Confessions of a Day Trader: Eat. Sleep. Take profits. Repeat.

Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

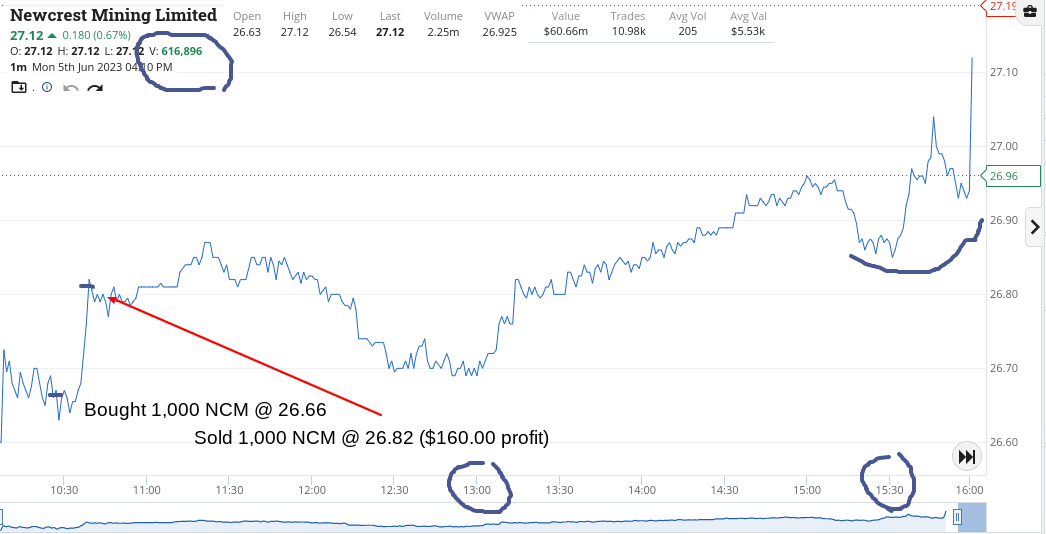

Monday June 5

A slower day for me, as today’s moves don’t really help my trading style. The only stock on my watch sheet showing red was NCM.

They gave me a nice little 16c turn and that was it for the day. As I said last week, I think today was a sucker’s rally, as expected, and tomorrow we have an RBA interest rate (hike?) day.

Up $160.

Recap

Bought 1,000 NCM @ 26.66

Sold 1,000 NCM @ 26.82 ($160 profit)

