Confessions of a Day Trader: Hoist the wet sail, this trader’s coming home!

Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

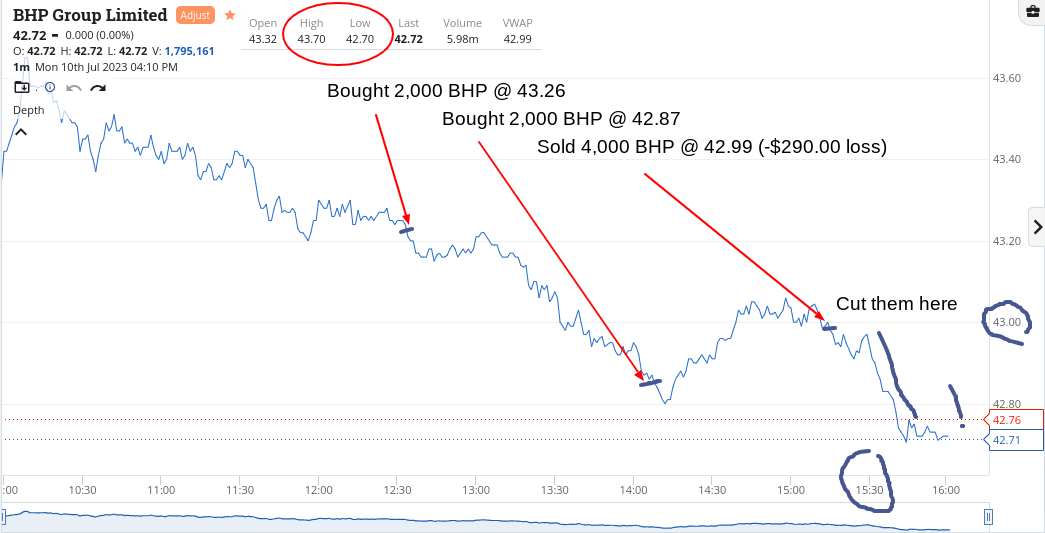

Monday July 10

Well. I wished I had taken today off, just like Friday.

Waited around with some limits on lower down, got hit and had to cut them and then at 3.30pm, things got a bit brutal, so back again with mixed results. The charts really paint the picture.

As I said on Friday, was expecting weakness but have to be careful of what you wish for. Some of the ranges were big today, like RIO’s range of $110.19 to $113.25.

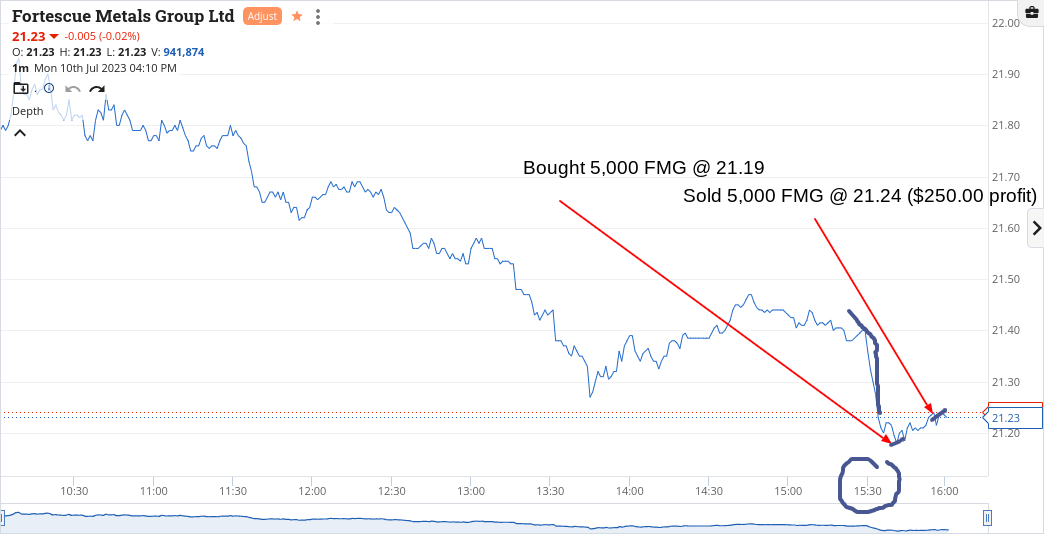

FMG’s range was $21.17 to $21.93 and they were the only one that I got right today. Really like sharp quick falls rather than slowly grinding down and I certainly got ground down today.

