Confessions of a Day Trader: Life’s a beach when you bet on the bank

Pic: metamorworks / iStock / Getty Images Plus via Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 for trades <$25,000 (previously $40 on alternative platform). Commission 0.02% for trades >$25,000.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday Movember 15

Here we go. Don’t know what we are in for, so just watching and waiting.

So start out buying 1000 NAB at $29.19, as they have gone xd 67c. Wished had made it 10,000!

Then get stuck into RIOs and start sinking. Buy 1000 at $92.56, 1000 at $91.94 and finally 1000 at $91.61.

RIOs have a low of $91.52 and a high of $93.23 and I get stuck in on the way down and hold them till the death and end up selling the 3000 at $91.84 (-$590).

However, NAB did okay and sold them at $29.40 (+$420) so ended up down $150 for the start of the week and not too bad a result after RIO gave me a bit of a heart attack.

Got a bit oversold but I went too early and should have piled more into the NABs, so got them round the wrong way!

Tuesday November 16

Discovered a new feature on Marketech today, which allows me to easily create a spreadsheet of the day’s trades and then display them in my journal and mark up the charts.

- Bought 1,000 RIO @ 90.38

- Bought 2,500 Z1P @ 5.81

- Bought 1,000 APT @ 115.00

- Sold 2,500 Z1P @ 5.84 ($75.00 profit)

- Sold 1,000 RIO @ 90.73 ($350.00 profit)

- Sold 1,000 APT @ 115.26 ($260.00 profit)

So today was a kinda cruisy day with the three purchases coming out OK in the end.

RIO was a good one as came off yesterday’s trading area of around the $92.50 level and never thought they would crack the $90.00 level, but they hit the $89s. Ear-marked them for tomorrow.

Clawed back $350 from RIO on yesterday. $240 left to go.

APT came in on a limit buy at $115.00 and I only sold them as they were struggling to hold the $115.30 level.

Couldn’t believe how they closed and the $2.65 trading range! OMG.

Z1P trading was boring so locked in a small profit and compared to APT’s chart, they became even more boring.

End the day up $685 but feel like I will give some back tomorrow. Wish all days were like this.

Wednesday November 17

Came in thinking the headlines on CBA latest profits not too bad and fell off my chair at the opening price. Not too long ago they were above $110.00 and today when there seemed to be a bit of a panic, bought 1500 at $99.60 and sold them at $99.96 and all very quickly.

When I saw them lower later in the day, just had to have another go at $99.21 but that turned out to be a bit fatal. They closed at $98.99, which is where I cut them.

As promised to myself, had a go at 1000 RIOs at below $90 and got them on a limit of $89.50. You beauty, or so I thought. Had to double down at $88.77 but they still kept falling. When they staged a kind of rally, I decided to buy 2500 FMG as they were lagging behind.

Made a small profit on them but lost again on the RIOs today and cut them with 2 mins left. Overall up $17.50 which will cover a burger and pint night special at the local! All that work and sweat.

Bloody RIOs. I will get you back!

- Bought 1,500 CBA @ 99.60

- Bought 1,000 RIO @ 89.50

- Sold 1,500 CBA @ 99.96 ($540.00 profit)

- Bought 1,500 CBA @ 99.21

- Bought 1,000 RIO @ 88.77

- Bought 2,500 FMG @ 15.53

- Sold 2,500 FMG @ 15.585 ($137.50 profit)

- Sold 2,000 RIO @ 88.97 (-$330.00 loss)

- Sold 1,500 CBA @ 98.99 (-$330.00 loss)

Thursday November 18

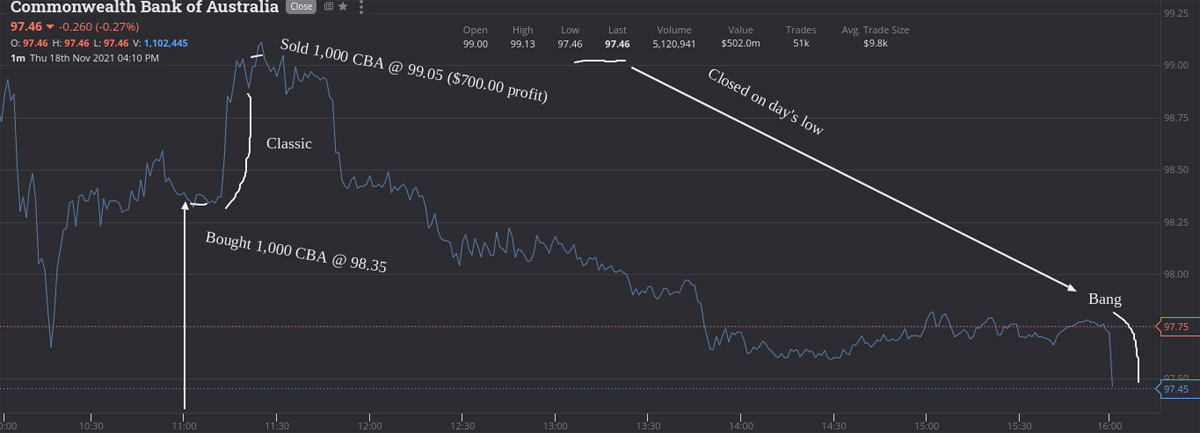

Had a think about yesterday and the savage markdown in CBA and plan for a 11.00am raid. I actually get there at 11.02am as I got caught on a phone call.

