Confessions of a Day Trader: Iron… man.

Pic: Getty

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday March 7

As we all know, we are travelling in uncharted waters, what with Russia and commodity prices plus inflation throwing us all a curveball every day.

The volatility in some of our favourite stocks is good and bad and in these kind of conditions I am expecting to lose more than I can gain.

But, we have to give it a go. Today I did OK but look at what I can grab as a cushion to start from.

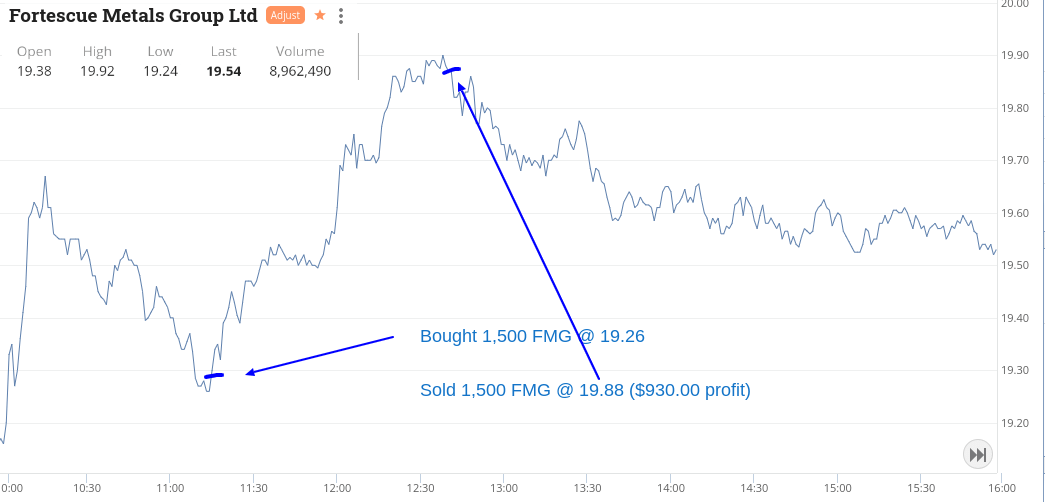

Picked up some FMG after a markdown, even with higher iron ore prices – the chart will sum up how it went.

Plus $930 for the day but still very nervous.

Recap

Bought 1,500 FMG @ 19.26

Sold 1,500 FMG @ 19.88 ($930.00 profit)

Tuesday March 8

Come into big falls overnight, which I suppose is to be expected in a way. Tech stocks getting smashed and commodities up and then inflation fears, especially with the oil price affecting petrol pump prices.

And on top of that we have these massive floods, so the general mood feels down.

