Confessions of a Day Trader: Kogan lucky! Saved on the bell!

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday July 26

Wall Street closing at all time highs but COVID lockdown frustration is everywhere.

Watch everything for the first 55 mins before pressing the buy button on 2000 CBA at $98.98, having seen them at $99.60 at 10.05am.

BHP have also come back from being above $52.00, so buy 1500 at $51.88.

Time is 11.06am. CBA take off at 11.08am and hit $99.17, where I quickly sell them and thank the 11.00am trading god. Plus $380.

At 11.49am, BHP move back through the $52.00 level and I manage to sell the 1500 at $52.04. Plus $240.

Later on CBA fall below $99.00 again and at 12.24pm, I’m back in for 2000 at $98.98. Then at 12.52pm for another 2000 at $98.89.

Z1P are in the doldrums and below $7.00 and having watched them, decide to buy 5000 at $6.88 for a bounce back above $7.00. Sell the CBA at $99.10, having watched them swing up and down through $99.00 and then back down, but I stuck to my limit. Plus $660.

Z1P not behaving that well so buy 10,000 this time at $6.80. Now long of 15,000 at an average of $6.8267 but have to cut them at $6.80 before the close, having seen them at $6.78. Minus $400. Ouch.

All up plus $880 and not sure about Z1P. They feel like they have contracted COVID.

Tuesday July 27

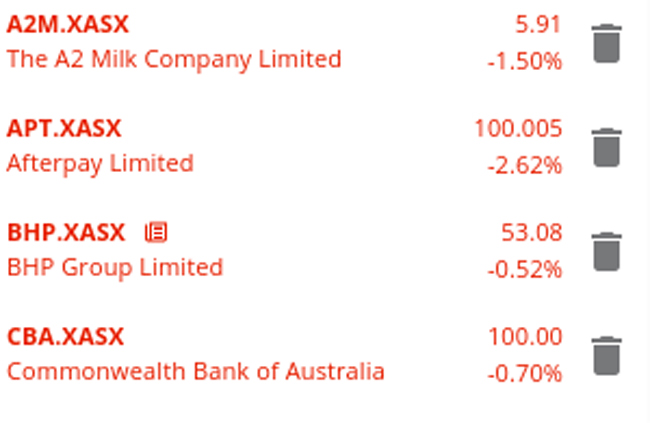

Not around till later in the day and I note that APT are edging down towards CBA’s share price. Only a difference of $1.99 gap now, with APT at 102.70 and CBA at 99.71.

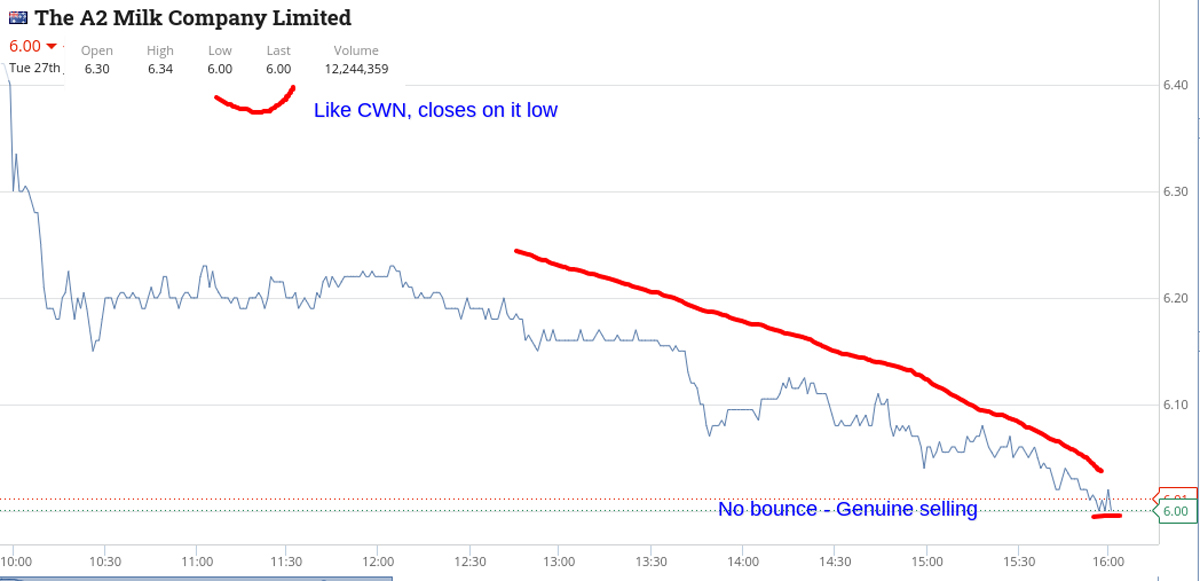

There were a couple of big fallers and worryingly for them they closed at their lows, with no short covering rallies. I’m talking about A2 Milk (A2M) and Crown Resort (CWN).

I have added snapshots of their charts and added them to my watch list for maybe tomorrow’s action.

