Confessions of a Day Trader: FMG + OMG = FOMO

Pic: Rommel Gonzalez / EyeEm / EyeEm via Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday November 30

Having a wedding to go to which starts at 11am. No phone reception when I arrive but have free wifi, so I patch in. Discreetly checking my phone every 15 mins or so.

After 2.30pm I can start to get serious as everyone hits the dance floor. TWE are down again from Friday’s trading halt and they seem stuck at 8.50, which is 18% lower than two days ago. Bite the bullet (it was a dry wedding) and buy 1,000 TWE, 1,000 NAB and 1,000 FMG, one after the other, as everything seems to be bouncing, and 15 mins after I can finally concentrate.

Finding the 1 min charts really useful to spot levels. Just as fast as I spent more than the cost of the wedding I was at, everything was going my way really fast, except FMG. So, close out TWE and NAB and watch FMG for another 10 mins but decide to take a $10 loss and square off.

It was only later as we swapped over driving and I had reception again that I saw the close of NAB and CBA and their sharp markdowns. All up +$180 for the day. Being forced to wait for 4.5 hours before being able to settle in is a good thing. May try the same tomorrow.

+1000 FMG at 18.52; -1000 FMG at 18.51; Loss $10 (cut after making a healthy profit on the other two)

+1000 TWE at 8.50; -1000 TWE at 8.61; Profit $110 (moved up 2c as was putting in my sell order – normally goes the other way!)

+1000 NAB at 23.07; -1000 NAB at 23.15; Profit $80 (still amazed that you can day trade a bank share)

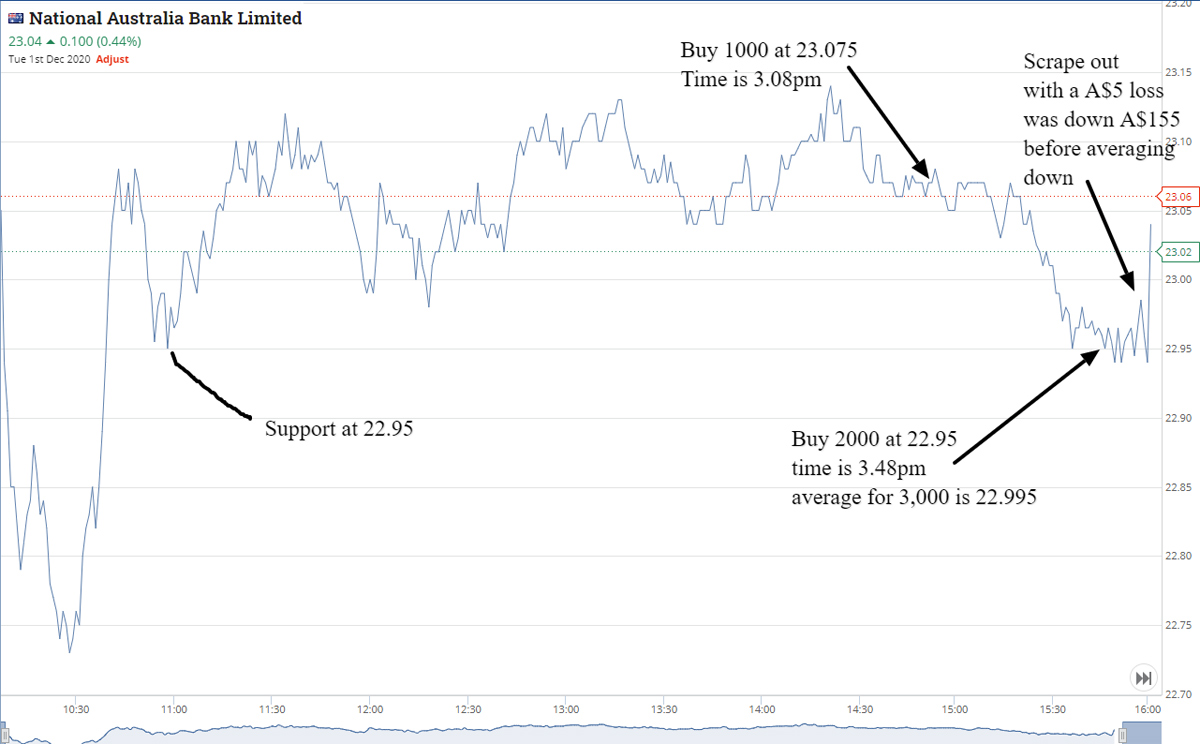

Tuesday December 1

The start of summer is here and make the most of it, relaxed and waiting to see where things are around lunchtime, having seen it work so well yesterday. Looking back, I missed some good trades by stubbornly sticking to this strategy.

