Confessions of a Day Trader: Good swings come to those that wait

Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday June 19

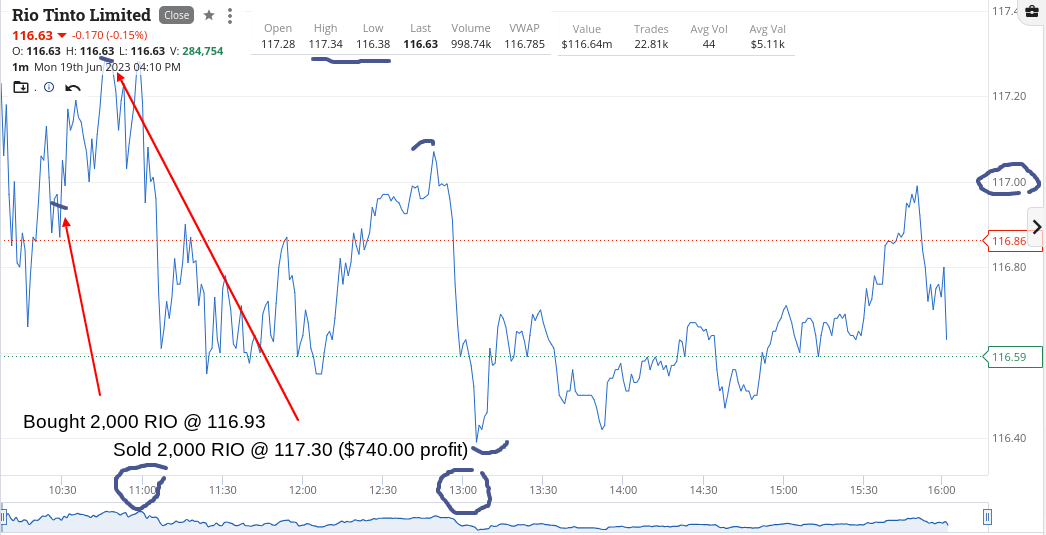

One trade today and it was a good one. Having seen RIOs in action last week, I decided to go ‘all in’ at below $117.00.

They went up to $117.20 before falling back down below $117.00 but I hung on in there, as the market was looking rosy, plus (and this is the main reason) Wall Street is shut tonight.

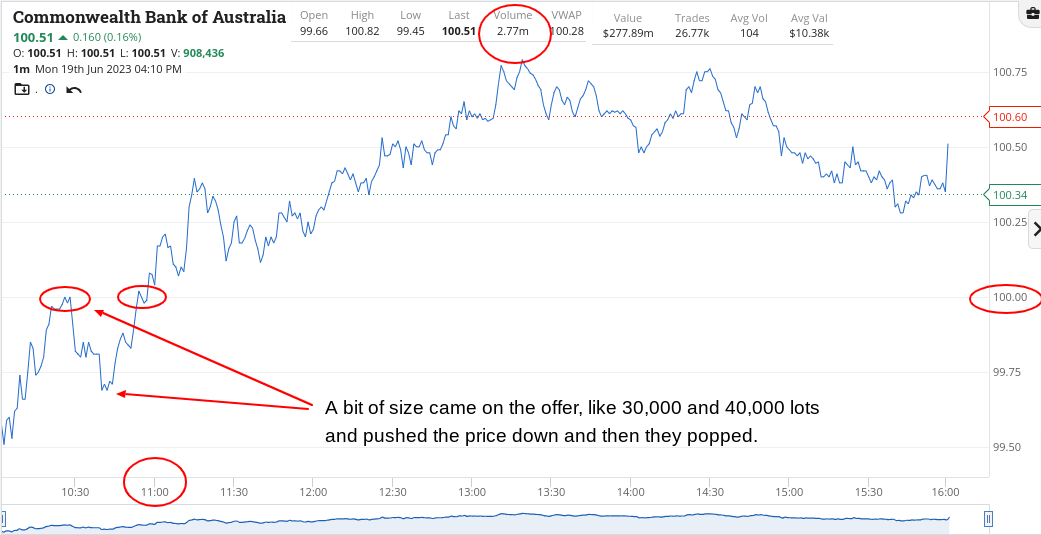

This means no leads overnight to worry the market, so in things like CBA, it was like taking your foot off the spring.

