Confessions of a Day Trader: Get Shorty!

Picture: Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday July 11

Off to another trading day and everything on the list was red today, though their ranges are tightening up a bit.

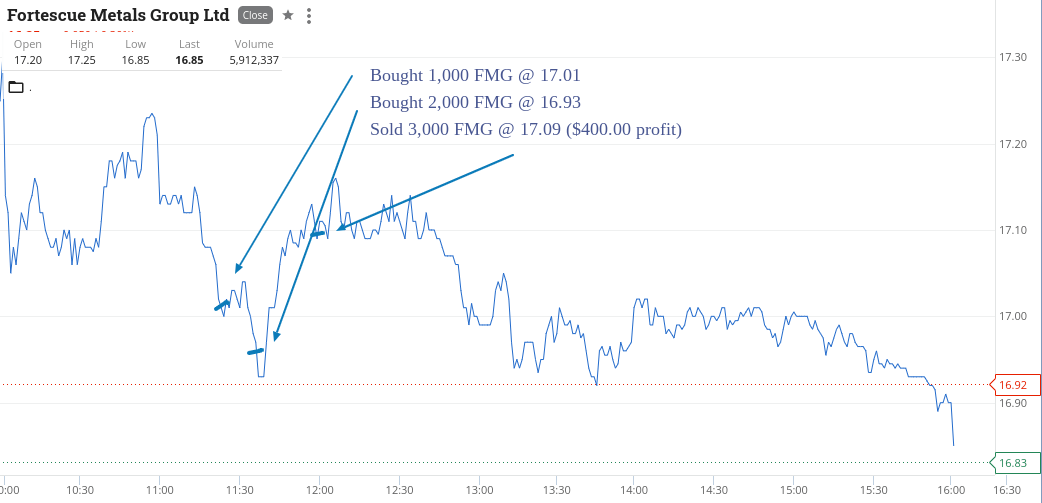

FMG pop up as trading around the $17.00 level.

So dipped in the toe for 1000 at $17.01, which if they go up, I’m okay and if they don’t, will have to double down.

They hang around that $17.00 level before breaking down and making me double down for another 2000 at $16.93.

Then they do this:

And I’m out of the 3000 at $17.09 for a $400 profit.

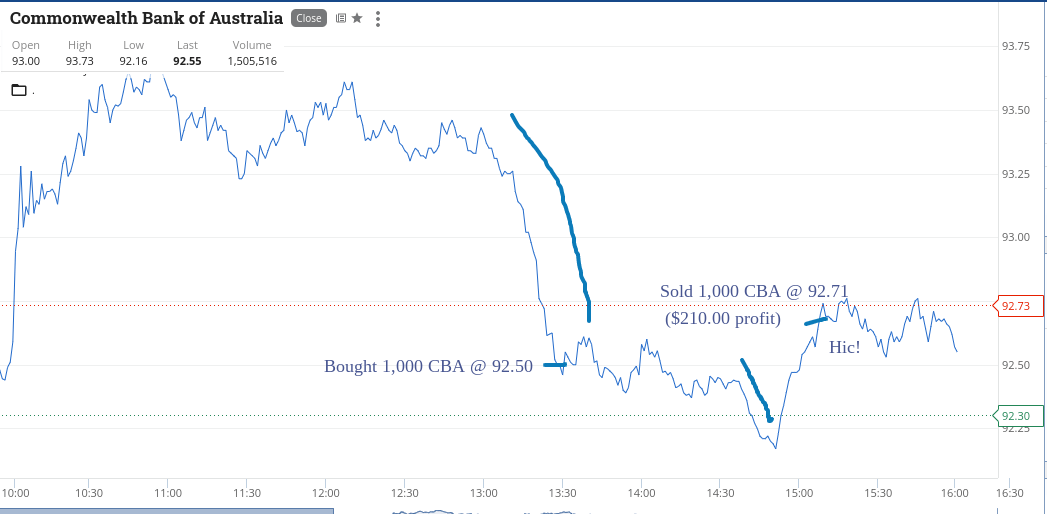

Catching up with a mate in the pub and whilst he is getting a round in, I check in on the phone and see this:

So pick up 1000 $92.50 and they fall more as does the level of my beer. Then finally this happens:

Happy days.

Plus $610 and a liquid lunch.

