Confessions of a Day Trader: How to make $10,000 a day pumping iron

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

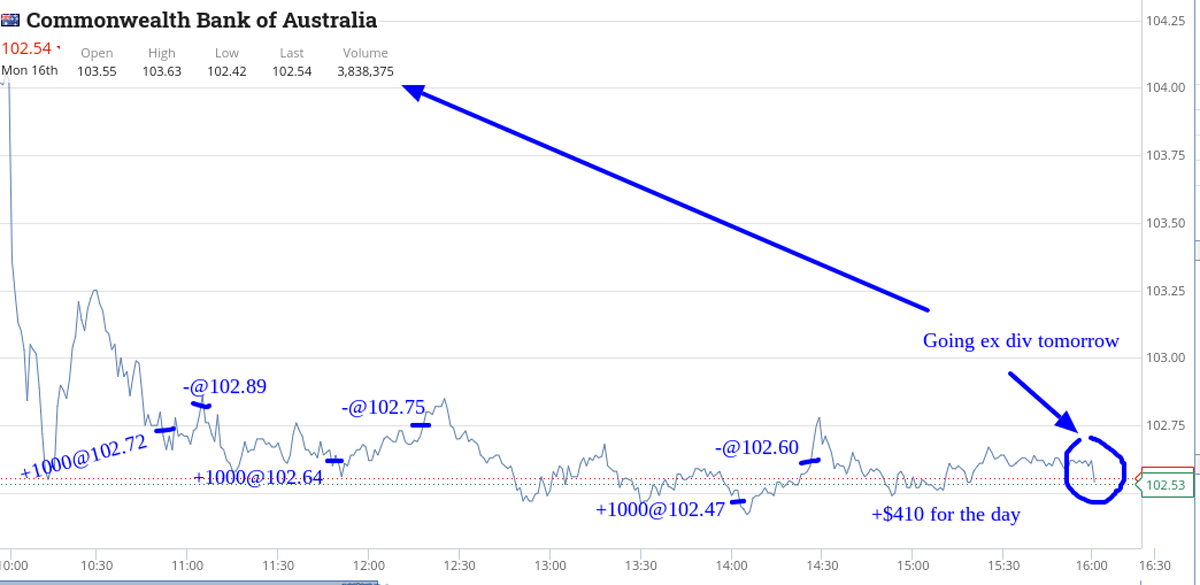

Monday August 16

In lockdown means that I slept in till about 10.45am, without feeling guilty as I’m sure I am not the only one. Make me a coffee and settle in.

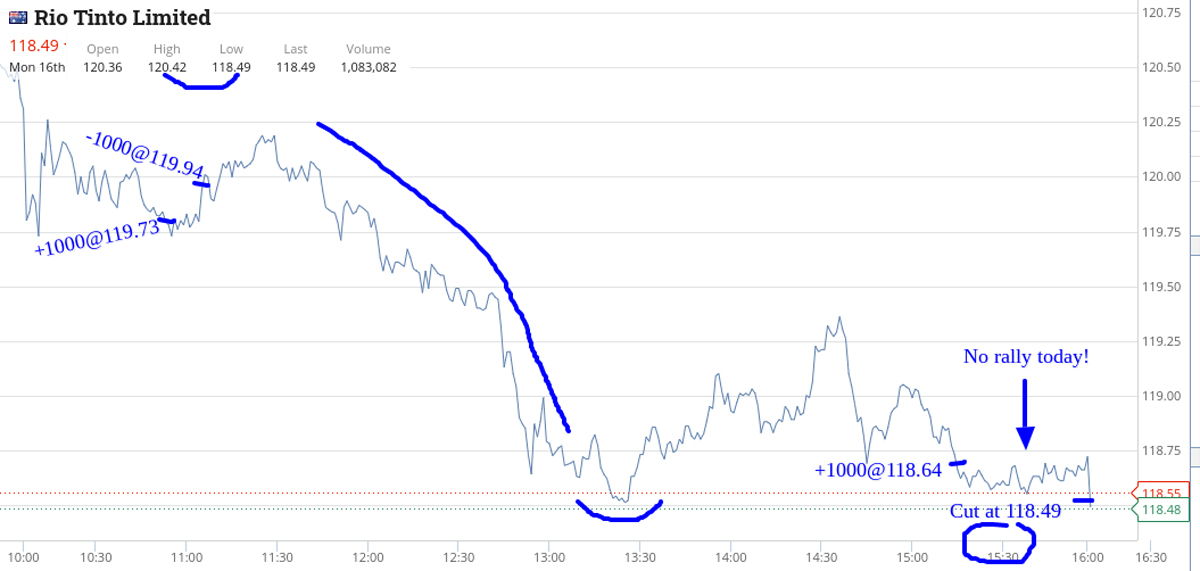

Big faller, down 9% is Bendigo Bank (ASX:BEN). Study them for a bit and buy 2000 at $10.15. They are down from $10.85. Next buy 1000 RIO at $119.73 and then 1000 CBA at $102.72.

