Confessions of a Day Trader: Hell hath no fury like a day trader scorned

Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday May 8

It’s snowing somewhere as it’s bloody freezing today.

Market though should be a bit warmer after some good gains on Friday night in America.

On que, CBA open up at $97.00 compared to their close on Friday of $96.13. They reach a day’s high of $97.54 before closing at $97.12.

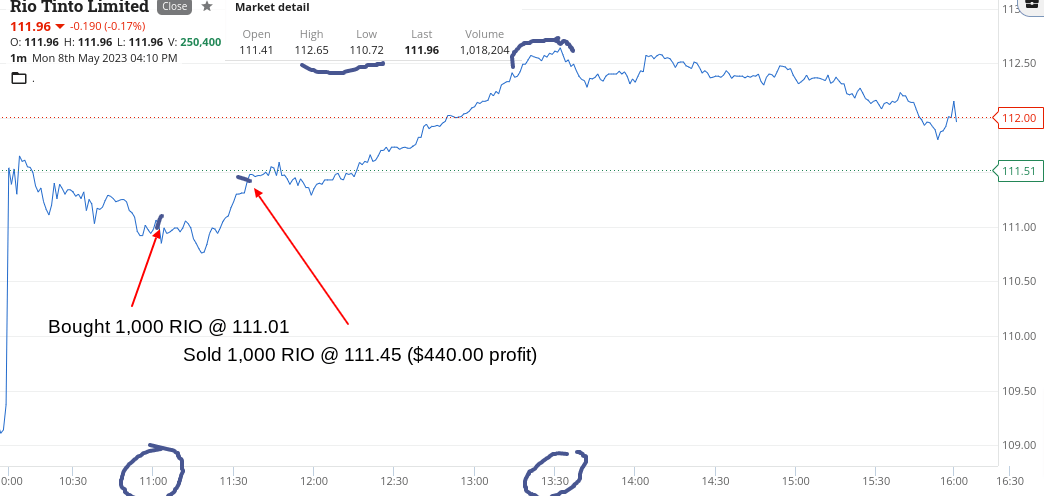

So, I’m left out in the cold, until RIOs appear to be a bit of a goer. They opened at $111.41 and their range was $112.65 to $110.72 and at a barrier level of $111.01.

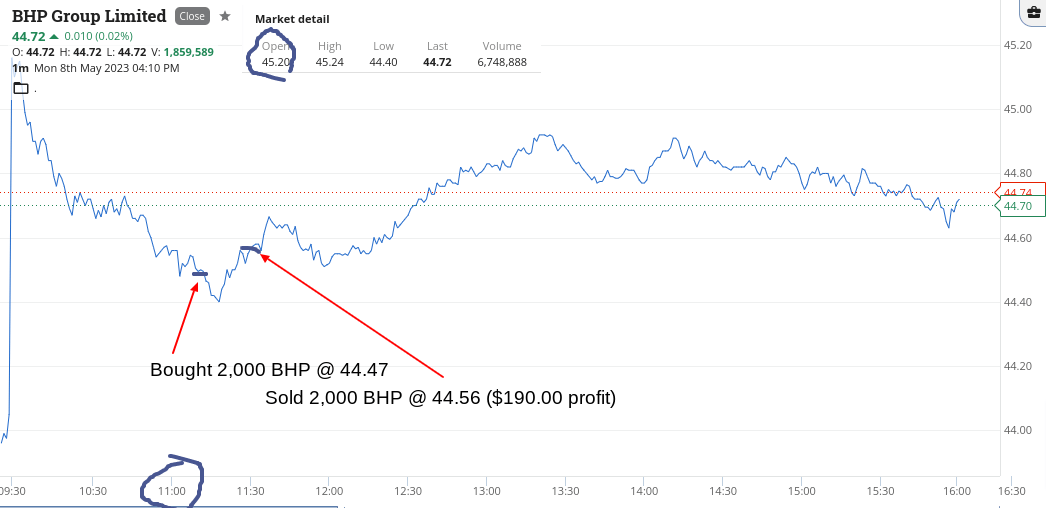

Also decide the BHP deserves a go, as both were stronger in American trading. They opened at $45.20 and I think that if RIOs do rally they will get dragged up with them.

