Confessions of a Day Trader: It won’t happen overnight… but it will happen

Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday May 15

Start off on a high and finish the day on a low.

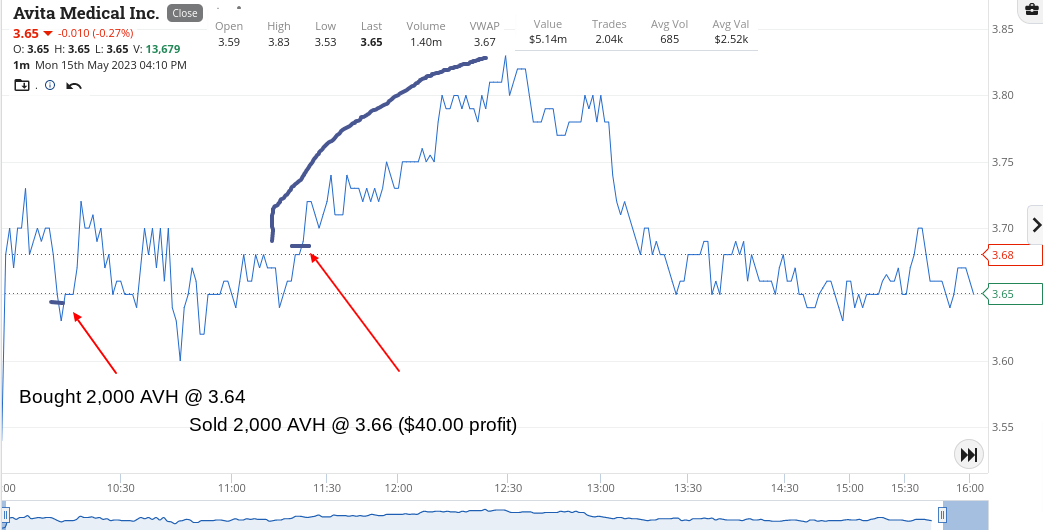

AVH were down 19% and it is a stock that I got tipped to buy about three months ago, so I did know a little bit about them. Looks like the market didn’t like their pre market figures release.

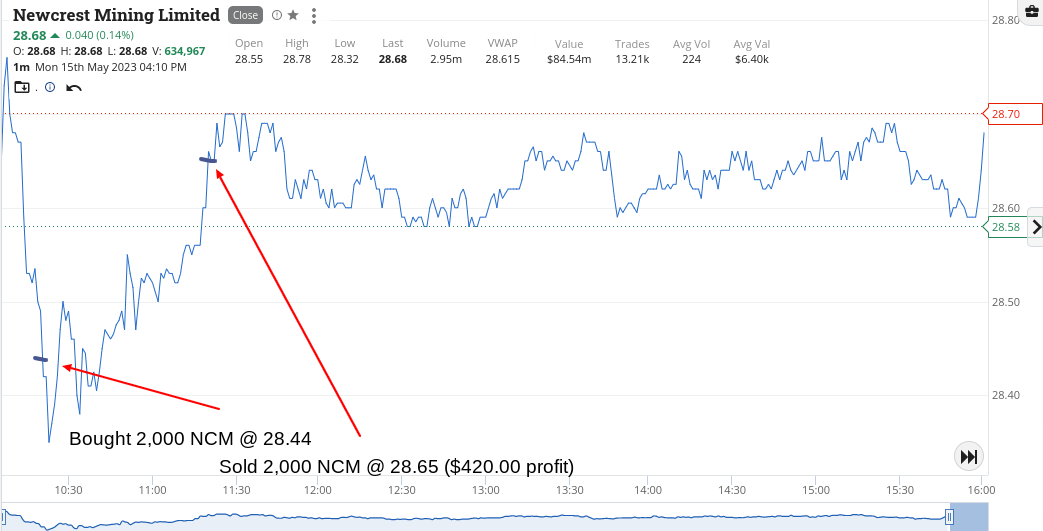

Then NCM directors have rolled over and accepted their takeover terms, which I saw as a good sign for the stock and they gave me my first trading profit for the week. Decided to close out AVH after this profit.