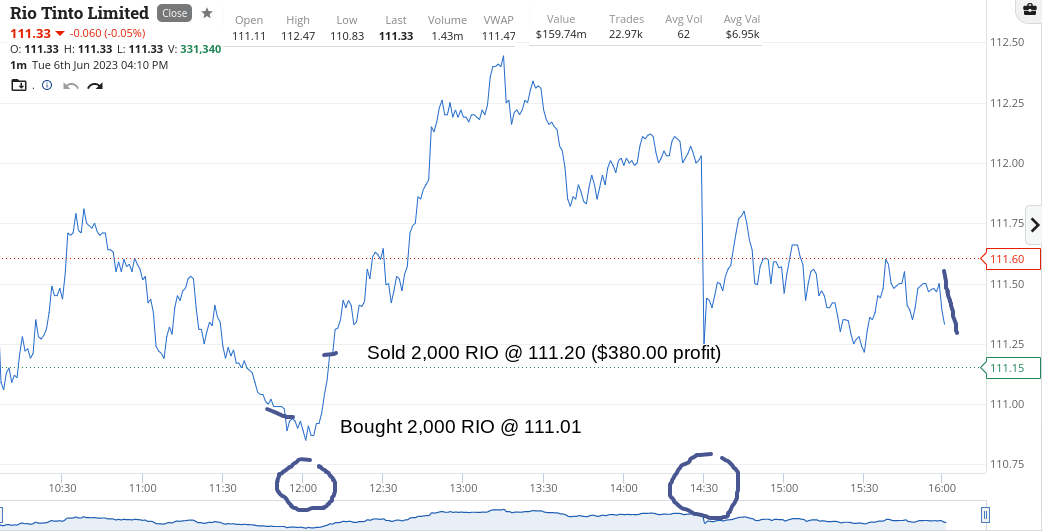

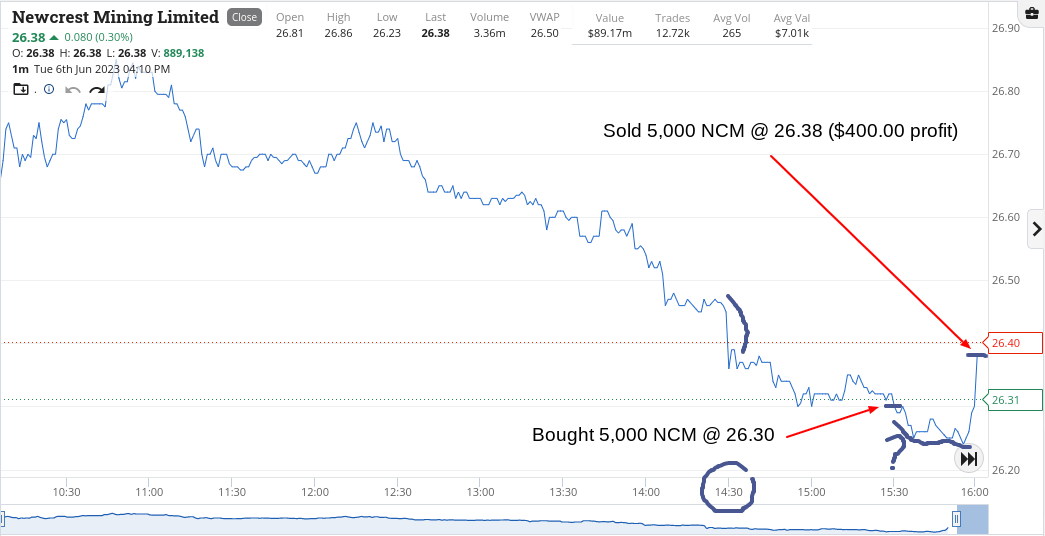

Tuesday June 6

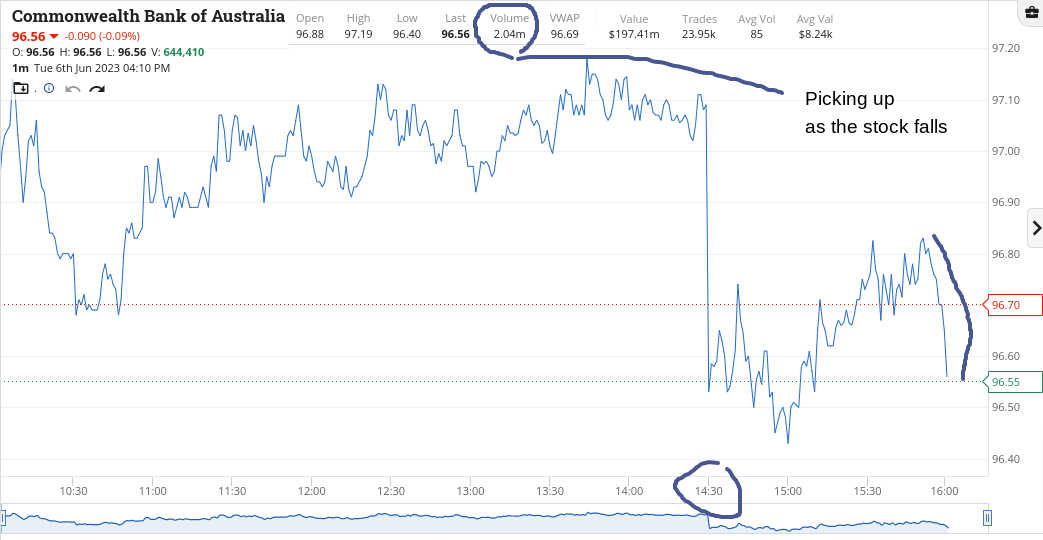

Well, we are all sitting around for the 2.30pm RBA announcement and we all know what it is going to be.

I was certainly sitting on my hands but then couldn’t help myself as some of the miners were glistening to me and I’m thinking they are not interest rate sensitive like the banks are.

When 2.30pm hits, everything falls like a stone, which I think is a big reaction, though volumes are getting a bit thin again.

Even NCM, a gold miner, got dragged down and I’m thinking why? Pumped up large and went all in at 3.30pm and waited. Got the timing a bit wrong but determined to get a profit from Mr Market being wrong.

Finally, I get an 8c turn as they were chased higher. Have added a few extra charts, so you can see what the day was like.

Up $840.