I was right on the rally, so that gives me my first trading profits of the week. By 11.36am, my trading day is over and I’m up $630, which means I can keep my hands gloved up and toasty warm. Good start to the week.

Recap

Bought 1,000 RIO @ 111.01

Bought 2,000 BHP @ 44.47

Sold 2,000 BHP @ 44.56 ($190 profit)

Sold 1,000 RIO @ 111.45 ($440 profit)

Tuesday May 9

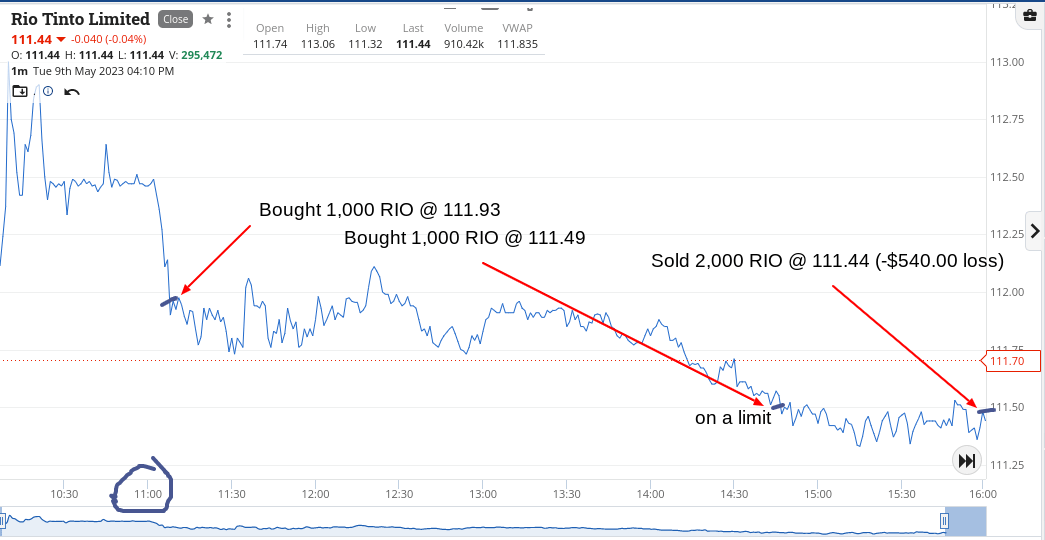

One step forward and two steps backwards day today. I manage to lose $320, thanks mainly to RIOs.

They opened at $112.74 and then hit a high of $113.06 before falling back again, so when I get involved at below $112, I thought I would be safe.

I even put on another 1,000 to buy on a limit af $111.49, which looked a long way away, until it got hit. Held on to the grim death but there was no recovery.

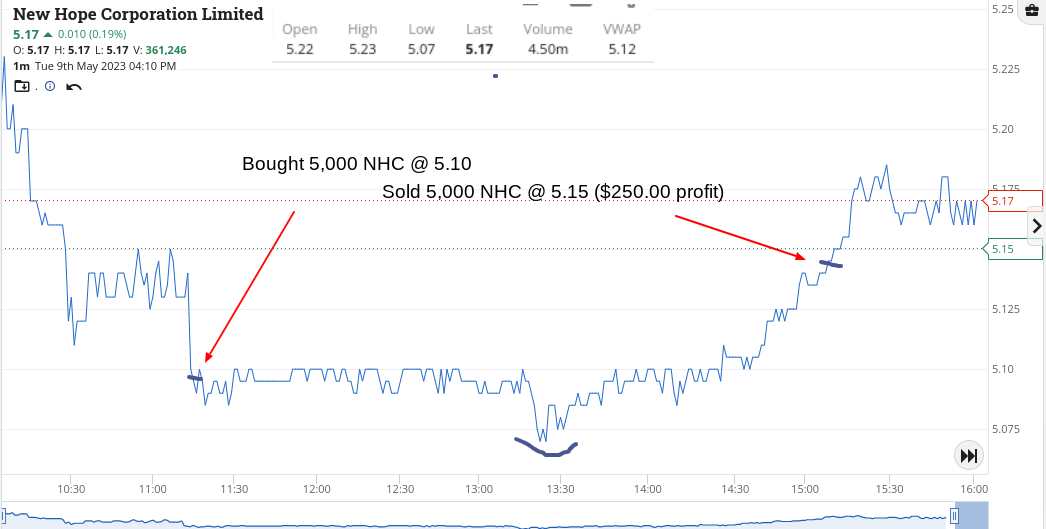

Luckily for me NHC came good and after I sold them I cut the BHP for a small loss, as I didn’t want to have exposure on two iron ore stocks only, so killed one off.

