Confessions of a Day Trader: How low can they go? How about… lower?

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday October 11

Up early as the excitement of COVID freedom day is in the air. The excitement got to me a bit and after APT open at $120 and fall towards $118.30 early on, (down from $122.00 on Friday’s close), I decide to bag 1000 at $118.31.

SGR are down 20% after a newspaper money laundering story. Five more days of falling 20% and they will disappear, I think to myself. Buy 1500 at $3.43.

Now 10.30am.

So the market has only been going 30 mins but feels like two hours to me, which is affecting thinking. Been up too early waiting for the opening.

Have to buy another 1000 APT at $117.97, just before selling the SGR at $3.54 (+$165) and then watch APT head towards $117.50.

It’s 10.45am.

Buy another 1000 at $117.60 and think how low can they go? That’s down $4.50 on Friday’s close.

Keep staring and not blinking.

Down about $1600, so decide to distract myself for a bit and get the hoover out and whizz around the place with it and sit back down, 8 mins later, to a rally.

Sell the 3000 APT at $118.51 and close the laptop and walk away up $1650 plus the $165 on SGR.

The hardest thing in trading is to sit on your hands and do nothing (even more so when you are publishing your trades) but being up $1,815 before 11am, there is nothing more to do than only give some back.

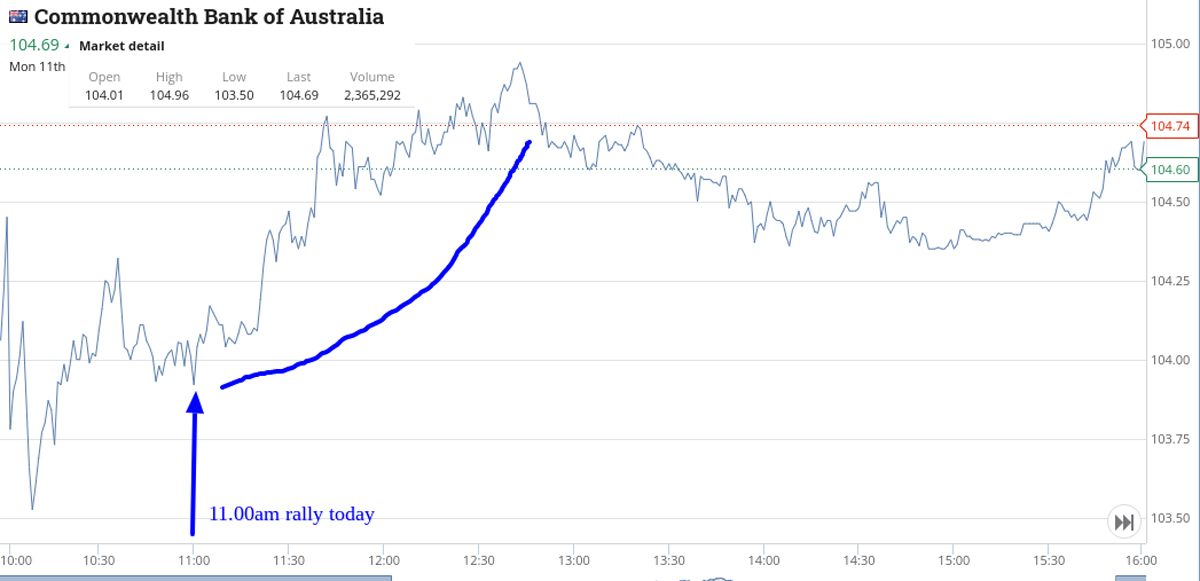

CBA, RIO and FMG all rally at 11am, so have also added their charts. Weather s..t and only one vax so far, so I can’t go anywhere to celebrate, not even the beach.

Tuesday October 12

Not much lead from overnight, so wait till 11am before opening the wallet. Buy 1500 SGR at $3.24 and 1000 PXA (down 4% plus) at $15.21.

WBC announced a $1.3bn writedown pre-market and buy 1000 at $25.85, thinking must be built in by now at 11.30am. Well, got that wrong as had to buy another 1000 at $25.59, as they keep drifting.