FMG opened above 18.00 and fell below that level and I could only watch them go from 17.90 to 18.40 in almost a straight line. Later was going to buy some at 18.32 but got distracted and missed them as they headed to 18.50.

At 2.45pm I buy 1000 Z1P at 5.99 and see them hit 6.03 four times before selling them at that level.

Time is 3.56pm. My lucky NAB buying level of 23.07 from yesterday lasted about 5 mins before they went the wrong way and crashed through 23.00. Having bought 1000 at 23.07 at 3.08pm, I had to average down by buying 2000 at 22.95, which was an earlier support level. This gave me an average of 3000 at 22.995.

Time now is 3.48pm. Having been down $155 at one point I scrape out at 22.99 with 2 mins of trading left. So after all this stress and ignoring some good trades earlier in the day I end up +$35 for the day. Will go back to my old strategies tomorrow, methinks.

+1000 NAB at 23.07; +2000 NAB at 22.95; -3000 at 22.99; Loss is $5 (was down $155 at one point)

+1000 Z1P at 5.99; -1000 Z1P at 6.03; Profit $40 (could have done this trade at least twice today but thought it too obvious!)

Wednesday December 2

Not going to play the same waiting game as yesterday. Z1P open up around 6.18 and slowly come down to the 6.03 level and then finally break below 6.00. At 11.11am I buy 1,000 Z1P at 5.96.

Go out for a coffee and leave a 6.02 limit sell on and adjust down to 6.01 when back. Coffee $5.00 and profit $50, thank you very much.

FMG are down from 18.61 to 18.21 and look tempting but leave alone. Z1P back below 6.00 to 5.975 so put on a limit order to buy 1000 at 5.95.

Time is 11.53. As soon as I get filled I put them on to sell at 5.99 and at 12.40pm, they are gone! I keep watching them and have another third time lucky bid in there at 5.95 for the usual amount. However, APT are still going down so cancel Z1P limit order and buy 100 APT at 97.88, which is down about 3% from their high.

Lucky for me they spike up when not really looking and too nice a profit not to lock in. So sell the 100 at 98.74.

Time is 2.22pm. Keep watching FMG but something does not feel right so leave them alone. All up, make up for yesterday and have a profit of $176.

+1000 Z1P at 5.96; +1000 Z1P at 5.95; -1000 Z1P at 6.01; -1000 Z1P at 5.99; Profit $50/$40 (keep milking this trend!)

+100 APT at 97.88; -100 APT at 98.74; Profit $86 (APT had a $3 swing day)

