Confessions of a Day Trader: Everything is broken

Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Tuesday April 11

And we are back. Back to a normal trading day, which makes me very happy, as it keeps my mind occupied.

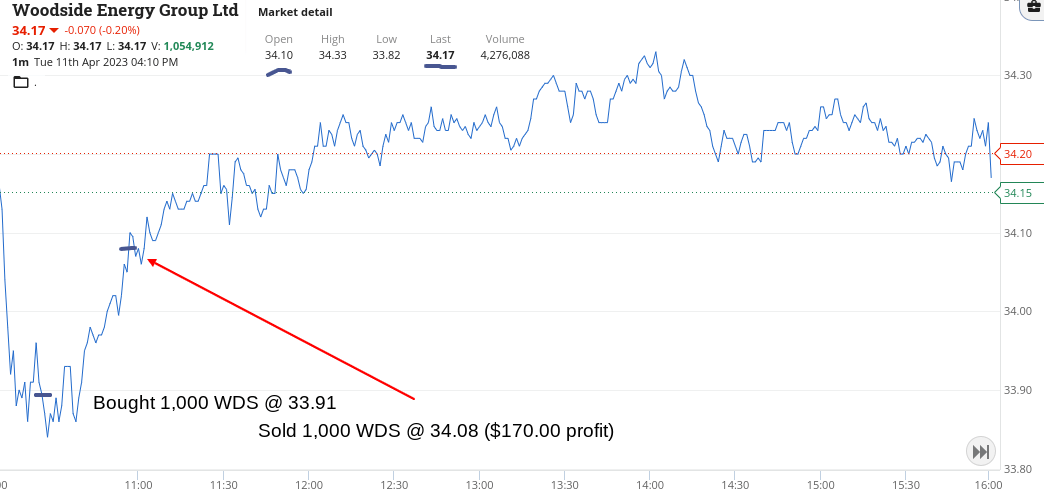

For some reason WDS are down and at below $34, they give me my first post Easter profit.

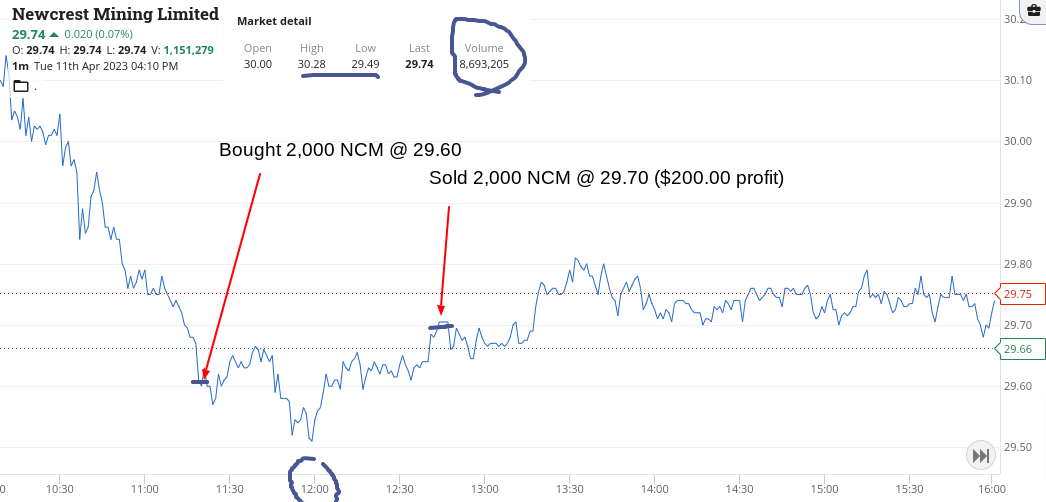

Then it was over to NCM, as they just had their takeover offer increased and after opening around the $30 mark, I got some 40c cheaper.

I then made the mistake of thinking this will be a real easy 20c and put them on a limit of $29.70. Serves me right as they promptly dropped and they gave me a poke in the ribs for thinking that way.

They did eventually get there but not before showing a bit of red in my P/L.

