Confessions of a Day Trader: How to profit from a trip to the hardware store

(Pic: Getty)

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday 5th July

OMG! What a slow day today. It was like being on a gondola rather than a jet ski today. Small volumes, things drifting, waiting and waiting.

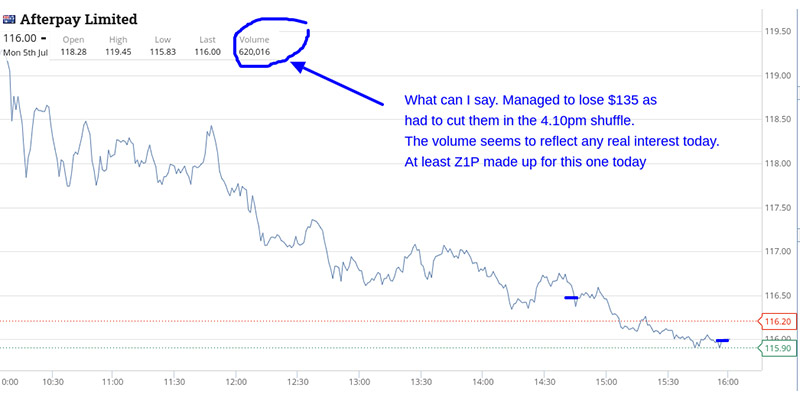

Z1P were in a foul mood and made a quick 2c turn on 5,000 just after lunch and then they fell from 7.40 to 7.34, so just had to have another go and managed a 3c turn. Lost money on APT. See the graph for their volume and no bounce, so had to cut them.

Did OK out of CBA and BHP today and didn’t require any doubling down for a change. CBA took ages to fall below $99.00, and I’d learned to wait for that after getting a bit slapped around last week. All up +$440 on the day, even after taking the loss on APT.

Tuesday 6th July

Wall Street closed overnight, so nothing to lead us this morning, though Europe was a touch higher.

CBA started out as the star of the day for me. Buy 1,000 at $99.66, 30c off its high and sell them at $99.77 into a rally, which then fizzles out.

Manage to buy 1,000 at $99.50 on way down and then another 1,000 at $99.25. Again sell into a rally at $99.49 and then the get whacked straight through from $99.37 to $98.73, bang.

Just had to buy some and wait for the bounce but it never came, so ended up buying 2,000 at 98.79 and then cutting them at the same level with 1 min to go.

So make $330 gross on CBA but costs me $200 in brokerage. On a happier note, I managed to claw back $99 from yesterday’s loss of $135 on APT.

Had a go at FMG but lost $20, having waited all day to buy some. All up +$389 gross for the day. Trading volumes seem to have the COVID wobbles.

Wednesday 7th July

Come into the day with the news that NSW COVID lockdown will get extended by a week, so I’m expecting funny volumes and movements again today.

Let’s hope that we get some good rallies at some point and not constant selling, like in FMG.

Pick up 1,000 CHN at $7.59 and sell them at $7.67 for a very quick $80 profit. FMG get down to $23.11 and manage to buy 2500 at $23.12. Half-hour later, out they go at $23.20 on a rally, which just continues to $23.50.

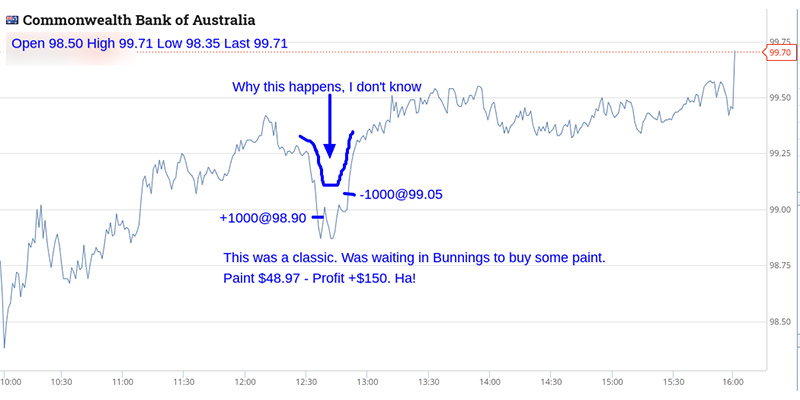

But the best one was me waiting at Bunnings to get some paint matched and it took them 10 mins to find the right bloke.