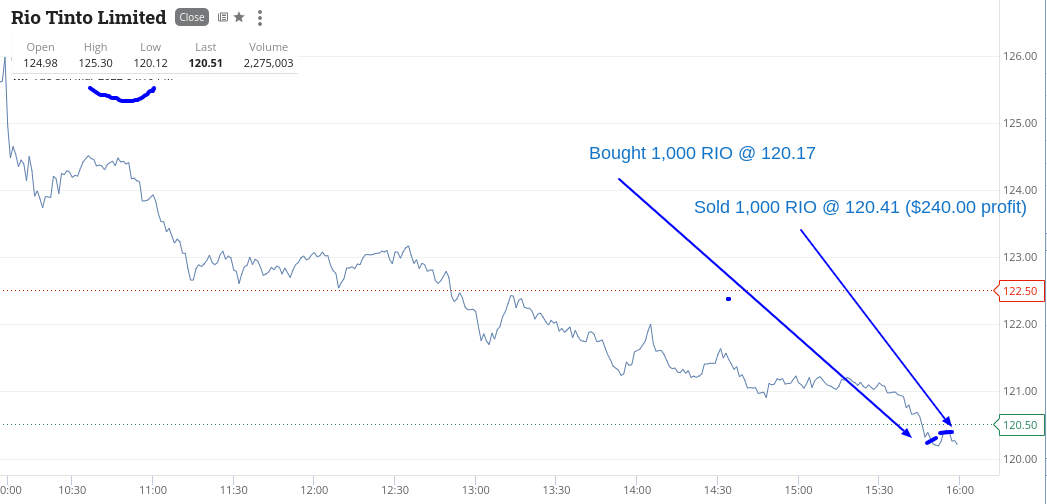

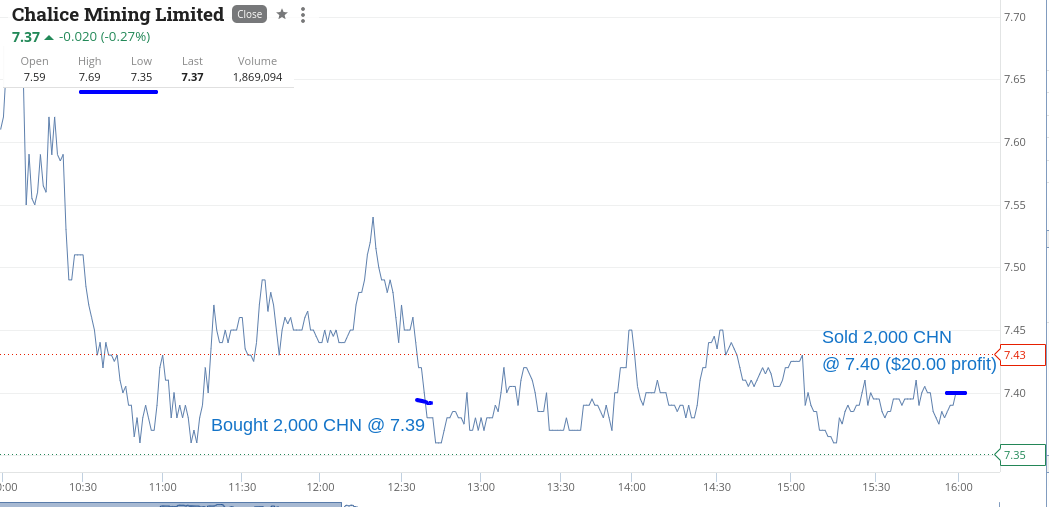

Gave back what I made on FMG yesterday plus more, had a real quickie in RIOs toward the last 10 mins of trading and watched a bigger profit in CHN wash away.

Down $782.50 for the day, so a tad ahead so far. Difficult times indeed.

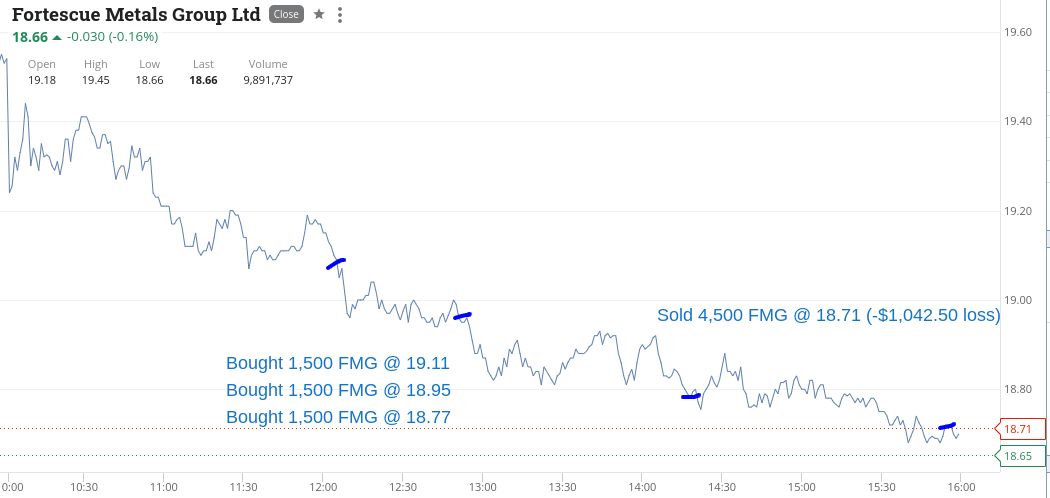

Had a profit in the first trade in FMG but procrastinated too much.

