Confessions of a Day Trader: Inflation’s coming. Get yourself a nice, safe bank job

Pic: metamorworks / iStock / Getty Images Plus via Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday November 8

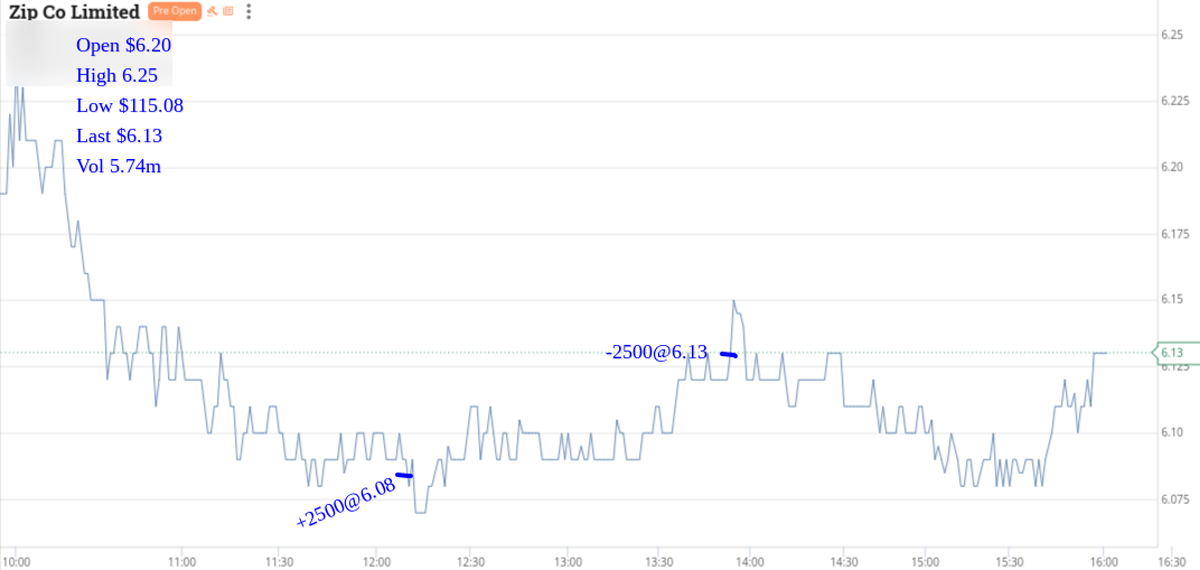

Manage to lose $360 in VUL and $110 in MIN and make $260 in CBA and $125 in Z1P, but today’s star was APT.

Buy 1000 at $115.54 and sell them at $116.17 (+$630) bringing in a nice Monday start at +$545 for the day.

Had to rush around today and time is against me, so see charts for full details. Thanks.

Tuesday November 9

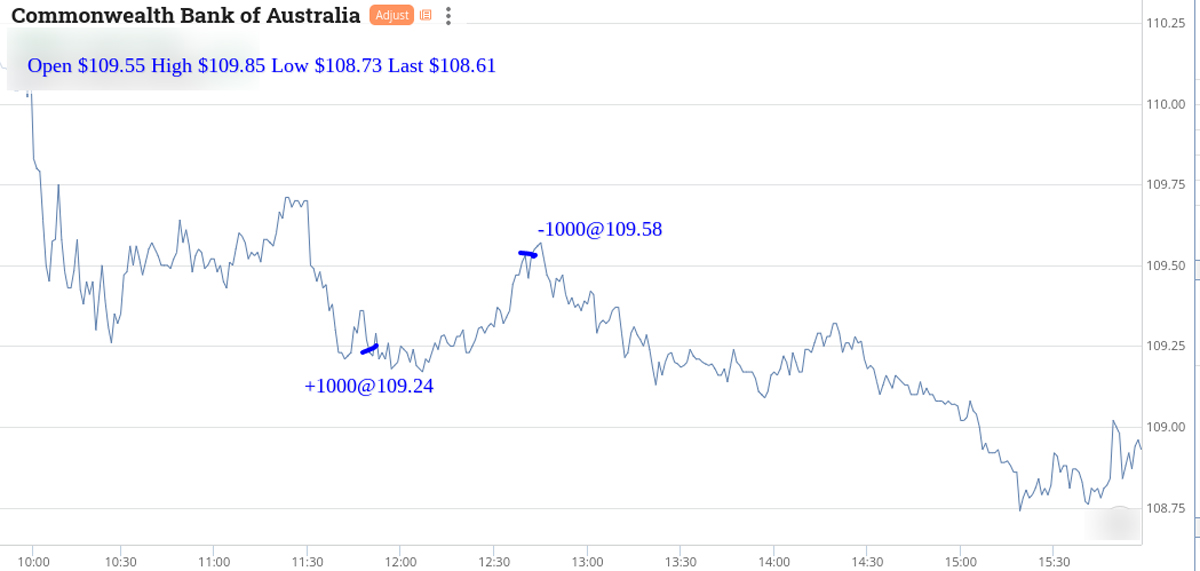

It’s all about the banks today, plus a late go at RIOs just to balance out things a bit.