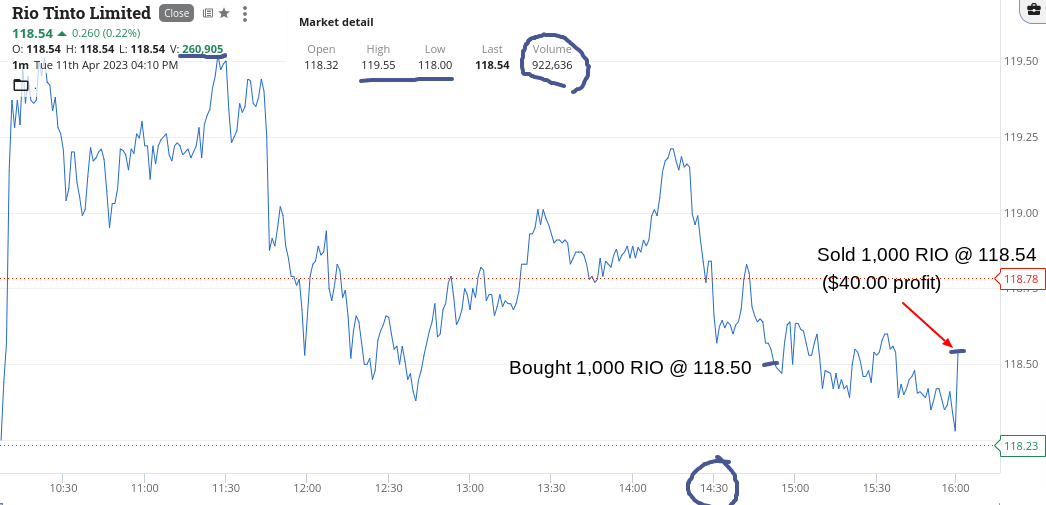

So looking good and towards the end of the day, RIOs looked also looking good, or so I thought.

Made $40, which doesn’t even make brokerage and wasted some of my watching energy, especially waiting for the 3.30pm tickle up, which never came.

Up $410 and now heading off to the supermarket to see how much Easter eggs have been marked down.

Looking for a min of 50% to cover off my chocolate craving as I am well short!

Recap

Bought 1,000 WDS @ 33.91

Sold 1,000 WDS @ 34.08 ($170 profit)

Bought 2,000 NCM @ 29.60

Sold 2,000 NCM @ 29.70 ($200 profit)

Bought 1,000 RIO @ 118.50

Sold 1,000 RIO @ 118.54 ($40 profit)

Wednesday April 12

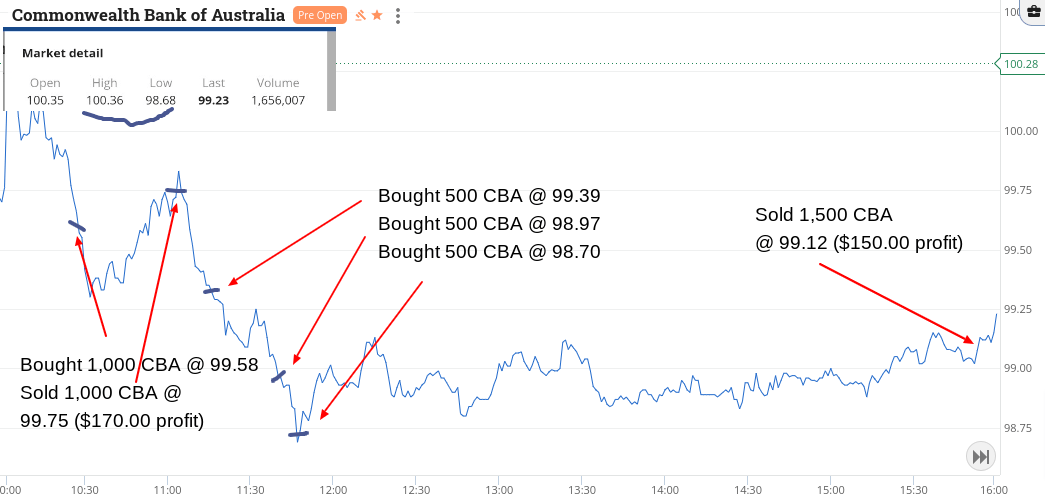

Manage an 11.00am trade in CBA and then go back for some more.

