Confessions of a Day Trader: I’m blue, Da ba dee da ba di, Da ba dee da ba di

Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

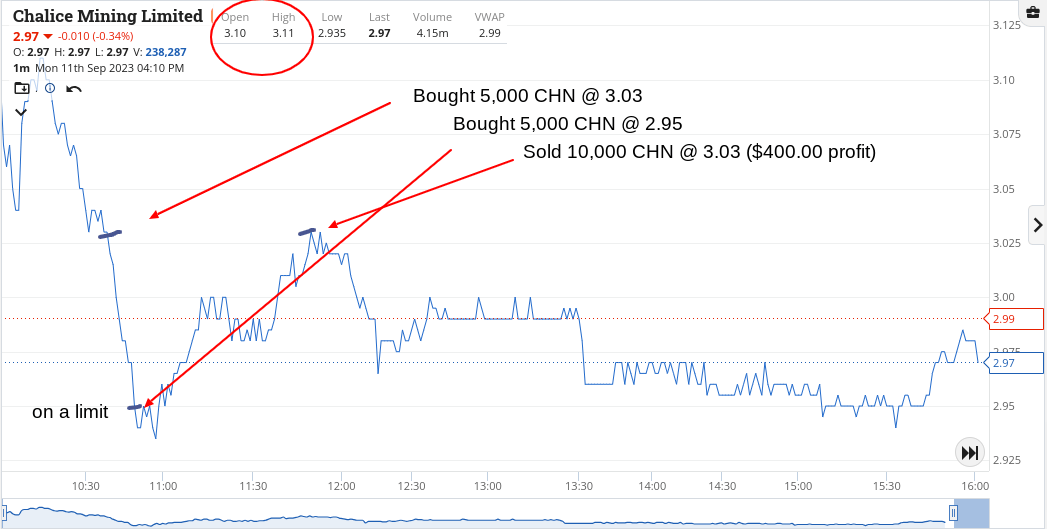

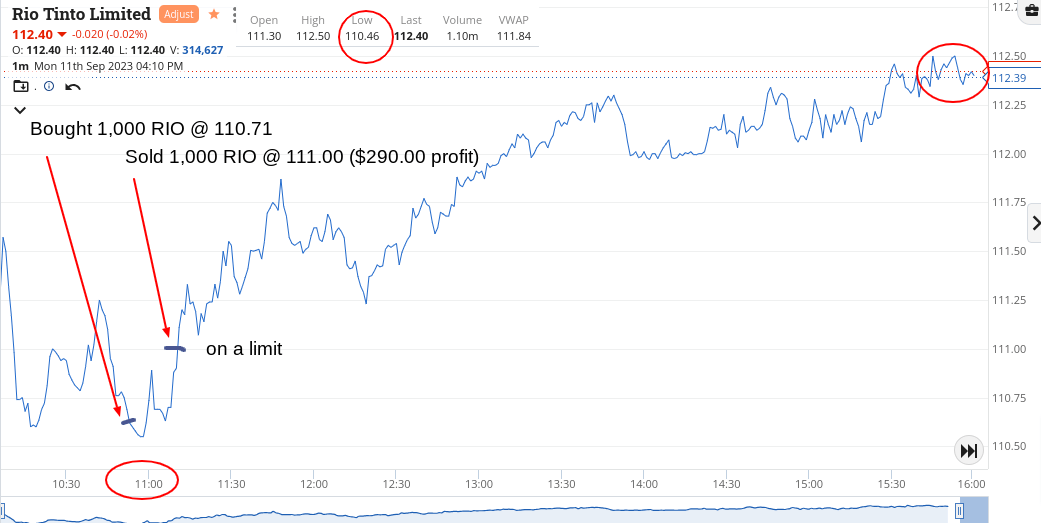

Monday September 11

Well today was one of those days, where everything started out ho hum but by the end of the day, my watch list was glowing a sea of blue across my keyboard.

Stocks like RIOs had a $2 range and CBA had a $1.50 range and both closed just under 10c from their day’s high.

Got stuck into RIOs at $110.71 for example and they closed at $112.40. I of course was long gone and just a mere blip on their chart!

CHN below $3.00 worked today, but you had to be quick. Finished the day up $690 and was just amazed at today’s strength in the blue chips.

