Confessions of a Day Trader: Great on either side, trash in the middle

Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday July 31

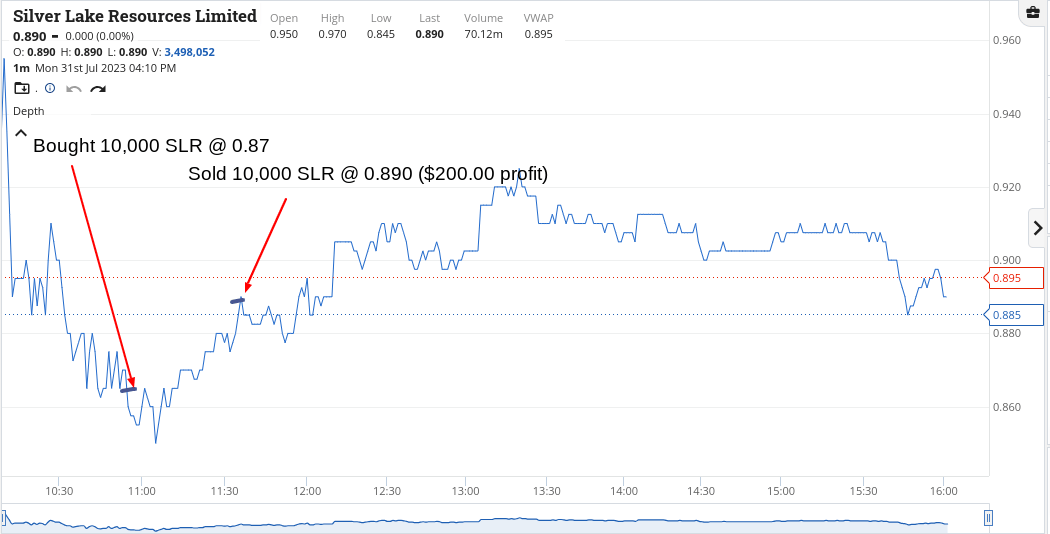

Got off to a good start in Silver Lakes, who were marked down 21%.

Working on the proviso that five more falls like that will make them disappear, I have a little dabble, which pays off.

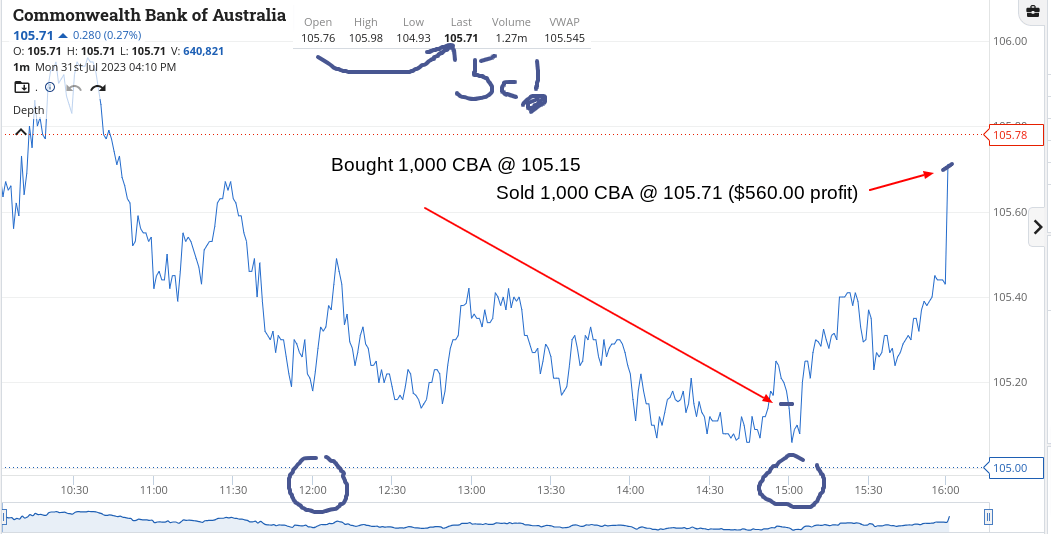

Then nothing till after lunchtime where RIOs were down from their $118 level and then CBA heading down towards $104.99 again.