Buy 2000 NAB at $28.34, 3000 WBC at $22.74 and 1000 CBA at $109.24.

CBA behave themselves okay, so manage to sell the 1000 at $109.54 (+$350) and the NAB do so as well. Sell the 1000 at $28.51 (+$340) but WBC going the other way.

Cut the WBC at $22.69 (-$150) and then go for a late trade in RIOs. Buy 1000 at $88.94 and sell them quickly at $89.28 (+$345)

Leaves me up $885 for the day.

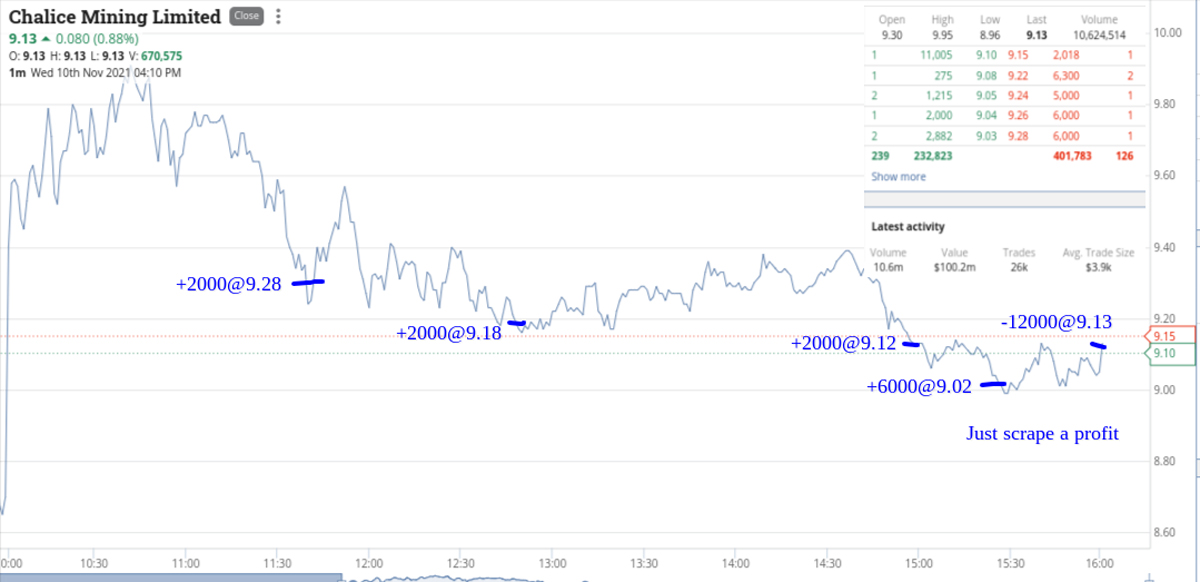

Wednesday November 10

Fancy CHN for a run at $10.00 today. Buy 2000 at $9.28, 2000 at $9.18, 2000 at $9.12 and just to prove myself completely wrong, top up with 6000 at $9.02. Manage to sell them all at $9.13 (+$280) which is a result, but not how I expected it to be.

In between banging the buy button on CHN, I sneak in an in ‘n out in CBA. In for 1000 at $108.88 and out at $109.03 (+$225) and put in a charge at MIN. Buy 3000 (as late in day, so gear up) at $37.02 and sell them at $37.05 (+$90). Not much of a profit after commission but I will take it.

Plus $595 for today.

Thursday November 11

Inflation news sends up bond yields overnight and leads us into a volatile day. Deciding to leave everything alone today, as trying to be a hero on a day like this, normally ends in tears for me.

Also had a second jab, so I want to rest myself.

Have added a few charts.

Look at the range in CBA. I think it’s some kind of record – $2.75 in a day is outrageous. CHN reach the $10.00 today, so only a day out on 12,000! Oh well. One more day to go.

TGIF November 12

All eyes on RIO and BHP today, as RIOs were up 6% in NY trading. Both open up at their day’s high, or just near them, and then both get sold down.

RIOs quickly came back over $100 and fell below $93 and started trading in the $92s.

Was only really meant to be watching but just seemed too tempting. Buy 1000 at $92.80 and sell them into a post-11.00am rally at $93.40 (+$600).

They are moving around very fast and then fall again below $93. Buy 1000 at $92.83 this time and sell them at $93.11 (+280).

Happy to leave everything alone and chill but can’t help myself after lunch and take a peek. Well, RIO heading to almost touching $92 and BHP were getting dragged down with them. Buy 1000 RIO at $92.15 and 2500 BHP at $37.58.

Sell the RIOs at $92.43 (+$280) and sell the BHP at $37.65 (+$175).

So, Tuesday was all about the banks and today was all about iron ore producers.

Maybe Monday will be all about APT and Z1P? Anyway, up $$1,335 today and $4,668 (+$4,103 net) for the week and that includes taking a break on Thursday.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.