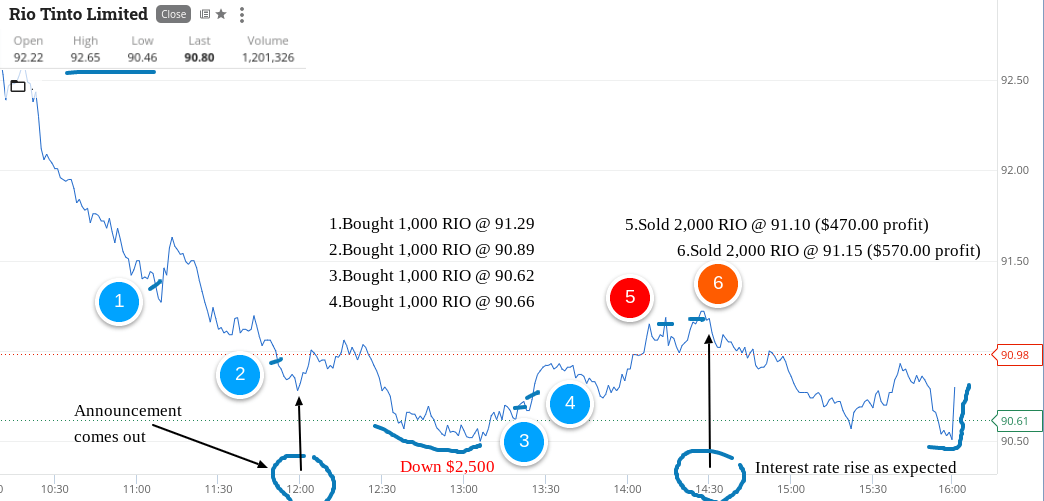

RIOs opened the day at $92.22 and started to get sold down, when everything is holding steady. Just after 11.00am, I pick up 1000 at $91.29 and happy to see a fall in a non-bank stock.

Well, you would have thought that the world had started to cave in because I soon get hit in a limit order below $91.00 and watch them keep falling.

Don’t understand what is happening and watch them go down to $90.46 before bouncing. By this time they had announced a takeover had been agreed on.

I had skimmed the headline just after it had come out and now I start to delve a little deeper. I am thinking there must be a hedge fund play shorting one stock and going long of the takeover stock.

When I read that it’s an all cash offer, I realise that that is not the case.

Even a simple person like me can work out that a cash generating machine like RIO offering cash and not scrip is a good thing, as no dilution.

By now I am down $2,500 on paper and thinking maybe, just maybe the market has got this wrong. It’s an interest rate day and RIOs are acting like a bank.

They quickly start to bounce off their low and I think I’m right and the market is starting to also realise it’s wrong as well.

I act aggressively and double down in 1000 and then f..k it, another 1000. At $90.66 they are down $2.00 from their day’s high and it’s not even 2.30pm yet, so no rate shock and I’m down big on a non-banker.

And then they bounce and head to $91.00 which they break and flirt with, break again to $91.12, then back down to $91.04. Put 1/2 on a limit sell at $91.10 and it takes a while but eventually they get there.

They fall back and I hold my nerve and put the balance of 2000 on at $91.15 and out they go, and off RIOs go on a rally.

What a turnaround. When 2.30pm does hit, I’m watching CBA, ready for a 50c knee jerk reaction fall but it doesn’t happen. Can’t buy the dip as there ain’t no dip.

RIOs collapse again towards the end of the day and I’m tempted but I hold off. Gut says go for another punt but the head says no!

They end the day at $90.80 and there was a 20c profit in them but don’t really care.

CBA end the day with a range of 54c, so they are obviously becoming immune to interest rate day rises and RIOs end the day with a $2.19 day range.

So, end the day turning around a $2,500 loss to a profit of $1,040 and on a what I thought was a safer punt than the banks on a day like this. Just goes to show that sometimes we can get it both wrong.

Me and the markets!