NHC came off their highs and after my NCM win, I decided to double up on my normal size for a quick $200 win, which turned out to be a $400 loss. My fault for being too cocky and assuming that this was a ‘money for jam trade’.

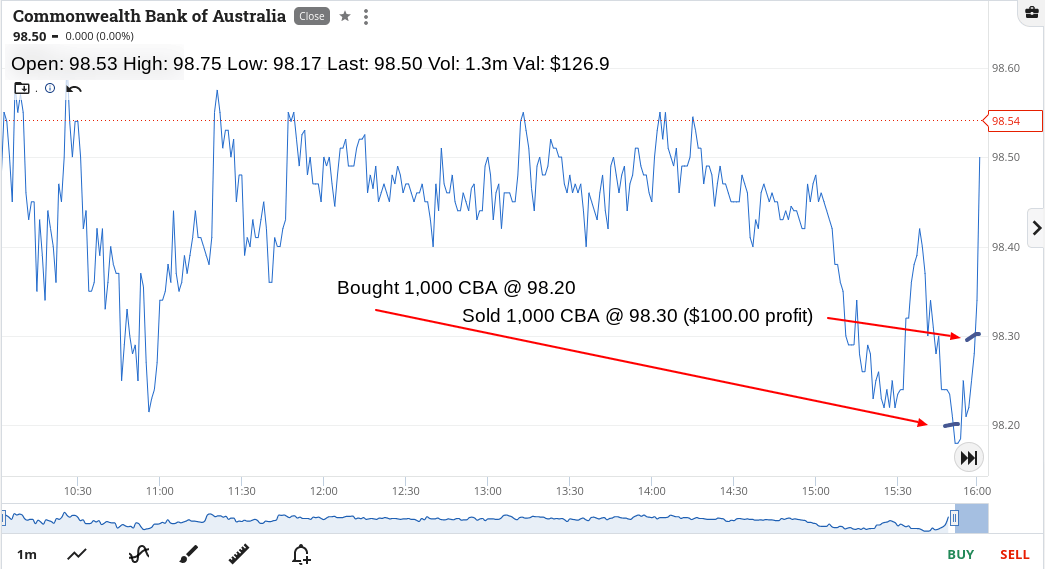

CBA came in with a real swan dive with 10 mins to go, so broke a golden rule and just had to have a go. Normally meant to leave this time of day alone, as only 10 mins to trade left.

Anyway, sold them in their last minute but held onto NHC till the very death and at 4.10pm got matched out at $5.13, which was a 4c loss.

Overall, up $540 thanks mainly to NCM and BHP but no thanks to NHC who became No Hope Coal for me today.

RBA minutes release tomorrow which may have a prune effect on the market but will have to wait and see.

Recap

Bought 2,000 AVH @ 3.64

Bought 2,000 NCM @ 28.44

Sold 2,000 NCM @ 28.65 ($420 profit)

Sold 2,000 AVH @ 3.66 ($40 profit)

Bought 10,000 NHC @ 5.17

Bought 1,000 BHP @ 43.77

Bought 1,000 BHP @ 43.69

Sold 2,000 BHP @ 43.92 ($380 profit)

Bought 1,000 CBA @ 98.20

Sold 1,000 CBA @ 98.30 ($100 profit)

Sold 10,000 NHC @ 5.13 (-$400 loss)

Tuesday May 16

Left all the banks alone today and have added a chart on CBA, as it had quite a dramatic finish for the day.