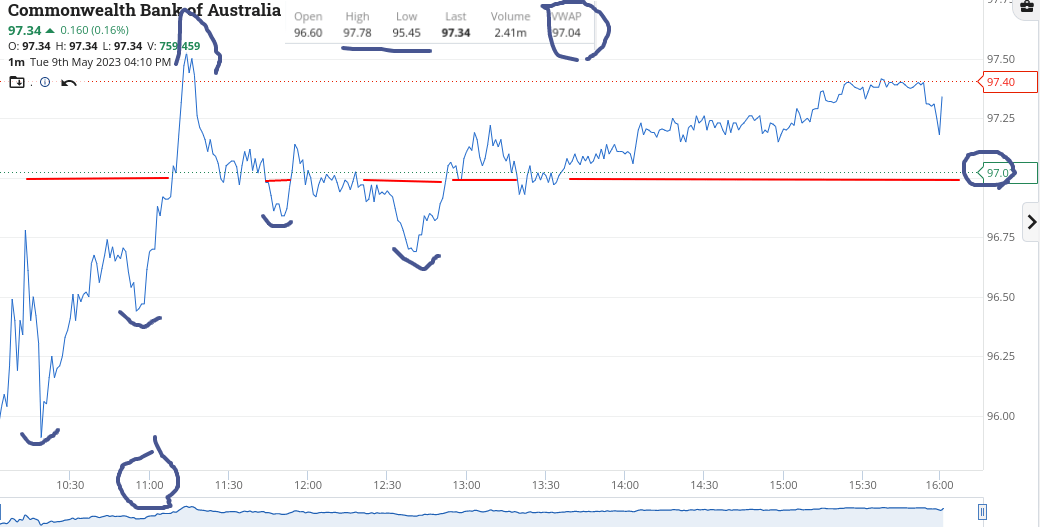

Everytime I looked at CBA, I would um and ah and go back 5 mins later and they had jumped without me being involved.

This happened at least three times today. I’ve added a chart so you can see what I mean. $97 and below was their magic number today.

Boring old budget day today, so there will be a few gainers and losers in tomorrow’s session. Let’s wait to see.

Recap

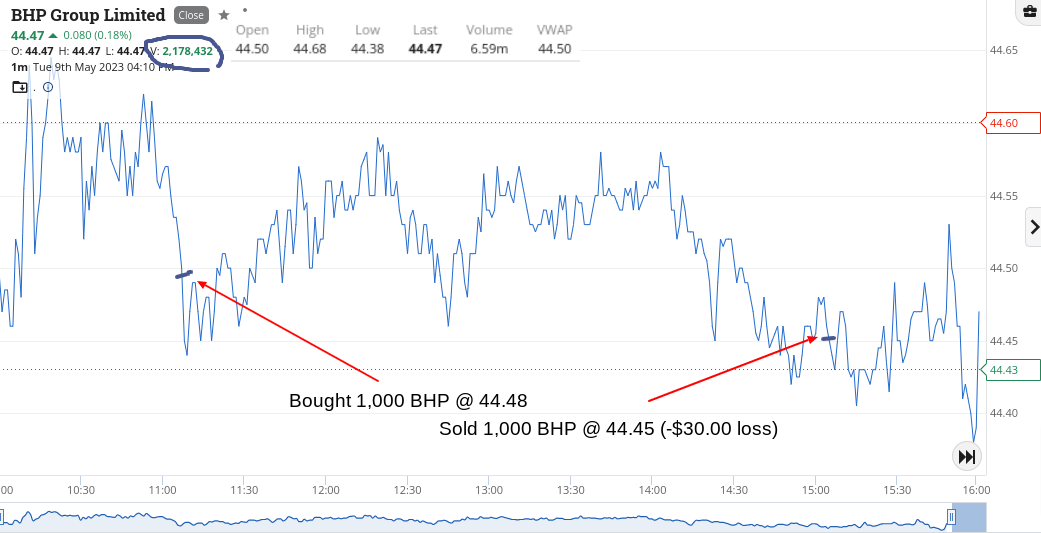

Bought 1,000 BHP @ 44.48

Bought 1,000 RIO @ 111.93

Bought 5,000 NHC @ 5.10

Bought 1,000 RIO @ 111.49

Sold 5,000 NHC @ 5.15 ($250 profit)