Bought three stocks one after the other – bang, bang, bang – but it wasn’t until 11.15am before they all started to run.

CBA is a classic margin call set up and the way they behaved makes my trading day/week/month/year plus I get a nice quick profit.

Sell out of the other two but leave more than a bit on the table in APT. I leave the whole frigging table but not to worry, as a profit is a profit. MIN just got bored with and didn’t want to keep watching the screens The beach beckons.

So, today’s takeaway is that you can margin up any blue chip stock against other ASX listed companies to cover off option trading and margin calls, which have to be covered off the next day. If you can’t meet the margin, you get sold out and 11.00am is the cut off time.

I know all of this because I have been caught out before when I was younger and witnessed myself being sold out and then the stock jumping.

Up $990 and at the beach by 11.30am. A brilliant trading day, unlike yesterday.

- Bought 1,000 CBA @ 98.35

- Bought 1,000 MIN @ 39.33

- Bought 1,000 APT @ 117.80

- Sold 1,000 CBA @ 99.05 ($700.00 profit)

- Sold 1,000 APT @ 118.02 ($220.00 profit)

- Sold 1,000 MIN @ 39.40 ($70.00 profit)

Friday November 19

Bided my time a bit today. Watched CBA do the 11.00am thing but I sort of didn’t think it would happen two days in a row. But it did. Had to put on three trades in them before they came right.

Why they fall so much and then bounce is a mystery to me. They fell 75c at one point before recovering and I got caught a bit timing wise in that fall.

Before all of that I thought NAB could be a safe trade as they are buying back their shares. Also get the timing a bit wrong and had to hold them to the 4.10pm session.

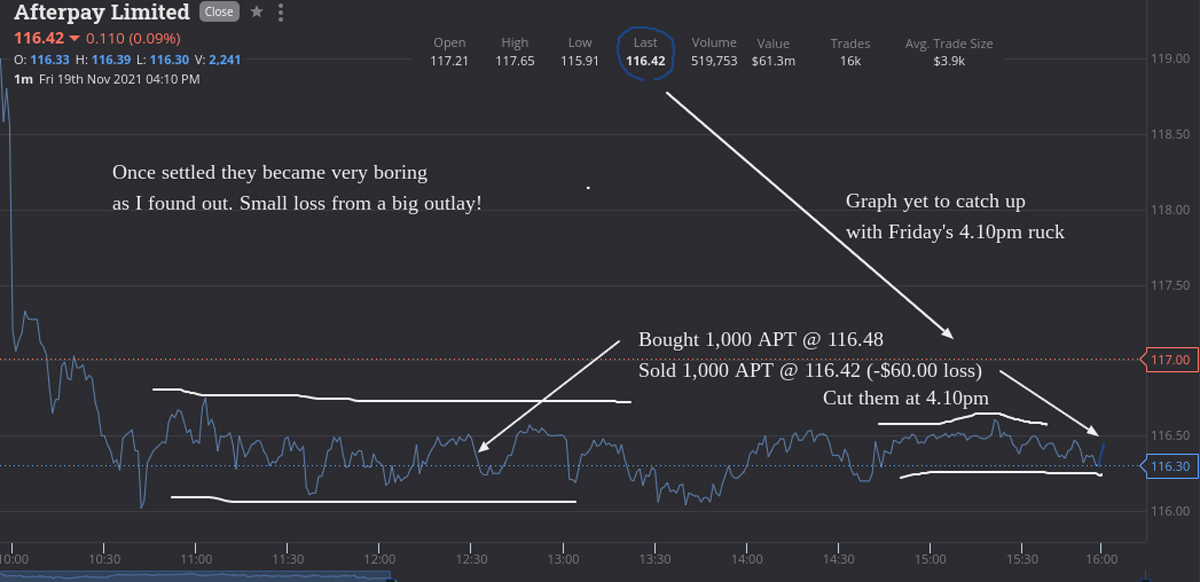

APT became very boring and having opened above $117 it was watching paint dry, after I got set. Ah well.

Finish the week OK, with a total of plus $2022.50 gross or $1460.50 net after brokerage and that includes two not so great days. Still can’t believe that CBA starts with a $97 in its price.

- Bought 1,000 APT @ 116.48

- Bought 2,000 NAB @ 28.65

- Bought 3,000 NAB @ 28.46

- Bought 1,000 CBA @ 98.02

- Bought 1,000 CBA @ 97.74

- Bought 1,000 CBA @ 97.54

- Sold 3,000 CBA @ 97.89 ($370.00 profit)

- Sold 5,000 NAB @ 28.57 ($170.00 profit)

- Sold 1,000 APT @ 116.42 (-$60.00 loss)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.