Whilst waiting, check my phone and see that CBA are tumbling. I buy 1,000 at $98.90 and sell them at $99.05 whilst the paint tin is being spun around. Make three times what the paint cost me. Happy days. All up +$430 for the day.

Thursday 8th July

Have to fit in my trading around a midday appointment today. Nothing happening before then for me to trade and I get to the appointment an hour early and find a park (because it took me 25 minutes last time).

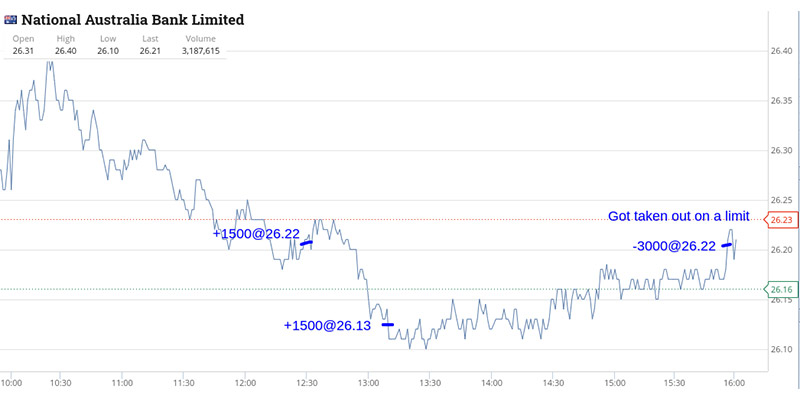

So I sit in the car listening to music and looking at stocks. In one trigger happy moment, I buy 1,500 BHP at $49.65, 1,500 NAB at $26.22, 1,000 CHN at 7.78 and 1,000 CBA at $99.60.

Waiting in the line, I double down on another 1,500 BHP at $49.46, another 1,000 CBA at $99.39 and 1,500 NAB at $26.13, Sell the CHN at $7.81 (+$35) and then the 3,000 BHP at $49.63 (+$225), then the CBA at $99.61 (+$230) and finally the NAB on a limit while I’m driving home at $26.22 (+$135). Profit for the day is $625.

TGIF 9th July

I start the trading day off by buying some CBA, CHN and APT just after 11.30am. Do OK on the CBA -in at $97.89 for 2,000 and out at $98.02.

CHN have to double down on twice. In at $7.41 for 1,000, then $7.34 for 2,000 and finally 3,000 at $7.29. Out they go, all 6000 at 7.35, after taking some pain before the gain!

APT came in at 300 for $117.69, then another 300 at $116.37 before I cut them at $116.94 after they never really break out strong enough above $117.

I lose $135 which is just what I had made by buying 1500 BHP at $49.20 and selling them at $49.29. So down brokerage on the two trades. This annoys me a bit, so buy CBA again to try and make up my brokerage.

2,000 CBA shares in at $97.90 and out at $97.99. 30 minutes later, in for another 2,000 but this time at $97.87. Sell them at $97.94.

In between I manage to buy 1,500 NAB at $25.87 and sell them at $25.90, which is not a big profit but it will do. Both CBA and NAB take off just before the close (see graphs). I even manage to make $40 on some CSR, who were the biggest faller of the day. All up plus $825 gross.

For the week, I make $2,709 gross and $1,817 net, after brokerage of $892. Best trade for me was the CBA at Bunnings on Wednesay, and worst was my APT on Friday.

Now off to do some painting.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.