Confessions of a Day Trader: Conflict trading edition — bumps, bruises (and some good wins)

(Pic: Getty

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday February 28

A seesaw of a day, as expected.

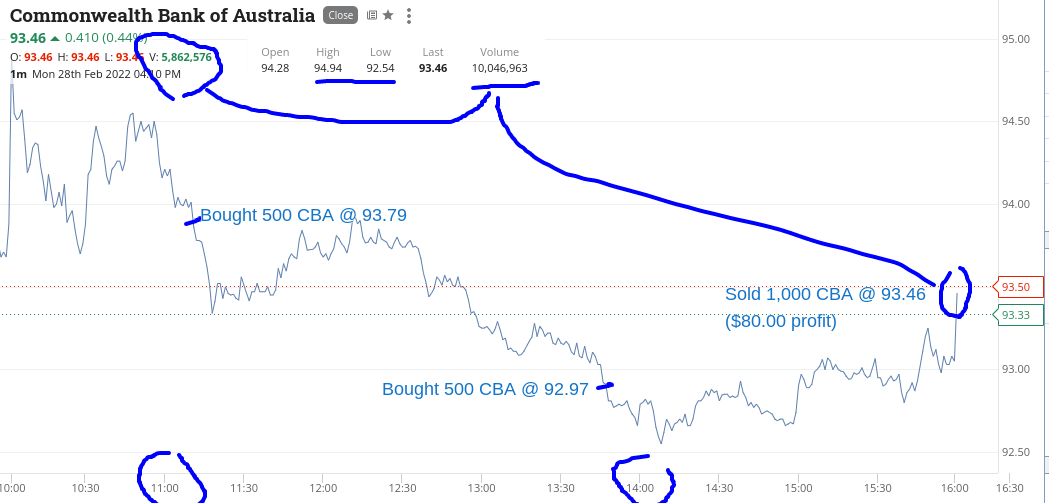

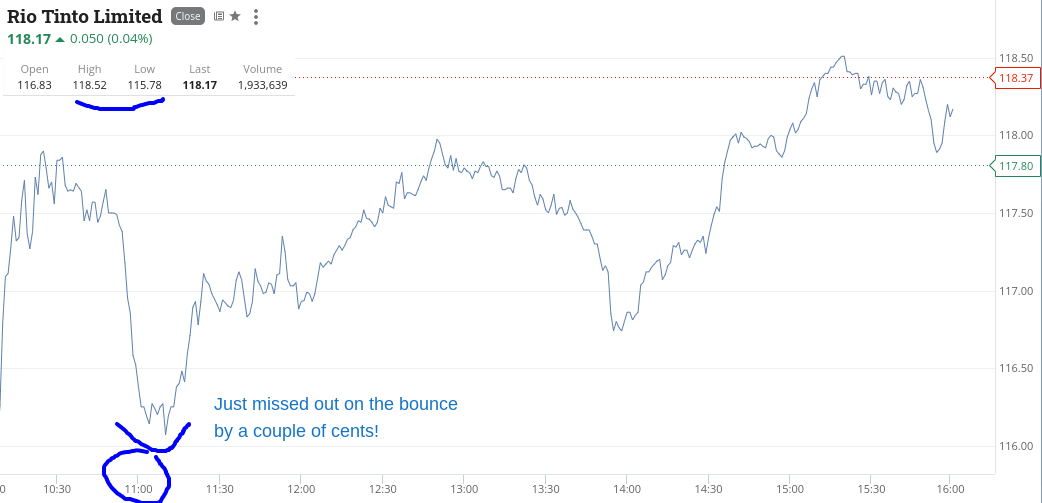

RIO’s had a low of $115.78 and a high of $118.52 and after it reached its low it bounced to $115.90 very quickly. I put in a limit to buy 500 at $115.89 and just missed it – see chart, so that one got away.

