Confessions of a Day Trader: Iron awe!

Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday November 13

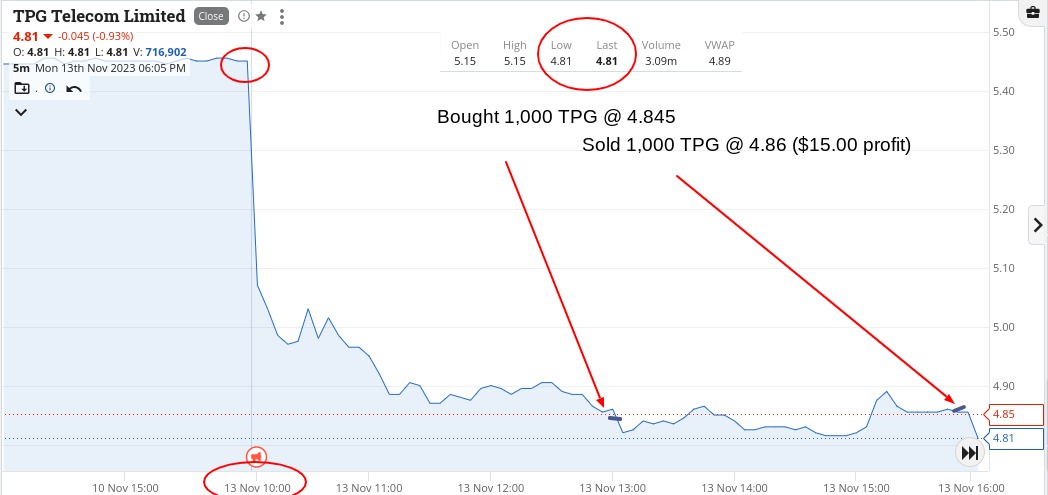

Start the day with a profit and end the day with a profit. However, in the middle I suffer a loss and the last day’s profit came in at $15 or a couple of schooners in Happy Hour.

ANZ was alright and the only big faller in the banks today, after their figs came out. At their last trade of $24.70, they were down 3% or so.

TPG fell and stayed there, like a stone at the bottom of a pond and WDS floated around on top and on both of these I just sold them before the 4.10pm rotation.

Down, drum roll please, $7.50 for the day! Far out.

Serves me right for not paying 100% attention and I promise to myself to try a little harder tomorrow.

Recap

Bought 2,500 WDS @ 31.98

Bought 2,000 ANZ @ 24.55

Sold 2,000 ANZ @ 24.62 ($140.00 profit)

Bought 1,000 TPG @ 4.845

Bought 2,500 WDS @ 31.845

Sold 5,000 WDS @ 31.88 ($162.50 loss)

Sold 1,000 TPG @ 4.86 ($15.00 profit)

Tuesday November 14

CBA came out with their figures and they opened up strongly, whilst NAB went xd and got whacked on the opening by 70c or so.

Just had a limit order in before the opening and got hit very quickly and watched them quickly move around. Although I had them on at a higher limit, I kept adjusting it down till eventually we met each other.

Then, having seen CBA at $102.35 at their opening, I thought that getting set at $101.74 didn’t seem too bad a deal. For once it turned to my favour.

Later on, as I was kicking back, NAB fell below $28.00, so I put some on at a lower limit, which turned out to be a nice little earner.

Love these xd days!

Up $1,110 and I also bank with NAB with my EFTPOS machine, it’s even sweeter as they charge 1.5% per transaction, so thank you NAB, from the bottom of my trading account.

Recap

Bought 5,000 NAB @ 28.23

Sold 5,000 NAB @ 28.31 ($400.00 profit)

Bought 2,000 CBA @ 101.74

Sold 2,000 CBA @ 101.87 ($260.00 profit)

Bought 5,000 NAB @ 27.89

Sold 5,000 NAB @ 27.98 ($450.00 profit)

Wednesday November 15

Well, RIOs hit a day’s high of $127.31 and CBA touch $103.64 to paint you a picture of today’s market.

Amazing stuff.

CBA had a day’s low of $101.92 and I manage to pick up 1000 as they headed towards it. Also, NAB below $28.00 came out alright but BHP below $47 didn’t.

Thems are the breaks.

Up $705 and was in awe of RIOs today – or should it be ‘ore’?

Either way there was a time when they and CBA would trade at par to each other’s share prices and now they have a difference of $23.46 in RIO’s favour.

Recap

Bought 2,500 NAB @ 27.78

Bought 1,000 CBA @ 101.98

Bought 2,000 BHP @ 46.91

Sold 1,000 CBA @ 102.31 ($330.00 profit)

Sold 2,500 NAB @ 27.97 ($475.00 profit)

Sold 2,000 BHP @ 46.86 ($100.00 loss)

Thursday November 16

Had an early go in CBA ahead of employment figures due at 11.30am, so wanted to be in and out before then. Worked out OK.

Then, went all into the banks and switched into the iron ore producers and then one more go into CBA.

This was after the employment figures were published, which the market didn’t like, though I read the headlines and thought about it and reckon the market was overreacting a bit too much.

I am but a simple thinker and more employed means more can afford their mortgage repayments, was my logic.

See charts as it was a busy day for me. Up $1,285.

Recap

Bought 2,000 CBA @ 102.28

Sold 2,000 CBA @ 102.52 ($480.00 profit)

Bought 2,000 CBA @ 102.32

Bought 5,000 NAB @ 27.77

Bought 5,000 ANZ @ 24.15

Sold 5,000 NAB @ 27.82 ($250.00 profit)

Sold 5,000 ANZ @ 24.18 ($175.00 profit)

Cut 2,000 CBA @ 102.28 ($80.00 loss)

Bought 2,000 BHP @ 46.70

Bought 5,000 FMG @ 25.08

Bought 2,000 CBA @ 101.92

Sold 2,000 CBA @ 102.11 ($380.00 profit)

Sold 5,000 FMG @ 25.11 ($150.00 profit)

Cut 2,000 BHP @ 46.66 ($70.00 loss)

Friday November 17

Did nothing today, as got a bit distracted and missed the fall in CBA at around 11.45am to 12.00pm but being a Friday and all that, I wasn’t really trusting anything.

They had an impressive 2.73m go through, though at the end of the day, their starting price and closing price came in at just plus 9c difference.

That’s a lot of shares for plus 9c and over a 5hr and 10min period!

Whereas RIOs came in with a difference of plus $1.27 from their opening and closing pricing.

They touched their bottom at 11.00am, recovered and then stayed in a tight zone, right till the very end.

See charts on them both.

Finished the week plus $3,107.50 gross or $2377.50 net and all I can say is, thank Christ for the 50c. Best tip I’ve had all week, as I didn’t get many from my tighter and older customers this week, eh Richard and Bill?

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.