Recap

Bought 2,000 CHN @ 7.39

Bought 1,500 FMG @ 19.11

Bought 1,500 FMG @ 18.95

Bought 1,500 FMG @ 18.77

Bought 1,000 RIO @ 120.17

Sold 1,000 RIO @ 120.41 ($240.00 profit)

Sold 2,000 CHN @ 7.40 ($20.00 profit)

Sold 4,500 FMG @ 18.71 (-$1,042.50 loss)

Wednesday March 8

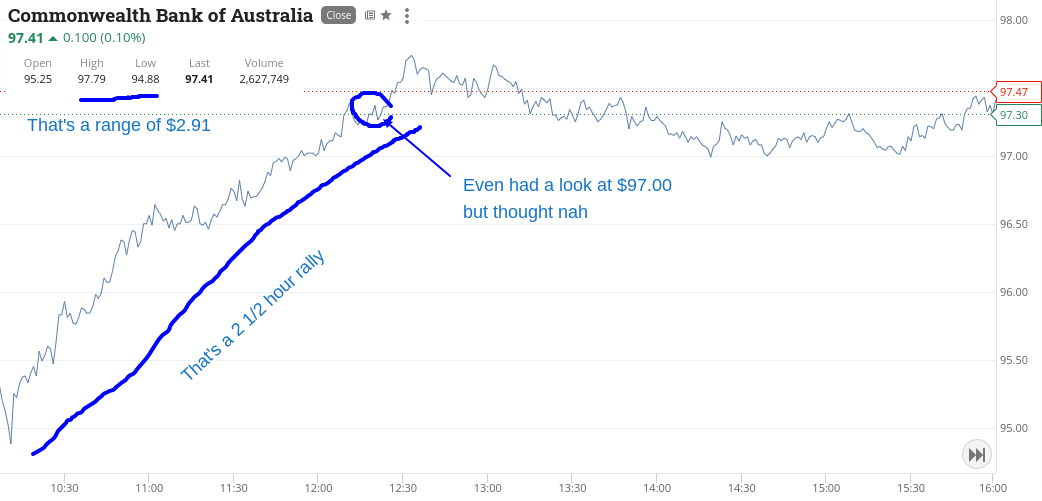

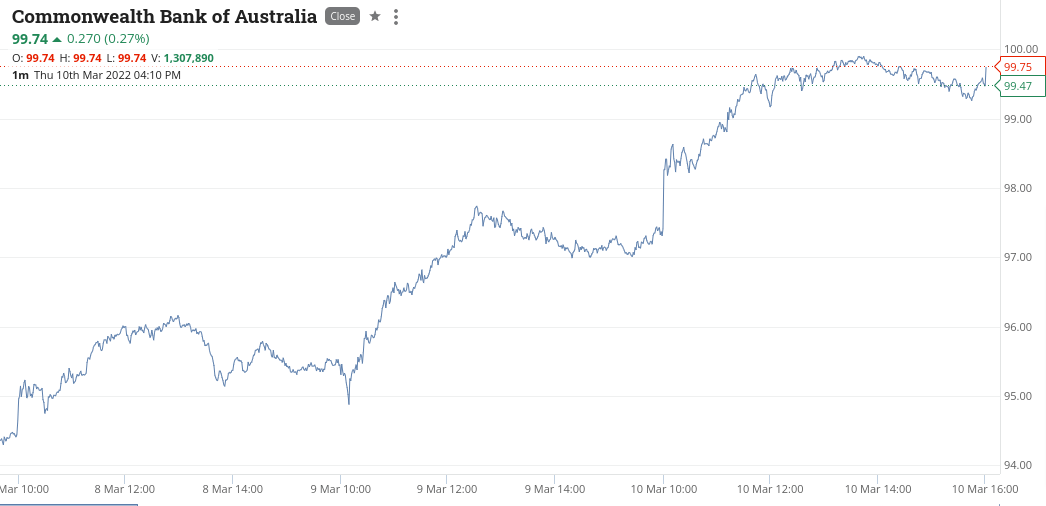

Today was a bit of a turning day, where reports in the paper talked about European banks’ exposure to Russian debt and how Australian banks’ exposure was almost zero.

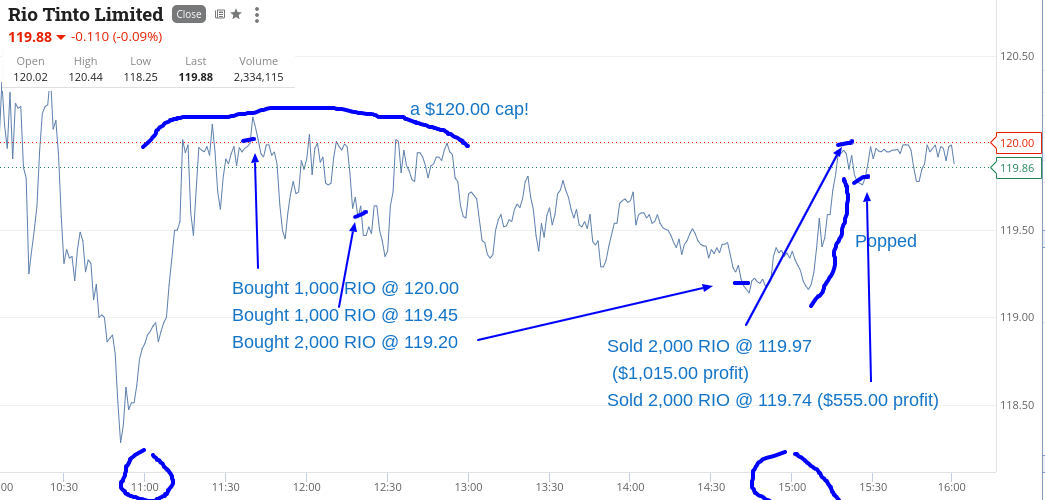

This led to a rally – as you will see in CBA’s chart – and it was hard to find anything to have a go at, until RIOs looked inviting around the $120.00 level… or so I thought.

Had a look, had a go and then had another go and then really had to have a go. I was convinced that they would rally at some point. Bit like the rain will stop at some point.

Hell, they were $126.00 yesterday. I had a limit on to sell 2000 higher up that I kept from my first two goes and thought I would need to adjust in down but they popped through it, which is why the second sale was a bit lower.

Was happy to take the second profit and walk away with a profit, albeit a bit eaten away by the brokerage, I was going for the leverage. Even if you traded just 40 shares, you would have done well.

Plus $1570.

Recap

Bought 1,000 RIO @ 120.00

Bought 1,000 RIO @ 119.45

Bought 2,000 RIO @ 119.20

Sold 2,000 RIO @ 119.97 ($1,015.00 profit)

Sold 2,000 RIO @ 119.74 ($555.00 profit)