Recap

Bought 2,000 FMG @ 20.22

Sold 2,000 FMG @ 20.25 ($60 profit)

Bought 2,000 RIO @ 111.01

Sold 2,000 RIO @ 111.20 ($380 profit)

Bought 5,000 NCM @ 26.30

Sold 5,000 NCM @ 26.38 ($400 profit)

Wednesday June 7

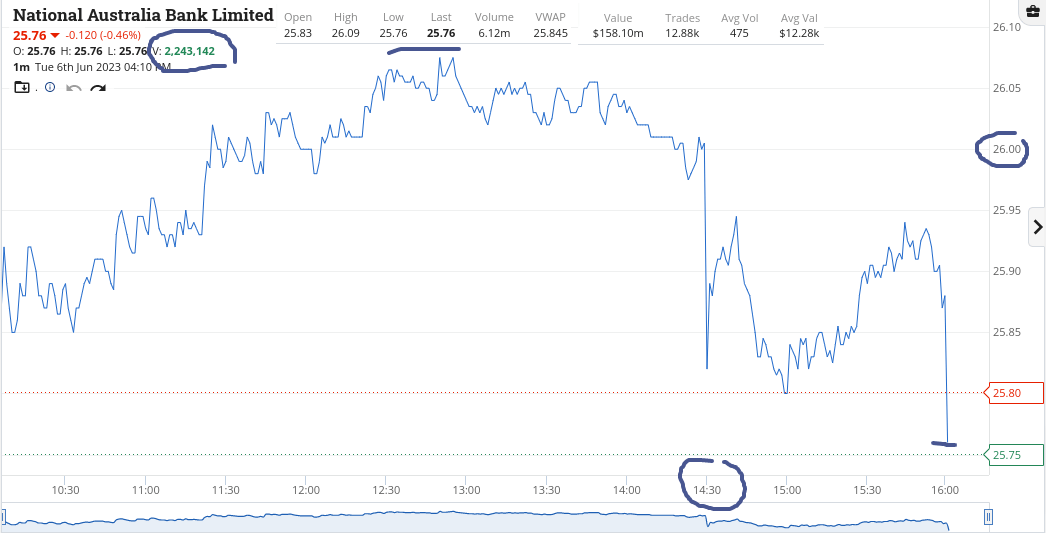

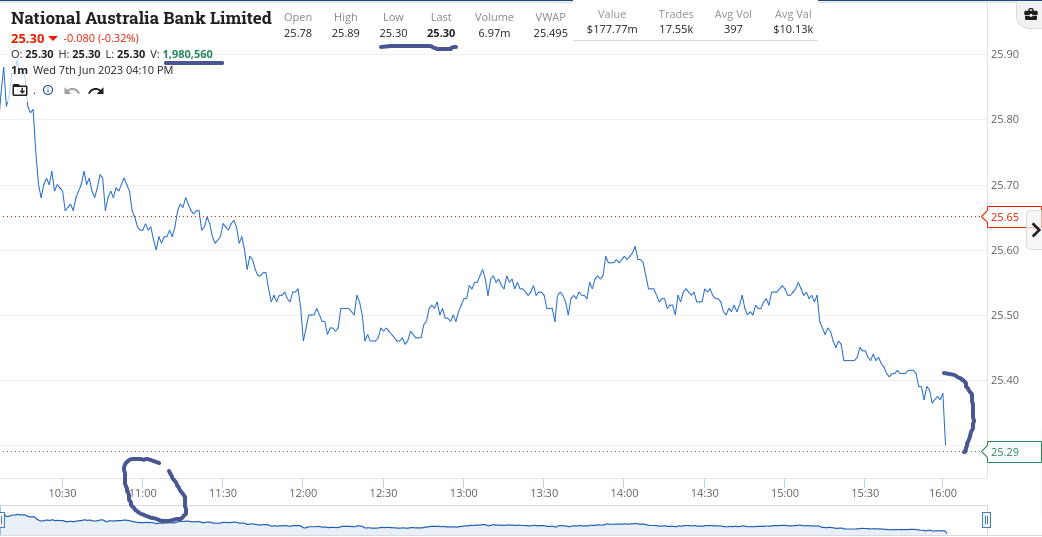

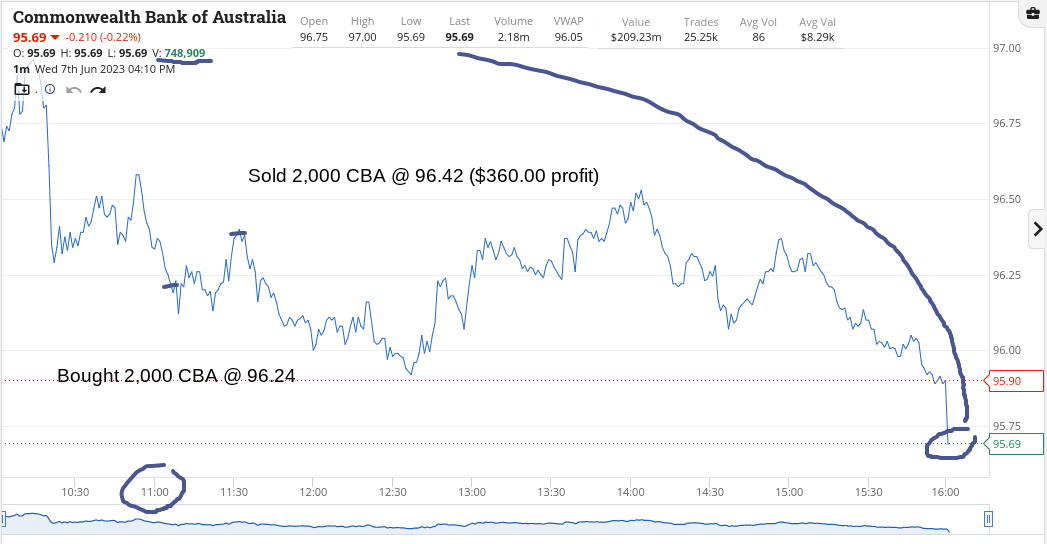

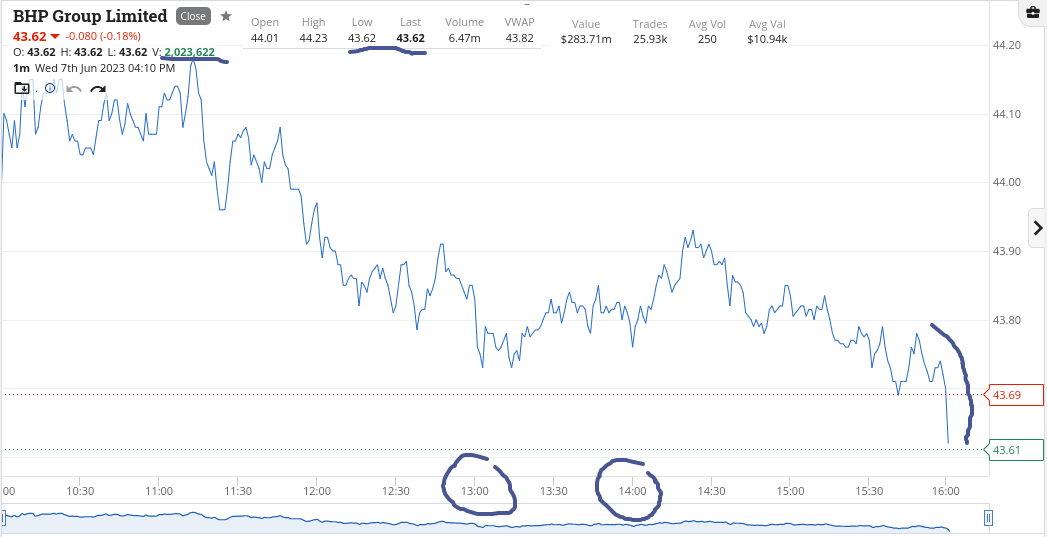

A sobering up day for all of the bank shares today and I ain’t trusting any rallies. The way they all ended was not a good look.

Managed to chip out a profit in CBA, avoid everything else and just sit tight.

CBA opened up at $96.75, had a high bang on $97.00 (those round numbers!) and closed at their day’s low of $95.69.

NAB had a high of $25.89 and closed on their day’s low at $25.30. BHP also closed on their day’s low at $43.62 after reaching $44.23 early on.

Still very cautious, as I can’t feel any good news coming America’s way or our way at the moment. Maybe CBA will trade at $93.00, which was something I predicted last week. Two days to go!

Up $360.

Recap

Bought 2,000 CBA @ 96.24

Sold 2,000 CBA @ 96.42 ($360 profit)

Thursday June 8

A nightmare of a trading day. Volumes picking up a bit but there is just not enough volatility.