Sold 1,000 BHP @ 44.45 (-$30 loss)

Sold 2,000 RIO @ 111.44 (-$540 loss)

Wednesday May 10

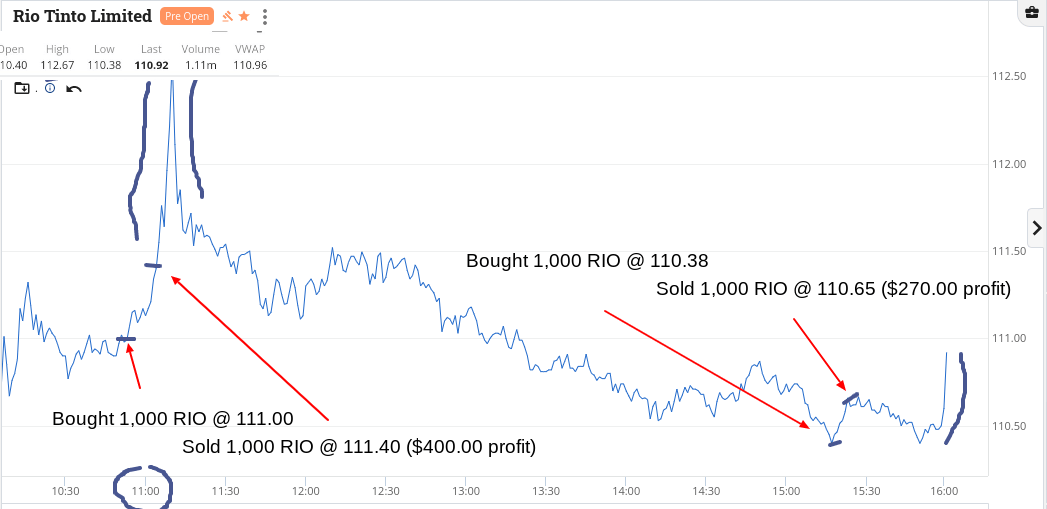

RIOs looked like a punt coming in to 11.00am and at $111.00 there were lots of ones flying around. Should have waited til 11.11am to really complete the numerology!

However, they gave me a quick 40c turn and then promptly went to $112.67 before coming back down to earth a bit.

So slowly clawing back the damage they did to me yesterday and then towards the close got another go and this time at their day’s low, which happens about three times a year, where you can get set at a day’s low.

Another quickie and up $670, so that’s me more than covering off yesterday’s loss in them. I hate losing, as you all know.

Nothing like a trader scorned!

Recap

Bought 1,000 RIO @ 111.00

Sold 1,000 RIO @ 111.40 ($400 profit)

Bought 1,000 RIO @ 110.38

Sold 1,000 RIO @ 110.65 ($270 profit)

