Confessions of a Day Trader: Here’s cheers to elevenses!

Pic: metamorworks / iStock / Getty Images Plus via Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday March 15

After last Monday’s fright, I decide to take a peek at around 10.15am at my screen and after about 15 mins, my waters don’t give me any inspiration.

I go out for an hour or so and come back to see a few spikes fizzle out in APT and Z1P.

Every time I look at FMG it looks like it’s stuck on one price and if you see the chart, they stay in a 20c range for a few hours. So end the day square! Let’s see what the bond market does overnight.

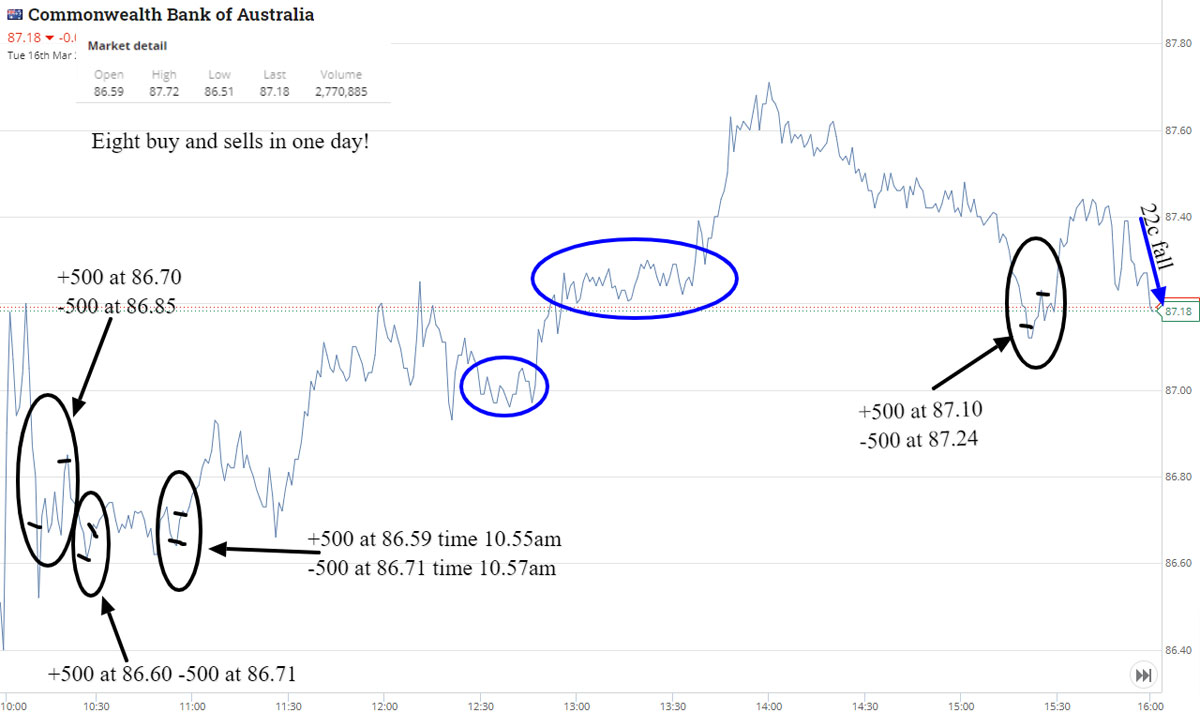

Tuesday March 16

Mmmm… Not much happening overnight and everything on my watchlist opens up in green. Z1P starts off in a 4c range and moves to an 18c range after 45 mins.

I was meant to just sit and watch but can’t help myself. APT hovered around 109.00 and then breaks down. Buy 100 at 108.60. Time is 10.10am. Out 3 mins later at 109.29.

Then see that CBA have broken below 87.00 and at 10.16am, I scoop up 500 for 86.70 each. Five mins later I’m out at 86.85.

Six mins go past and CBA are now 86.60. Buy 500 and sell them at 86.71. Time is 10.30am.

Buy and sell 1000 Z1P for 5c profit before eyeing off FMG at below 20.40. This makes them rally 11c! Have to wait till 11.23am to buy 1000 at 20.34 and they promptly fall to 20.30 before rallying and I manage to sell them for 20.45. Time is 11.36.

Only major blue chip trading down is BHP. See the chart for how I went, day trading them for the very first time. Up A$489 ((before brokerage).

+1000 Z1P at 8.63; -1000 Z1P at 8.68; Profit A$50 (happy to take small ones today)

+100 APT at 108.60; -100 at 109.29; Profit A$69 (was meant to just watch but couldn’t help myself)

+1000 FMG at 20.34; -1000 FMG at 20.45; Profit A$110

+500 CBA at 86.70; -500 at 86.85; +500 CBA at 86.60; -500 at 86.71; +500 CBA at 86.59; -500 at 86.71; Profit A$190 (then they rally above 87.00)

+1000 BHP at 47.155; -1000 at 47.21; +1000 at 47.00; +1000 at 46.90; +2000 at 46.88; -4000 at 46.91; Profit A$35 (brokerage was A$92, so lost overall)

Humpday March 17

Lead us not into temptation, as the saying goes, so stay away till 11.30am and notice BHP trading steadily around 46.10/46.15. Buy 500 at 46.11 and have a limit in to buy another 500 at 45.95. Time is 11.39am.

Have to wait till 1.08pm before I sell at 46.22, having seen me miss out on the other 500 by 2c! So, bit of a wait to bank A$55.

Straight in to buy 500 CBA at 86.60. Have to double down at 86.49. Time is 1.33pm. Six mins later they hit 86.66 (my favourite sixes) and out they go after seeing them hit this level three times.