Then notice FMG below yesterday’s support level of $15 and buy 2000 at $14.85. Also buy 2000 Z1P on a devil’s limit of $6.66.

Doing OK in FMG and have a $14.97 limit on them when flirting around $14.92, then they crash very fast, so buy another 2000 at $14.78. They recover almost as quick and make my first sale of the day – out go 4000 FMG at $14.92 (+$420).

Buy another 2000 WBC at $25.54 and then 1000 APT at $114.37. Finally another sale, this time PXA. Sell the 1000 at $15.32 (+$110).

Decide to cut the 4000 WBC at $25.54 (-$195 see chart) and sell the 1000 APT at $114.58 (+$210) to cover it off.

Then FMG have another quick fall, so back in for 4000 at $14.73. Have to cut the Z1P at $6.62 (-$80) and the SGR at $3.20 (-$60) and then sell the FMG at $14.75 (+$80).

So, all up plus $485 gross with four wins and three losses and out of my 10 stocks on my watch list eight close in the red.

Wednesday October 13

At 50am, AFR calling the market slightly higher. I have to go for another eye check today, before the market opens, but not expecting too much to happen on hump day.

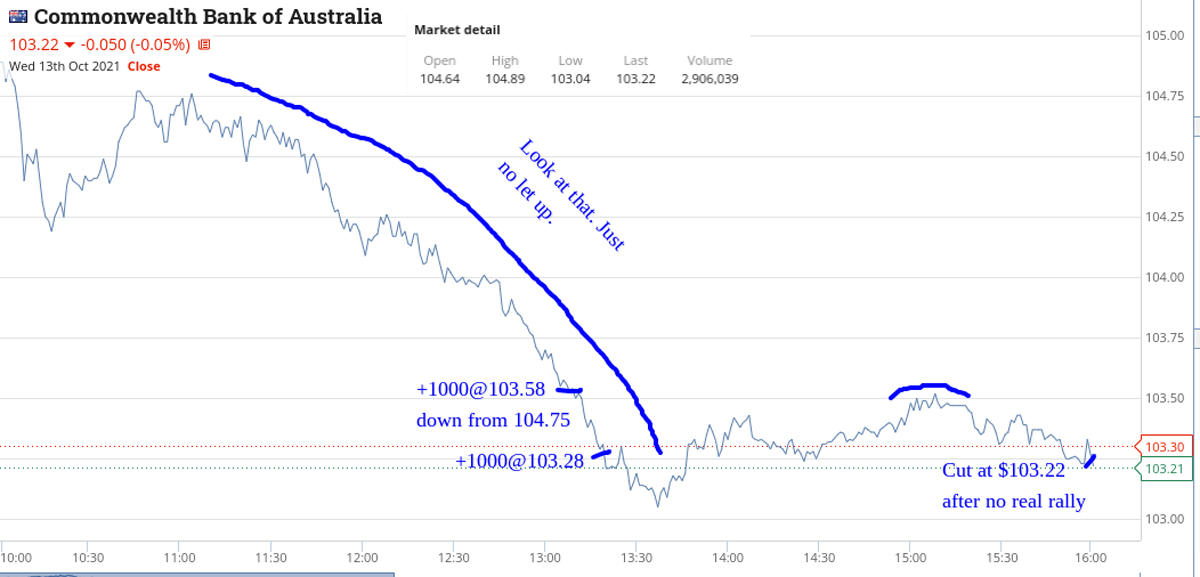

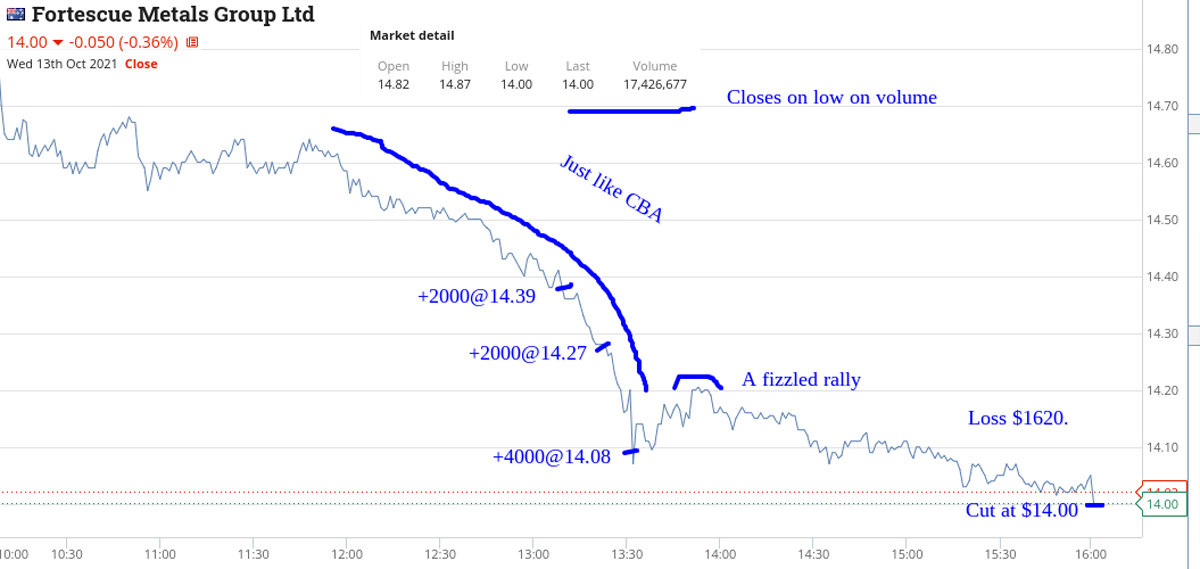

Turns out that today was brutal, absolutely brutal. Managed to lose $2130 today out of four stocks. One profit and three losses, with FMG causing the most pain.