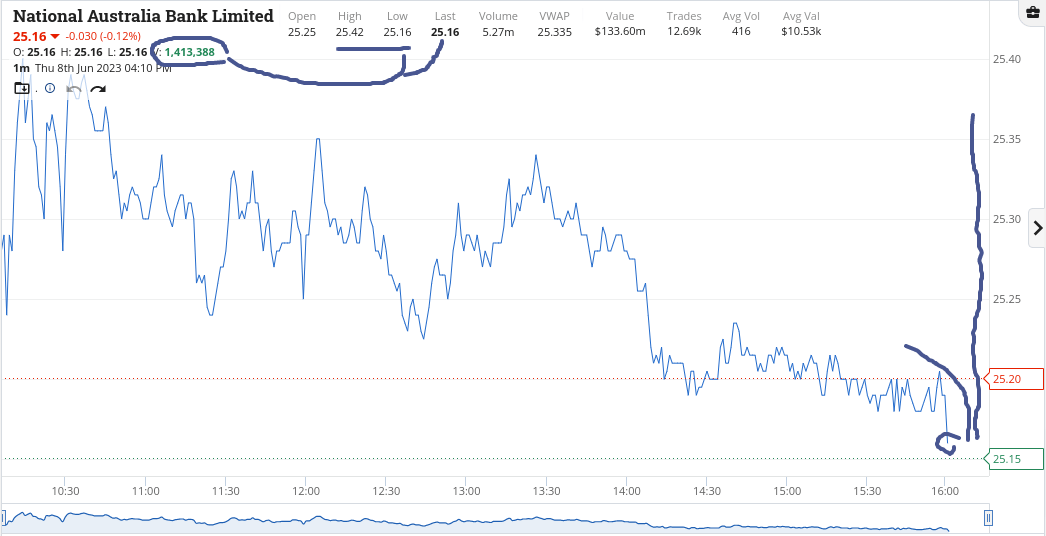

I spent hours staring at my phone, trying to find something to do. CBA had a range of just 66c and NAB, who closed on their day’s low at $25.16, had a range of just 26c.

More worryingly for them, they closed at their day’s low on good volume, so maybe there is a bit of switching going on into CBA?

Now of course tomorrow is a Friday ahead of a long weekend, so I just hope there will be something to give me my daily bread, oh Lord!

Recap

Doughnut day FFS!

Friday June 9

Long weekend coming up, so didn’t want to have anything open past 2.00pm. Basically cut NCM last trade for that reason, plus happy to take any profits that come my way.

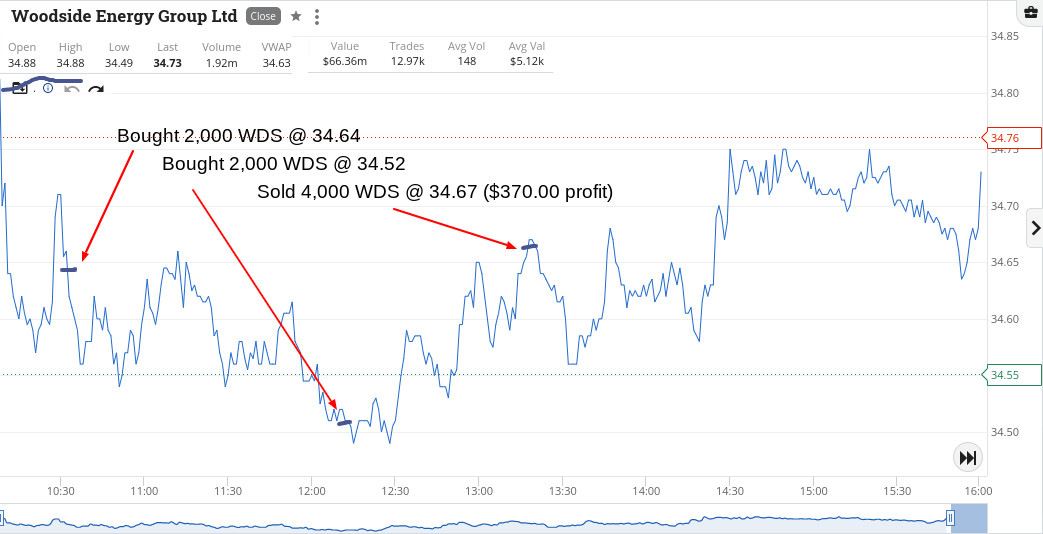

CBA below $96.00 seemed a goer and with WDS, had to double down before they came good. Volumes and price ranges are narrow, which you would expect on a trading day like this.

Just happy that the week is over with so I can have a break. I think I have been over-thinking things a bit this week, so will have a mental reboot and come back refreshed.

Up $710 today. Plus $2,070 gross or $1,699 net. Ctrl-Alt-Delete. Drink a red or two!

Recap

Bought 2,000 WDS @ 34.64

Bought 2,000 CBA @ 95.90

Bought 2,000 NCM @ 26.46

Sold 2,000 NCM @ 26.52 ($120 profit)

Sold 2,000 CBA @ 96.01 ($220 profit)

Bought 2,000 NCM @ 26.36

Bought 2,000 WDS @ 34.52

Sold 4,000 WDS @ 34.67 ($370 profit)

Sold 2,000 NCM @ 26.36 ($0 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.