Confessions of a Day Trader: Here’s to making your cash work harder

Pic: Getty

Each week Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Wednesday 29th December

I kinda love these holidays, and kinda hate them. Having no screen to entertain my head and being forced to relax is like a ‘ying and yang’ on my brain.

Anyway, today had the usual movers but on lower volumes.

Had to have a tickle in a few, just to get my eye in.

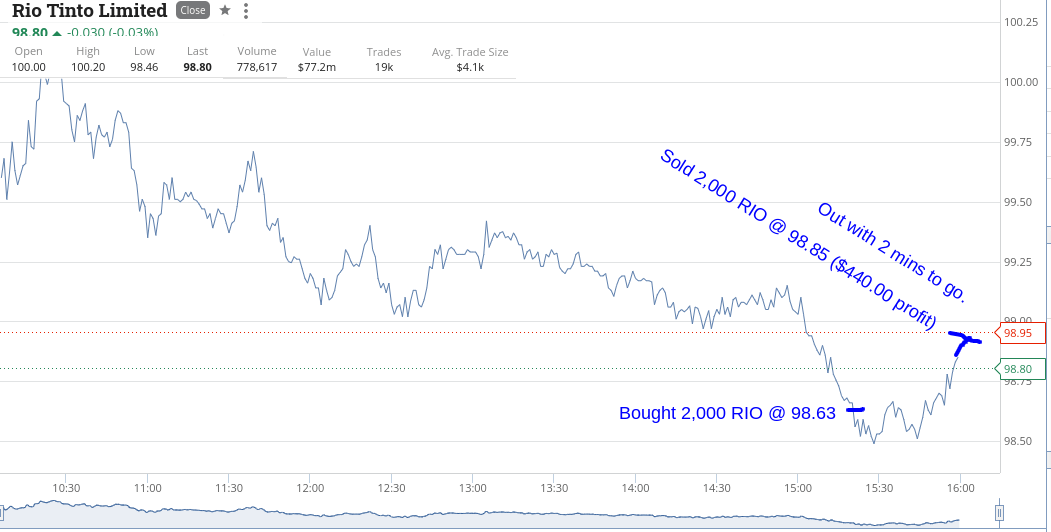

Bought some APT and some NAB and made a smallish gain, but when you see the chart of RIO, you will see why I went in a bit heavier.

Remember, it’s all about trying to make your money work harder for you and stretching it out, hopefully in your favour.

Doesn’t always work but worth giving it a go, rather than just having it sitting there, being lazy.

Up $590 for the day and waiting for open tomorrow, so I can get my trading fix.

Recap:

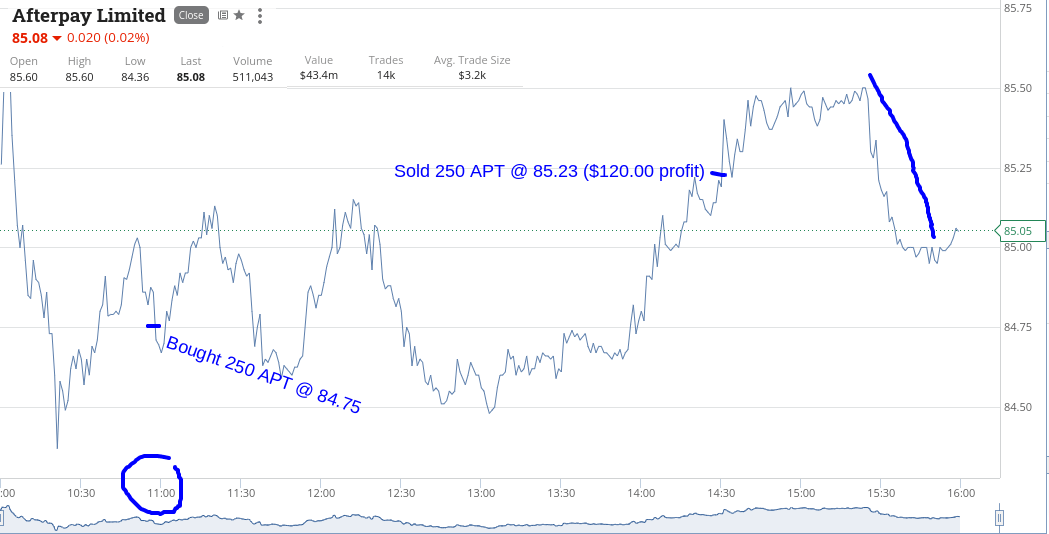

Bought 250 APT @ 84.75

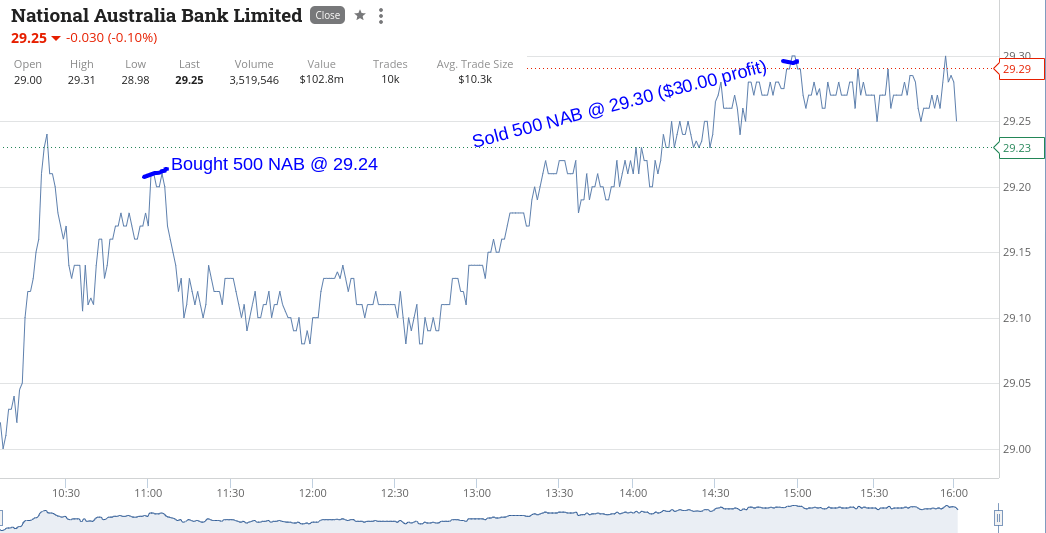

Bought 500 NAB @ 29.24

Sold 250 APT @ 85.23 ($120.00 profit)