Thursday May 11

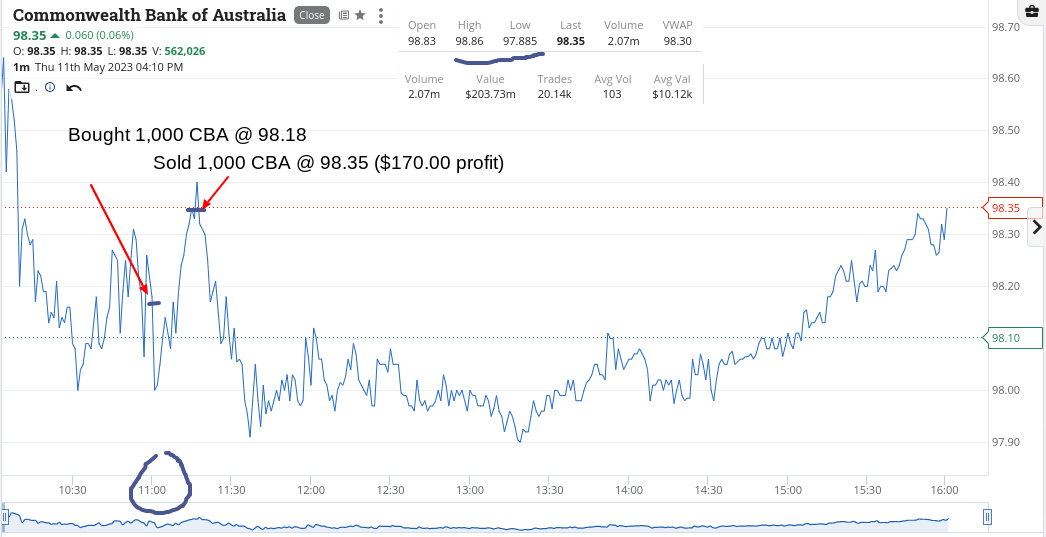

Image: Marketech[/caption]

Recap

Bought 1,000 CBA @ 98.18

Sold 1,000 CBA @ 98.35 ($170 profit)

Bought 1,000 RIO @ 108.83

Sold 1,000 RIO @ 109.21 ($380 profit)