It looked like such an obvious move, breaking out above $100.00 and giving the shorts a bit of a squeeze.

So obvious in fact, that I just left them alone and you could have bought in size, like 30,000 to 40,000, without blinking. Someone was doing a bit of market manipulation and pushing them down, but eventually they broke the 100km/h speed limit and just kept on going.

Up $740 and a very happy chappie.

Recap

Bought 2,000 RIO @ 116.93

Sold 2,000 RIO @ 117.30 ($740 profit)

Tuesday June 20

Today feels like it will be an up and down day, with the down coming towards the end of the day.

Let’s see.

———————–

Well, I had to wait till after 3.30pm before becoming involved in the action. CBA closed up $1.11 at $101.62. Their low was $100.36 and their high was $101.97 on 2.7m.

Amazing stuff.

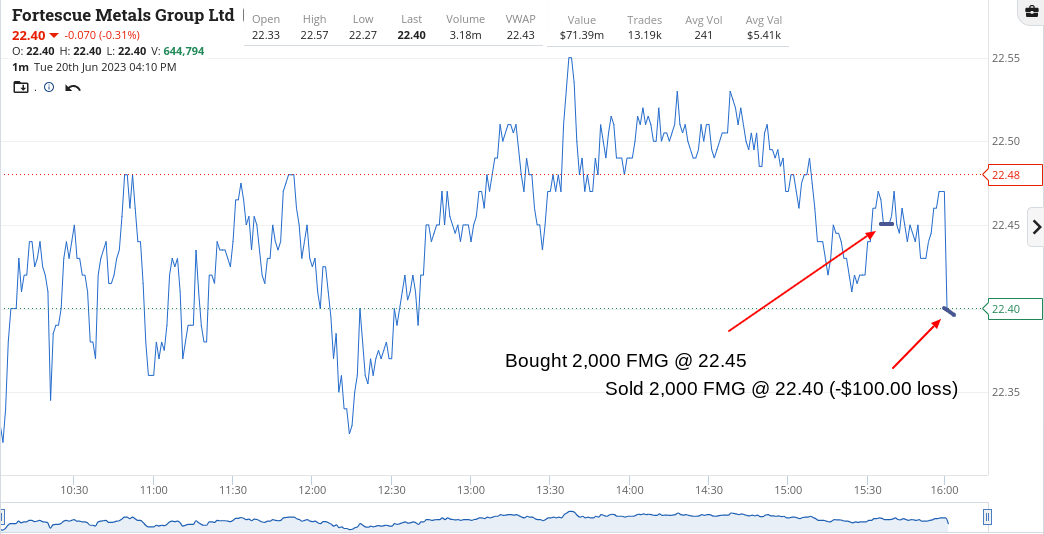

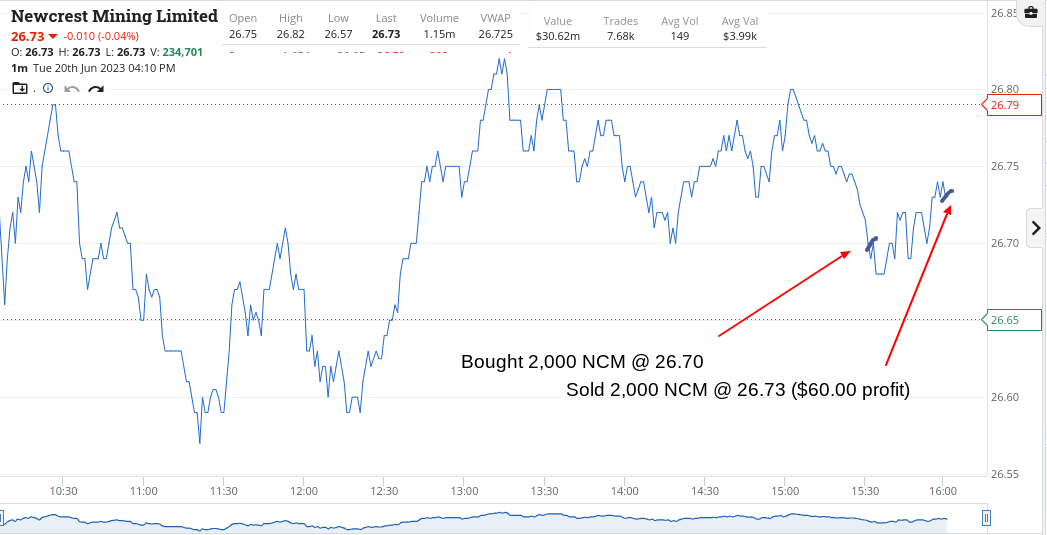

The three I went for were the only ones to really turn down on my watch list and boy was I frustrated by now. It’s a long time to wait.

Two came good and one didn’t.

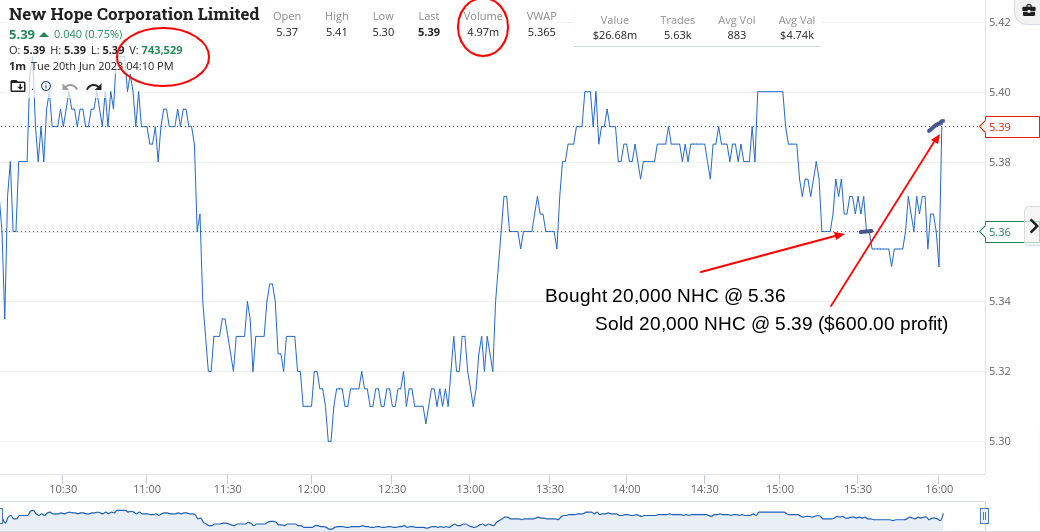

As you could get a bit of size in NHC, I could feel a squeeze coming on towards the death.

All three trades I let run into the 4.10pm match up. Let’s hope tomorrow will not be such a long wait.

Up $560.

Recap

Bought 2,000 NCM @ 26.70

Bought 20,000 NHC @ 5.36

Bought 2,000 FMG @ 22.45

Sold 20,000 NHC @ 5.39 ($600 profit)

Sold 2,000 NCM @ 26.73 ($60 profit)

Sold 2,000 FMG @ 22.40 (-$100 loss)