Down $170 today.

Recap

Bought 2,000 BHP @ 43.26

Bought 1,000 CBA @ 98.84

Bought 2,000 BHP @ 42.87

Sold 1,000 CBA @ 98.74 ($100 loss)

Sold 4,000 BHP @ 42.99 ($290 loss)

Bought 5,000 FMG @ 21.19

Bought 1,000 CBA @ 98.55

Sold 5,000 FMG @ 21.24 ($250 profit)

Sold 1,000 CBA @ 98.52 ($30 loss)

Tuesday July 11

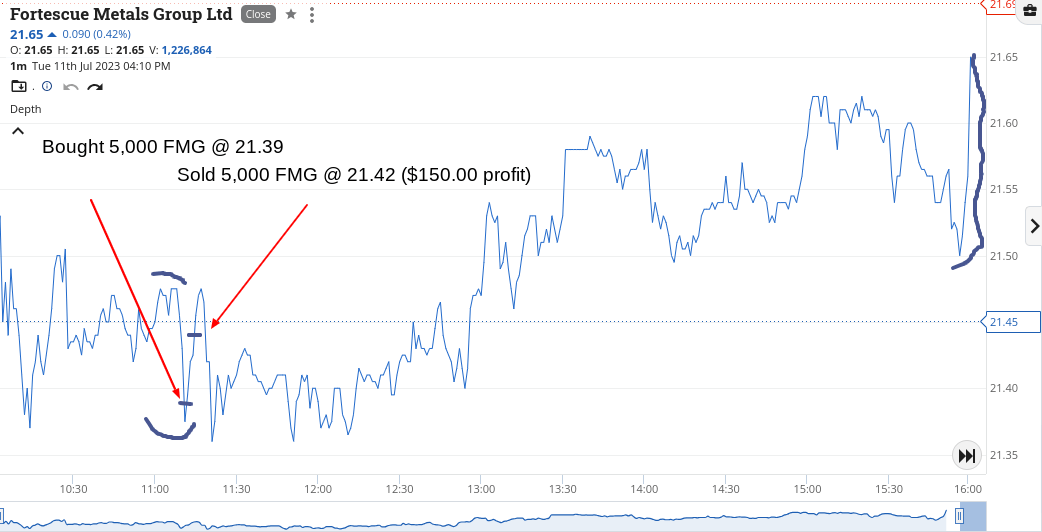

Another agonising day, where ranges and volumes remained small – and no volatility, which means a boring day waiting around for something to happen.

RIO’s range was $1.00 and CBA’s was $1.11 and they traded 1.8m of which 700,000 went through at 4.10pm.

