Confessions of a Day Trader: Just when I thought I was out… they pull me back in

Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday September 18

I had a break from making coffees today as I had some running around to do. When I finally got to have a break, I sat on a bench by the beach and opened up my watchlist.

Not much I can play with but AZS popped up as a big faller.

I know they are a bit of a fave for the punters, so at 15% down, in I go.

Put them out on a limit, which I adjust down as they start to rise and hover around the $2.45 level.

Out they go and I have the first trade under my belt for the week.

Two minutes later they are now back down below my buying level, so I get another go and this time put them on a limit at $2.44, seeing as $2.45 was their last kind of ceiling level.

Soon they were gone. Now with a bit of profit under the belt, have another look around and find FMG as a potential. RIOs and BHP are rallying and these are lagging behind.

Just buy a couple of thousand because at $21.14, they could easily crack the $20.99 level. I close my mind and imagine where they could go and put them on a limit there.

That worked and now I’m back on the road again, checking the market every so often but nothing really sticks out.

Finish the day up $640 and boy is it getting hot outside today. Expecting the market to be a bit cooler tomorrow though.

Recap

Bought 5,000 AZS @ 2.41

Sold 5,000 AZS @ 2.46 ($250 profit)

Bought 5,000 AZS @ 2.39

Sold 5,000 AZS @ 2.44 ($250 profit)

Bought 2,000 FMG @ 21.14

Sold 2,000 FMG @ 21.21 ($140 profit)

Tuesday September 19

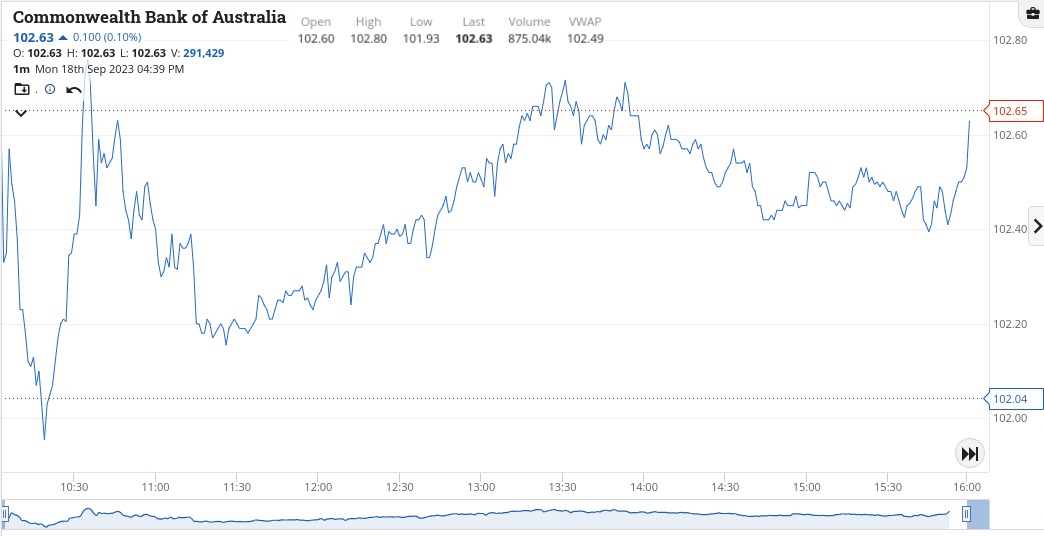

CBA at below $102 was a bargain and FMG at just above $21 was also a bargain until it fell and became expensive for me.

Had to double down and wait till the end of the day to come out a little bit ahead.

Went a bit off-piste in BRN and WBT with mixed results.

Basically cut the BRN after taking a few profits. Both WBT and BRN were big fallers on my alert list but not really that interested in them.

Up $450. Go the CBA!

Recap

Bought 2,000 FMG @ 21.02

Bought 1,000 CBA @ 101.75

Bought 10,000 BRN @ 0.25

Bought 2,000 WBT @ 3.57

Sold 1,000 CBA @ 102.04 ($290 profit)

Sold 2,000 WBT @ 3.62 ($100 profit)

Sold 10,000 BRN @ 0.25 ($0 profit)

Bought 2,000 FMG @ 20.89

Sold 4,000 FMG @ 20.97 ($60 profit)

Wednesday September 20

On a short break away, so trying not to do anything but like Al Pacino, I keep getting drawn back in!

FMG are kind to me and so are BRN but they have to be kicked out of bed in their last 4.10pm session, otherwise will still be stuck with them in the queue.

CBA had a range of $102.49 to $101.44 and RIOs were $118.21 to $116.54.

Ended up $230 which doesn’t cover the accommodation but certainly covers off my steak, chips and salad, with a touch of Italian dressing on the side, just to keep me fired up. Back to normal tomorrow.

