Confessions of a Day Trader: Dear CSL, sorry I know it’s Valentine’s Day but I have a new lover. Or two…

Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday February 12

Well it’s Super Bowl final day today, though for me it turned out to be Super Begging Bowl day.

Ended up underwater, after letting everything ride into the 4.10pm touchdown and came out a bit sore from my play.

BHP did me proud and CBA let me down but my manic child really did throw a tantrum after some poor trial results came out, pre market.

These babies were trading at $305 on Friday but today they touched a low of $286.14 and a high of $293.98, so at least a few people came out worse than me.

Ended my first day of the week down $255 before brokerage. Not a good start.

Recap

Bought 500 CSL @ 291.18

Bought 2,500 BHP @ 45.90

Bought 1,000 CBA @ 115.94

Sold 2,500 BHP @ 46.07 ($425 profit)

Sold 500 CSL @ 290.24 ($470 loss)

Sold 1,000 CBA @ 115.73 ($210 loss)

Tuesday February 13

Got back onto the horse today, as CSL fell even more than yesterday, so at $279, they are down about $26 from last week, which even for a manic child is a bit too much red-cordial reaction.

Close my eyes and get 500 and wait. Goes a bit against me. Keep checking over a coffee with a friend. Keep checking after coffee with friend before heading to beach and bang, they leap like a leopard jumping on its prey.

Far out!

I must admit that I was a bit fingers and thumbs trying to close it out, as yesterday I missed a profit by just 1c on a $290 stock.

Locked it in, got taken out and bingo, made back yesterday’s loss and some. Having learnt my lesson last week, I just left everything alone, knowing that tomorrow will be another day and I will have a fresh start on my P/L.

Up $735 and leave today with a little prayer to the trading God.

Thank you.

Amen.

PS. Have a go at CBA’s close!

Recap

Bought 500 CSL @ 279.57

Sold 500 CSL @ 281.04 ($735 profit)

Wednesday February 14

CBA figures came out pre market and the headlines were not that flattering, so it was obvious that they would head down.

So, this is playing into my trading style as it’s good to see something get a good whack once in a while.

I made the decision to wait until 11.00am and then just buy, whatever the level. However, I just couldn’t help myself and just like a teenaged boy on Valentine’s Day, I – ahem – ‘went’ a bit too early and not just once but twice.

I just had to go twice as at these levels (or so I thought) they are a bargain, having seen the stock at $118 last week.

Their bounce did eventually come and I missed them at $112.65, as having reached $112.67, they fell like a stone and left me staring at a $10 profit instead of $690.

So, I just left them on at a limit and waited.

After 30 mins they got there.

However, in between all of this, ANZ offered themselves up with not one but two goes, whilst waiting for CBA to move my way.

See chart.

Today, CBA made my manic child CSL look like the best behaved little child in the class, as they had a $2.50 swing on 2.74m shares and closed at their day’s high of $114.07.

So today, we banked $1,490 from the banks!

Now, that is a good Feb 14 ‘roses and chocolate’ Valentine trading feeling.

MWA to you all.

Recap

Bought 1,000 CBA @ 112.27

Bought 1,000 CBA @ 112.34

Bought 5,000 ANZ @ 27.59

Sold 5,000 ANZ @ 27.70 ($550 profit)

Bought 5,000 ANZ @ 27.57

Sold 5,000 ANZ @ 27.62 ($250 profit)

Sold 2,000 CBA @ 112.65 ($690 profit)

Thursday February 15

The only thing I could find that was taking a bit of battering today was BHP, after they came out with an impairment notice, pre market.

Not looking too crash hot but find a bottom would be hard to do, so I dipped in my toes to give me something to concentrate on.

It took three goes, before they moved my way but I kept the faith. Also RIOs then popped up as they had had a high of $129.18, which was basically $2 higher than when I got involved.

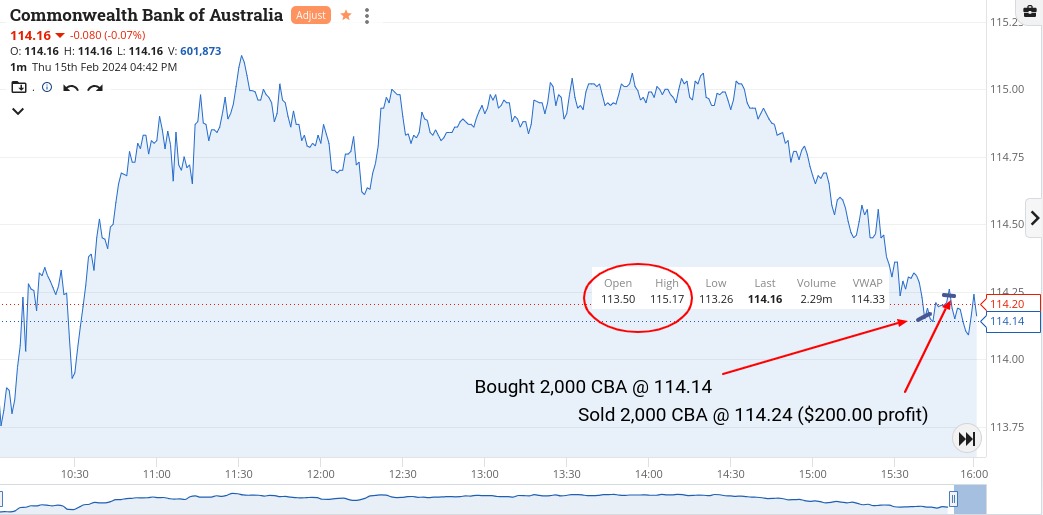

Finally, determined to do nothing, I just couldn’t help myself with CBA and when you see the chart, you will know why.

Up $950, on a day where I had to do a bit of driving and then entertain the in-laws for a pub lunch, so my activities were restricted on all fronts, not just screen watching.

Recap

Bought 1,000 BHP @ 45.43

Bought 1,000 BHP @ 44.95

Bought 1,000 RIO @ 126.60

Bought 1,000 BHP @ 44.76

Sold 1,000 RIO @ 127.16 ($560 profit)

Sold 3,000 BHP @ 45.11 ($190 profit)

Bought 2,000 CBA @ 114.14

Sold 2,000 CBA @ 114.24 ($200 profit)

Friday February 16

Mmmmm. What started out as a one good trade in the bag and now relax and just chill out, became a dealing frenzy of opportunities, which I haven’t seen in a long time.

Yesterday, I added a new stock to the old watchlist, PME, and then today I had to add NEU after it was a big faller.

If I thought yesterday that CBA was wild, well these two became absolutely off the dial!

You will just have to look at their charts and see the day’s recap to get the picture. At one point I had a nana nap and woke up and just had to go again. Real madness.

Recap

Bought 1,000 NEU @ 19.97

Sold 1,000 NEU @ 20.65 ($680 profit)

Bought 1,000 PME @ 87.09

Sold 1,000 PME @ 87.40 ($310 profit)

Bought 1,000 NEU @ 19.81

Sold 1,000 NEU @ 20.21 ($400 profit)

Bought 1,000 PME @ 86.80

Sold 1,000 PME @ 87.05 ($250 profit)

Bought 1,000 NEU @ 19.80

Sold 1,000 NEU @ 19.98 ($180 profit)

Bought 5,000 NEU @ 18.85

Sold 5,000 NEU @ 19.05 ($1000 profit)

These trades left me up $2,820 for the day and up $5,740 gross ($5063 net) which after Monday’s result, was not expecting that!

CSL must now just be a boring old blue chip when compared to NEU and PME…

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.