BHP reached an all-time high intraday at $53.65 and Z1P remained with COVID, closing at 6.74, which was 5c off their low. They had a high of $6.94, so never reached $7.00. Will be back tomorrow to have a go.

Wednesday July 28

Wall Street off a bit overnight and BHP were down 1.7%, which gives me a benchmark fall to work with. COVID lockdown for another month.

Maybe today will see APT and CBA crossover and if not today, maybe tomorrow.

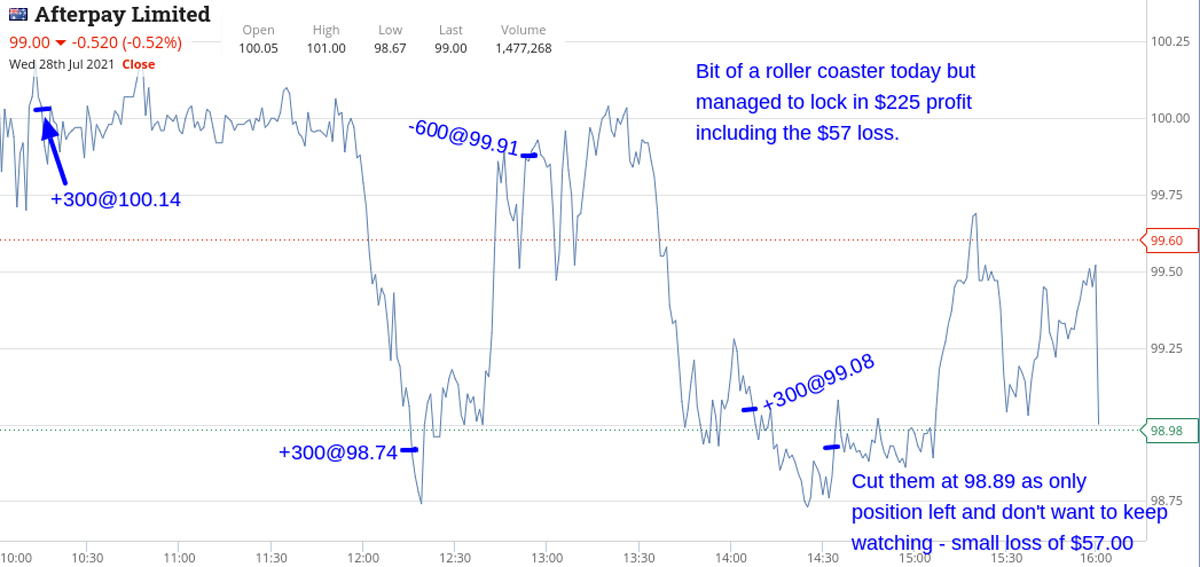

No, it’s today – they cross over at 10.40am. Was long of 300 at $100.14 (15mins in) and had to double down at $98.74, after the market got the inflation wobbles. Sold them at $99.91.

That’s how much they moved around today.

Same for Z1P. Bt 2000 at $6.64 (10.28am), doubled down at $6.55 and sold the 4000 at $6.685 after they recovered.

In the morning session, I had a go at KGN, bt 2000 at $10.66 and sold them at $10.70. Bt 1000 CHN at $6.75 and sold them $6.80 plus in for 2000 A2M at $5.85 and out at $5.89. All in the morning.

In the afternoon, bt 2000 CBA at $99.28 and sold them on a limit of $99.40. Also tried again in APT but had to cut them for a $57 loss, as needed to take a nap.

Woke at bang on 3.59pm, which I thought was ironic as now I can’t even sleep through a closing market!

Anyway, up $1,035 gross, thanks mainly to CBA, Z1P and APT after they all had sharp markdowns, before bouncing.

Thursday July 29

Early indicators are calling the market up, with the futures up 28 points at 5.55am. Let’s see.

BHP open above $54.00 and then settle in at around the $53.50 level, with brief falls to the $53.15 level.

CBA have a small range but very very quick movements. I bt 2000 at $99.11 and sold them 1 min later at $99.21 in amazement. Time was 11.52am and 11.53am.

I did pick up 2000 BHP on one of their dips at $53.15 and take a 7c turn on them.

Later I had a go at KGN at $10.43 and at $10.40 but cut them for a small profit as they were too boring to keep watching.

Plus $360 gross on the day and go to sleep wondering what Wall Street will do. All this COVID news is doing my head in.