Out go the RIOs first at $119.94 (+$210) and then the CBA at $102.89 (+$170) and then finally the big BEN go out at $10.19 (+$80) and all thanks to 11.00-ish rallies.

Now what to do? RIO keep on partying upwards but CBA and BEN are not joining in. Pick up 1000 CBA at $102.64 and 2000 BEN at $1.09.

Sell the CBA at $102.75 (+$110) and then back in for 1000 at $102.47, 45 minutes later. BEN not behaving themselves, so buy another 2000 at $10.04.

Sell the CBA at $102.60 (+$130) and then the 4000 BEN at $10.09 (+$100) and then I go in for a RIO rally.

Buy 1000 RIOs at $118.64 just before 3.30pm and wait for their rally. Last three trading sessions had the 3.30pm horn but of course today, no.

Cut them at $118.49 and book a $150 loss and with brokerage I basically make nothing on them for the day.

That’ll teach me! Overall up $650, thanks mainly to CBA.

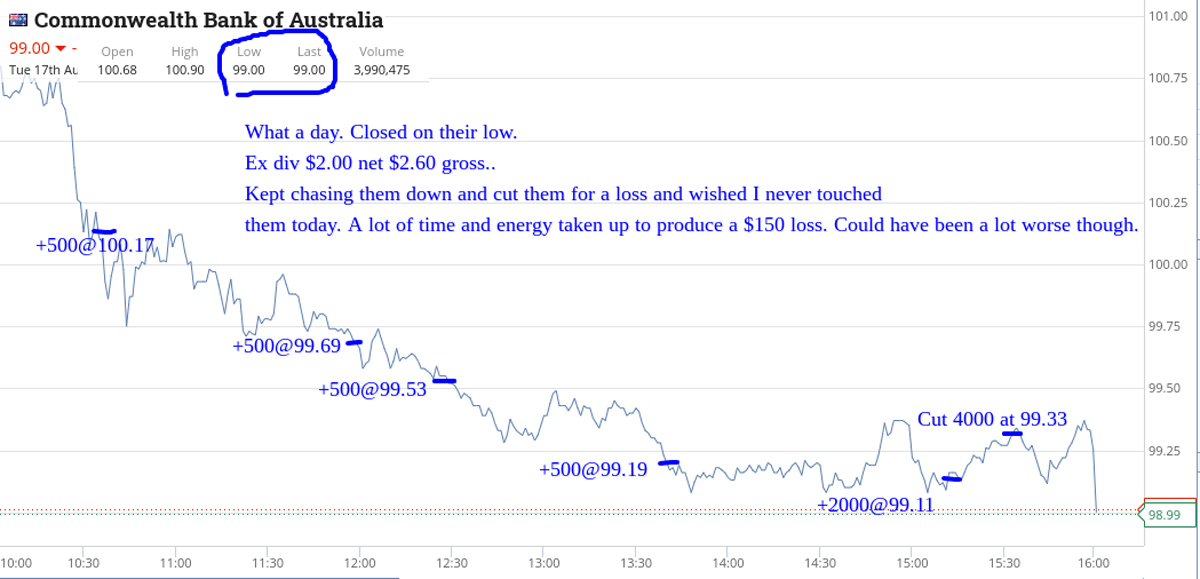

Tuesday August 17

CBA are ex div today and yesterday they closed at $102.54. Div is $2.00 per share and is 100% fully franked at 30% tax rate, so gross div is $2.60.

Should open up around the $99.96 level. They actually open at $100.66 and my first punt of the day is to dip my toes in and buy 500 at $100.17. Then buy 2000 BEN below $10.00 at $9.90. Add another 500 CBA at 99.69.

Buy 2000 BHP at $51.29 and top up BEN by buying another 2000 at $9.84.

CBA still falling.

Buy another 500 CBA at 99.53 just before selling the 2000 BHP at $51.41 (+$240). That’s seven trades so far today and my first profit.

Everything starting to glow red on my watch list. Time is 11.54am.

Add another 4000 BEN to my holding at $9.79, buy 1000 RIO at $117.29 and yet another 500 CBA at $99.19!

Have to go out, so stick a limit on BEN at $9.85, which gets hit 2.13pm. RIO now looking as sick as CBA.