Recap

Bought 1,000 RIO @ 91.29

Bought 1,000 RIO @ 90.89

Bought 1,000 RIO @ 90.62

Bought 1,000 RIO @ 90.66

Sold 2,000 RIO @ 91.10 ($470 profit)

Sold 2,000 RIO @ 91.15 ($570 profit)

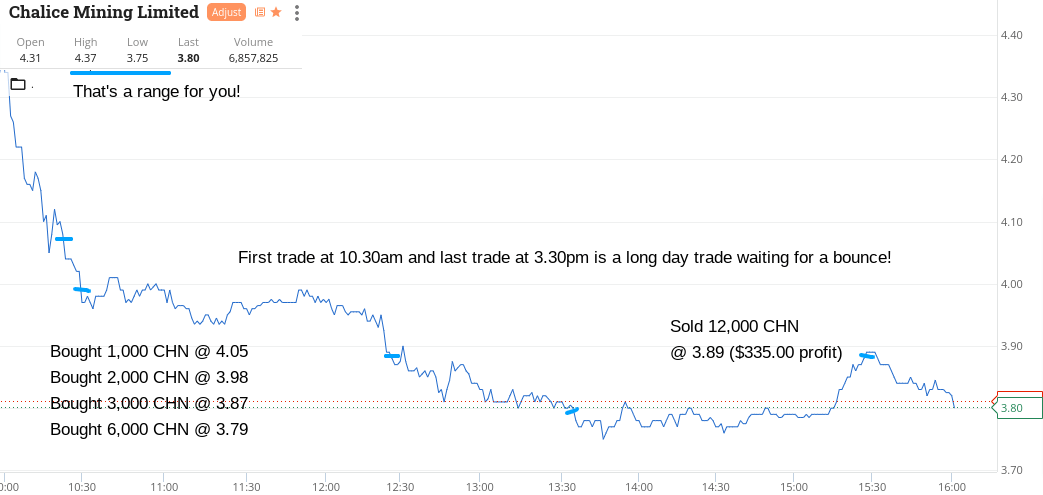

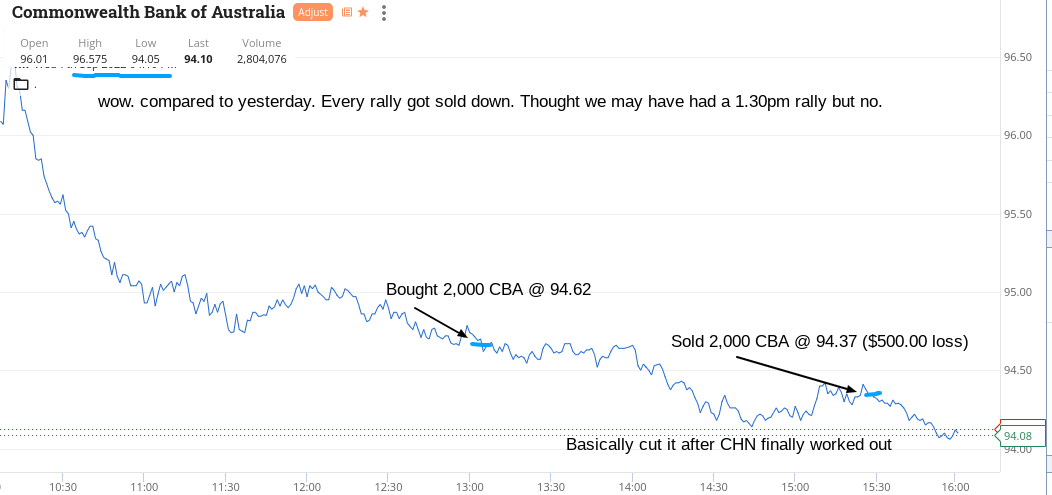

Wednesday September 7

Today wasn’t my finest hour(s) of trading. Got caught in CHN going for a quick trade, which only came right with 1/2 an hour to go.

In between waiting for them to rally, I thought it was time to have a go in yesterday’s boring stock CBA. That didn’t work out very well and basically cut them after closing out CHN.

Watching CBA was like hovering over the ‘chair turn button’ on the voice. Would hover over the buy button and they would rally and then fall further down after I looked away.

When I finally did hit the button it was at the complete wrong time. Just cut them and will come back again tomorrow for another go.

Finish down $165 before brokerage. Not happy Jan.