Thursday March 9

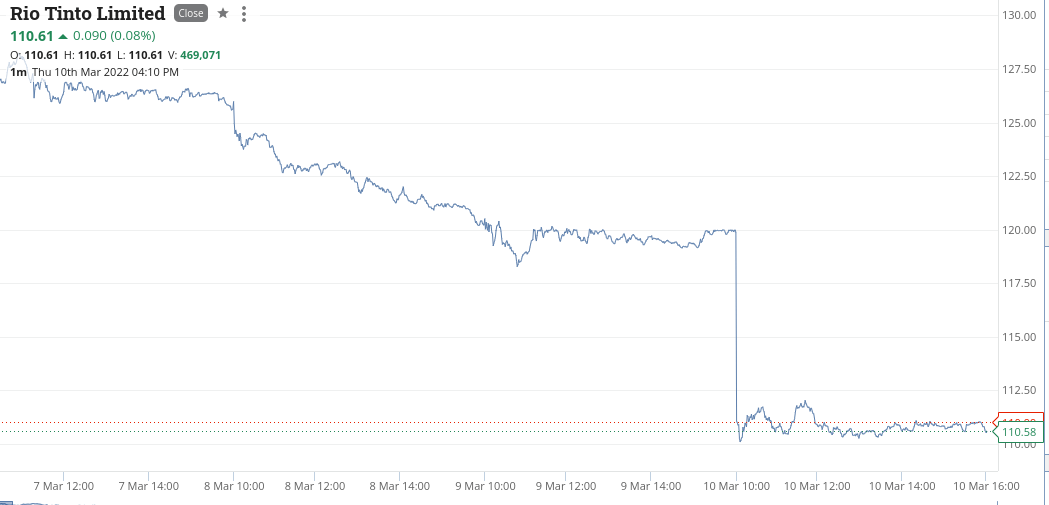

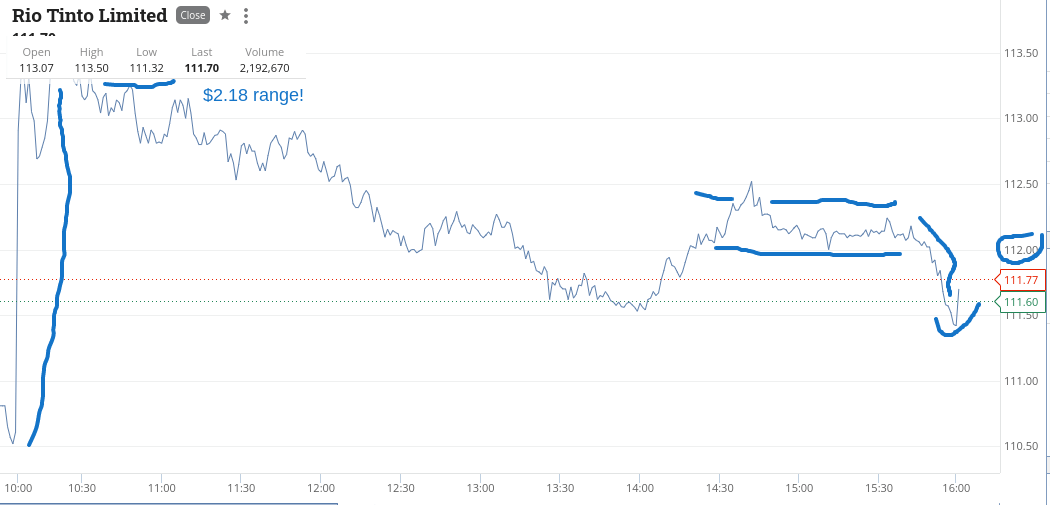

Very strong European markets overnight means that most stocks on my watch list open up strong, except for RIO.

They are marked down to below $111.00 and I had a limit order in for 1000 at $109.95 but never got there after it touched $109.92 earlier.

So ended up doing nothing today.

CBA almost reached $100 today but stopped at $99.92 and RIOs were $126 two days ago. Crazy stuff.