Recap

Bought 5,000 CHN @ 3.03

Bought 5,000 CHN @ 2.95

Bought 1,000 RIO @ 110.71

Sold 1,000 RIO @ 111.00 ($290 profit)

Sold 10,000 CHN @ 3.03 ($400 profit)

Tuesday October 12

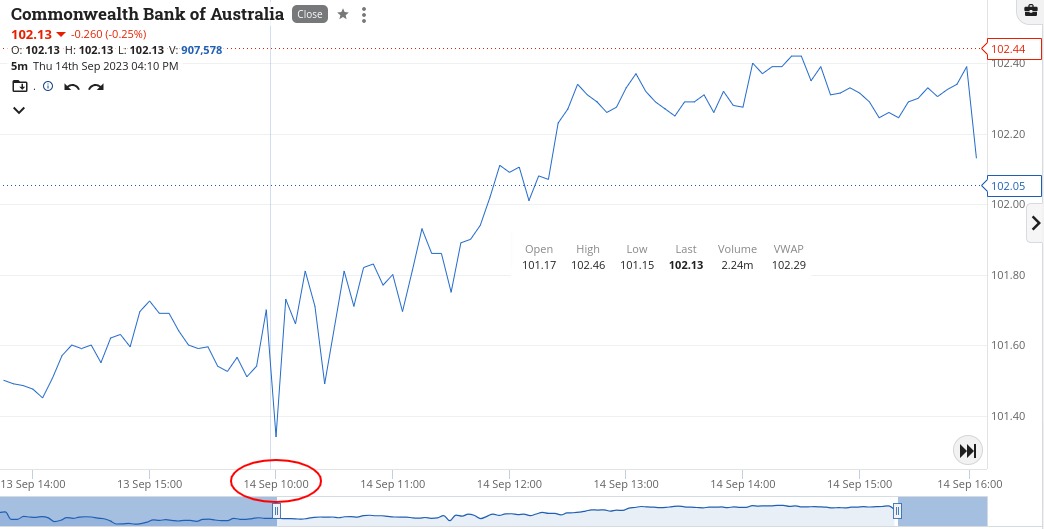

Upped the size a bit today, to see if I could get some profits going, with a smaller turn required. Firstly worked OK in BHP but then went a bit pear-shaped in CBA.

Getting set at almost $1.00 below their day’s high I thought was a shoo-in, but they still had another 47c to fill before they came back to reach my in level.

They then finished the day at 60c higher than my buy in price. Why a share price like CBA gyrates like that, when there is no news, is beyond me.

Today’s 11.00am trade only kicked off at 11.30am, as you will see from the chart.

Up $545.

Recap

Bought 3,000 BHP @ 43.85

Sold 3,000 BHP @ 43.93 ($225 profit)

Bought 2,000 CBA @ 101.52

Sold 2,000 CBA @ 101.68 ($320 profit)

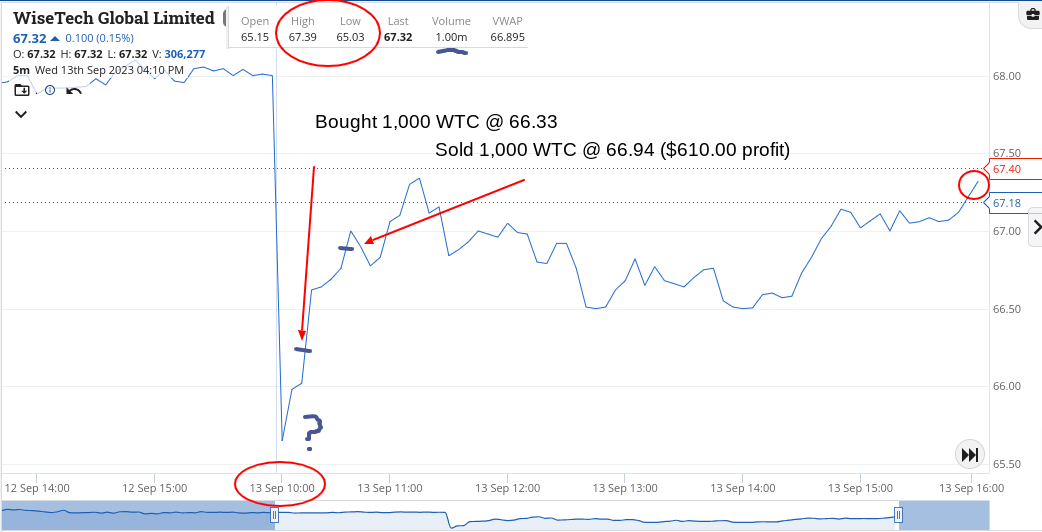

Wednesday September 13

Going by yesterday’s movements, I am expecting the same today, a bit of a sharp movement down midday followed by a recovery.