Recap

Bought 1,000 CHN @ 4.05

Bought 2,000 CHN @ 3.98

Bought 3,000 CHN @ 3.87

Bought 2,000 CBA @ 94.62

Bought 6,000 CHN @ 3.79

Sold 12,000 CHN @ 3.89 ($335 profit)

Sold 2,000 CBA @ 94.37 ($500 loss)

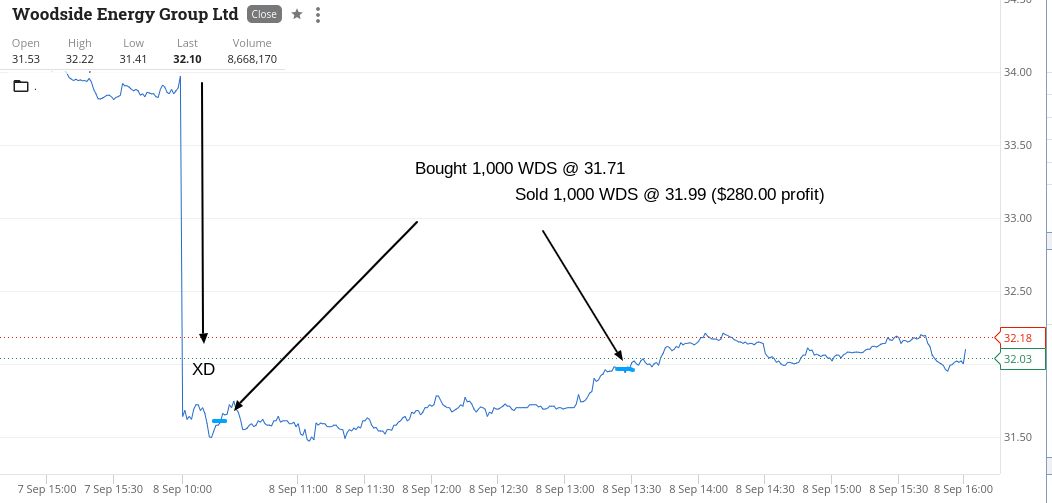

Thursday September 8

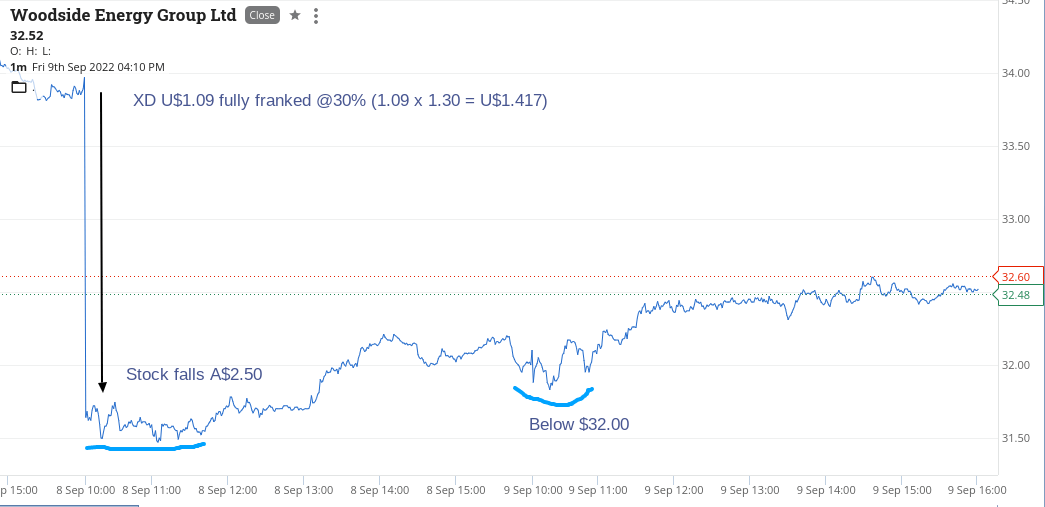

Only have eyes for one stock today and it’s yet another XD situation. Woodside go ex their dividend and fall about 7% on the opening but missed them down there as they soon rallied.

Bought 1000 at $31.71 and then had to watch and wait for ages, before they started to head up. Finally got out of them at 1c below $32.00.

It was the only stock on my watch list that was down and I regret not buying 3000 of them, but them’s are the breaks.

Plus $280.