Friday March 10

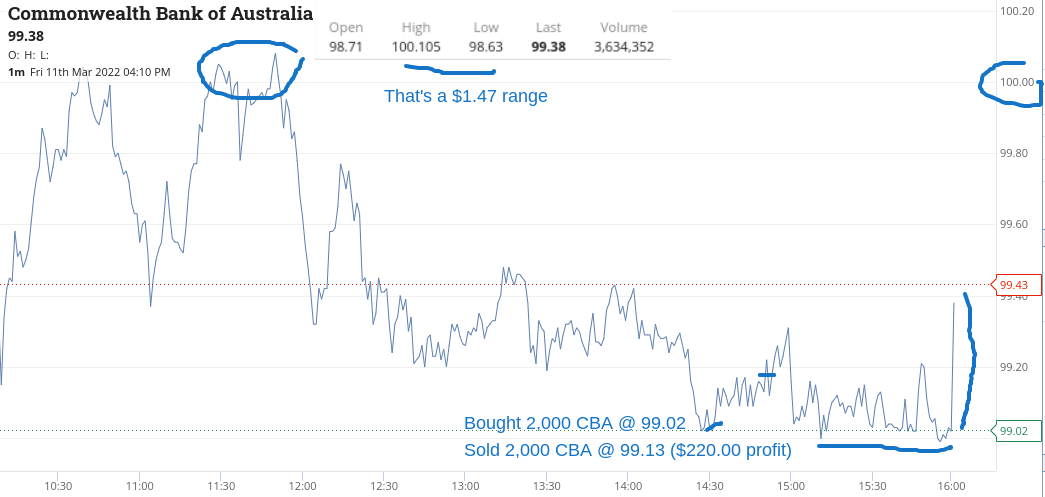

Had to wait around for a long time, sitting on my hands. CBA broke through the $100 level twice but could never hold and then later it was trading around the $99.00 level and holding. Had a quick grab and run but paid a bit of brokerage.

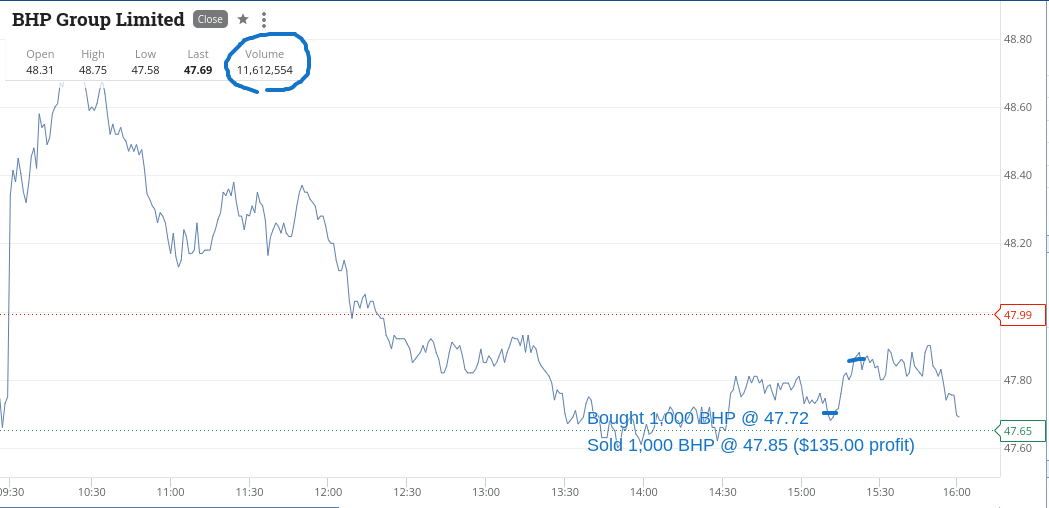

Same for BHP. Just seemed to find a level and again put them on a limit to sell.

Waiting around doing nothing is so hard, but being a Friday, I didn’t want to hang around too long. RIOs were tempting in last 15 mins but the selling never stopped. Attached a chart, so you can see their close.

Wash up for week is plus $2073 gross and $1876 net and that’s with a doughnut day on Thursday. Hoping that next week may have some direction but doubt it somehow.

Recap

Bought 2,000 CBA @ 99.02

Sold 2,000 CBA @ 99.13 ($220.00 profit)

Bought 1,000 BHP @ 47.72

Sold 1,000 BHP @ 47.85 ($135.00 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.