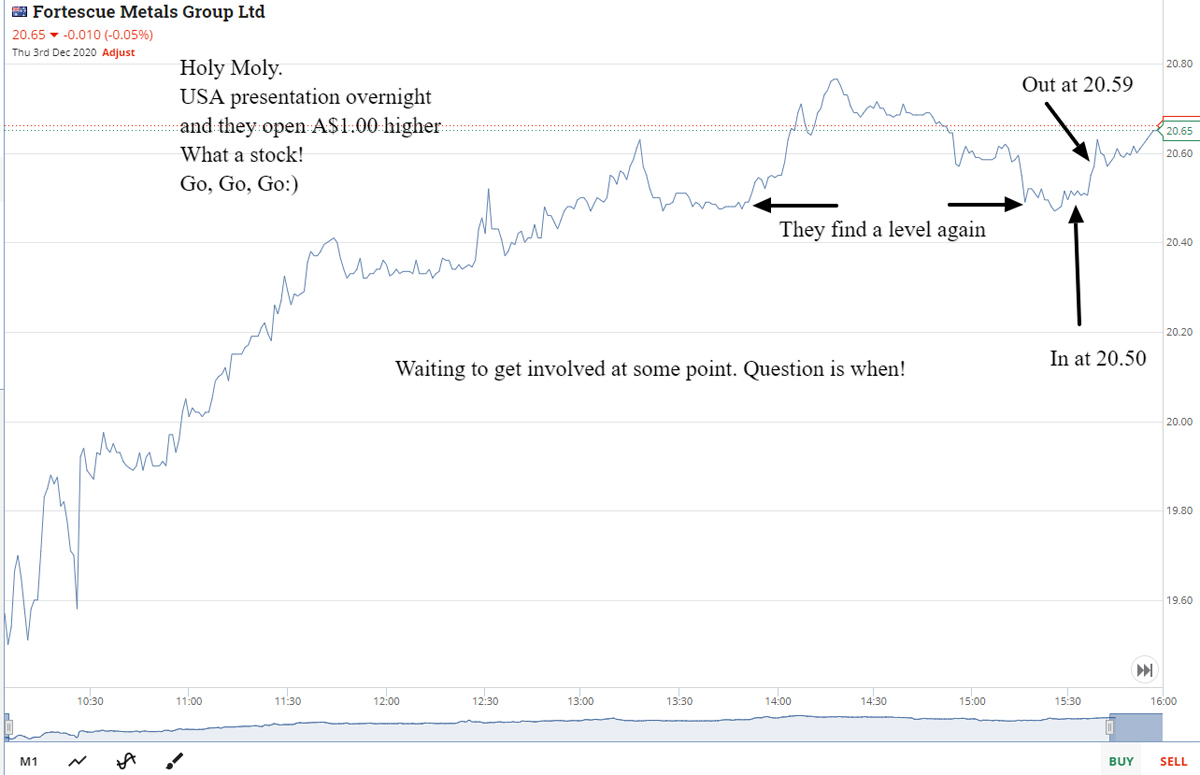

Thursday December 3

What a day.

FMG comes out of the traps up a whole dollar and just keeps going and it’s like wow. My fave stock, with my lucky ‘16.66 level’ opens up at 19.53. So this mainly occupies my day, making me happy and sad. I hope I can find a level for them today!

At 10.52am I put in a limit buy order for 1000 Z1P at 5.85. Their recent low is 5.88 and currently they are 5.91. At 10.59am, I raise my coffee cup and toast FMG as they break the $20 level. Finally get filled in at 1.27pm in the Z1P and put them on to sell at 5.89.

FMG hit 20.66 at 2.13pm. Get taken out of Z1P at 2.19pm for a slow $40 profit.

FMG hit a high of 20.77 before they seem to find a level around 20.50. I close my eyes and buy 1000 FMG at 20.50 as there is no way I am not going to have a go today.

Time is 2.24pm. I try not to look as they move up and down and then they start to shoot up and at 20.59, I’m out. Twiggy makes a few billion and I book in a profit of $90. Total for day up +$130.

+1000 FMG at 20.50; -1000 FMG at 20.59; Profit $90 (eyes wide shut!)

+1000 Z1P at 5.85; -1000 Z1P at 5.89; Profit $40 (very slow day trade)

Friday December 4

Not really seeing too much early on so go out and do a few things and come back home around 11.30am. Some things are starting to level out and at 12.01pm I buy 2000 Z1P at 5.61. Feeling a bit more aggressive as I feel not too many opportunities today.

My buying promptly triggers them to fall and I watch them settle at their next level which is 5.55. This could be my new ‘lucky number’ and I buy another 2000 at 5.55.

Time is 1.00pm and now every 1c movement in the stock is worth plus or minus $40 to my trading account. Average in price is now 5.58, so am down $120 on paper. Put on a limit to sell them at 5.60 and at 1.38pm I get out of jail and pocket $80.

Had a go at FMG whilst all of this was going on and they were settling at 20.56. Bought 2000 and snuck out of them at 20.58 at 1.55pm for a $40 profit. Overall, come out with a gross profit of $120 and live to fight another day. TGIF!

Buy 2000 Z1P at 5.61; Buy 2000 Z1P at 5.55; -4000 Z1P at 5.60; Profit $80 (was down $120 at some point)

Buy 2000 FMG at 20.56; -2000 FMG at 20.58; Profit $40 (still can’t believe they now start with a 20 at the front!)

For the week: +$641

Less brokerage: $140

Best trade for week: TWE +$110

Worst trade for the week: NAB -$5

Me for the week: +$501 net; Andrew Forrest for the week: +$2.3bn

Rolling net tally: +$2014.60 (10.073% up after five weeks)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.