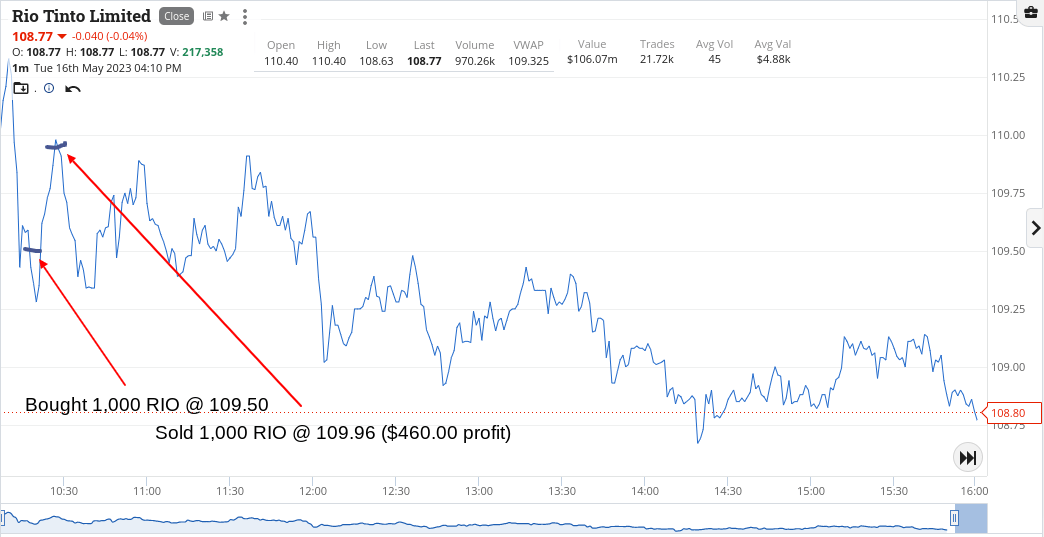

RIOs did us proud this morning very early on and left them on a limit just below $110.00 which came in.

Then went a little bit off piste with two of the day’s biggest fallers.

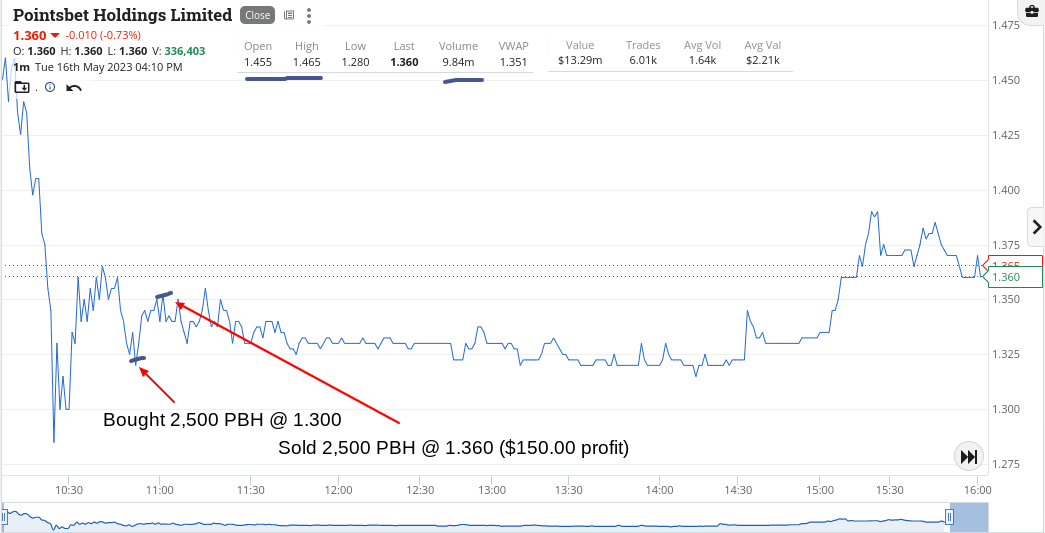

One was PBH, which was a punt on a punting stock and unlike their customers, it was nice to come out as a winner.