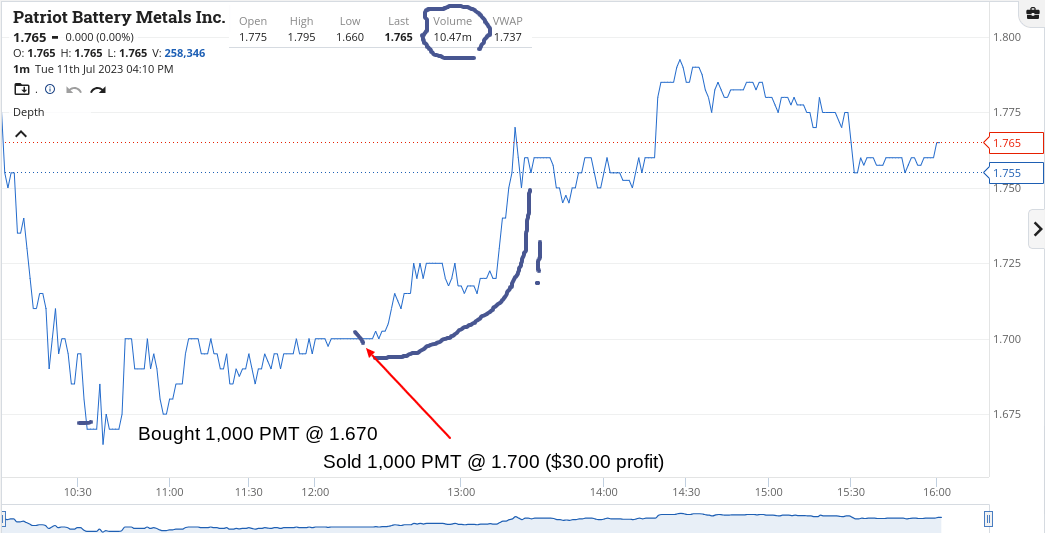

PMT responded to a shorters’ report and I just bought a small parcel to relieve the boredom and also to give me something to watch. Sold them after moving on from FMG.

Funnily enough, just as I added PMT to my watch list was the exact time that FMG took a swan dive. None of the other two, BHP and RIO did the same so, snapped some up and put them on a limit to sell.

Up $180, which makes up for yesterday’s effort.

Now up $10 after two days and 13 trades. Going off to paint something and watch it dry!

Recap

Bought 1,000 PMT @ 1.670

Bought 5,000 FMG @ 21.39

Sold 5,000 FMG @ 21.42 ($150 profit)

Sold 1,000 PMT @ 1.700 ($30 profit)

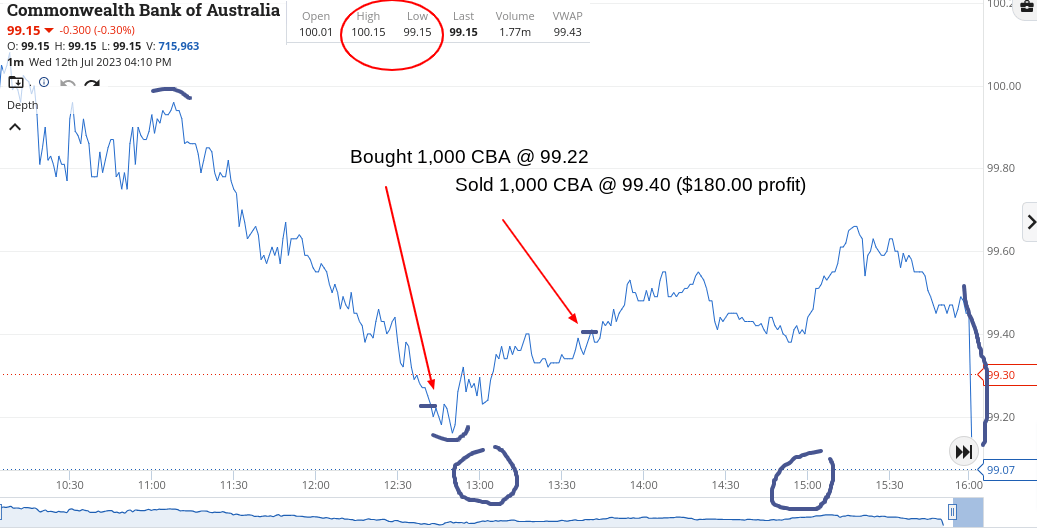

Wednesday July 12

Another day of waiting around, with lower ranges than usual. CBA’s range today was exactly $1.00 – $99.15 to $100.15.

Managed to grab an 18c turn getting in to them just before lunch, but otherwise from that, everything was a waste of time.

RIO’s range was not much better at $1.14 – $112.92 to $114.06 and at their last price of $113.75, they were up $1.84 for the day.

Up $180 for the day and even though that was it, it was not from a lack of trying.

Recap

Bought 1,000 CBA @ 99.22

Sold 1,000 CBA @ 99.40 ($180 profit)