Wednesday June 21

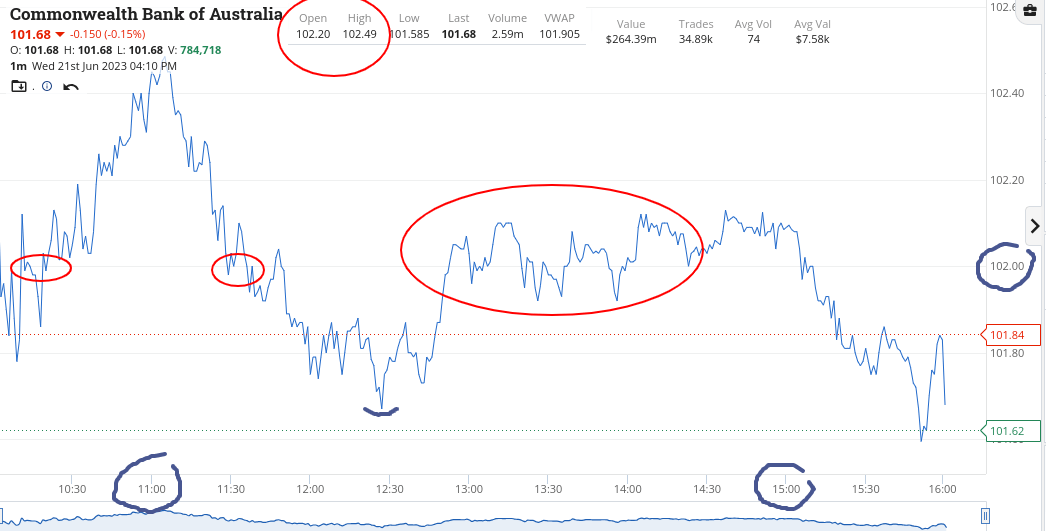

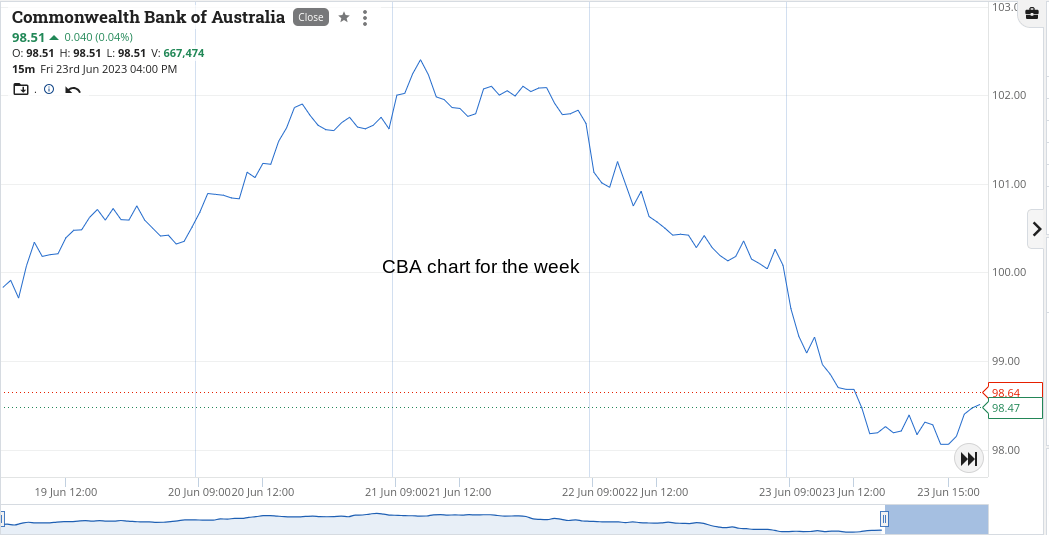

Another amazing day for CBA, as it cracked the $102.00 level. Its range today was $101.58 to $102.48 before they finished the day up 6c at $101.68, on 2.6m shares.

The other three banks were decoupling downwards today, so presuming that either a flight to quality or a real hard short squeeze going on.