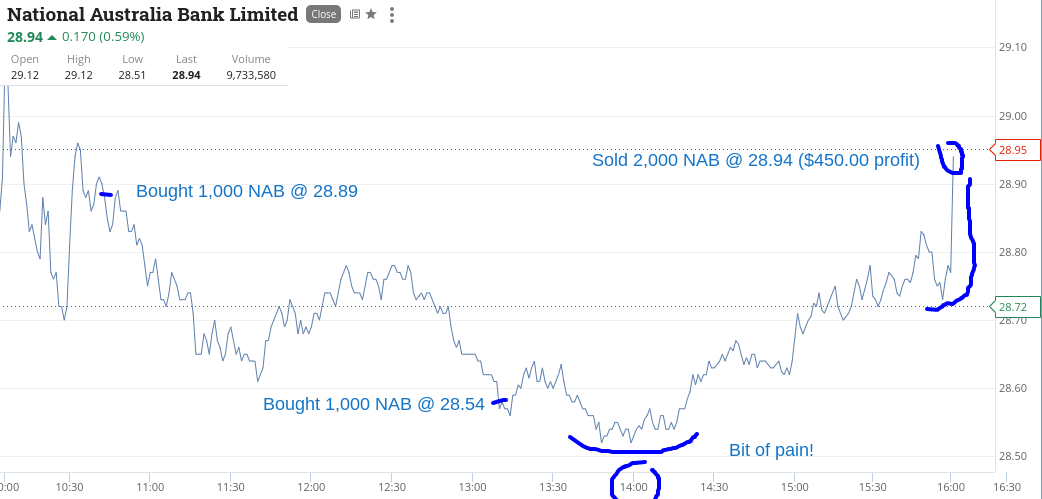

With NAB below $29.00 (they were $30.00 last week) and their buy back still on, I bt 1000 at $28.89 and then some CBA below $94.00 and then blow me down, below $93.00.

Had to do the same in NAB. As the headlines about the war were looking a bit ‘warmer’ I decided to wait till the 4.10pm ruck to close out.

As ever, you never know how it will go, but with the feeling of an updraught coming through, I punted on it coming in my way, which it did. I would say 70% of the time it doesn’t.

CBA seemed a bit detached today, on the down side, which felt a bit strange.

Anyway, up $530, though after comm, CBA barely washed its face and volume was about four times higher than normal.

Recap

Bought 1,000 NAB @ 28.89

Bought 500 CBA @ 93.79

Bought 500 CBA @ 92.97

Bought 1,000 NAB @ 28.54

Sold 1,000 CBA @ 93.46 ($80.00 profit)

Sold 2,000 NAB @ 28.94 ($450.00 profit)

Tuesday March 1

Was doing ok until I had a second go at FMG at below $18.00 in the afternoon from where they never recovered. Held on till the end of the day and unlike yesterday, it just made it worse.

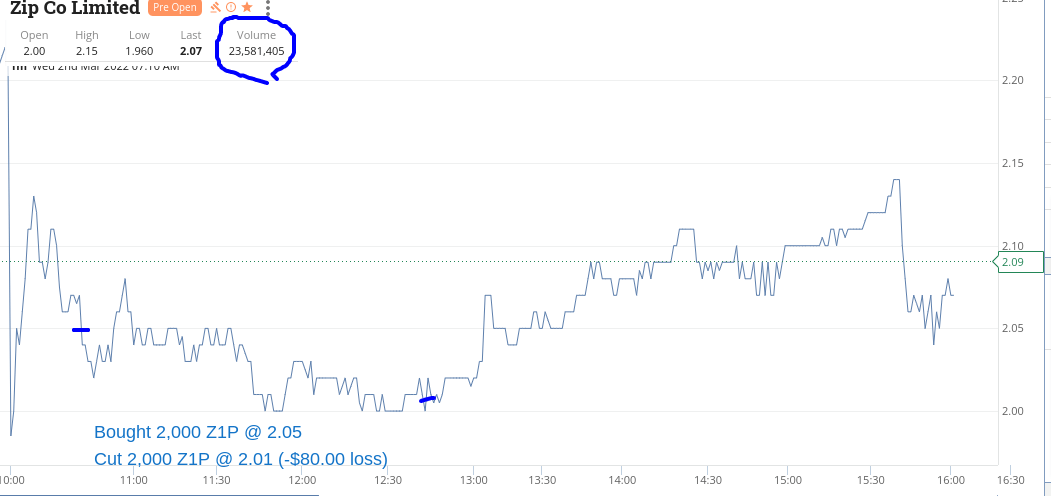

Z1P came back on after their raising and expansion, so had a nibble but cut them after my first profit and intended to walk away for the rest of the day, as it’s getting very hard at the moment.

So, down $65 for the day and not really looking forward to tomorrow as it will need something to make something super oversold.