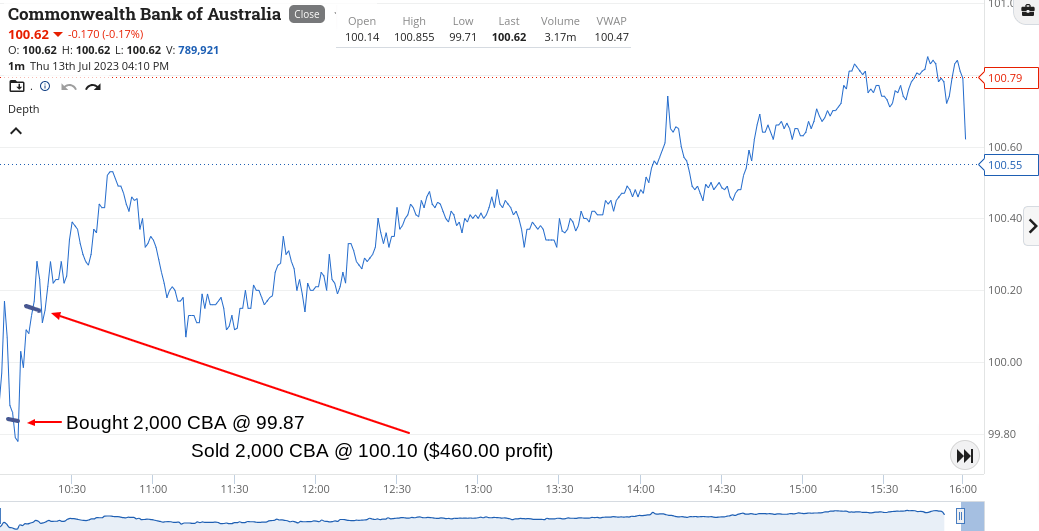

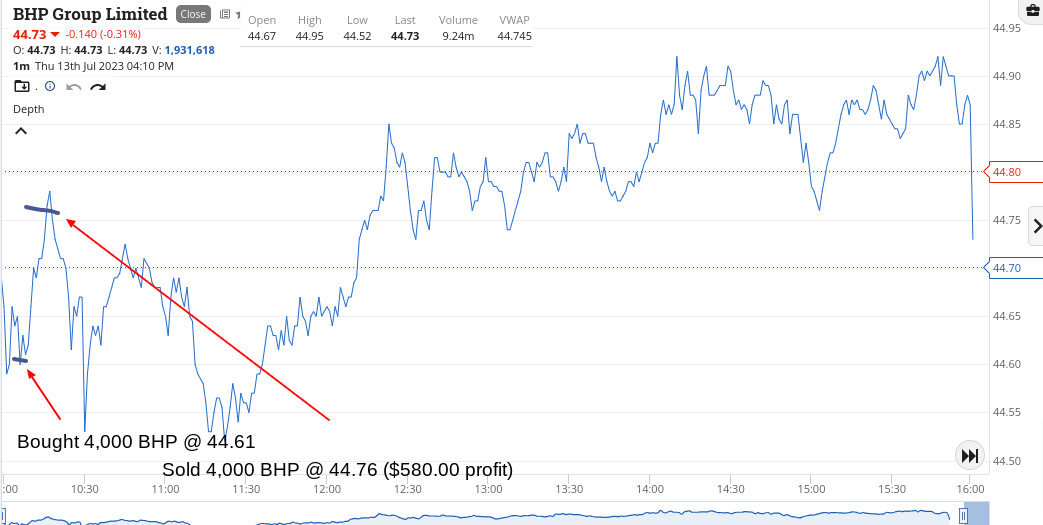

Thursday July 13

Today was like coming back from 40 days and 40 nights out in the wilderness.

Bullish tones coming out of America overnight were leading into a strong market today.

After the last three days, I had put a plan in place for today’s action in my head and was ready for 10.00am.

Ten mins into the market open and I couldn’t believe some of the prices being offered, so I hoovered up what I could at what I thought was the wrong price and put them onto sell at higher limits.

I then closed my phone and put it away for 30 mins in the belief that my gut feeling was correct.

Finished up $1,040 in first 30 mins of trading and then just walked away with a skip in my step. I’m back!

Recap

Bought 2,000 CBA @ 99.87

Bought 4,000 BHP @ 44.61

Sold 2,000 CBA @ 100.10 ($460 profit)

Sold 4,000 BHP @ 44.76 ($580 profit)