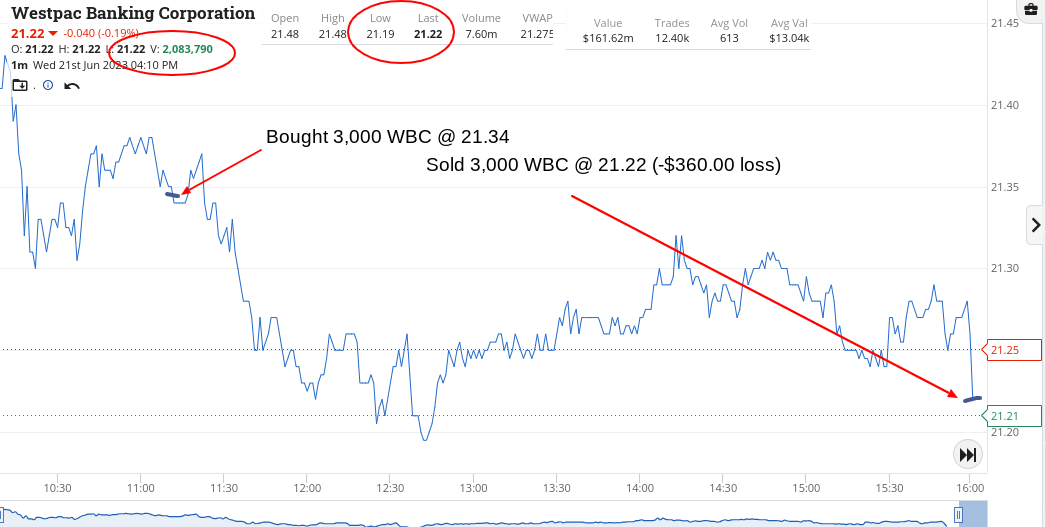

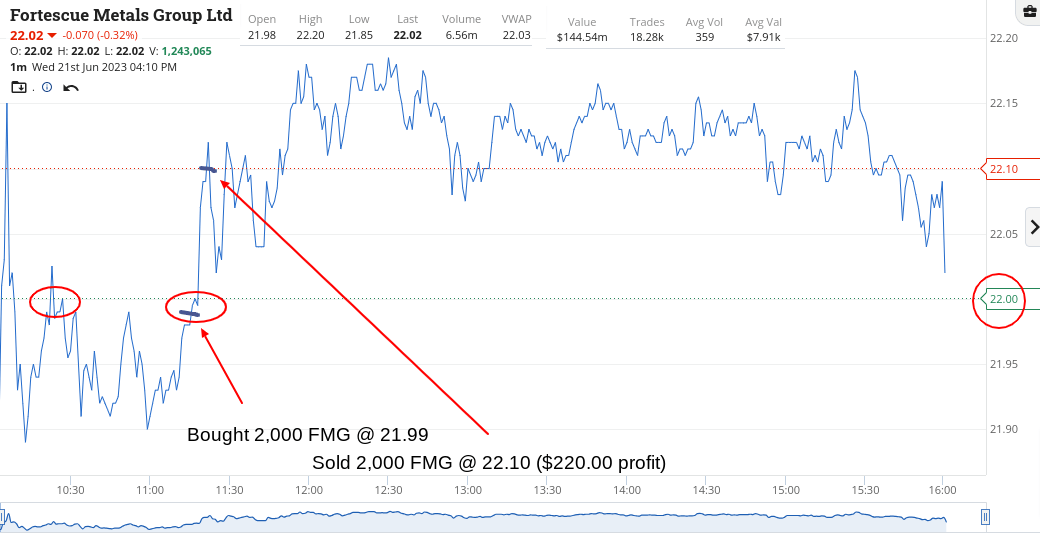

Either way, WBC were my choice today for a bounce which unfortunately didn’t happen for me. FMG did happen for me though, as I went long and waited for them to crack the $22.00 level.

Down $140, mainly as I didn’t want to double down on the WBC and held them till their grim death at 4.10pm.

Hoping for a fall back in CBA tomorrow, for a trade, as they are due for one.

Recap

Bought 2,000 FMG @ 21.99

Bought 3,000 WBC @ 21.34

Sold 2,000 FMG @ 22.10 ($220 profit)

Sold 3,000 WBC @ 21.22 (-$360 loss)