Made $140 from buying 2000 BOQ at $9.13 and selling them at $9.20 for plus $140. Then it all went downhill from here. I have added a chart on APT. Didn’t trade them but they tell the story. See how they closed. Awful.

Smallest loss was $230 on trading 500 RIOs. Bought 500 at $99.38 and sold at 4.10pm at $99.37. Then next was a loss of $420 on CBA. Bought 1000 at $103.58 and 1000 at $103.28 and sold them all at $103.22 at 4.10pm.

And finally FMG. Bought 2000 at $14.39, 2000 at $14.27 and then 4000 at $14.08 and had to cut them at $14.00 for a loss of $1620.

Nothing bounced today and unlike other days, a bit of doubling down only made it worse. Every time you thought they had reached a bottom, they would fall more. You have to see the charts. So, overall up $170 for the week so far.

All that effort and pain, for hardly any gain! Will try and get back on the horse tomorrow but confidence is at a bit of a low.

Thursday October 14

Dust myself off and get straight back on the horse early and buy 1000 CBA at below $103. Buy them at $102.85 and sell them at $103.22 for an early gain of $370.

Then back in at the exact same level for 1000 and again sell them again above $103, at $103.13 for a $280 gain.

Up $650 in just over an hour, so fighting back.

At the time of buying the second lot of CBA below $103, I grab 1500 BHP at below the $38 level.

Buy 1000 at $37.96 and sell them at $38.08 and they never fall below $38 again. Plus $280. Come on!