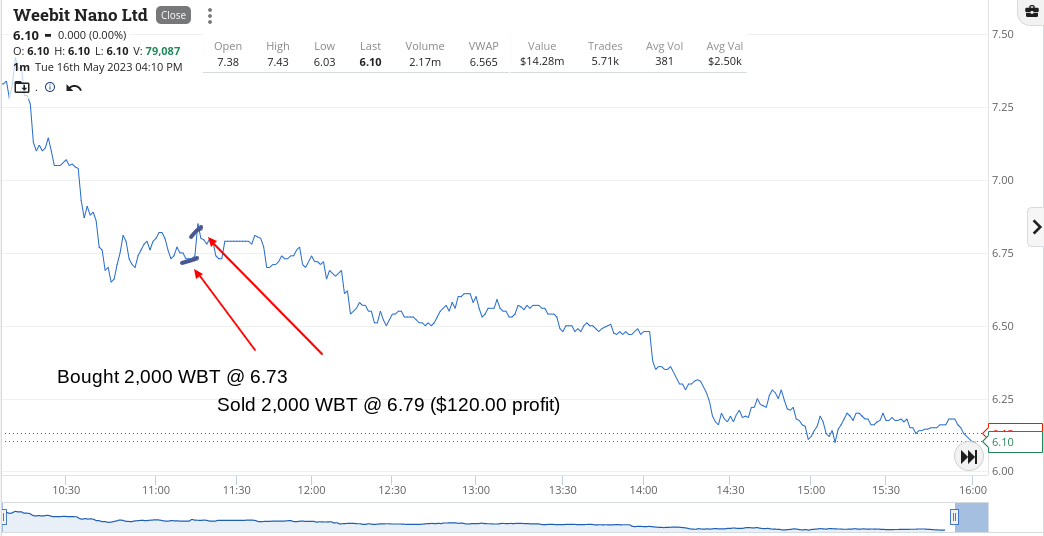

The other one, WBT, has been one that we have had a go in a few months ago, after they got sold down ahead of capital raising. Again, no news out and a big fall. Happy for a quick grab and run.

End the morning up $730 and RBA looks towards another interest rate hike according to their minutes, hence the reason for avoiding the bank shares today.

Recap

Bought 1,000 RIO @ 109.50

Sold 1,000 RIO @ 109.96 ($460 profit)

Bought 2,500 PBH @ 1.300

Sold 2,500 PBH @ 1.360 ($150 profit)

Bought 2,000 WBT @ 6.73

Sold 2,000 WBT @ 6.79 ($120 profit)