Recap

Bought 1,000 WDS @ 31.71

Sold 1,000 WDS @ 31.99 ($280 profit)

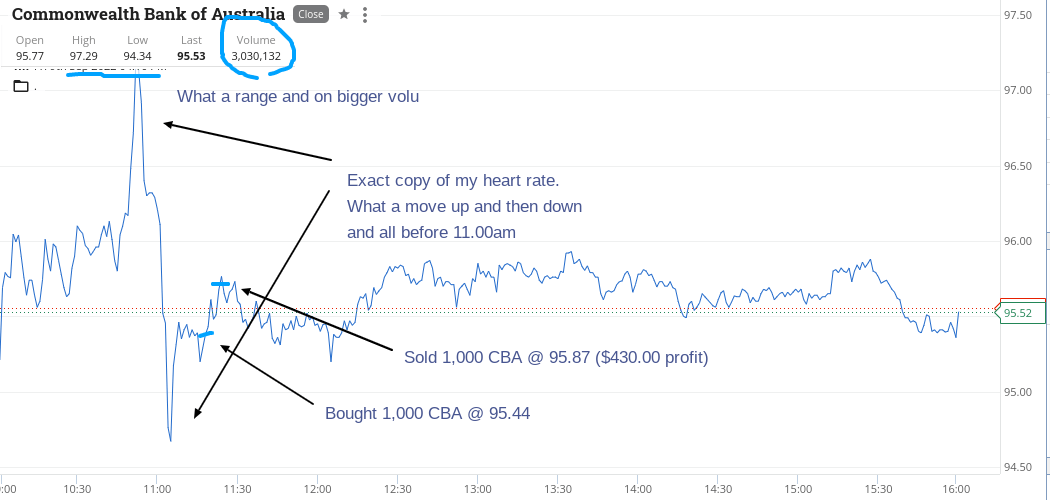

Friday September 9

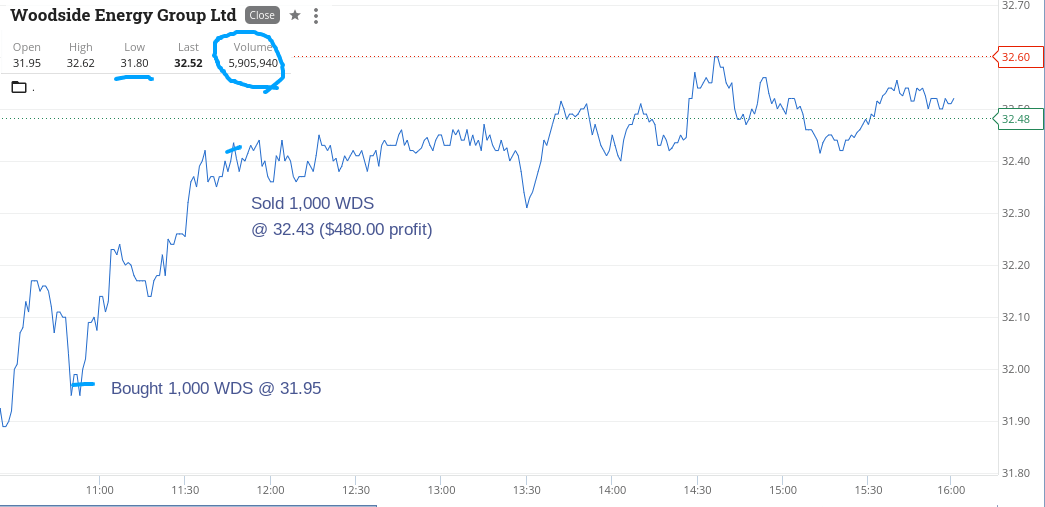

Come in and find that WDS open up below $32.00, bounce up 25c and then fall back below $32.00. Can’t believe my luck in being able to buy some below $32.00.

Then CBA go on a really wild ride before 11.00am and in what looked like a move into buying a lithium mine, they shoot up from $95.60 to $97.29 at 10.54am and then hit $94.34 at 11.05am and three mins later they are $95.50.

Never ever seen anything like it and if you look at the chart, you will see a direct copy of my heart rate.

Just shows that even a stock like CBA can go on a wild ride.

One of Australia’s biggest companies and it can do this:

Amazing.

Still kicking myself (again) for not buying more WDS!

Finish up $910 today and $2,633 gross for the week or $2,210 net as went a bit bigger than usual in RIOs and CBA but now waiting for any more dividend stocks to become my new ex next week.

Recap

Bought 1,000 WDS @ 31.95

Bought 1,000 CBA @ 95.44

Sold 1,000 CBA @ 95.87 ($430 profit)

Sold 1,000 WDS @ 32.43 ($480 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.