Mull a few things over in my mind then buy 4000 RIO at $116.45 and buy 2000 CBA at $99.11. Sell the 5000 RIO at $116.75 (+$660) and switch into 5000 FMG at $21.61.

All getting a bit much, as the day is coming to a close. Cut the 4000 CBA at $99.33 (-$190) and the FMG at $21.61 (+$0).

It was a horrible day today and CBA really disappointed me. Plus $890 gross for the day with brokerage coming in at $506 from a total of 17 trades.

Lots of pain and not much gain! Open an expensive red… that matches the colour of my watch list.

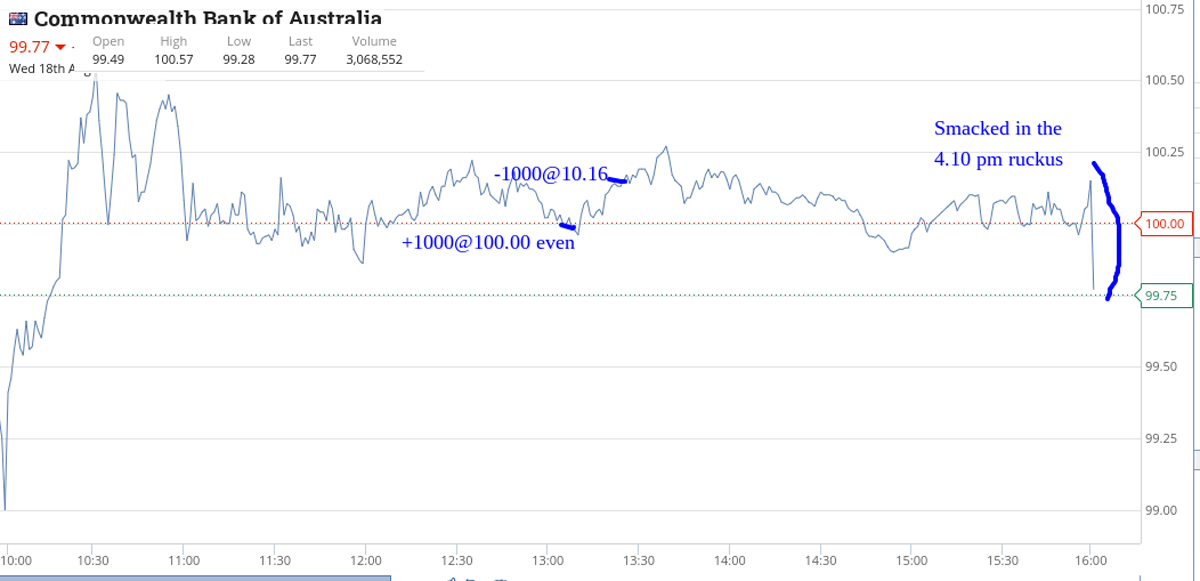

Wednesday August 18

BHP are down 9.3% in NY trading, thus setting the tone for today. Have my hard hat on and expecting plenty of red. Will be interesting around 11.00am for both CBA and BHP.

Well what a day. BHP is the star of the day but for all the wrong reasons. Over 2m shares go through in the first minute of trading and by the end of the day they are down 7% for the day on 25m shares.

I had a go in them but lost the battle. See chart. Down $685 on them but up $1,160 total for the day.

Managed to buy 1000 APT at $130.59 and sell them for $130.90 (+$310), as I worked out that with the A$ falling overnight and as Square shares are priced in US$, then APT should hold steady, unlike BHP and CBA.

Made a quick $100 on the opening in CHN. In for 1000 at $6.10 and out at $6.15. For some reason they were down 5% and finish the day in the $6.30s.

Do well in RIOs but I make a mistake in leaving a limit sell, which left me long of 1000. See chart.

Lost a bit of concentration, which gives me some grief before I come out smelling of roses.

My love affair continues as I make $1,275 out of them. First purchase was at $115.26 and last sale was at $114.69. They have a $2.60 range over the day and close at $113.69.