Recap

Bought 1,000 FMG @ 17.01

Bought 2,000 FMG @ 16.93

Sold 3,000 FMG @ 17.09 ($400.00 profit)

Bought 1,000 CBA @ 92.50

Sold 1,000 CBA @ 92.71 ($210.00 profit)

Tuesday July 12

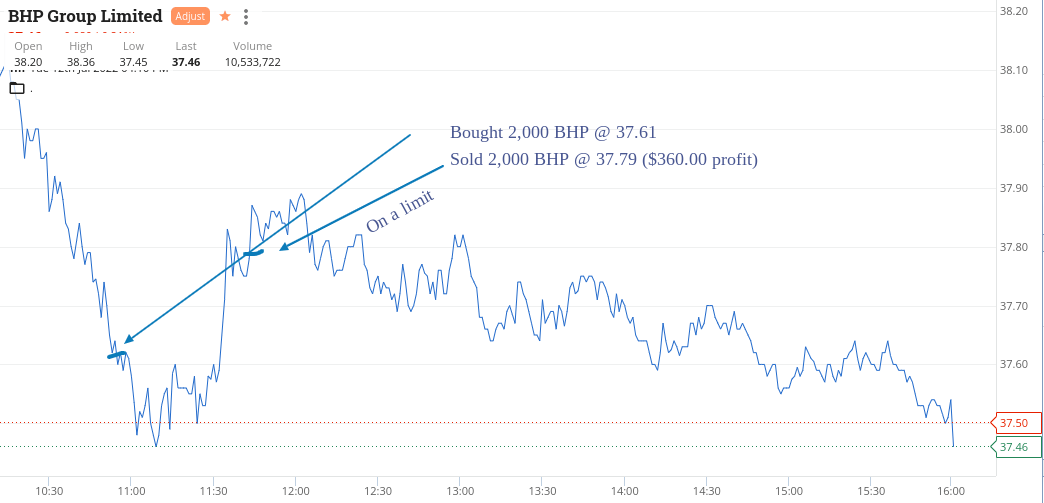

I only have eyes for BHP today. Iron ore was down overnight and BHP and RIOs were down in NY trading.

Had to wait around until around 11.00am, until this happened:

Half hour later, they did this:

Bloody amazing I thought, as they were just hovering around. Got my thumb into overdrive mode to lock in a profit of $360 for the day.

Recap

Bought 2,000 BHP @ 37.61

Sold 2,000 BHP @ 37.79 ($360.00 profit)

Wednesday July 14

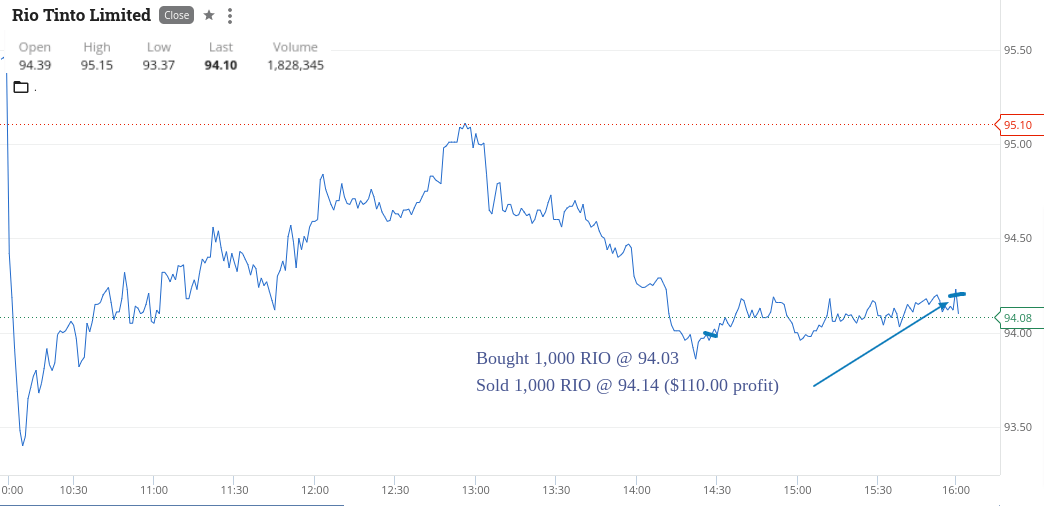

It’s a hard day today, as volatility in the trading range on some of the stocks I follow has come right back in.

For example CBA’s high/low range today was $94.63 to $93.09.

FMG $17.05 to $16.63

BHP $37.14 to $36.60

NST $6.94 to $6.75 on 4.3m volume

NAB $28.45 to $28.05

So spent most of the day watching and waiting and eventually RIO cracked below the $94.00 level, dropped and bounced and I chased 1000 from $93.90 upwards and eventually got them at $94.03.

They just sat around and never reached my higher limit, so sneaked them out with 5 mins to go at $94.14. Their range was a little bit better than the ones above, but still had to wait till 2.15pm before having a go.

Up $110 and thinking that fishing requires less patience than trading at the moment. Just thankful for a small profit, rather than a loss.

Recap

Bought 1,000 RIO @ 94.03

Sold 1,000 RIO @ 94.14 ($110.00 profit)

Thursday July 14

US inflation figures came out above expectations and Wall Street just seemed to take it in its stride.