Recap

Bought 2,000 Z1P @ 2.05

Bought 1,500 FMG @ 18.09

Bought 1,500 FMG @ 17.98

Sold 2,000 Z1P @ 2.01 (-$80.00 loss)

Sold 3,000 FMG @ 18.14 ($315.00 profit)

Bought 1,500 FMG @ 17.96

Sold 1,500 FMG @ 17.76 (-$300.00 loss)

Wednesday March 2

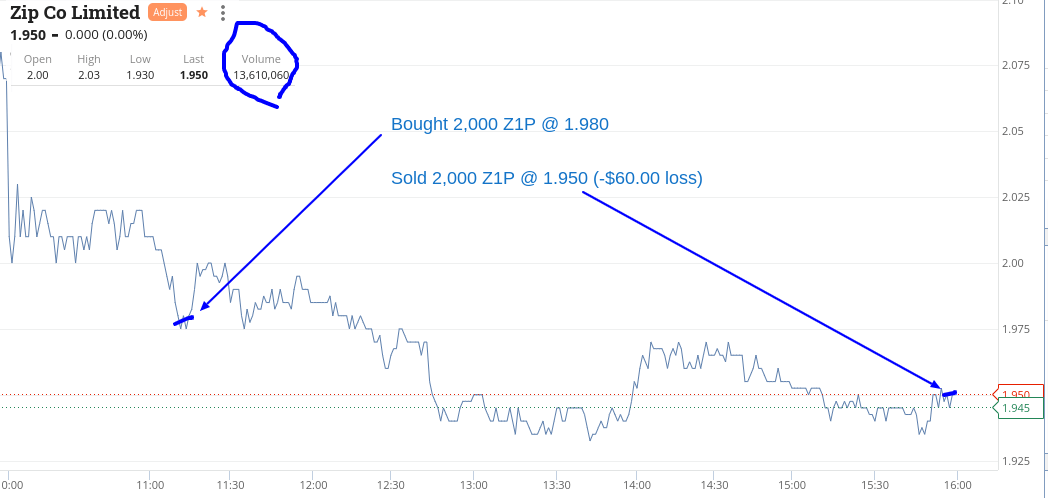

Well, I am struggling so far this week. I managed to make $25 today and also managed to lose again on Z1P.

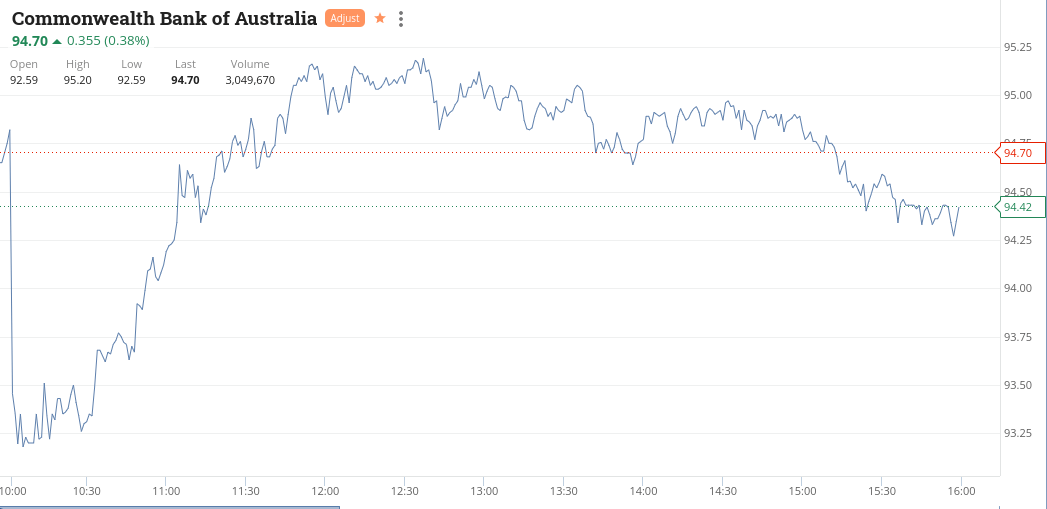

CBA just about sums up the current action.

They opened on their low at $92.59, had a high of $95.20 and closed at $94.70 on a volume of 3m.

