Confessions of a Day Trader: Keep your eyes on the ball

'Cheer up, no doubt the lads'll get us home in the cricket tonight.' Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday October 16

Start the day in BHP and then end it in CBA and NCM.

BHP was a quickish one as it was lagging behind RIO’s rally and then Woodside fell below $36, so just had to have a go. Took a bit of time but they eventually rallied back towards $36.00.

I thought that was it for the day until RIOs had a spectacular spike downwards. Thought I had found the bottom but had to go again to get my average down.

Cut my FMG trade with a small profit as I wanted to get back into BHP and didn’t want to be exposed to RIO, BHP and FMG all at the same time.

After all of this CBA were back down to $100.50, which was kind of their support level. In fact managed to get in there twice at that level, with the second on a limit order.

Out they went in the 4.10pm session, as did NMC.

Today was good but volumes are still low and the banks were stronger than I liked to begin with.

Plus $1,320.

Recap

Bought 2,000 BHP @ 45.15

Sold 2,000 BHP @ 45.24 ($180 profit)

Bought 2,000 WDS @ 35.93

Sold 2,000 WDS @ 35.99 ($120 profit)

Bought 1,000 RIO @ 114.80

Bought 2,000 FMG @ 21.33

Bought 1,000 RIO @ 114.65

Sold 2,000 FMG @ 21.36 ($60 profit)

Bought 2,000 BHP @ 45.09

Bought 2,000 CBA @ 100.50

Sold 2,000 RIO @ 114.84 ($240 profit)

Sold 2,000 CBA @ 100.65 ($300 profit)

Sold 2,000 BHP @ 45.15 ($130 profit)

Bought 2,000 CBA @ 100.50

Bought 2,000 NCM @ 26.89

Sold 2,000 CBA @ 100.67 ($340 profit)

Sold 2,000 NCM @ 26.86 ($50 loss)

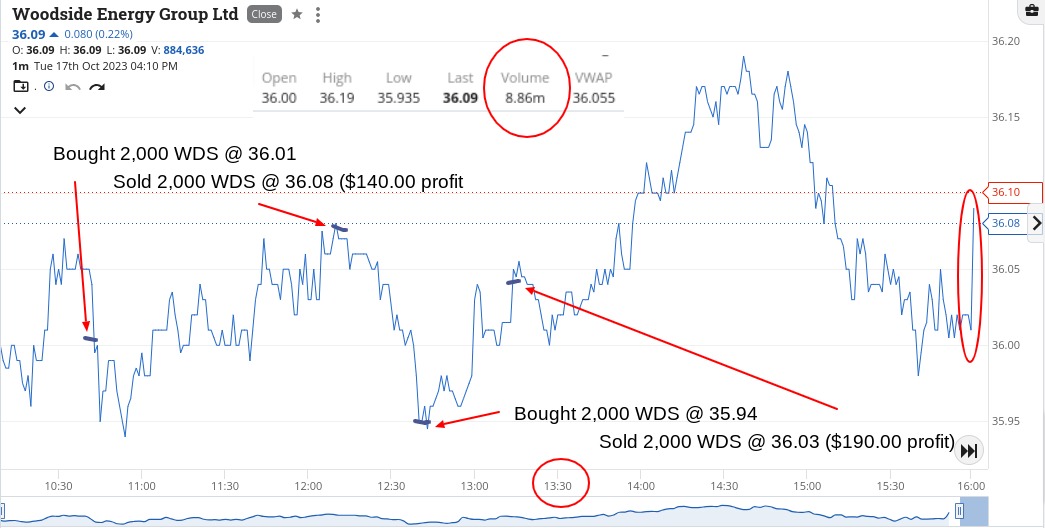

Tuesday October 17

Yet another stronger day on the opening and the only stock on my watch list in the red was WDS.

At or around their $36.00 level they kept going higher or lower by a couple of pips, like someone slipping in and out of consciousness, and they gave me two goes before they took off at 1.30pm.

RIOs were the top mover on my watchlist and having seen them yesterday round $114.65 level, today they touched $119.50 just after the opening.

Then for some reason they got sold down and traded in the late $116s and I caught them on the way down and basically $2.50 off their day’s high.

Couldn’t believe how they were performing and I reckoned that they could get back up to $118, which they did but I was out as they started to rally towards it.

I had contemplated going in a bit heavier but decided to hang on for a higher level. Still can’t figure out why they move like they do – no announcements out but they moved over $2.70 in one day and again not on great volume.

To give you another clue to the day, CBA only moved 69c over the day on a volume of just over 1m.

Up $1,430 and still nervous.

In two days time it is the anniversary of the ‘87 crash and I still get flashbacks and I’m all ready to go all in if we get any big falls.