Everything open up mixed and volumes seemed a bit subdued today.

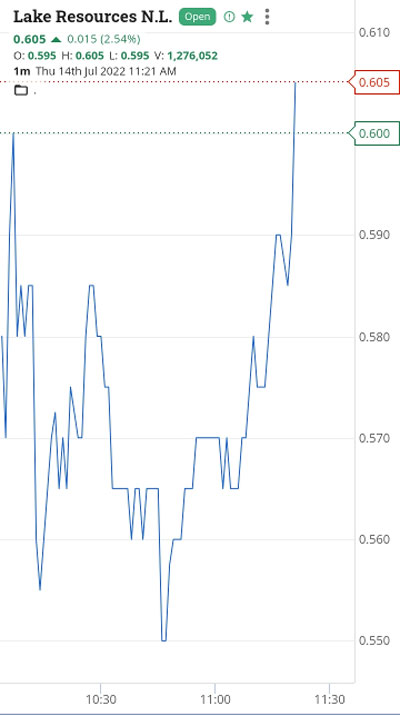

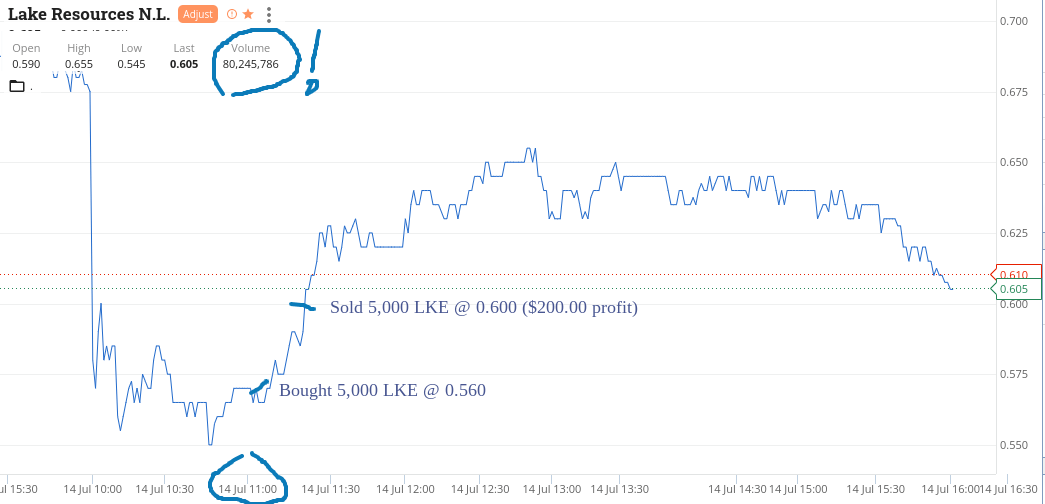

An old favourite type of punt came up today. LKE were subject to a short seller raid and came out of their suspension with their reply.

The stock got marked down and by 11.00am, I picked up 5000 at 56c, with the thinking that all the bad news was out and any margin calls, out of the way.

Pre-suspension they were 68c.

This is what happened next:

Out they went at 60c and they promptly kept rising to 65c or so but you have to feed the ducks when they are quacking, as they say.

Up $200 on a cold and wet and miserable winter day. At least the heating can stay on for another day!

Recap

Bought 5,000 LKE @ 0.560

Sold 5,000 LKE @ 0.600 ($200.00 profit)