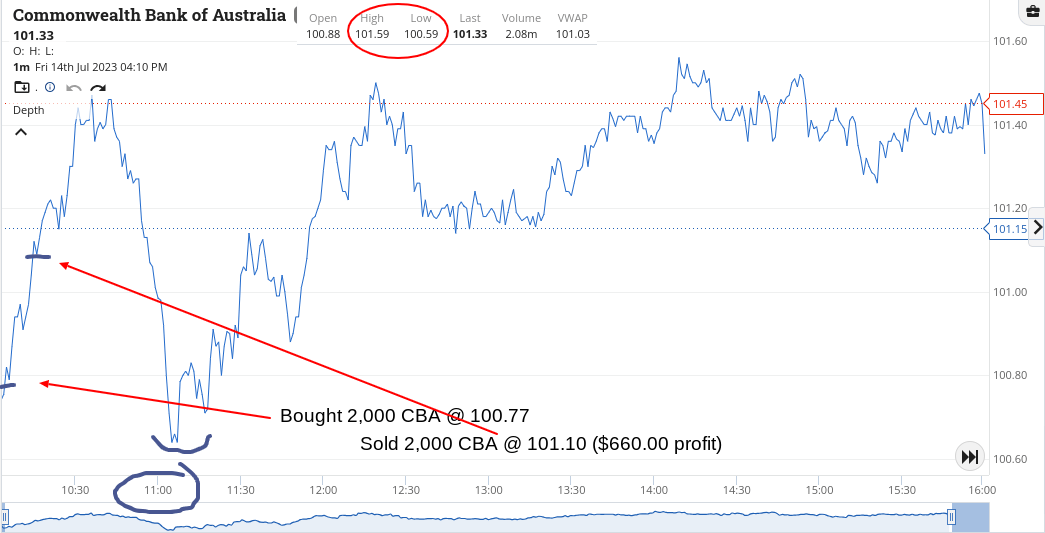

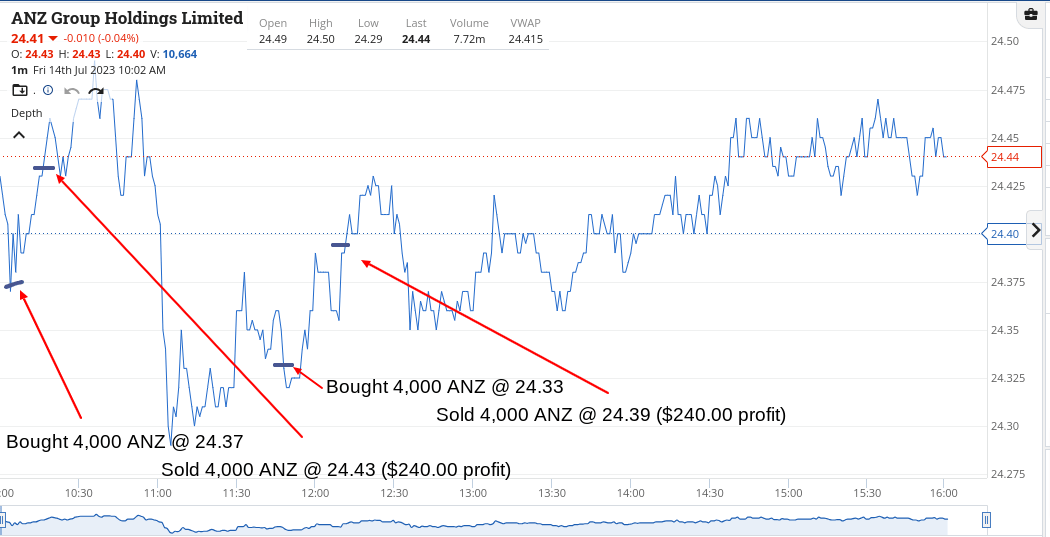

TGIF July 14

Bt some CBA and ANZ very early on and put them on a sell limit.

CBA were sensational at below $101.00 and ANZ gave me two goes at the cherry.

What can I say!

CBA did a classic 11.00am special but I didn’t care and their range for the day was $1.00 exactly

Up $1,140 today and $2,373 for the week which saw one minus day and two days that both only made $180.

Worked out at $1,833 net.

Bit mentally draining this week because of those slower days, so off for a nana nap ahead of the pub.

Recap

Bought 2,000 CBA @ 100.77

Bought 4,000 ANZ @ 24.37

Sold 4,000 ANZ @ 24.43 ($240 profit)

Sold 2,000 CBA @ 101.10 ($660 profit)

Bought 4,000 ANZ @ 24.33

Sold 4,000 ANZ @ 24.39 ($240 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.