Have to double down not once but twice. And then have to wait for the dying minutes to finally get out. Had them on a limit of $99.17 and they get to $99.16 twice.

Don’t you just hate that? I finally crack and adjust down to meet the market.

Then of course they bounce to $99.17, just to slap me in the face!

RIOs and BHP were up 4% or so overnight, so they were no good today for my style of trading.

Up $320.

Recap

Bought 1,000 CBA @ 99.58

Sold 1,000 CBA @ 99.75 ($170 profit)

Bought 500 CBA @ 99.39

Bought 500 CBA @ 98.97

Bought 500 CBA @ 98.70

Sold 1,500 CBA @ 99.12 ($150 profit)

Thursday April 13

Not a good day today. Unemployment figures came out stronger than suspected, which means the odds of another interest rate hike, dramatically improved.

The day selling was relentless, especially in the banks. CBA closed 2c above their day’s low at $98.22, having reached a high of $99.49, just after their opening.

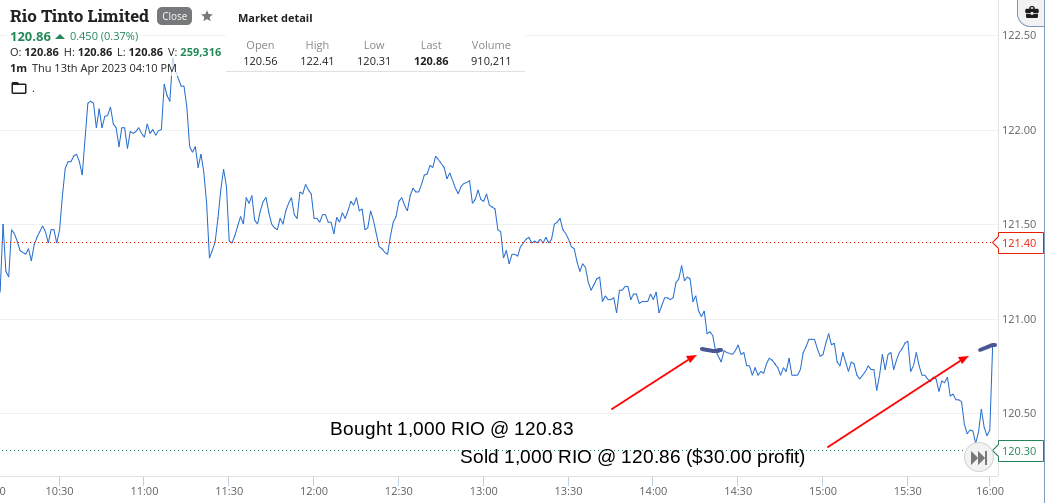

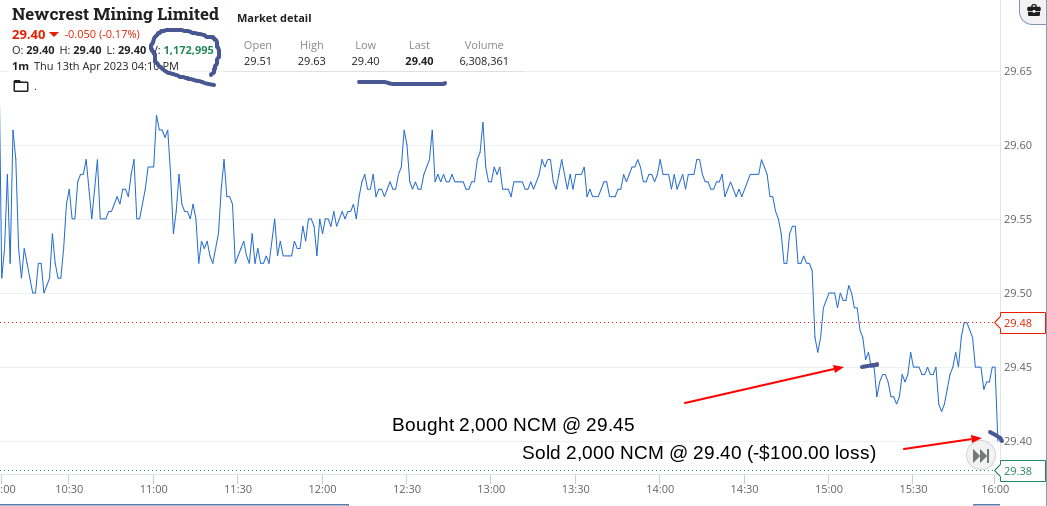

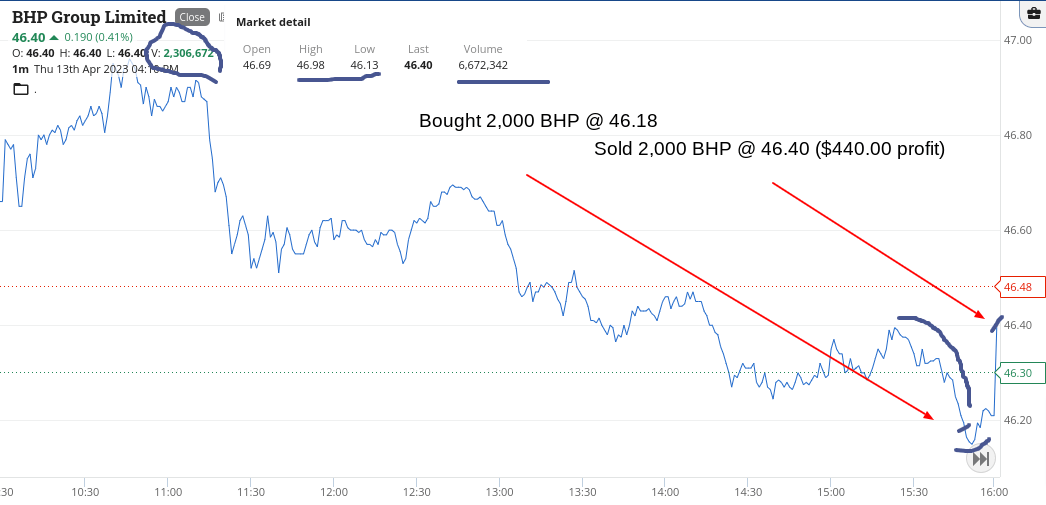

The thing that I couldn’t understand today was why things like RIOs and BHP were getting marked down on interest rate wobbles.

Banks, I can understand – but miners? And not any old miners, these are global miners.

So I went on a bit of a who’s right and who’s wrong mission and came out battered and bruised. Blood splattered across the trading screen, but I’ll live to fight another day.

In fact it was BHP who came to my rescue in the dying throes of trading, though NCM and RIOs let me down badly.

Scraped in with a $370 profit. Even though I ended up on the ropes, a technical win came into play.

Recap

Bought 1,000 RIO @ 120.83

Bought 2,000 NCM @ 29.45

Bought 2,000 BHP @ 46.18

Sold 2,000 NCM @ 29.40 ($100 loss)

Sold 1,000 RIO @ 120.86 ($30 profit)

Sold 2,000 BHP @ 46.40 ($440 profit)