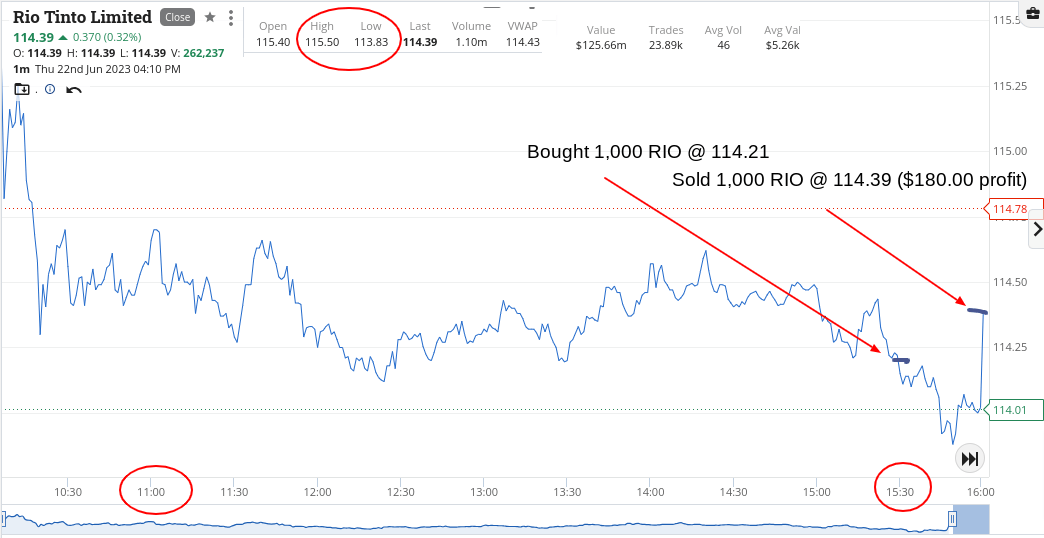

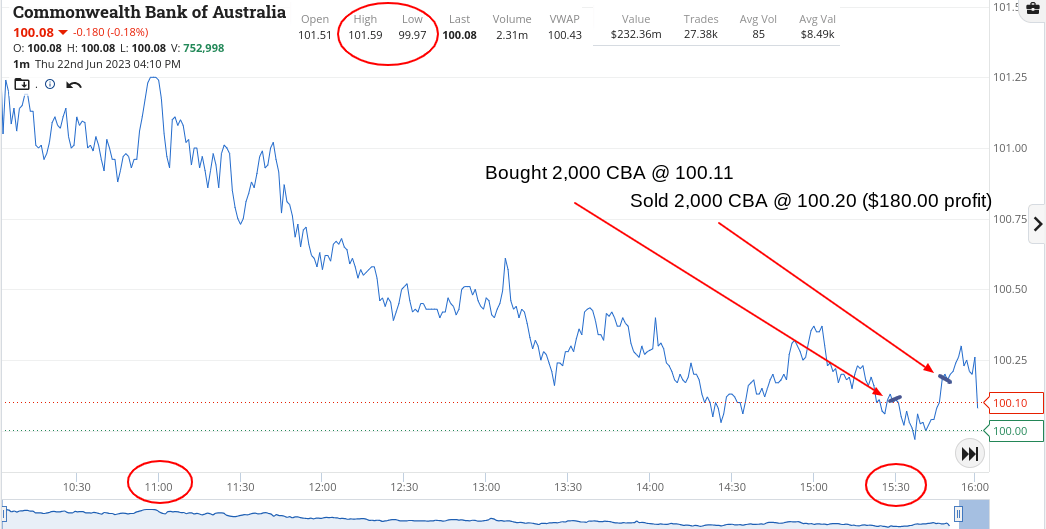

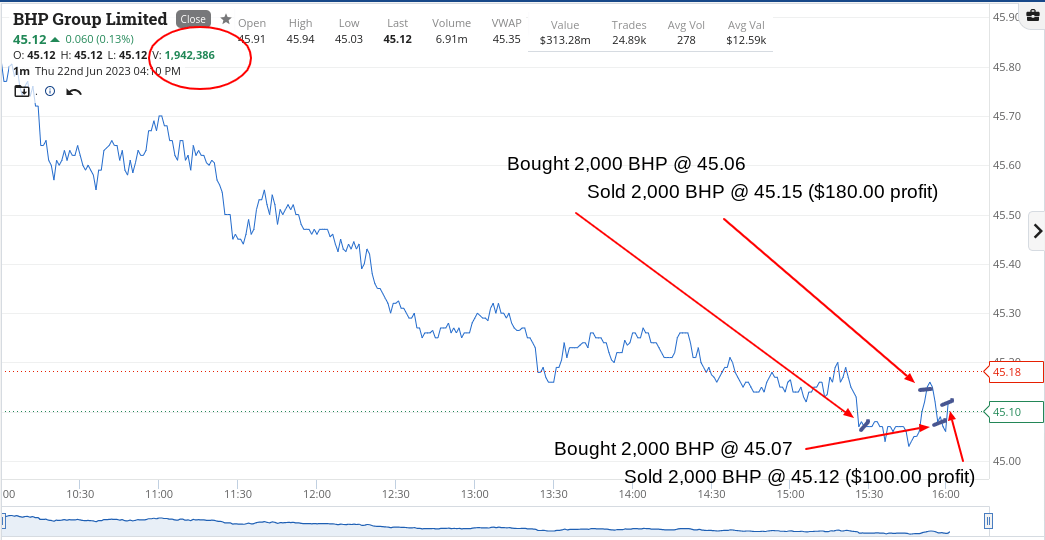

Thursday June 22

At last, CBA really do fall and get below $100.00, just after 3.30pm. So, had another long day in the trading waiting room before Dr Market appears with his price sheet.

More out of boredom and frustration, I open up the wallet and go on a 3.30pm buying spree.

Bang, bang, bang and I have RIO, BHP and CBA in the bag and then BHP again just for good luck.

You could feel the tension building ahead of the 4.00pm close. I got the timing wrong a bit on the way in but not on the way out.

I got my revenge for yesterday’s loss plus finally got a go in CBA. Hallelujah!

Up $640 on the shortest day of the year.

Recap

Bought 1,000 RIO @ 114.21

Bought 2,000 BHP @ 45.06

Bought 2,000 CBA @ 100.11

Sold 2,000 CBA @ 100.20 ($180 profit)

Sold 2,000 BHP @ 45.15 ($180 profit)

Bought 2,000 BHP @ 45.07

Sold 1,000 RIO @ 114.39 ($180 profit)

Sold 2,000 BHP @ 45.12 ($100 profit)