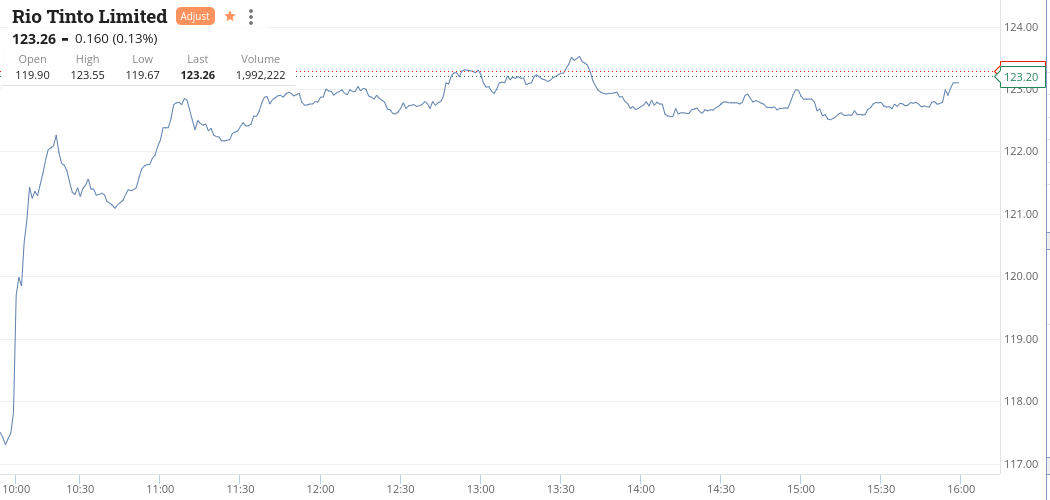

So that is a range of $2.61 and if you see their chart, it’s not behaving like normal. Rio managed a day range of $3.88 on a volume of 1.9m and also behaving strangely to their usual day movements.

I can’t see the rest of the week being any different.

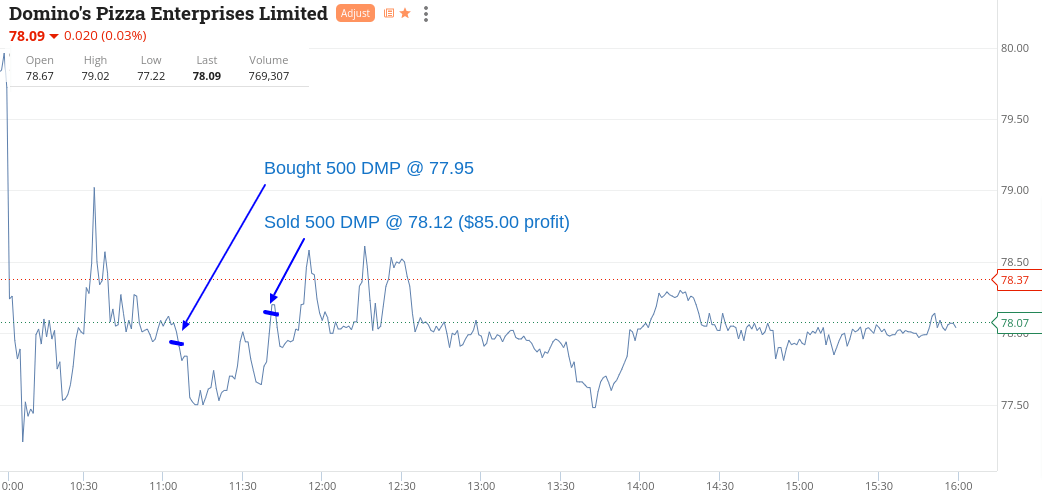

Recap

Bought 2,000 Z1P @ 1.980

Bought 500 DMP @ 77.95

Sold 500 DMP @ 78.12 ($85.00 profit)

Sold 2,000 Z1P @ 1.950 (-$60.00 loss)