Z1P get sold down, but APT don’t really on CBA news that it’s going to offer 4m customers a BNPL option. Steer clear. Profit of A$170. Time for a Guinness, to be sure.

+500 CBA at 86.60; +500 at 86.49; -1000 at 86.66; Profit A$115

+500 BHP at 46.11; -500 BHP at 46.22; Profit A$55 (missed them at 45.95)

Thursday March 18

It’s the start of APT four-day sale, so a bit of press. Wait till they fall a bit and then look like they want to rally. Have a figure of 112.00 in my head, so as a rally looks on, buy 100 (only) at 110.38.

Time is 10.55am and eBay have sent me an APT email of offers (all crap) but may raise awareness. I have to wait till almost 2pm before I wave goodbye to them at 112.00. You need to see the chart for the next 90 mins of trading movements.

So, out of APT and into 1000 CBA at 85.88 and move them out at 85.98. Time is 2.03pm.

BHP are next and buy 500 at 45.99 for a move above 46.00, which doesn’t happen. Double down at 45.85. Time is 2.45pm.

They don’t really move my way so cut them at 45.85, having seen them go to 45.90 and fizzle out. Time is 15.21pm and no real volatility in BHP unlike CBA!. Up A$192 for the day having lost A$70 on boring BHP.

+100 APT at 110.38; -100 APT at 112.00; Profit A$162 (won’t be spending this on their crappy sale items)

+1000 CBA at 85.88; -1000 CBA at 85.98; Profit A$100 (still big-ish volatility)

+500 BHP at 45.99 +500 BHP at 45.85; -1000 at 45.85; Loss A$70 (getting boring!)

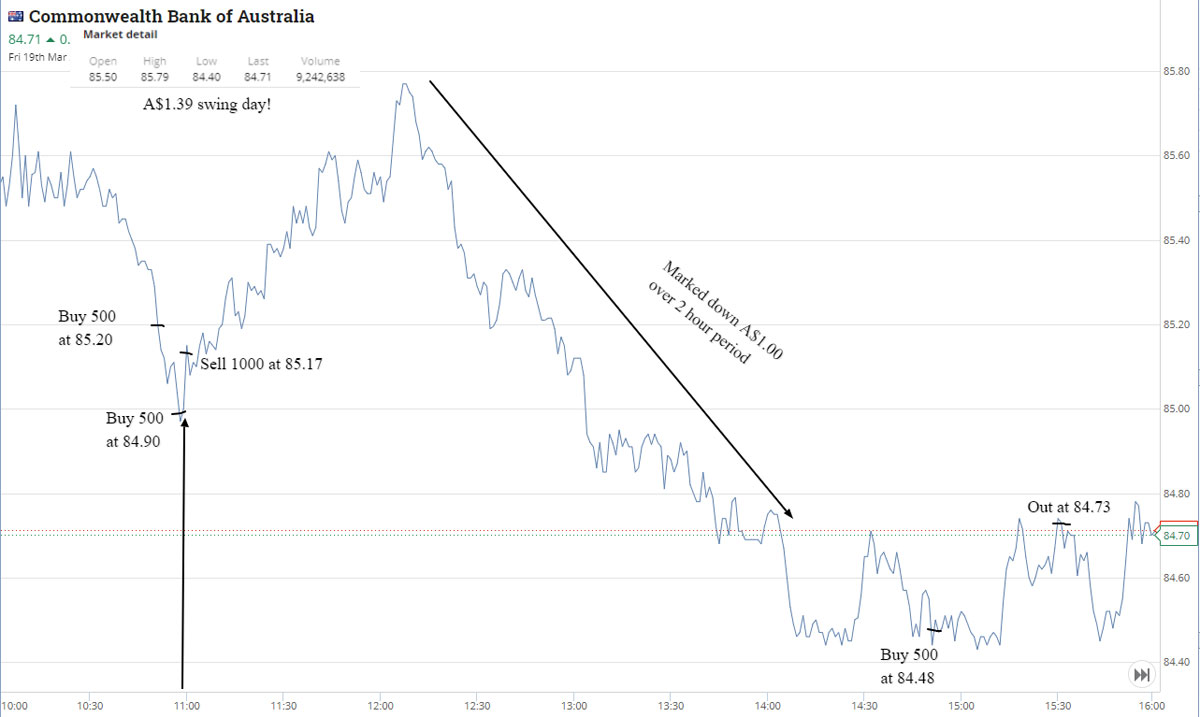

TGIF March 19

Energy prices are down overnight and bond yields ticking up again. I buy some CBA at just before 11.00am at 85.20. Time is 10.52am.

Double down at 84.90. Time 10.58am.

In six minutes they fall 30c to below 85.00 and I think I have made a major mistake. Two mins later I’m out at 85.17. Bang on 11.00am, where they start a major rally, as do BHP and APT. Normally it is after the previous day falls that the after-margin call rally begins, but today they really squeezed down CBA aggressively, so someone was crying somewhere.

Left everything else alone but came back for some more CBA at 3.02pm. Buy 500 at 84.48, which started out at 84.54 but by the time I was about to hit the buy button, they had fallen, 6c. Out at 3.30pm, when the hit 84.73.

All up, made A$245 for the day. Time for a beer.

+500 CBA at 85.20; +500 CBA at 84.90; -1000 CBA at 85.17; +500 CBA at 84.48; -500 CBA at 84.73; Profit A$245

Gross profit for week: A$1096

Less brokerage: A$300

Net profit: A$796

Most satisfying: APT (Thur)

Least satisfying: BHP (Tue)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.