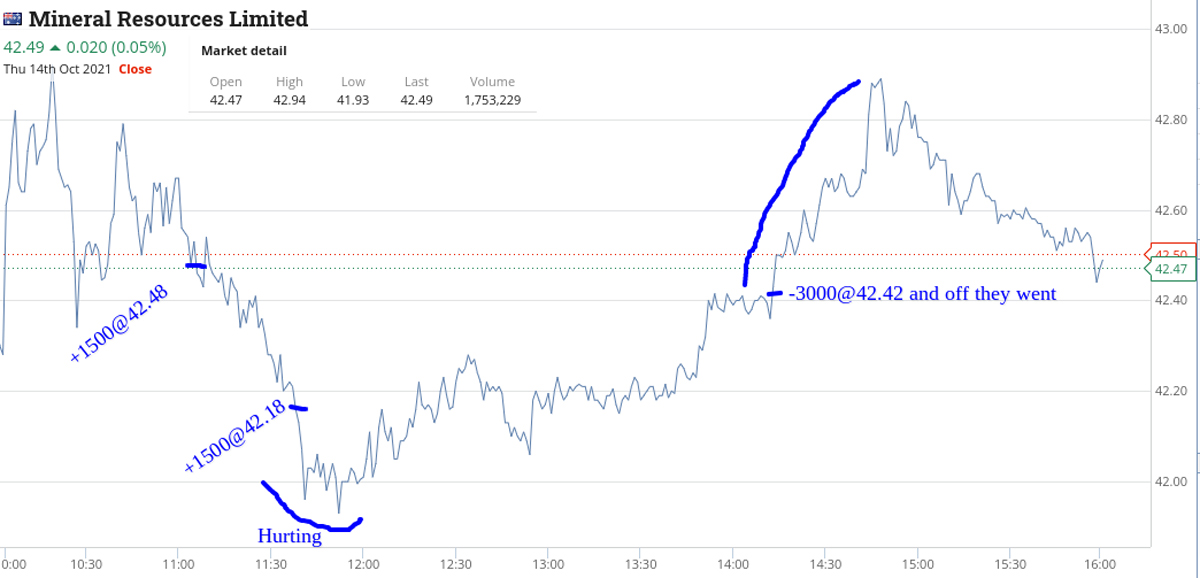

Now, in my mission to make up for yesterday’s losses, I remember that MIN can be a bit of a wild child. Buy 1500 at $42.48. Then back into CBA at again below $103. This time grab 1000 at $102.89.

They both promptly fall and I’m thinking ‘ah McCain, you’ve done it again’ as I know the heavy feeling in my stomach… and watch me start to rack up losses of $1000 or more again.

Buy another 1500 MIN, this time at $42.18 and another 1000 CBA at $102.61. MIN fall below $42.00 and my losses grow above $1500.

Eventually, MIN gradually grow back and I go from a big loss to a gain and out they go at a relieving $42.42 (+$270). From that sale they go up another 40c, so I’ve gone from a loss to a gain and leave $1200 on the table.

Far out, I can’t win and decide to cut the 2000 CBA at $102.62 for a loss of $260, which wipes out my gain in MIN. As soon as I sell them they rally to $102.82, before slowly falling to below $102.62 and then bang.

See graph as they close below $102.

Make back $840 today and seriously thinking of taking tomorrow off, as these profit and loss swings are getting to me mentally and maybe by Monday normality may return.

Friday October 15

I was planning to not do any trading today but CBA just stood out for a trade when I was just taking a sneak peak. They got smacked down 60c in last 25 mins of trading to $101.91 yesterday and today they opened at $102.27.

I bought 500 at $102.07 and then another 500 at $101.92 which is 1c higher than yesterday’s close. Time is 11.05am.

They continue to fall so now buy 2000 at $101.62 (they were above $104 on Wednesday) and finally they start to rally, but then fall back and it is not until 12.36pm that the real rally starts.

They break back through $102 and at 1.20pm, I’m out of 3000 at $102.06 (+$945). From the graph you can see them come back again and then just before 3.30pm, they put in a rally.

The amazing thing for me was that after turning over 1.7m shares they finish just plus 1c for the day and swing 97c from their high to their low.

My thinking today was that a short cover rally would kick in at some point, as it’s Friday and why hold a position ahead of the weekend. The 3.27pm rally underwrote my trading thoughts.

So, after a see-saw of a week, I did come out with a profit of $2005 gross and $1186 net and Friday’s 1c gain for CBA about sums it up for me and my week.

At least COVID restrictions are easing for next week!

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.