Had a lower level of $104.88 in CBA, just in case they did crack down again, which never came into play.

Added WDS into the mix at $38.02 and rode them till the 4.10pm death, with mixed results. Interest rate day tomorrow and a bit of book squaring on the close ahead of tomorrow and Wall St tonight.

Up $1,350 and thinking will give some of this back tomorrow.

Recap

Bought 10,000 SLR @ 0.87

Sold 10,000 SLR @ 0.890 ($200 profit)

Bought 1,000 RIO @ 116.45

Bought 1,000 CBA @ 105.15

Bought 1,000 WDS @ 38.02

Sold 1,000 CBA @ 105.71 ($560 profit)

Sold 1,000 RIO @ 117.07 ($620 profit)

Sold 1,000 WDS @ 37.99 ($30 loss)

Tuesday August 1

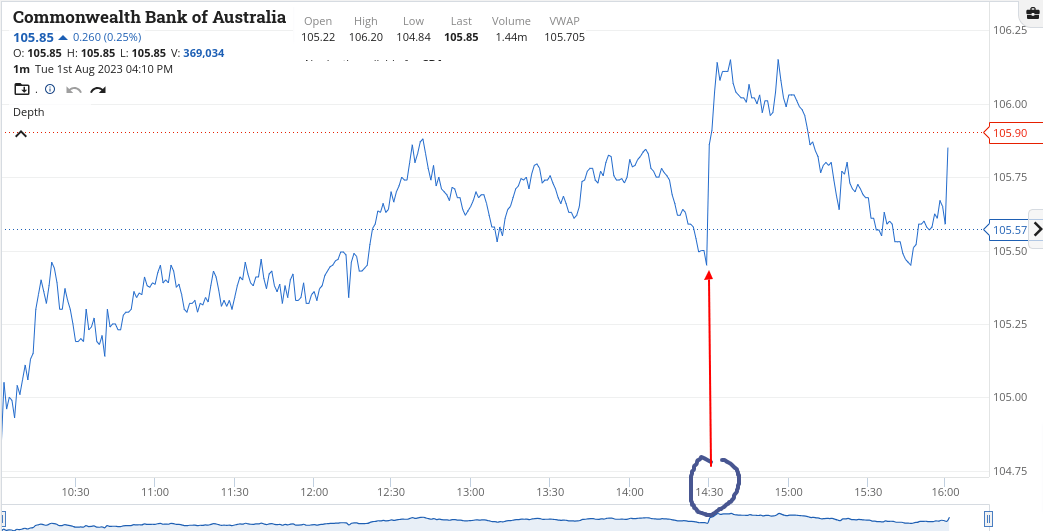

So, today was interest rate day which meant I wasn’t willing to do anything until 2.30pm.

Everything shot up and my strategy was to grab some RIOs as they were marked down the most, pre 2.30pm.

Made a small turn, which is better than giving anything away. I was going to buy 250 CBA with 1 min to go before the RBA announcement so would have a 50/50 bet but thought it too risky.

Ah well.

Up $130.

Recap

Bought 1,000 RIO @ 117.09

Sold 1,000 RIO @ 117.24 ($130 profit)

Wednesday August 2

Today is one of those days where nothing feels right.

After yesterday’s non interest rate increase rally, things open lower and don’t really get any better.

Watching CBA, whose high yesterday was $6.20, open at $5.20 and then get sold down to $104.00, where they stayed most of the day, was frustrating.

Going up and down around the $104.00 level, finally cracked at 3.15pm and they started to hurtle down to $103 before bouncing.

I got some on the bounce and held them tight and only let them go on the death.

I think news that the US debt had been given a downgrade was maybe the catalyst for the sharp fall below $104.00.

I shall keep using push alerts as stocks fall, rather than actually buying, as I had the image of $103 for CBA today and $99 is my image for them over the next two days.