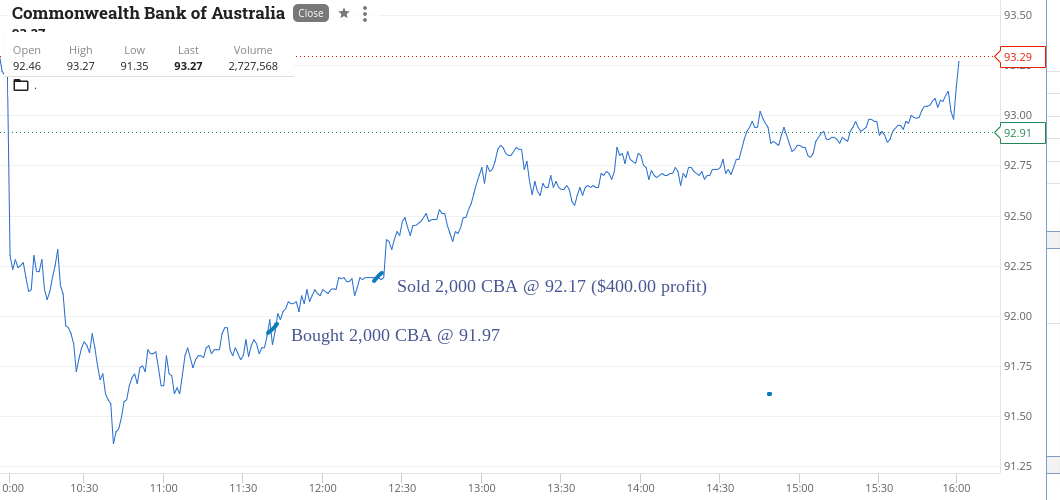

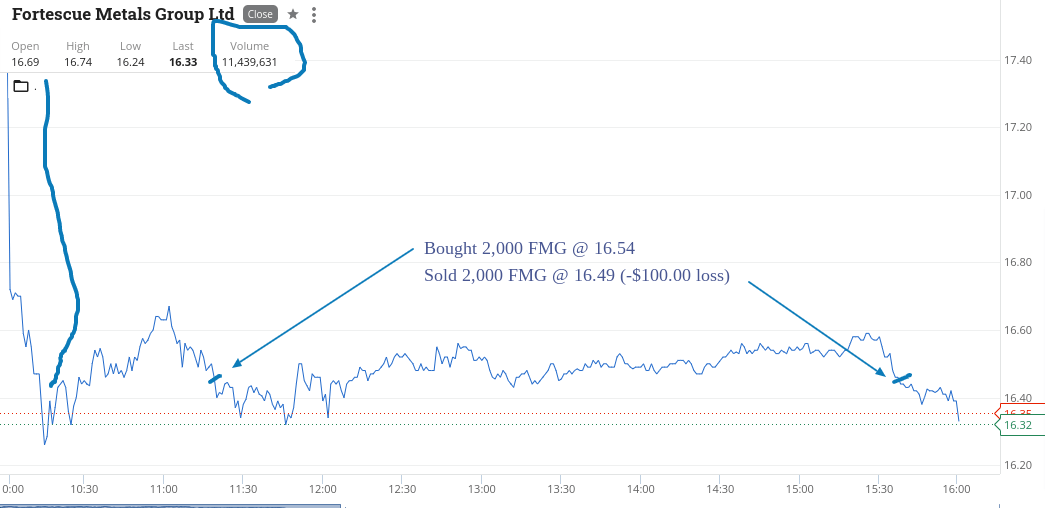

Friday July 15

Iron ore down overnight. Had a crack at FMG but ended up cutting them after a couple of winners.

CBA – had a go at just below $92 for a jump back through, which it did.

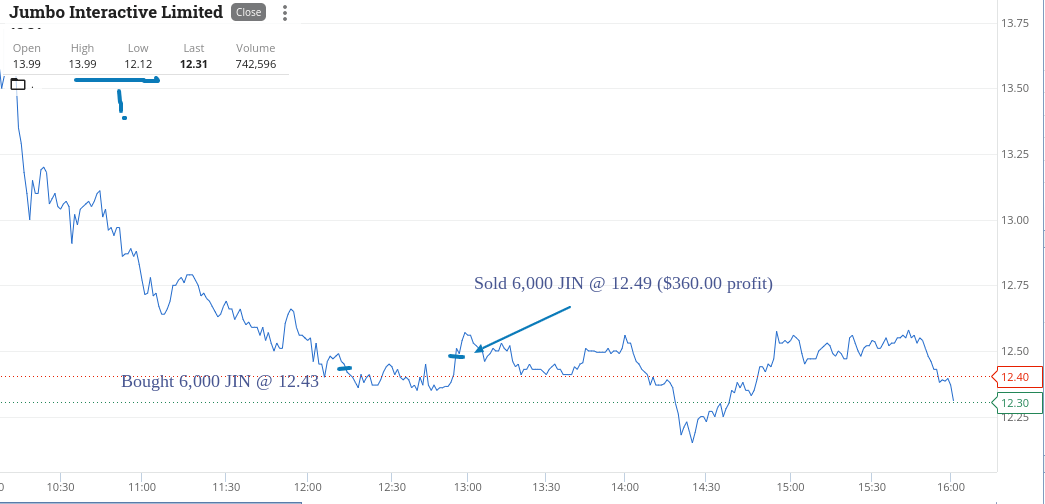

JIN – Biggest large cap faller on my list today, after a profit guide update. Been one from the past and again the bad news was out, so just went for a quick trade.

Took a bit longer than I wanted but eventually managed a 6c turn.

Up $660 today and plus $1940 gross or $1685 net for the week and the rain has stopped! Hallelujah.

Recap

Bought 2,000 FMG @ 16.54

Bought 2,000 CBA @ 91.97

Sold 2,000 CBA @ 92.17 ($400.00 profit)

Bought 6,000 JIN @ 12.43

Sold 6,000 JIN @ 12.49 ($360.00 profit)

Sold 2,000 FMG @ 16.49 (-$100.00 loss)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.