Wednesday May 17

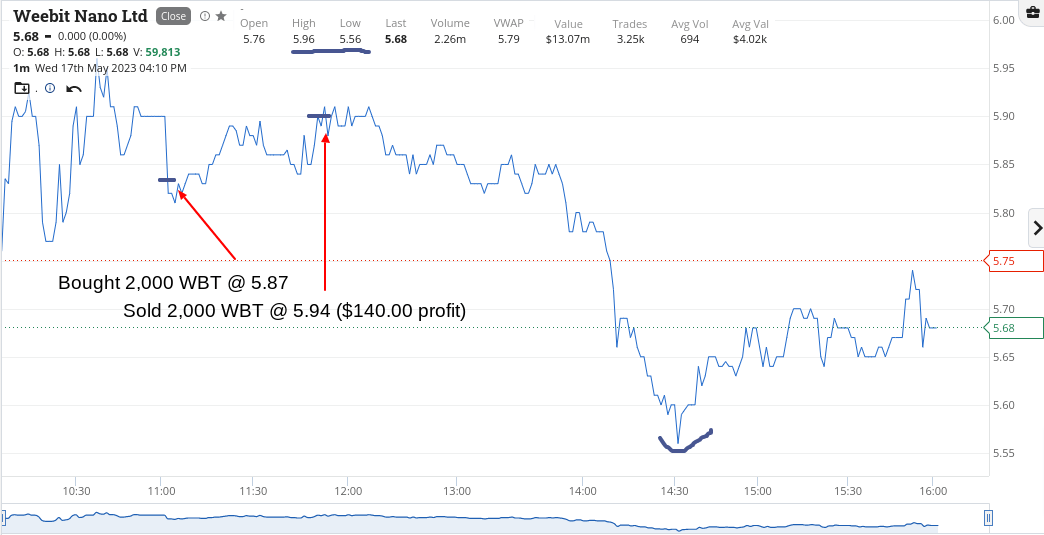

WBT got a speeding ticket and were below $6.00 today and moving around quite fast so just had to have a go. Happy with a quick turn.

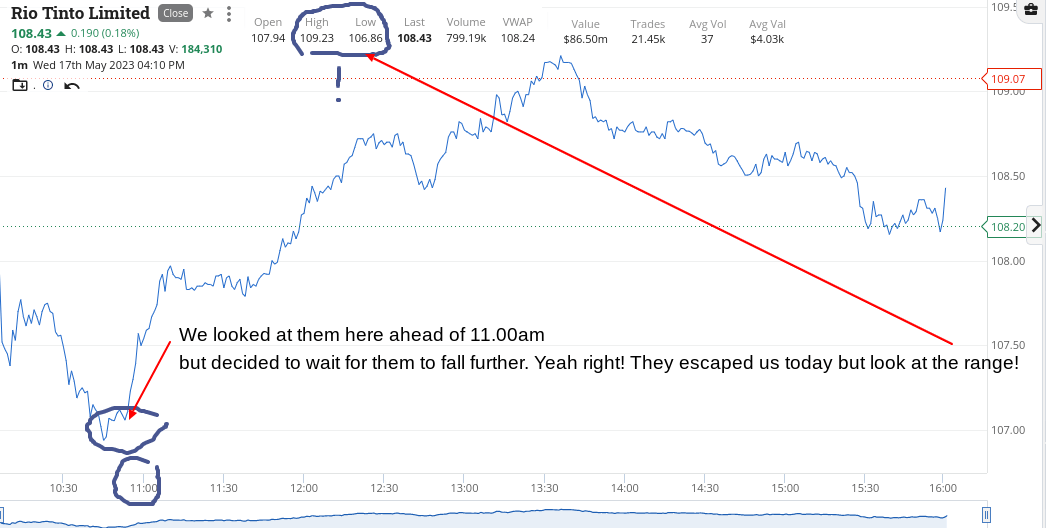

Having missed an 11.00am special in RIOs yesterday, I didn’t want to do the same thing in CBA. They had touched $96.00 before recovering, so I was paying 61c above their low.

The time was the factor here and as they headed towards $97, I left the party and ended the morning up $370.

I am bearish at the moment and everything I thought I would wait on all rallied from their lows and held their gains, which had me wrong-footed mentally.

Recap

Bought 2,000 WBT @ 5.87

Sold 2,000 WBT @ 5.94 ($140 profit)

Bought 1,000 CBA @ 96.61

Sold 1,000 CBA @ 96.84 ($230 profit)