Recap

Bought 2,000 FMG @ 20.66

Sold 2,000 FMG @ 20.75 ($180 profit)

Bought 10,000 BRN @ 0.220

Sold 10,000 BRN @ 0.225 ($50 profit)

Thursday September 21

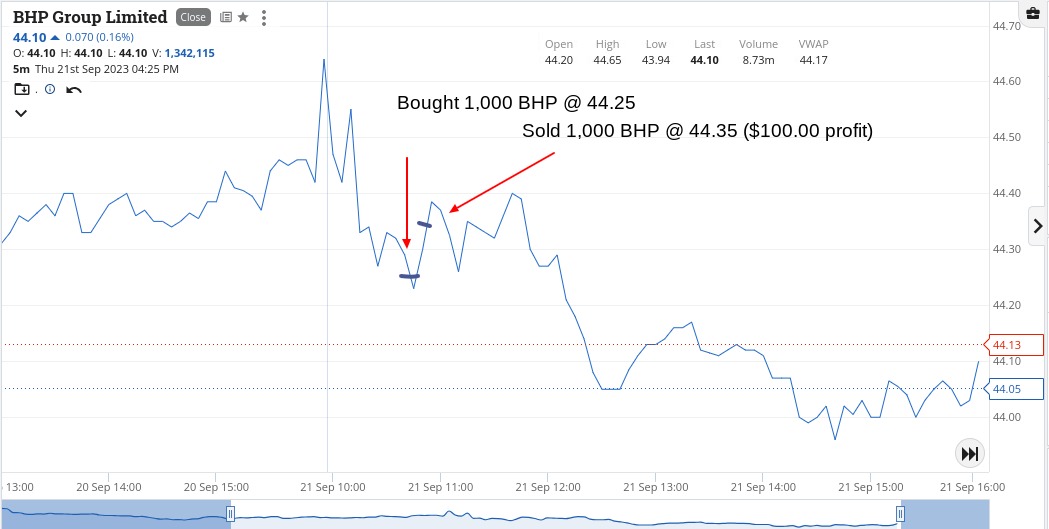

I wish I was still away, as everything which was sold down got smashed again in the afternoon and as you will see from the charts, today was a fugly day all round.

CBA’s range was $101.88 to $99.75 and ended the day down $1.76 at $100.08.

RIO’s range was $117.84 to $$115.46 and they ended the day down $1.13 at $115.90.

All the banks were down today after bond rates moved up, so I was staying away from them and sticking to the iron ore plays, to mixed results.

Had a few early hit and runs, as I could feel that my guts were telling me to be cautious.

Ended the day down $40 and that was in a way thanks to WBT, which feels strange.

Recap

Bought 2,000 FMG @ 20.58

Bought 1,000 BHP @ 44.25

Bought 2,000 WBT @ 3.40

Sold 2,000 WBT @ 3.43 ($60 profit)

Sold 1,000 BHP @ 44.35 ($100 profit)

Bought 1,000 RIO @ 115.97

Sold 1,000 RIO @ 115.90 ($70 loss)

Sold 2,000 FMG @ 20.51 ($130 loss)

Friday September 22

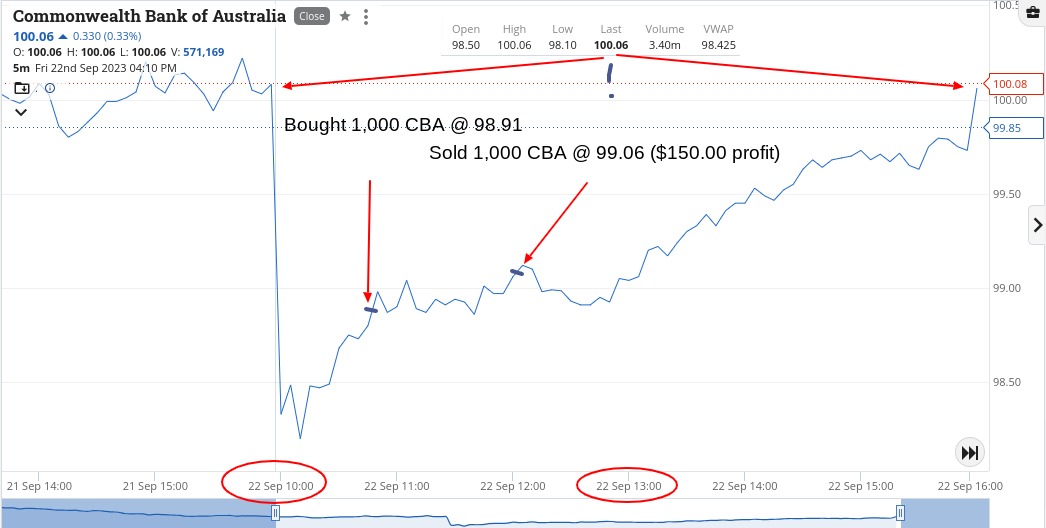

Well, well, well. Come in today and everything is marked down on the open.

CBA open down $1.58 at $98.50 and touch $98.10 before starting to firm up as I’m watching them.

When I do eventually get involved it is more of a timing thing, rather than anything else.

Coming into 11.00am I get set in both CBA and RIOs.

RIOs had opened down $2.10 at $13.80 and hit $112.58 before recovering and I of course had lower limits in both.

Looking back, I must be mad hoping for lower prices but at the time I was thinking maybe some margin calls could keep them lower.

CBA were $102 on Tuesday and today, Friday, they touched $98.10 and I’m trying to buy them at $97.85.

Oh well, hindsight is a wonderful thing and I was just happy to take a profit in both and the charts tell the rest.

Oversold and then overbought sums up today.

Plus $330 today and up $1610 in a difficult week, what with the market and taking a break away.

Comes in at $1,277 net and I was not really concentrating enough this week because my routine got out of whack.

Fully back next week though. CBA at $97?

Recap

Bought 1,000 RIO @ 113.42

Bought 1,000 CBA @ 98.91

Sold 1,000 RIO @ 113.60 ($180 profit)

Sold 1,000 CBA @ 99.06 ($150 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.