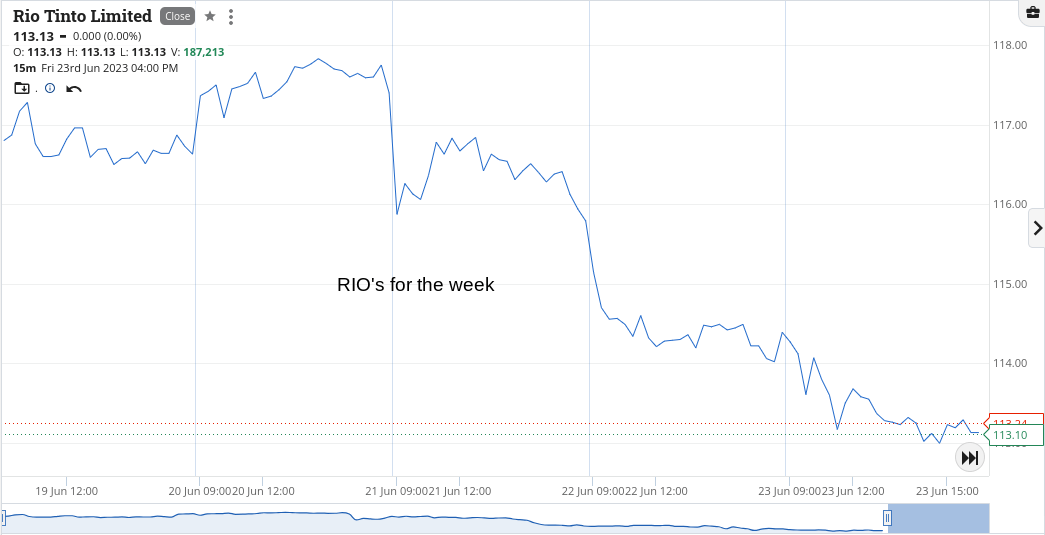

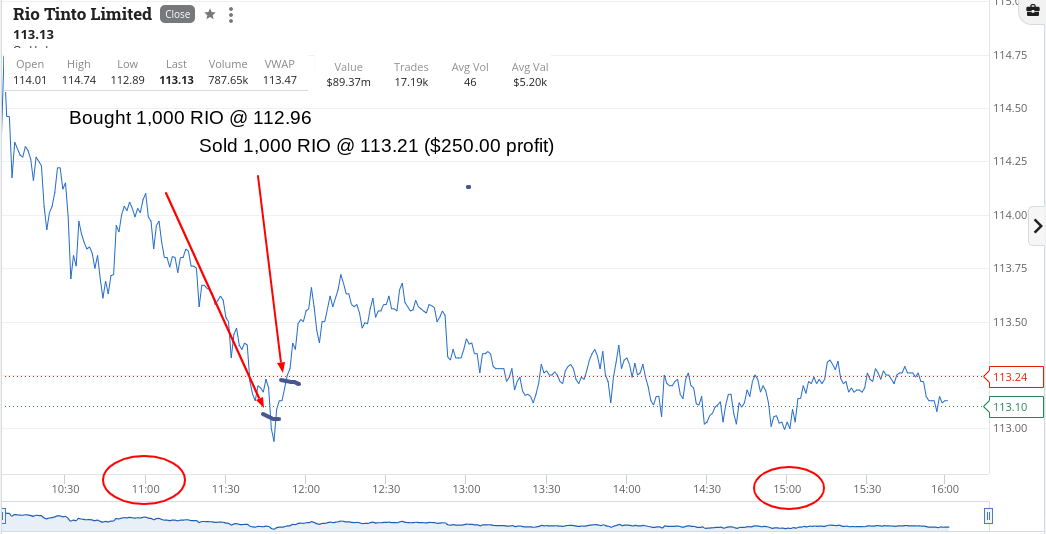

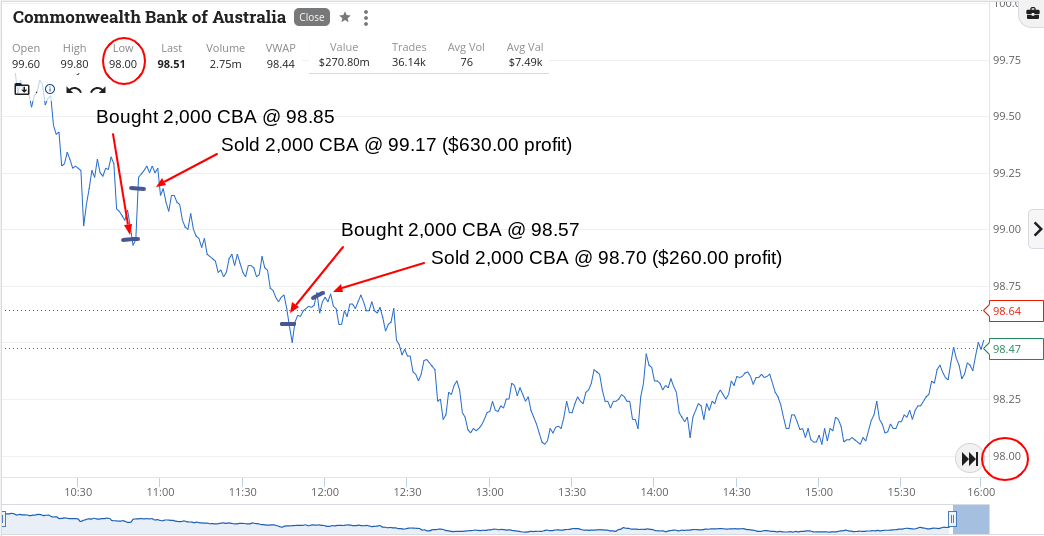

Friday June 23

Finally, I get a market that I can get my teeth into. CBA has had an amazing week and today they gave me two goes and even though I could have gone a few times more, I was happy to just take it easy.

Their $99.00 level was the one to watch today and they sort of found support around the $98.50 level.

RIOs at below $113.00 blew me away a bit, but them are the markets and who am I to grumble, as today was my kind of day. Have added a five day chart on CBA and RIOs for us all to have a study of.

Up $1,140 today and $2,200 gross for the week or $1,690 net. Looking forward to Monday as a down day and Tuesday as a rally day!

Recap

Bought 2,000 CBA @ 98.85

Sold 2,000 CBA @ 99.17 ($630 profit)

Bought 1,000 RIO @ 112.96

Bought 2,000 CBA @ 98.57

Sold 1,000 RIO @ 113.21 ($250 profit)

Sold 2,000 CBA @ 98.70 ($260 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.