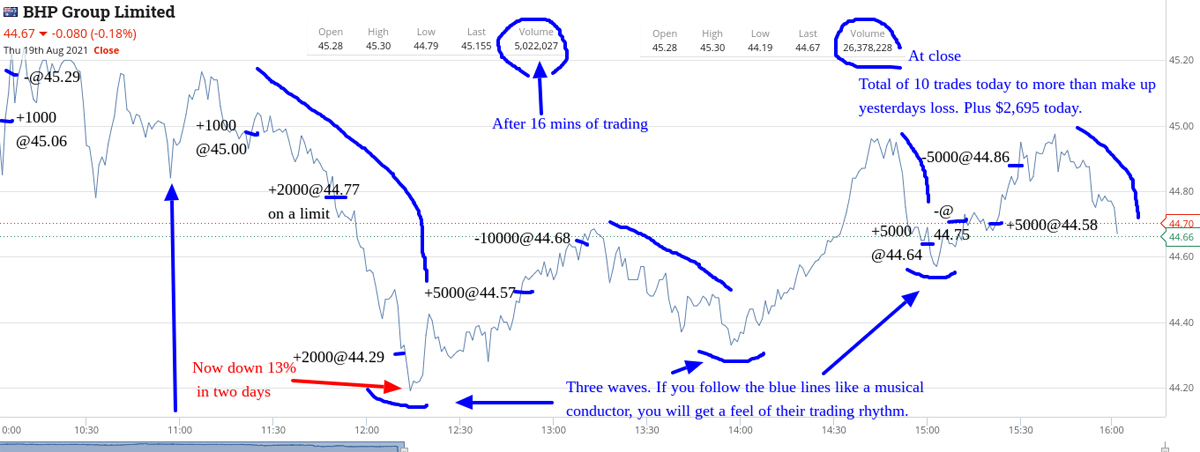

Thursday August 19

Today turns out to be a magical day for me, with 21 trades in total in BHP, RIO and FMG. At some point today both BHP and RIO were down around 13% from Tuesday’s closes.

Up $10,490 for the day and make up much more out of BHP than yesterday’s $685 loss.

Have marked up the graphs with all of the trades. RIO fell below $107, twice today.

They were $118.49 on Monday’s close and BHP traded below $45.00. They closed at $51.33 on Tuesday.

Friday is going to be interesting in these three stocks, as we head towards the end of the trading week.

Around 12.30pm I will be taking a hard look and expect them to open on Monday higher than their Friday close.

Friday August 20

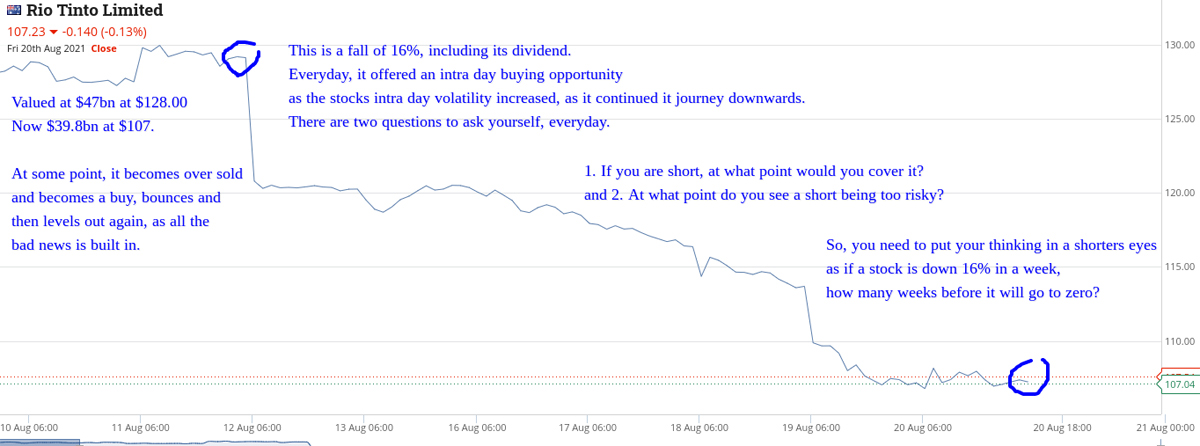

So for the week, up $13,190 gross and $10,782 net and take a day off.

I have included a couple of snapshots of RIO and BHP from over the last week or so. I know if I do any trading today, I would more than likely give back a couple of grand.

The thing is the market will offer opportunities every day and you need not feel guilty because a day away from the screen means you are missing potential trades.

When you have low minimum brokerage costs and live and direct through trading, the intraday swings are only going to get bigger, as more less experienced players become involved.

You shouldn’t look at the headline capital I generate but at the capital involved. If you have $50,000 or $5m to play with, you just need to adjust your trading size down and concentrate on fewer companies.

Trading forums are full of holders moaning about losing or suspended positions after they appear to chase the ‘10 bagger’ dream or the latest hot sector.

Just remember that day trading is all about protecting your capital whilst trying to make it work harder for you and no matter how much you study graphs or paper trading, you will only really learn by doing the actual thing.

Cheers and here’s to Monday’s trading.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.