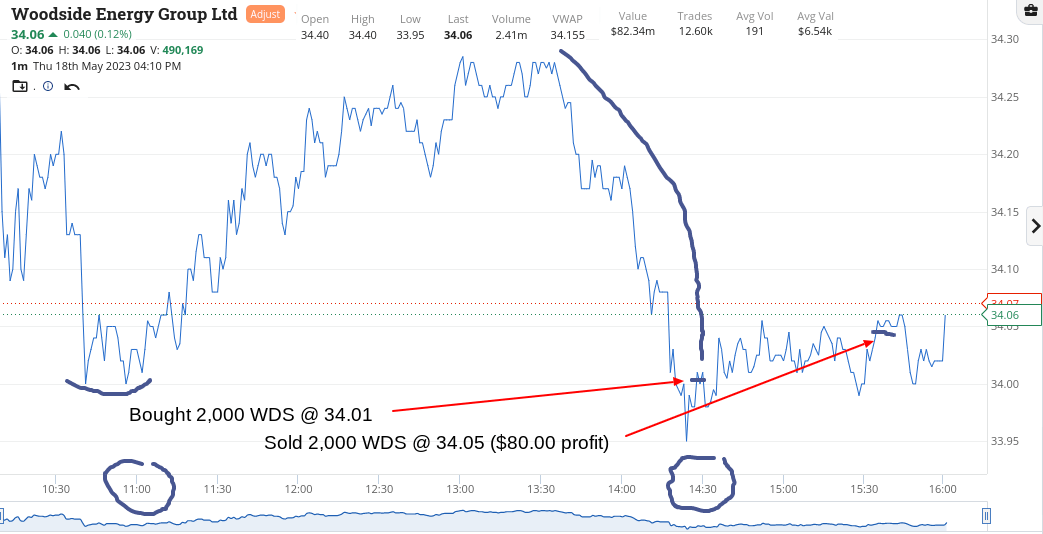

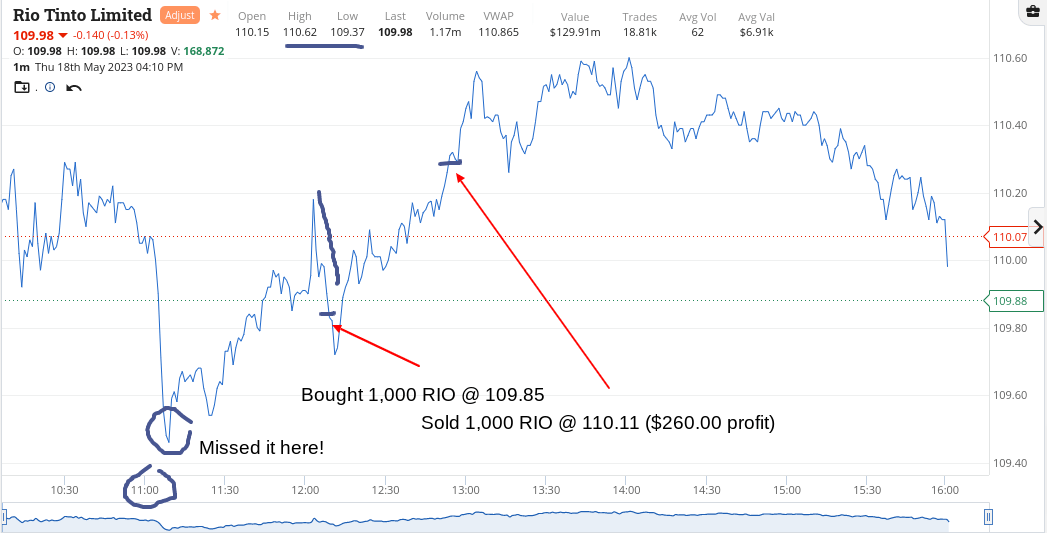

Thursday May 18

Today started out as a flatliner of a day. Everything was up on overnight markets and stayed up, so just had to wait around for any falls. I honestly thought that today would be a donut trading day.

Then a few cracks started to appear in some support levels.

Firstly RIOs, whose 11.00am rally I missed, unlike yesterday, but they gave me another chance below $110 and this worked out okay, though I did leave a bit more than I would have liked on the table.

In between all of this WBT reared up its head again. They hit an early high of $6.10 and then fell back. Had to go twice to get my average down. Had them on a higher limit and having watched them hit $5.80 three times and then drop back, I adjust the limit down and they got taken on a rally. Phew.

WDS were the same. They opened on their high at $34.40, fell to $34.00 and bounced and finally really cracked below $34.00 four hours later! Got some at $34.01, as had to chase them a little bit and again had them on a higher limit and had to adjust it down till eventually they popped through it.