We shall see. Up $260.

Recap

Bought 1,000 CBA @ 103.20

Sold 1,000 CBA @ 103.46 ($260 profit)

Thursday August 3

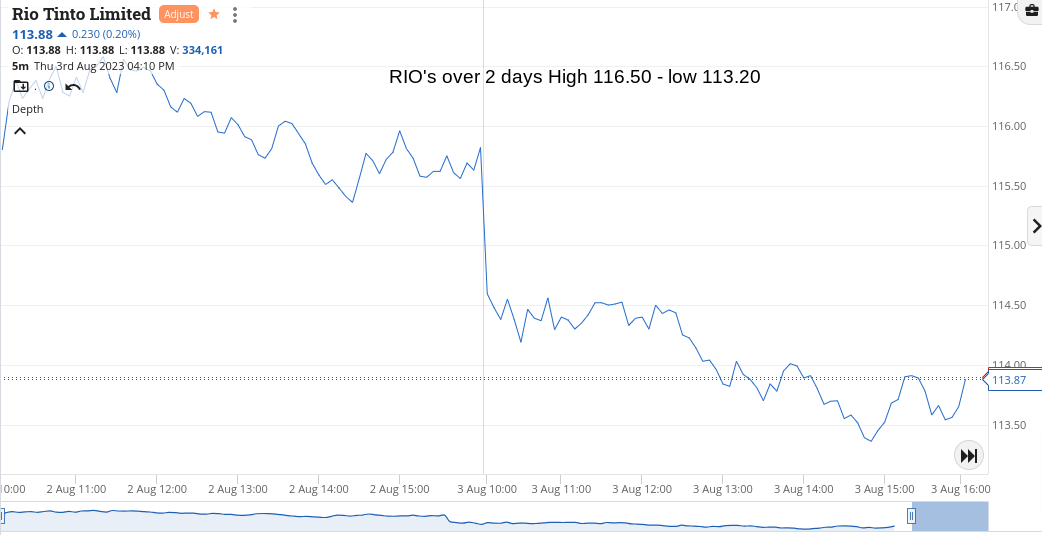

My trading style is getting cramped in today. Volumes are picking up as momentum selling keeps coming through and the risk/reward is just not there.

It gets very mentally tiring, just watching and waiting but I know from experience that any boredom trades will usually end up in tears.

Better to sit on your hands than trade at all and am wishing I had taken this week off and gone away. Of course if I had done that, I may have missed some wonderful trades, as that is what usually happens to me.

We are all a bit nervous of America and don’t want to be like rabbits caught in the headlights, just waiting to get run over.

Have added some two day charts on CBA and RIOs because as you all know, a picture paints a 1000 words.

Up/down zero today!

Friday August 4

Today we have a blast. Well a Mesoblast, as the company fell more than 50% after the American FDA seems to be given them a hard time.

Biotechs are always hard ones and the smaller companies that want to go up against the big boys always seem to be all or nothing plays.

They finished the day down 56.9%, which is one of the biggest falls we have seen in a long time.

So, they closed on Thursday at $1.09 and today they opened at 50c. Their high was 55c and their low was 45.5c and the volume was a very tasty 68.7m shares.

I managed to eke out a $700 reward from them and I know that they have been a punter’s dream/nightmare for many years, with most of those punters caught long and wrong.

Don’t get me wrong but if Mesoblast had announced something exciting I would have also played in them as the correct announcement would have lead them to a major re-rating, which could normally last for two days.

So, to me biotech stocks are like junior oil stocks. Never hold them in hope but trade them on announcements.

Up 2,440 for the week, with a good start and a good end, with a rubbish middle bit. Works out to be $2,198 net.

CBA never made $99 this week but they did trade with a $101 in the front, so maybe next week they will. We shall see.

Recap

Bought 10,000 MSB @ 0.520

Sold 10,000 MSB @ 0.550 ($300 profit)

Bought 20,000 MSB @ 0.495

Sold 20,000 MSB @ 0.515 ($400 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.