Sold 500 NAB @ 29.30 ($30.00 profit)

Bought 2,000 RIO @ 98.63

Sold 2,000 RIO @ 98.85 ($440.00 profit)

Thursday 30th December

Volumes again drying up today.

CBA managed to turnover just over 1m shares and APT managed just over 600,000.

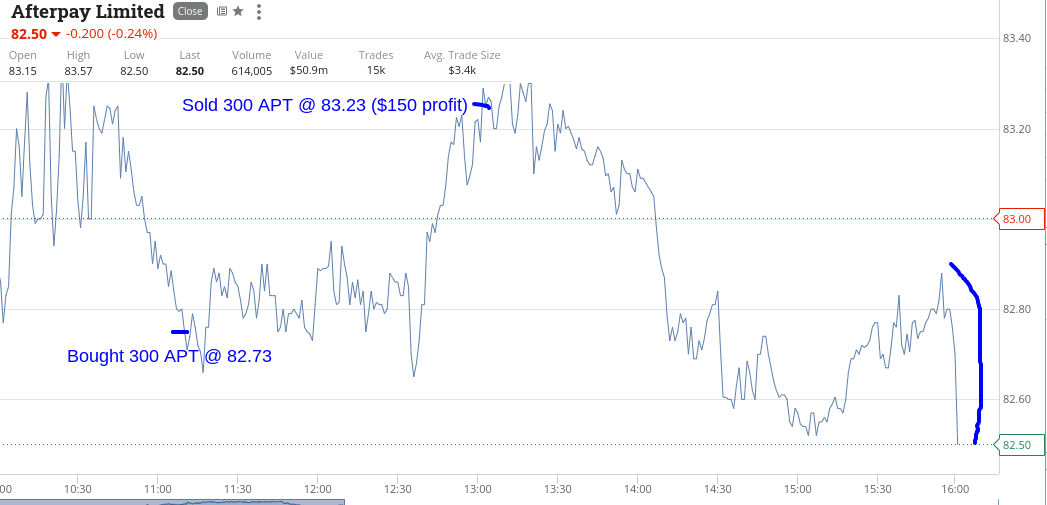

Got in a trade in APT only today and waiting to see how tomorrow will pan out, being the last trading day of the year.

Recap:

Bought 300 APT @ 82.73

Sold 300 APT @ 83.23 ($150 profit)

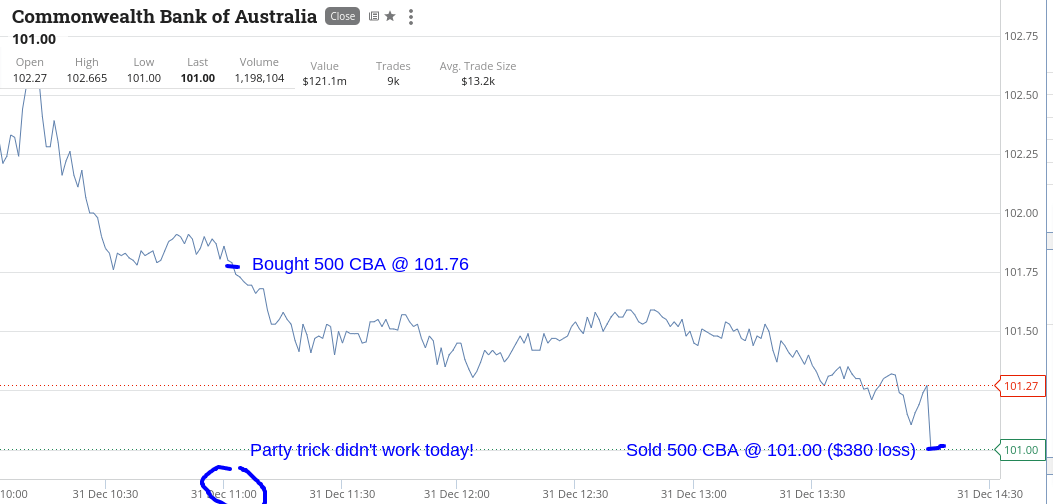

Friday 31st December

Last day of the trading market and shutting at 2.10pm.

A real gamble of a day today, as things can be moved around by the pros and you can get caught in their wake.

Trying to avoid this gets me into rough water and I get treated to the opposite of what I intended.

End the last trading of the year down $380 (plus commission) after having a go at CBA.

Their range for the day was $1.65 on 1.1m shares of which 400,000 went through in the 2.10pm session.

So, the parcel of 500 that I bought, I decided to basically run for the day and have a punt on the close.

Well and truly got my fingers burnt but on the flip side, this is a good omen for my year ahead.

So down $380 today and up $360 for the week, which comes in at $217 net.

Anyway, HNY to everyone and let’s hope we can get on top of COVID in 2022!

Recap:

Bought 500 CBA @ 101.76

Sold 500 CBA @ 101.00 ($380 loss)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.