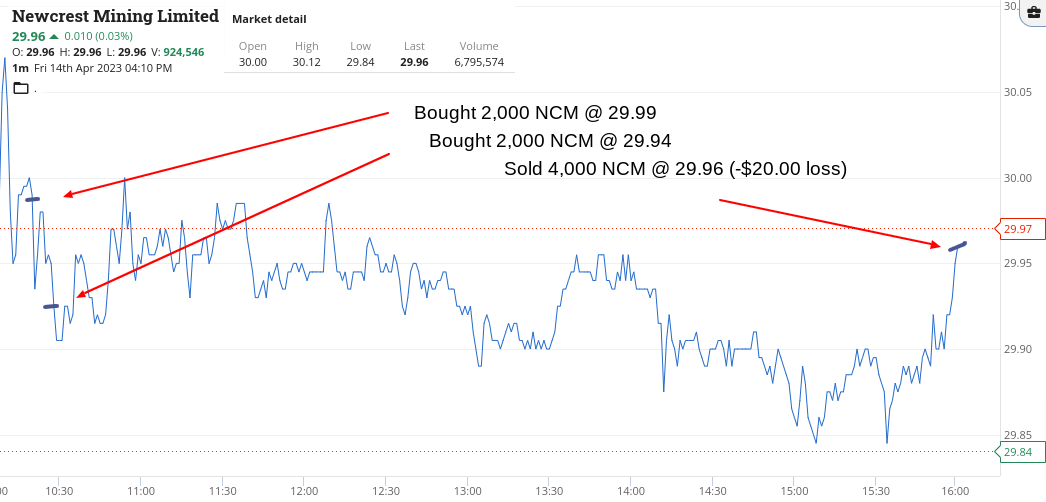

TGIF April 14

Gold was up overnight, so I thought some NCM may be a safe bet but I got the timing a bit wrong and had to double down and then wait till the very end of the day to book a $20 loss.

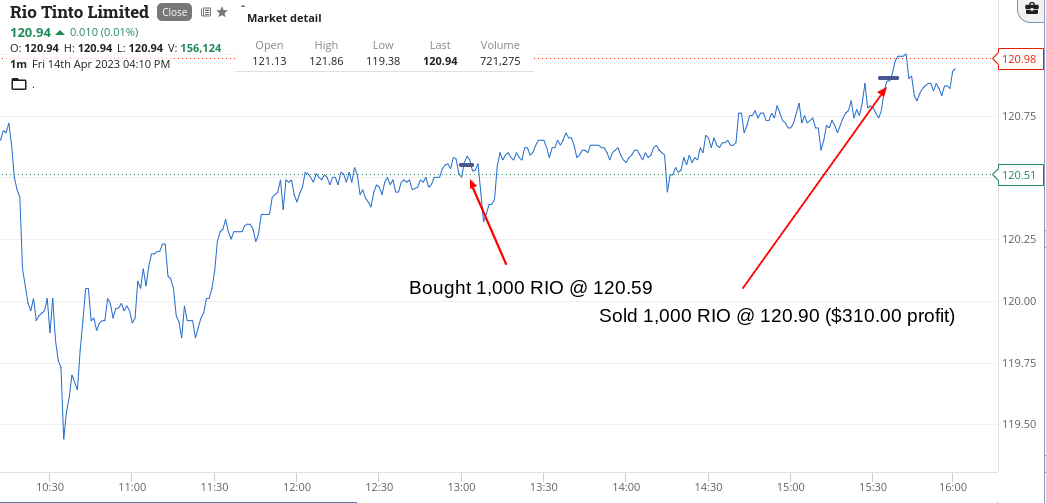

At one point I was down about $380 on them. RIOs also took ages to go the way I wanted and then finally a limit buy order in BHP got hit.

Happy to book my first profit in them, then finally RIOs and lastly wait for the close.

I did have a bid in CBA at below $97, but they never got that low. The lowest they got to was $98.20 and they took a few goes to crack the $99 level and when they finally did they hit $99.28 before closing at $99.11.

So, all up plus $440, which takes the total for this short week to $1,540 gross or $1,102 net and now getting ready to think about next week.

After today’s success in a lower limit buy in BHP, I think a bit more of that next week will be the order to go.

Recap

Bought 2,000 NCM @ 29.99

Bought 1,000 RIO @ 120.59

Bought 1,000 BHP @ 45.90

Sold 1,000 BHP @ 46.05 ($150 profit)

Bought 2,000 NCM @ 29.94

Sold 1,000 RIO @ 120.90 ($310 profit)

Sold 4,000 NCM @ 29.96 ($20 loss)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.