Up $560 and I even surprised myself with my patience today.

Recap

Bought 1,000 RIO @ 109.85

Bought 2,000 WBT @ 5.76

Sold 1,000 RIO @ 110.11 ($260 profit)

Bought 2,000 WBT @ 5.73

Sold 4,000 WBT @ 5.80 ($220 profit)

Bought 2,000 WDS @ 34.01

Sold 2,000 WDS @ 34.05 ($80 profit)

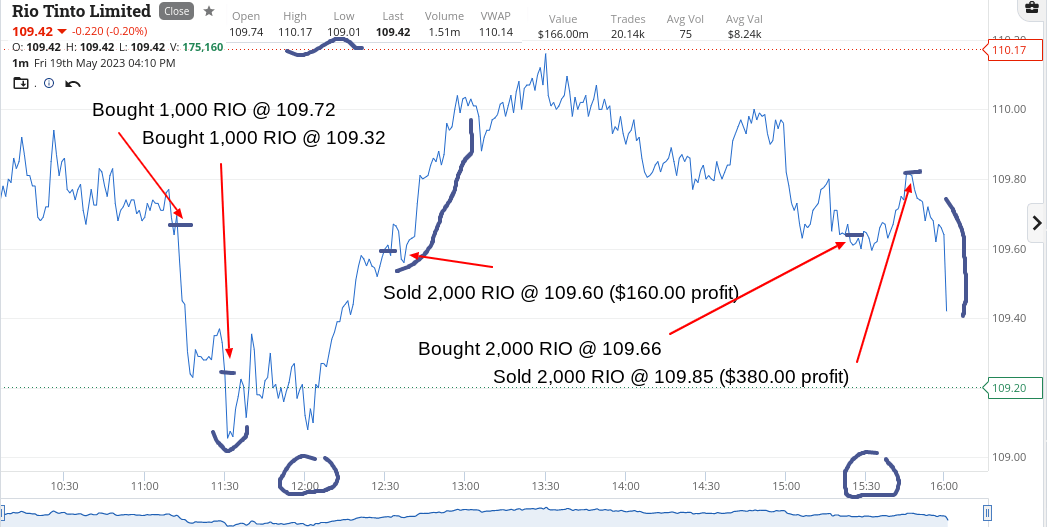

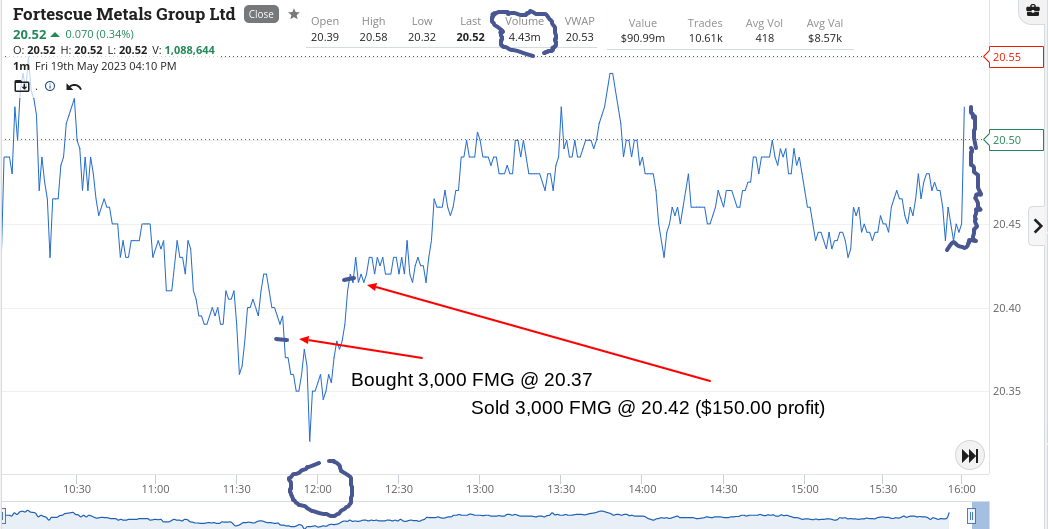

Friday May 20

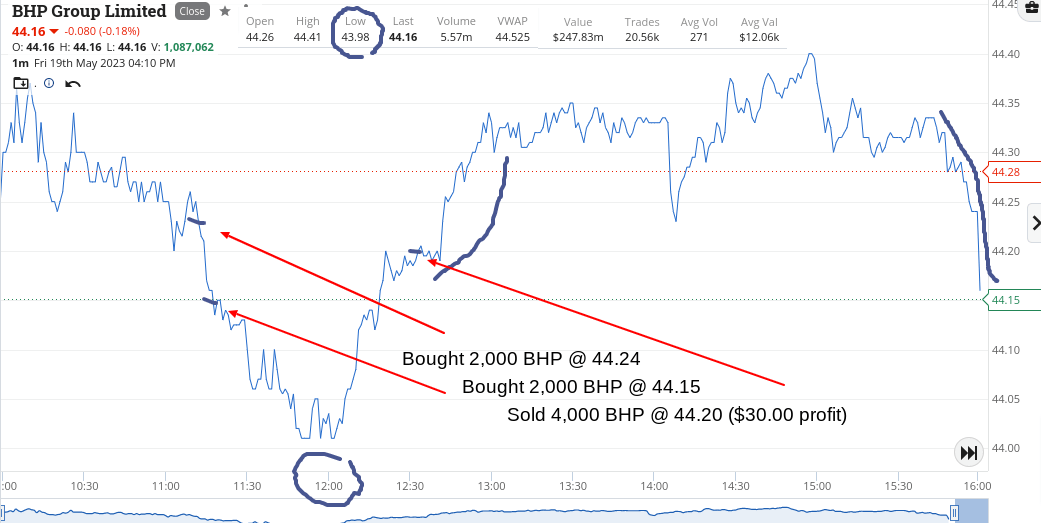

Basically hang around till 11.15am and then go on a big spending spree. My timing was atrocious in RIO, BHP and FMG and I had to double down and then almost bang on 12.00pm, everything turned around and my p/l swung from a $2000 loss and into a $350 gain on those three amigos alone.

RIOs first, then BHP and finally some FMG as I couldn’t double down any more, so FMG was my hedge and hence the first sale out of them. After seeing RIOs recover, I just bolted for the door in both RIO and BHP.

Later on and towards the end of the day, I decided, in my wisdom, to do a f*&k it trade and went all-in on RIOs as I suspected a 3.30pm rally.

Again got my timing a bit wrong and it became a Pantene trade. It won’t happen overnight but it will happen! I was out by 8 mins or so and my limit sell was triggered out. Nice way to end the day and the week.

Up $1,060 today and $3,260 gross for the week or $2,720 net and now we just wait for the USA to get their act together on repainting their debt ceiling.

Recap

Bought 2,000 AVH @ 3.44

Bought 2,000 WBT @ 5.52

Bought 1,000 RIO @ 109.72

Bought 2,000 BHP @ 44.24

Sold 2,000 WBT @ 5.58 ($120 profit)

Bought 1,000 RIO @ 109.32

Bought 2,000 BHP @ 44.15

Bought 3,000 FMG @ 20.37

Sold 3,000 FMG @ 20.42 ($150 profit)

Sold 2,000 AVH @ 3.49 ($100 profit)

Sold 2,000 RIO @ 109.60 ($160 profit)

Sold 4,000 BHP @ 44.20 ($30 profit)

Bought 2,000 AVH @ 3.42

Bought 2,000 AVH @ 3.38

Bought 2,000 RIO @ 109.66

Sold 4,000 AVH @ 3.43 ($120 profit)

Sold 2,000 RIO @ 109.85 ($380 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.