TGIF July 30

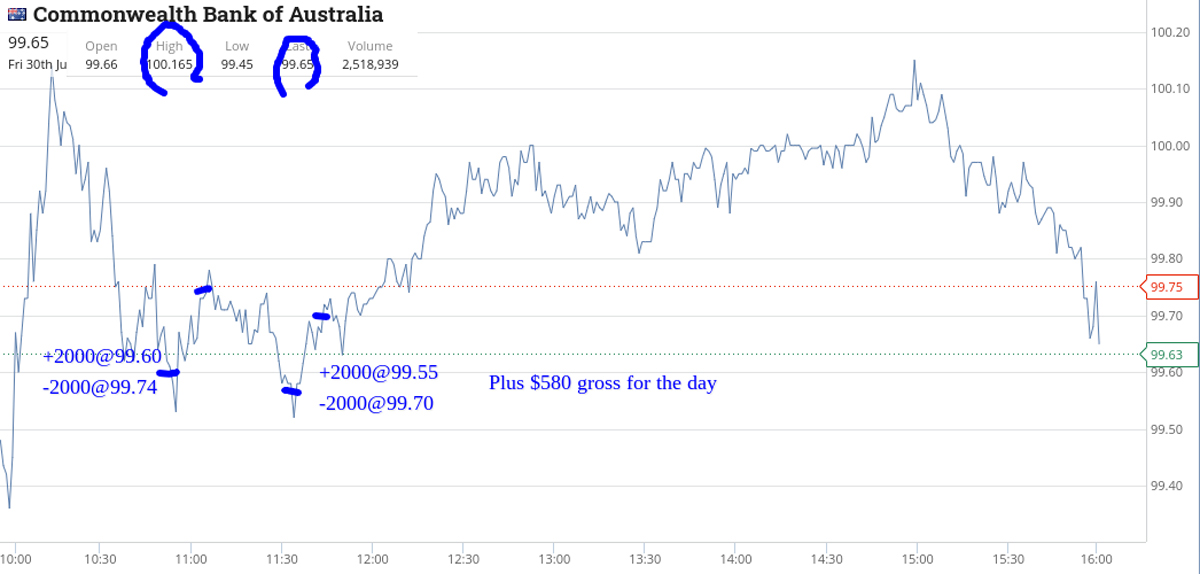

CBA open strong and then drift down just before 11.00am. So buy 2000 at $99.60 at 10.58am. Out 6mins later at $99.74.

Then they do it again and I manage to buy another 2000 at $99.55, which is unexpected. Put them on a limit at $99.70 and switch over to look at KGN.

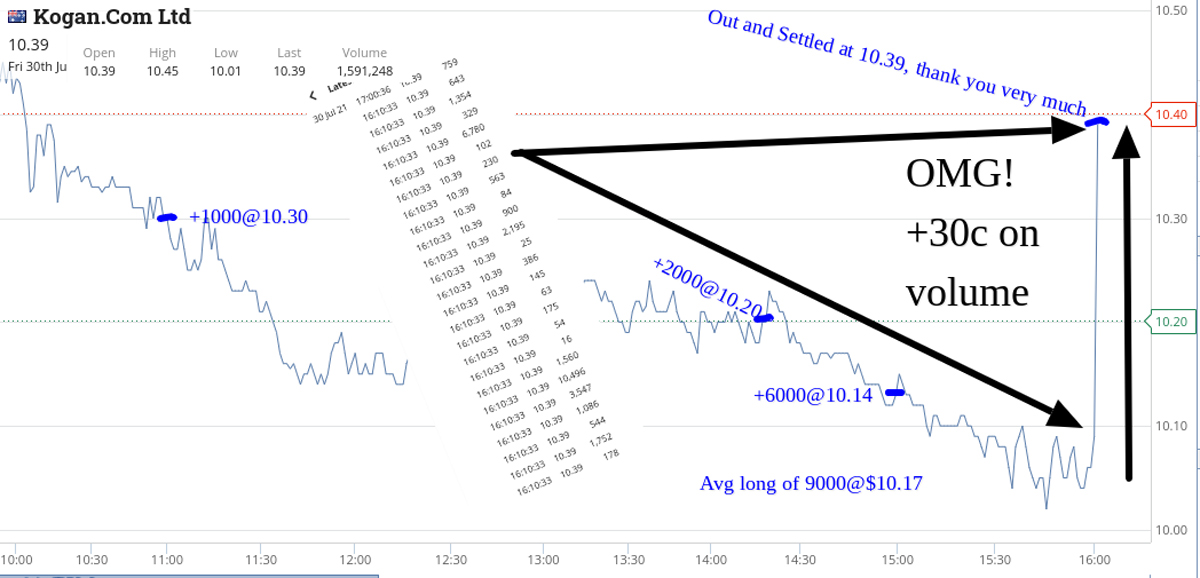

I had bt 1000 earlier at $10.30 for a bounce which didn’t come. Buy 2000 at $10.20 and then out of real frustration I buy 6000 at $10.14, which gets my average in cost down to $10.17.

They were $10.70 on Wednesday FFS and now I watch them fall even more.

Decide to cut them all in the 4.10pm session. Down 8c at 4.00pm, so not looking very pretty.

Then something magical happens.

In the 4.10pm ruckus, they close at $10.39 (see graph, it’s amazing). I’m +$1,940 net of brokerage and sitting here gob smacked.

Leaves me up $3,903 for the week or $3,126 after brokerage. Thank you Ruslan Kogan!

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.