However, with these thoughts in my mind WTC come out of the traps down $2.00 and within 2 mins of them opening, I’m in, as no news out. Eight mins later I’m out and it’s all happened in the first 10 mins of their opening.

Now I’m back to waiting as planned and a bit shell-shocked at what just happened to my ‘day ahead strategy’.

It feels like I am waiting around for my bus to arrive and eventually does around 11.30am. This meant I had jumped on the CBA express and I didn’t get off till around 12.45pm.

Wait around for the next bus which just happens to be BHP and I ride it all the way home, which turns out to be a mistake. Should have got off a few stops earlier, I tell myself at 4.10pm.

Up $850, thanks mainly to WTC, who’s last trade was at $67.32, which was 7c off their day’s high.

Recap

Bought 1,000 WTC @ 66.33

Sold 1,000 WTC @ 66.94 ($610 profit)

Bought 1,000 CBA @ 101.11

Sold 1,000 CBA @ 101.42 ($310 profit)

Bought 1,000 BHP @ 43.87

Sold 1,000 BHP @ 43.80 ($70 loss)

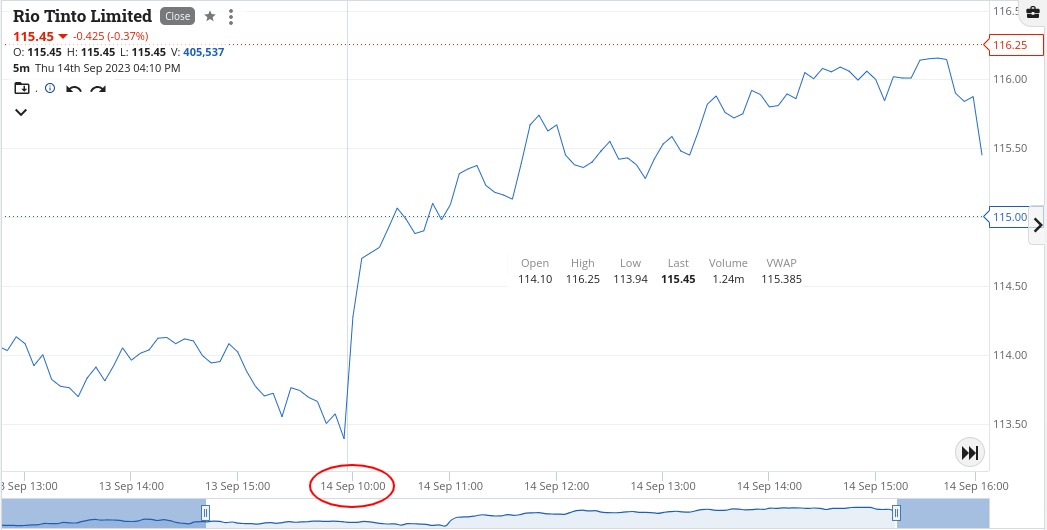

Thursday September 14

Everything on my watch list opens up okay and then as the day goes on, they all get stronger and stronger.

The only one showing red was WTC, so that became my one and only trade of the day as unlike the previous two days, there weren’t any falls before recovery kicked in.

Up $360 but today didn’t suit my trading style as all of the bottoms came out at the beginning of the day. RIOs, who touched $110.71 on Monday, today reached $116.25!

Recap

Bought 1,000 WTC @ 67.03

Sold 1,000 WTC @ 67.39 ($360 profit)

Friday September 15

For me it’s going to be one of those days. Super strength overnight in BHP and RIOs, means they are going to come screaming out of the car park, with their wheels screeching and leaving me in a fog of burnt rubber.

Not fingers but rubber.

Though today I have a cunning plan.

Pick up some BHP as fast as I can and wait for RIOs to open 8 mins later, as I think they will be stronger than everyone expects.

Then sell the BHP as it gets pulled up by RIO’s strength.

It goes to plan and I manage to get a result on a day where normally I would be struggling to find a trade.

My whole watch page bathes me in a sea of blue and not one speck of red. The only spec of red will be at the bottom of my wine glass tonight.

RIOs were $110.71 on Monday and today they reached a high of $120.11. Far out!

Up $600 today, which brings the week to plus $3045 gross or $2,739.

If I could go back in time, I could have just held the RIOs from Monday till today and made $9,000, though that would have left me with a very bland diary journal.

The things I do for my readers!

Recap

Bought 2,000 BHP @ 45.27

Sold 2,000 BHP @ 45.57 ($600 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.