Recap

Bought 2,000 WDS @ 36.01

Sold 2,000 WDS @ 36.08 ($140 profit)

Bought 2,000 WDS @ 35.94

Bought 1,000 RIO @ 117.37

Sold 2,000 WDS @ 36.03 ($190 profit)

Bought 1,000 RIO @ 116.99

Sold 2,000 RIO @ 117.73 ($1,100 profit)

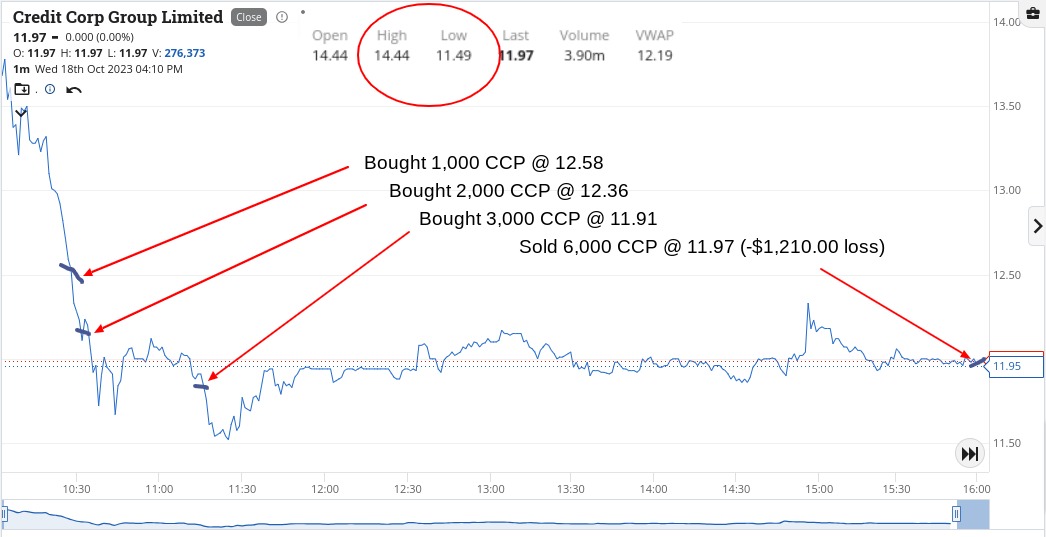

Wednesday October 18

Occasionally I can get caught with my pants down in the market and today was one of those days.

It always seems to happen when you don’t have to much capital exposure plus when you’re getting a bit complacent. Being up $2,750 in two days in a low volume, high volatility market maybe gets the thinking and discipline a bit relaxed.

Anyway, I thought CCP would be a goer, having been down 30% on a bad market update and working on the theory that all the bad news is out.

Turns out my P/L was the bad news,as I rode them right into the sunset and after all the dust had settled down, I managed to book a loss of $1,210 on them.

This loss managed to wipe out my gains, which on a normal day would be hard to do.

Down $350 today which is annoying but also means I need to sharpen up my act a bit. Have to go to a hospital appointment tomorrow with an eye specialist, so maybe a bit preoccupied.

Recap

Bought 2,000 NCM @ 25.15

Bought 1,000 CCP @ 12.58

Bought 2,000 CCP @ 12.36

Bought 3,000 CCP @ 11.91

Bought 2,000 RIO @ 117.22

Sold 2,000 RIO @ 117.58 ($720 profit)

Sold 2,000 NCM @ 25.22 ($140 profit)

Sold 6,000 CCP @ 11.97 (-$1,210 loss)

Thursday October 19

I have to take today off as I have to go and see my eye specialist and the appointment is a year in the making.

Ironically, it’s also the anniversary of the crash of ‘87 and that was a day that many would have liked to have actually lost their eyesight!

When I leave the hospital, my eyes are fully diluted and by the time I can fully focus on my phone, the market is over, so I will leave you with some charts.

RIO’s range was $2.30 on double yesterday’s volume and CBA’s range was $1.25 and also double yesterday’s volume.

Recap

A no hero zero!

Friday October 20

Tight ranges today mean that I had slim pickings to look at and just like last Friday, want to be long gone before 12.30pm otherwise may get caught long and wrong.

Volumes were a bit stronger today, especially in CBA and I had a couple of look at RIOs but they never really fell hard enough.

WDS was my only look in today and I went all in, as you can trade a bit of size easily in and out.

So one trade today and up $500 on it, so will take that.

After a somewhat strange week, ended up $2,900 gross or $2,128 and had it not been for CCP, I would have been another $1,200 on top.

Oh well.

Recap

Bought 5,000 WDS @ 36.57

Sold 5,000 WDS @ 36.67 ($500 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.