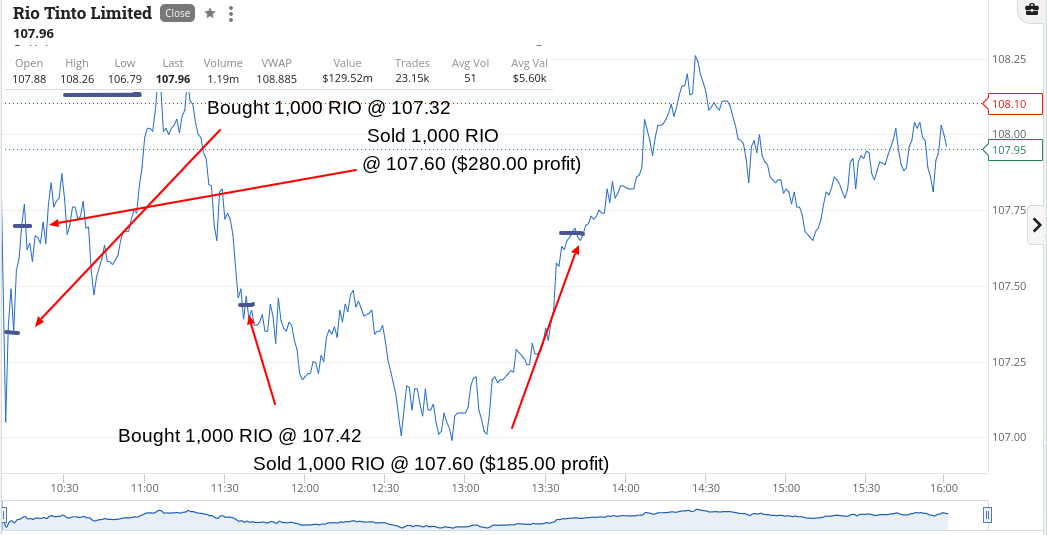

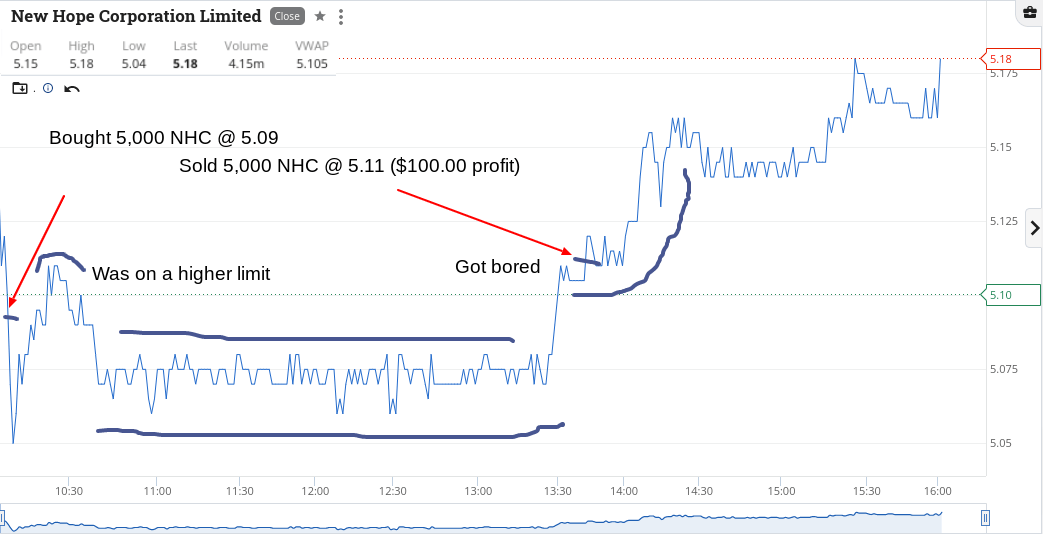

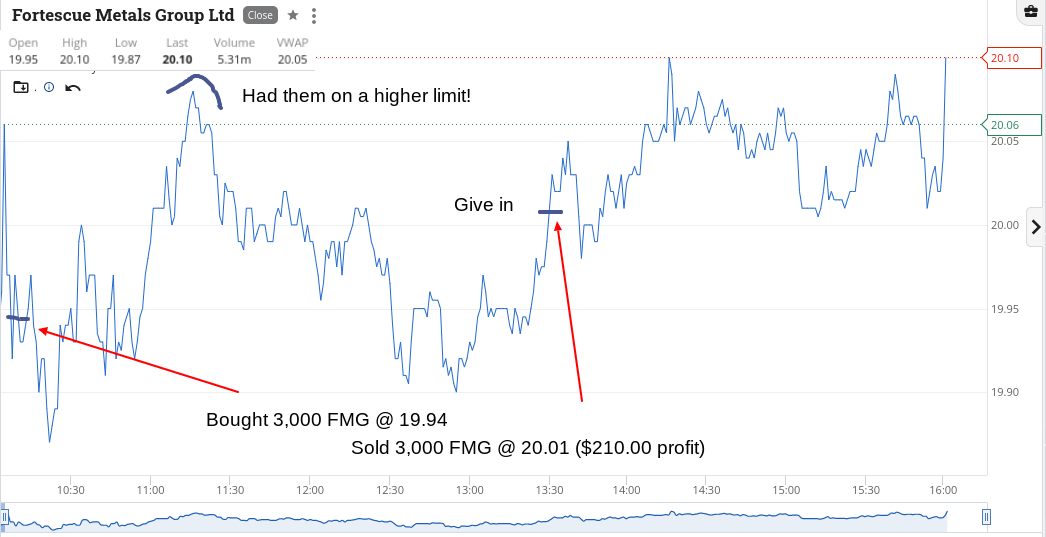

Friday May 12

Waiting around for the market feels just like sitting in a hospital emergency deparment waiting for your name to be called.

At 10.00am we are off and go for a few real quick ins (which could be boredom of waiting) or a masterstroke.

Turns out it was a combination. RIOs trading with a $107 in the front. Come on! They were $111.50 on Monday.

NHC had to be picked up with their share buy back still on.

FMG below $20 was a gift from the trading Gods and then RIOs gave me a second go and both times was able to get out at $107.60 which just amazes me.

Bit of a wobble in the iron ore price and I’m in like Flynn. End the day up $775 and $2,305 gross after my lost day in RIO and $1,893 net.

RIOs in the end were a bit like my favourite dish from the Hawker Inn Chinese restaurant up the road.

A bit sweet and sour but with a hot chilli finish! No Brazilian in sight.

Recap

Bought 1,000 RIO @ 107.32

Bought 5,000 NHC @ 5.09

Bought 3,000 FMG @ 19.94

Sold 1,000 RIO @ 107.60 ($280 profit)

Sold 3,000 FMG @ 20.01 ($210 profit)

Bought 1,000 RIO @ 107.415

Sold 5,000 NHC @ 5.11 ($100 profit)

Sold 1,000 RIO @ 107.60 ($185 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.