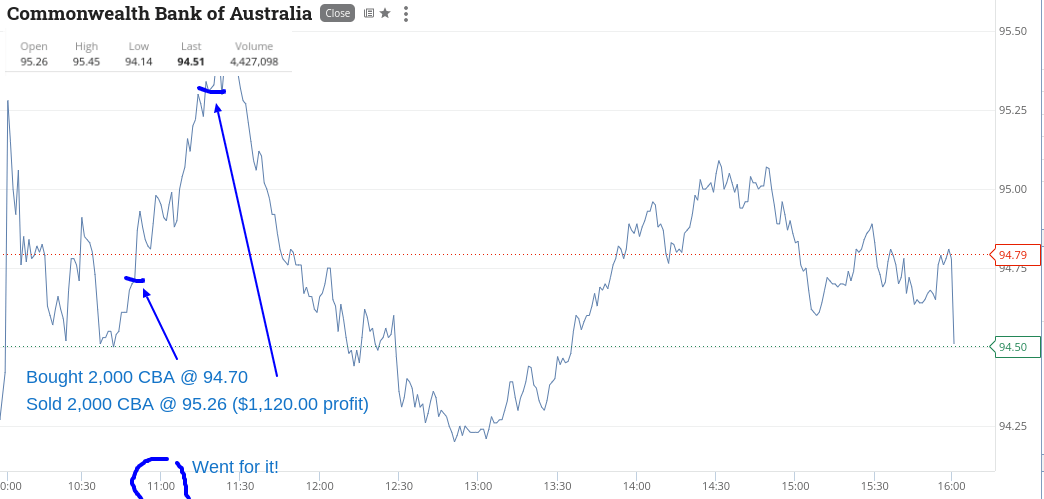

Thursday March 3

Having struggled for the last couple of days, I decided to change tactics a bit. Overnight, BHP and RIO’s were marked up by 3% or so on higher commodity prices.

So they raced out the door on the opening and I decided to concentrate just on CBA today and go for the 11.00am trade.

They started to rally at 10.42am from $94.50 so I caught them in the updraft 7 mins later as the rally appeared to be on early. Rode them through $95.00 and onwards, took my profit and walked away.

I think the market was a bit positive overnight and that’s what gave CBA that upswing and we will have to see what tomorrow’s sentiment feels like, as being a Friday, I can’t see many professional traders wanting to stay long heading into the weekend.

Up $1,120.

Recap

Bought 2,000 CBA @ 94.70

Sold 2,000 CBA @ 95.26 ($1,120.00 profit)

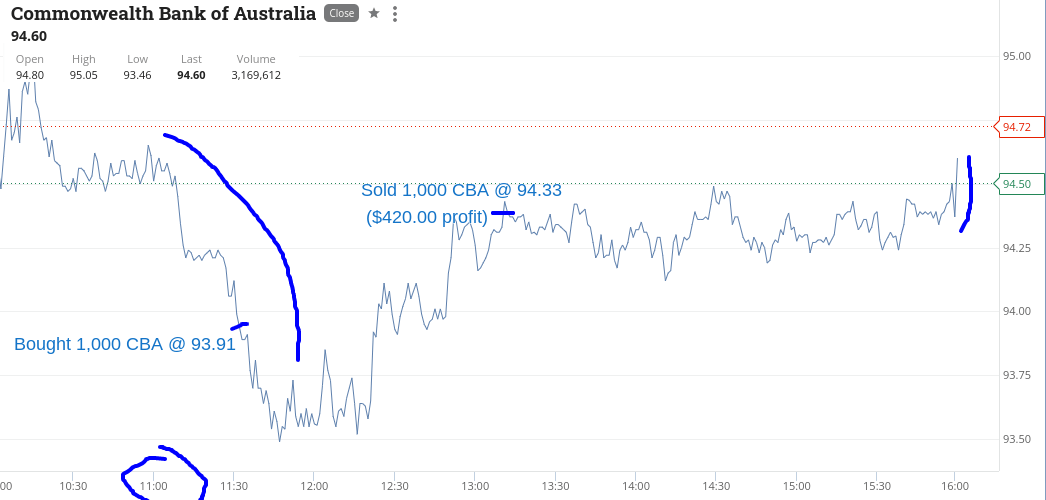

Friday March 4

Well they gave CBA a bit of a kicking at 11.00am today plus they marked them up in the 4.10pm ruck, both of which I did not expect to see today.

But that’s the market for you. I had to wait around a bit till my watch screen was a sea of red before having a go at CBA and even then they gave me some pain.

When you look at them, they opened at $94.80, had a high of $95.05 (10.16am) and a low of $93.46 (11.48am) and closed at $94.60 (4.10pm).

So, that’s a difference of 20c between its opening price and its closing price, though their whole range for the day was $1.57 on just over 3m shares. Talk about manic.

Anyway, like most of my trading buddies, glad that the week is over. Up $420 today, $2030 gross and $1788 net.

Recap

Bought 1,000 CBA @ 93.91

Sold 1,000 CBA @ 94.33 ($420.00 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.